Insurance Broker

In today's complex and ever-evolving world, the role of an insurance broker has become increasingly vital. With a wide array of insurance policies and an ever-growing need for protection, individuals and businesses alike rely on insurance brokers to navigate the intricate landscape of risk management. This comprehensive guide aims to delve into the world of insurance brokering, exploring the key aspects, challenges, and opportunities that define this profession.

The Evolution of Insurance Brokering: A Historical Perspective

The concept of insurance brokering traces its roots back to the early 17th century, when marine insurance policies were introduced to protect merchants against the risks of sea voyages. Over the centuries, insurance brokers have played a pivotal role in shaping the industry, adapting to the changing needs of society and emerging as trusted advisors in the realm of risk mitigation.

In the modern era, the insurance brokerage industry has undergone a significant transformation. With the advent of technology and a more interconnected world, brokers now have access to a wealth of information and tools that enhance their ability to provide tailored insurance solutions. From online platforms that facilitate policy comparisons to advanced analytics that predict potential risks, the insurance brokerage landscape has evolved to meet the demands of a digital age.

The Role and Responsibilities of an Insurance Broker

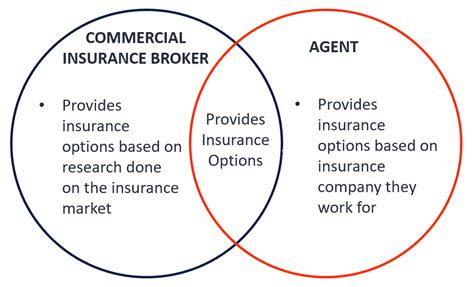

An insurance broker is a professional intermediary who acts as a liaison between clients and insurance companies. Their primary objective is to assess their clients’ unique needs, offer personalized advice, and secure suitable insurance coverage. This involves a thorough understanding of various insurance policies, the ability to negotiate favorable terms, and the expertise to guide clients through the complex process of risk assessment and management.

The responsibilities of an insurance broker extend beyond mere policy procurement. They are often called upon to provide ongoing support and guidance to their clients, offering assistance in the event of claims and ensuring that the insurance coverage remains aligned with the evolving needs of the client. Brokers also play a crucial role in educating their clients about the intricacies of insurance, helping them make informed decisions and navigate the complexities of the insurance industry.

Key Skills and Attributes of Successful Brokers

- Knowledge and Expertise: A deep understanding of insurance products, industry regulations, and risk management strategies is essential for brokers. Staying abreast of the latest industry developments and continuously expanding their knowledge base is crucial for success.

- Analytical Skills: Brokers must possess strong analytical abilities to assess risks accurately, evaluate insurance policies, and make informed recommendations. The ability to interpret data and identify potential areas of vulnerability is vital in this role.

- Communication and Interpersonal Skills: Effective communication is at the heart of insurance brokering. Brokers must be adept at building rapport with clients, understanding their unique needs, and conveying complex insurance concepts in a clear and concise manner.

- Negotiation and Relationship Building: Building strong relationships with insurance companies is essential for brokers to secure the best deals for their clients. Negotiation skills are crucial in this regard, as brokers often need to advocate for their clients’ interests while maintaining positive relationships with insurance providers.

- Ethical Conduct: Integrity and ethical behavior are non-negotiable in the insurance brokerage profession. Brokers must always act in the best interests of their clients, maintaining confidentiality and transparency in all their dealings.

Navigating the Insurance Landscape: A Broker’s Perspective

The insurance landscape is vast and diverse, offering a myriad of options to cater to different risk profiles and needs. Insurance brokers play a pivotal role in helping clients navigate this complex terrain, ensuring they select the most appropriate coverage.

Types of Insurance Policies

Insurance policies can be broadly categorized into two main types: personal insurance and commercial insurance.

Personal Insurance includes policies that protect individuals and their assets, such as:

- Health Insurance: Covering medical expenses and providing access to healthcare services.

- Life Insurance: Offering financial protection to beneficiaries in the event of the insured's death.

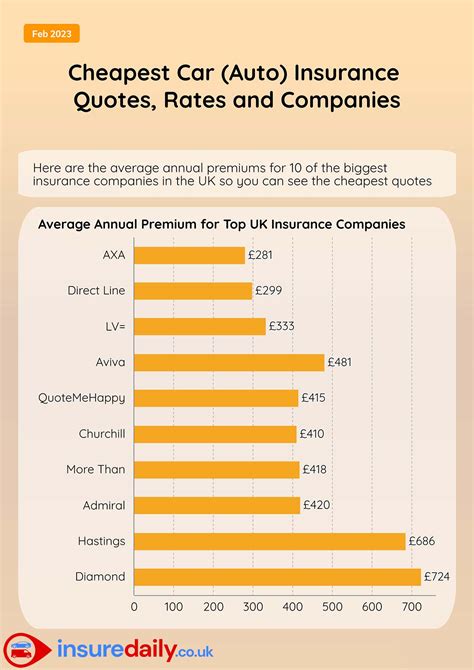

- Auto Insurance: Providing coverage for vehicles, including liability and comprehensive protection.

- Home Insurance: Protecting homeowners against damage to their property and personal belongings.

- Travel Insurance: Covering unexpected events during travel, such as medical emergencies or trip cancellations.

Commercial Insurance is designed to protect businesses and their operations. Some common types include:

- Business Owner's Policy (BOP): A package policy that combines property and liability coverage tailored to the specific needs of small businesses.

- General Liability Insurance: Protecting businesses against third-party claims, such as bodily injury or property damage.

- Professional Liability Insurance (Errors and Omissions): Providing coverage for professionals against negligence claims arising from their services.

- Workers' Compensation Insurance: Covering medical expenses and lost wages for employees injured on the job.

- Product Liability Insurance: Protecting businesses that manufacture or sell products against claims arising from product defects or harm caused by the product.

Assessing Client Needs and Providing Tailored Solutions

One of the most critical aspects of an insurance broker's role is understanding their clients' unique circumstances and tailoring insurance solutions accordingly. This involves a comprehensive assessment of the client's risks, financial situation, and desired level of protection.

For instance, a business owner may require a customized insurance package that includes property insurance, liability coverage, and business interruption insurance to protect against financial losses in the event of a disaster. On the other hand, an individual seeking health insurance may need guidance on choosing a plan that covers their specific medical needs while aligning with their budget.

| Client Profile | Insurance Needs |

|---|---|

| Small Business Owner | General Liability, Product Liability, Professional Liability |

| Young Professional | Health Insurance, Auto Insurance, Personal Liability |

| Family with Children | Home Insurance, Life Insurance, Education Savings Plans |

| Retired Couple | Long-Term Care Insurance, Annuities, Travel Insurance |

The Broker-Client Relationship: Building Trust and Confidence

The success of an insurance broker is intrinsically linked to the trust and confidence they build with their clients. Establishing a strong relationship based on integrity, expertise, and personalized service is crucial for long-term success.

Understanding Client Expectations

Insurance brokers must actively listen to their clients’ concerns and expectations. This involves asking the right questions to gain a comprehensive understanding of their financial goals, risk tolerance, and any specific requirements they may have. By tailoring their approach and recommendations to align with client expectations, brokers can ensure a higher level of satisfaction and loyalty.

Delivering Exceptional Service

Going beyond the mere sale of insurance policies, brokers should strive to provide exceptional service throughout the client’s insurance journey. This includes offering ongoing support, promptly addressing any queries or concerns, and proactively reviewing and updating insurance policies to ensure they remain relevant and adequate.

For instance, a broker might provide regular updates on industry trends or changes in insurance regulations that could impact their client's coverage. They might also initiate reviews of the client's policies at key life events, such as marriage, the birth of a child, or retirement, to ensure the insurance remains aligned with their evolving needs.

The Future of Insurance Brokering: Embracing Innovation and Technology

The insurance brokerage industry is experiencing a digital transformation, with technology playing an increasingly pivotal role. Brokers who embrace innovation and leverage technology effectively are poised to thrive in this evolving landscape.

Digital Tools and Platforms

Digital tools and platforms are revolutionizing the way insurance brokers operate. Online comparison platforms, for instance, enable brokers to efficiently search for and compare insurance policies, saving time and providing clients with a more comprehensive overview of available options.

Additionally, the use of advanced analytics and data-driven insights allows brokers to make more informed decisions and provide personalized recommendations. By leveraging technology, brokers can enhance their efficiency, accuracy, and overall client experience.

The Rise of Insurtech

Insurtech, a portmanteau of insurance and technology, refers to the use of innovative technologies to enhance and disrupt traditional insurance processes. Insurtech startups and companies are introducing new business models, products, and services that are reshaping the insurance industry.

Insurance brokers can benefit from partnering with Insurtech firms to access cutting-edge solutions and enhance their service offerings. For instance, the use of telematics in auto insurance, where driving behavior is monitored and insurance premiums are adjusted accordingly, can provide brokers with a competitive edge and attract tech-savvy clients.

Overcoming Challenges: Navigating the Complexities of the Insurance Industry

While the insurance brokerage industry offers numerous opportunities, it also presents several challenges that brokers must navigate effectively.

Regulatory Compliance

Insurance brokers must adhere to a myriad of regulations and compliance requirements, which can be complex and ever-changing. Staying up-to-date with the latest regulatory developments and ensuring compliance is crucial to avoid legal and financial repercussions.

Market Competition

The insurance brokerage industry is highly competitive, with numerous brokers vying for clients. To stay ahead of the competition, brokers must differentiate themselves by offering exceptional service, building strong client relationships, and staying at the forefront of industry trends and innovations.

Managing Client Expectations

Managing client expectations is a delicate balance for insurance brokers. Clients often have varying levels of insurance literacy and may expect instant solutions or unrealistic outcomes. Brokers must educate their clients, set realistic expectations, and provide transparent and honest advice to build and maintain trust.

The Impact of Insurance Brokering on Society

The role of insurance brokers extends beyond the individual or business level; it has a significant impact on society as a whole. By helping individuals and businesses mitigate risks and plan for the future, insurance brokers contribute to a more secure and resilient community.

Financial Security and Peace of Mind

Insurance policies provide individuals and families with financial security and peace of mind, ensuring they are protected against unforeseen events such as accidents, illnesses, or natural disasters. Insurance brokers play a crucial role in ensuring that clients have adequate coverage, empowering them to face life’s challenges with confidence.

Economic Stability and Business Growth

For businesses, insurance brokers are essential partners in their growth and sustainability. By securing comprehensive insurance coverage, businesses can protect their assets, manage risks, and focus on their core operations without the fear of catastrophic financial losses. This, in turn, contributes to a thriving business ecosystem and a robust economy.

Conclusion: The Vital Role of Insurance Brokers in a Complex World

In an increasingly complex and uncertain world, insurance brokers serve as trusted advisors, guiding individuals and businesses through the intricacies of risk management. Their expertise, coupled with a deep understanding of their clients’ needs, allows them to provide tailored insurance solutions that offer financial protection and peace of mind.

As the insurance industry continues to evolve, driven by technological advancements and changing societal needs, insurance brokers must adapt and innovate to remain relevant and provide exceptional service. By embracing the opportunities and overcoming the challenges, insurance brokers will continue to play a vital role in shaping a more secure and resilient future.

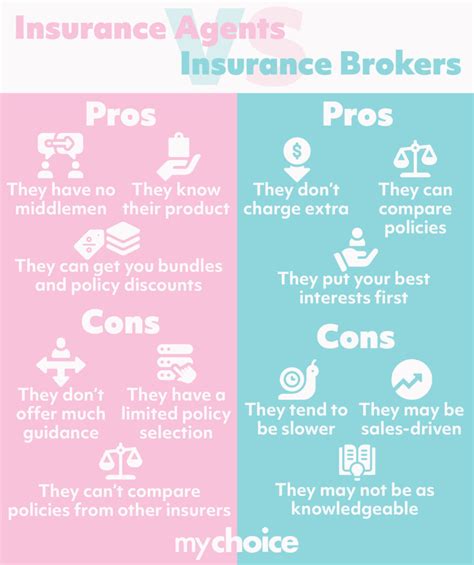

What are the key differences between an insurance agent and an insurance broker?

+An insurance agent represents a specific insurance company and sells policies on behalf of that company. They typically receive commissions based on the policies they sell. On the other hand, an insurance broker is an independent intermediary who works on behalf of their clients, offering advice and guidance on insurance policies from multiple companies. Brokers are compensated through fees or commissions paid by the client or the insurance company.

How do insurance brokers stay updated with industry changes and regulations?

+Insurance brokers invest in continuous professional development to stay abreast of industry changes and regulations. This includes attending industry conferences, workshops, and seminars, as well as obtaining additional certifications and licenses. They also subscribe to industry publications and maintain relationships with insurance professionals to stay informed about the latest developments.

What should I consider when choosing an insurance broker?

+When selecting an insurance broker, consider their experience, expertise, and reputation. Look for a broker who specializes in the type of insurance you require and has a proven track record of success. Check their credentials, read client reviews, and ask for referrals to ensure they are trustworthy and reliable. Additionally, consider their communication style and responsiveness to ensure a good fit for your needs.