All States Renters Insurance

Renters insurance is an essential yet often overlooked form of protection for individuals and families living in rental properties. It provides financial coverage and peace of mind, ensuring that renters are safeguarded against various unexpected events and losses. While it is not required by law in most states, the benefits it offers make it a highly recommended consideration for all renters. This comprehensive guide will delve into the world of renters insurance, exploring its significance, coverage options, and how it can protect individuals and their belongings across the United States.

Understanding Renters Insurance

Renters insurance is a type of property insurance specifically designed for individuals who do not own the property they reside in. It offers protection against a range of potential losses, including damage to personal belongings, liability for accidents or injuries that occur within the rental unit, and additional living expenses in the event of a covered loss that renders the rental unit uninhabitable. This insurance policy serves as a vital safety net, safeguarding renters from financial burdens that can arise from unforeseen circumstances.

The coverage provided by renters insurance typically includes the following:

- Personal Property Coverage: This protects the renter's belongings, such as furniture, electronics, clothing, and appliances, against perils like fire, theft, vandalism, and water damage.

- Liability Coverage: It provides protection if someone is injured or their property is damaged due to the renter's negligence. This coverage can help cover medical bills and legal fees.

- Additional Living Expenses: In the event of a covered loss that makes the rental unit unlivable, this coverage helps cover the costs of temporary housing and other necessary expenses.

- Medical Payments to Others: This coverage pays for medical expenses if a visitor is injured in the rental unit, regardless of fault.

State-Specific Considerations

While renters insurance is not mandated by law in most states, certain states have unique regulations and requirements that renters should be aware of. Here’s a breakdown of some state-specific considerations:

California

In California, renters insurance is not mandatory, but it is highly recommended due to the state’s susceptibility to natural disasters like earthquakes and wildfires. Many renters opt for policies that include coverage for these events, providing an extra layer of protection.

New York

New York City, being one of the most densely populated urban areas, has a high concentration of renters. While renters insurance is not required by law, the high cost of living and the potential for various risks make it a prudent investment for New York residents.

Texas

Texas, known for its diverse climate and frequent severe weather events, sees a high demand for renters insurance. Many policies in Texas include coverage for hurricanes, tornadoes, and hailstorms, addressing the state’s unique weather-related risks.

Florida

Florida’s susceptibility to hurricanes and tropical storms makes renters insurance a crucial consideration for residents. Policies often include coverage for wind damage, ensuring renters are protected against these frequent natural disasters.

Illinois

In Illinois, renters insurance is not mandatory, but the state’s diverse weather patterns and potential for severe storms make it a wise investment. Many policies cover losses from storms, floods, and other weather-related incidents.

Washington

Washington state, with its variable climate and potential for earthquakes and floods, offers renters insurance policies that include coverage for these specific risks. Renters should carefully assess their needs and choose a policy that provides adequate protection.

Coverage Options and Customization

Renters insurance policies can be tailored to meet the specific needs and circumstances of individual renters. Here are some key coverage options and considerations:

Personal Property Coverage

Renters can choose the level of coverage for their personal belongings based on their estimated value. It’s essential to accurately assess the value of one’s possessions to ensure adequate coverage.

Liability Coverage

Liability coverage limits can be adjusted to match the renter’s needs and potential risks. Higher limits provide greater protection against legal claims and medical expenses resulting from accidents or injuries.

Additional Living Expenses

This coverage can be customized to cover the expected costs of temporary housing and other necessary expenses during the period of displacement. It’s crucial to consider factors like the local cost of living and the potential duration of displacement.

Personal Injury Coverage

Some policies offer personal injury coverage, which provides protection against claims arising from libel, slander, or invasion of privacy. This coverage can be beneficial for renters who want added protection against non-physical injury claims.

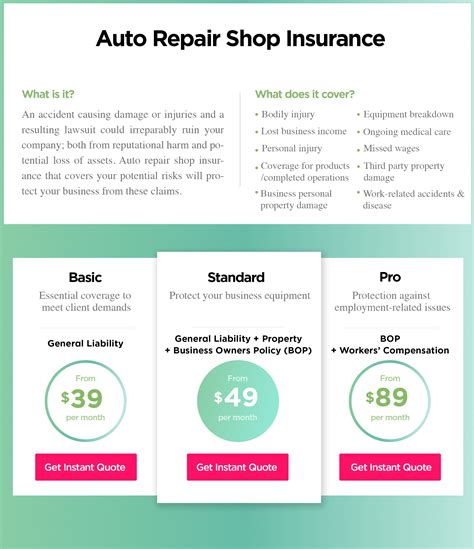

Cost of Renters Insurance

The cost of renters insurance varies depending on several factors, including the level of coverage, the location of the rental property, and the renter’s claims history. On average, renters insurance policies can range from 150 to 300 per year, making it an affordable form of protection.

Renters can further reduce their premiums by bundling their renters insurance with other policies, such as auto insurance, or by maintaining a good credit score. Additionally, increasing the deductible can lower the premium, although it's essential to choose a deductible amount that is manageable in the event of a claim.

Claims Process and Filing

In the event of a covered loss, renters should promptly notify their insurance provider and initiate the claims process. The process typically involves the following steps:

- Contacting the Insurance Company: Renters should contact their insurance provider as soon as possible after the loss occurs to report the incident and begin the claims process.

- Providing Documentation: Renters will need to provide documentation of the loss, including photos, videos, and any relevant receipts or invoices. This helps the insurance company assess the extent of the damage and determine the appropriate compensation.

- Assessment and Adjustment: An insurance adjuster will be assigned to evaluate the claim and determine the amount of compensation owed. The adjuster will consider factors like the policy limits, deductibles, and the actual cash value or replacement cost of the damaged items.

- Receiving Compensation: Once the claim is approved, the insurance company will issue a payment to cover the agreed-upon amount. Renters should carefully review the compensation to ensure it accurately reflects the losses incurred.

It's important for renters to understand their policy's coverage and limitations, as well as their responsibilities in the claims process. Promptly reporting the loss and providing accurate documentation can help ensure a smoother and more efficient claims experience.

Renters Insurance Myths Debunked

There are several misconceptions surrounding renters insurance that can deter individuals from obtaining this valuable coverage. Let’s address some of these myths:

Myth: Renters Insurance is Expensive

Renters insurance is often more affordable than many people realize. The average cost of a policy is relatively low, and by comparing quotes and customizing coverage, renters can find a policy that fits their budget.

Myth: My Landlord’s Insurance Covers My Belongings

Landlord insurance policies typically cover the structure of the rental property but do not extend to the personal belongings of renters. Renters insurance is necessary to protect one’s possessions against various risks.

Myth: I Don’t Have Enough Valuable Belongings to Warrant Insurance

Even if a renter doesn’t own high-value items, the cost of replacing everyday items like furniture, clothing, and electronics can quickly add up. Renters insurance provides protection against a range of losses, ensuring that even small items are covered.

Myth: Renters Insurance is Only Necessary for High-Risk Areas

While certain areas may have higher risks of natural disasters or crimes, renters insurance provides protection against a wide range of incidents, including fires, theft, and accidents. Regardless of location, renters should consider the potential risks and the financial impact of a loss.

Benefits of Renters Insurance

Renters insurance offers numerous advantages that go beyond financial protection. Here are some key benefits:

- Peace of Mind: Knowing that one's belongings and personal liability are covered provides a sense of security and reassurance.

- Financial Protection: Renters insurance helps cover the costs of replacing damaged or stolen items, as well as any legal fees or medical expenses resulting from accidents or injuries.

- Additional Living Expenses: In the event of a covered loss that renders the rental unit uninhabitable, renters insurance can provide the means to cover temporary housing and other necessary expenses.

- Personal Liability Protection: Renters insurance offers protection against lawsuits arising from accidents or injuries that occur within the rental unit.

- Enhanced Security: Many insurance providers offer discounts or incentives for renters who take proactive measures to secure their rental property, such as installing smoke detectors or security systems.

Choosing the Right Renters Insurance

When selecting a renters insurance policy, it’s essential to consider the following factors:

- Coverage Limits: Ensure that the policy provides adequate coverage for your personal belongings and liability risks. Assess the value of your possessions and choose limits that match your needs.

- Deductibles: Select a deductible amount that you are comfortable paying in the event of a claim. A higher deductible can lower your premium, but it's important to choose an amount that is manageable.

- Additional Coverage Options: Review the available coverage options and choose the ones that best fit your needs. Consider factors like personal injury coverage, additional living expenses, and coverage for specific risks like earthquakes or floods.

- Reputable Insurance Provider: Choose an insurance company with a solid reputation and a history of fair claims handling. Check customer reviews and ratings to ensure you are working with a reliable provider.

- Policy Exclusions: Carefully review the policy exclusions to understand what is not covered. Some common exclusions include damage caused by pests, flooding, and intentional acts.

Conclusion

Renters insurance is a vital form of protection for individuals and families living in rental properties. It offers financial coverage and peace of mind, safeguarding renters against a range of unexpected losses. By understanding the coverage options, state-specific considerations, and the benefits of renters insurance, individuals can make informed decisions to protect their belongings and ensure their financial security. Remember, while renters insurance is not mandatory in most states, it is a wise investment that can provide valuable protection and peace of mind.

What is the average cost of renters insurance per year?

+The average cost of renters insurance per year typically ranges from 150 to 300, although prices can vary based on factors such as location, coverage limits, and the renter’s claims history.

Does renters insurance cover natural disasters like hurricanes or earthquakes?

+Renters insurance policies often include coverage for specific natural disasters, such as hurricanes or earthquakes, but it’s essential to review the policy carefully to understand the extent of coverage and any potential exclusions.

Can I add additional coverage for valuable items like jewelry or electronics?

+Yes, many renters insurance policies allow for the addition of special coverage for valuable items that exceed the standard coverage limits. This ensures that high-value items are adequately protected.