Long Term Care Insurance

Long-term care insurance is a crucial topic that often goes unnoticed until it becomes a necessity. With an aging population and the increasing prevalence of chronic illnesses, the need for long-term care is on the rise. This article aims to delve into the intricacies of long-term care insurance, exploring its importance, how it works, and why it should be a consideration for individuals and families planning for the future.

Understanding Long-Term Care Insurance

Long-term care insurance is a specialized form of coverage designed to provide financial protection and support for individuals requiring extended care due to age, illness, or disability. Unlike traditional health insurance, which primarily covers acute medical conditions, long-term care insurance focuses on the ongoing, daily assistance required for basic activities of daily living (ADLs) and instrumental activities of daily living (IADLs).

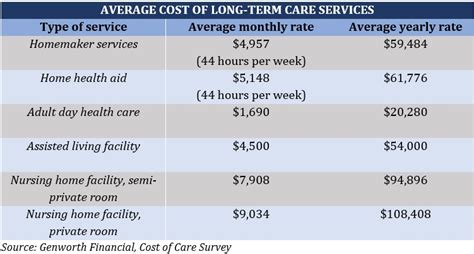

This type of insurance gains significance as we consider the potential financial strain of long-term care, which can quickly deplete savings and assets. With the average cost of nursing home care exceeding $100,000 annually in many regions, the need for a comprehensive plan becomes evident. Long-term care insurance aims to mitigate this financial burden, ensuring individuals can access the care they need without compromising their financial security.

The Growing Need for Long-Term Care

The demand for long-term care services is rising due to several demographic and societal factors. As life expectancy increases, so does the likelihood of requiring extended care. Additionally, the prevalence of chronic conditions such as Alzheimer’s disease, Parkinson’s disease, and diabetes is growing, often necessitating long-term support.

Furthermore, the traditional family caregiving model is evolving. With more individuals pursuing careers and living farther from their families, the availability of informal caregivers is declining. This shift underscores the importance of having a financial plan in place to cover the costs of professional long-term care.

How Long-Term Care Insurance Works

Long-term care insurance policies typically cover a range of services, including in-home care, assisted living facilities, adult day care, and skilled nursing care. The coverage and benefits provided by these policies can vary widely, making it crucial to understand the specific terms and conditions of each plan.

Key Components of Long-Term Care Insurance

Eligibility Criteria: To qualify for benefits, policyholders must meet certain medical criteria, often defined as needing assistance with two or more ADLs or suffering from a severe cognitive impairment. These ADLs include tasks such as bathing, dressing, and eating, while IADLs encompass activities like cooking, managing finances, and taking medication.

Benefit Triggers: Long-term care insurance policies typically have specific triggers that must be met to activate coverage. These triggers can include a cognitive impairment diagnosis, a specific level of functional impairment, or a physician's certification of the need for long-term care.

Benefit Period and Coverage Limits: Policies offer varying benefit periods, ranging from a few months to several years. The benefit period determines the duration for which the policy will cover care expenses. Additionally, policies may have daily, monthly, or annual coverage limits, capping the amount of financial support provided.

Eligible Care Settings: Long-term care insurance policies outline the types of care settings and services that are covered. This can include in-home care, adult day care, assisted living facilities, and skilled nursing care. Some policies may also cover respite care, which provides temporary relief for primary caregivers.

Inflation Protection: To account for the rising costs of long-term care, many policies offer inflation protection. This feature adjusts the policy's benefits annually to keep pace with inflation, ensuring that the coverage remains adequate over time.

Example Policy Details

Consider the following example policy details to illustrate the practical application of long-term care insurance:

| Policy Feature | Description |

|---|---|

| Eligibility Criteria | Requires assistance with at least two ADLs or a severe cognitive impairment. |

| Benefit Trigger | Policyholder must be certified by a physician as needing long-term care. |

| Benefit Period | 3-year benefit period, with the option to extend to a lifetime benefit. |

| Coverage Limits | Daily benefit of $150, with a maximum lifetime benefit of $180,000. |

| Eligible Care Settings | In-home care, assisted living facilities, and skilled nursing care. |

| Inflation Protection | 5% compound inflation protection, increasing benefits annually. |

Benefits and Advantages of Long-Term Care Insurance

Long-term care insurance offers several key advantages that make it a valuable consideration for individuals and families:

Financial Protection and Peace of Mind

The primary benefit of long-term care insurance is financial protection. By having a policy in place, individuals can ensure that their assets and savings are protected in the event of a long-term care need. This peace of mind allows them to focus on their health and well-being without the added stress of financial concerns.

With long-term care insurance, individuals can access a wide range of care options, including in-home care, which is often the preferred choice for many. This flexibility ensures that care is tailored to the individual's needs and preferences, promoting a higher quality of life.

Preserving Independence and Quality of Life

Long-term care insurance empowers individuals to maintain their independence and dignity. By providing access to professional care services, policyholders can continue living in their own homes or preferred care settings. This autonomy is essential for preserving one’s quality of life and sense of self-determination.

Family Support and Caregiver Relief

For families with long-term care needs, insurance can be a vital source of support. It reduces the financial burden on caregivers, allowing them to focus on providing emotional support and quality care. Additionally, long-term care insurance can help ensure that family members are not forced to choose between their careers and caregiving responsibilities.

Access to Specialized Care

Many long-term care insurance policies cover a range of specialized services, including rehabilitation therapy, dementia care, and palliative care. This access to specialized care can significantly enhance the quality of life for individuals with specific medical needs or cognitive impairments.

Factors to Consider When Choosing a Policy

When selecting a long-term care insurance policy, several critical factors should be taken into account to ensure the best fit for your needs:

Coverage Options and Flexibility

Evaluate the range of coverage options offered by different policies. Consider the specific care settings and services you may require, such as in-home care, assisted living, or specialized care for specific conditions. Policies with flexible coverage options can provide greater peace of mind.

Benefit Amounts and Inflation Protection

Assess the daily or monthly benefit amounts provided by the policy. Ensure that these amounts align with the anticipated costs of care in your region. Additionally, look for policies with inflation protection to ensure that your benefits keep pace with rising care expenses over time.

Waiting Periods and Elimination Periods

Policies often have waiting or elimination periods, which are the durations an individual must wait before benefits become payable. Shorter waiting periods can provide quicker access to benefits, but they may result in higher premiums. Consider your financial situation and the potential timeline of your care needs when selecting a policy with appropriate waiting periods.

Policy Duration and Renewal Options

Long-term care insurance policies can vary in duration, with some offering coverage for a set number of years, while others provide lifetime benefits. Assess your long-term care needs and financial situation to determine the appropriate policy duration. Additionally, consider policies with flexible renewal options, allowing you to adjust coverage as your needs evolve.

Policy Reviews and Updates

Regularly review and update your long-term care insurance policy to ensure it remains aligned with your changing needs and circumstances. Life events such as a new diagnosis, a change in residence, or a significant shift in financial status may prompt the need for policy adjustments.

The Future of Long-Term Care Insurance

The landscape of long-term care insurance is evolving, driven by advancements in healthcare and changing societal dynamics. As the demand for long-term care continues to rise, insurers are developing innovative solutions to meet the diverse needs of policyholders.

Emerging Trends in Long-Term Care Insurance

One notable trend is the integration of technology into long-term care insurance. Insurers are leveraging digital platforms and telemedicine to enhance policyholder experiences and improve access to care. This includes the use of remote monitoring devices, virtual care consultations, and digital health records, all of which contribute to more efficient and effective care management.

Additionally, insurers are exploring new coverage options to address the unique needs of specific demographics. This includes policies tailored to individuals with pre-existing conditions or those who require specialized care for chronic illnesses. By offering more targeted coverage, insurers aim to provide comprehensive support to a wider range of policyholders.

Addressing the Challenges of Long-Term Care

While long-term care insurance offers valuable protection, it also faces challenges. One significant concern is the rising cost of care, which can outpace the benefits provided by some policies. Insurers are actively working to address this issue by offering policies with flexible benefit structures and enhanced inflation protection.

Another challenge is the need for greater public awareness and education about long-term care insurance. Many individuals remain unaware of the benefits and importance of this type of coverage. Insurers and industry experts are collaborating to develop educational campaigns and resources to ensure that individuals can make informed decisions about their long-term care needs.

Conclusion

Long-term care insurance is an essential tool for individuals and families planning for their future well-being. By providing financial protection and access to a wide range of care options, these policies offer peace of mind and support during times of need. As the landscape of long-term care continues to evolve, staying informed and proactive about your insurance options is crucial.

Whether you're considering long-term care insurance for the first time or evaluating your existing policy, consulting with financial and insurance professionals can help ensure that your coverage aligns with your unique needs and circumstances. By taking a proactive approach, you can secure the financial stability and quality of life you deserve as you navigate the journey of aging and caregiving.

What is the average cost of long-term care insurance policies?

+The cost of long-term care insurance policies can vary significantly based on factors such as age, health status, coverage limits, and policy features. On average, premiums for long-term care insurance range from 1,500 to 3,000 per year, with some policies costing even more depending on the level of coverage and benefits selected.

Can long-term care insurance be used for in-home care?

+Yes, many long-term care insurance policies cover a wide range of care settings, including in-home care. In-home care services can include assistance with activities of daily living (ADLs), such as bathing, dressing, and meal preparation, as well as instrumental activities of daily living (IADLs), like light housekeeping and medication management.

How do I know if I need long-term care insurance?

+Consider your personal and family health history, your financial situation, and your long-term care goals. If you have a history of chronic illnesses or disabilities that may require extended care, or if you want to preserve your assets and maintain independence as you age, long-term care insurance may be a wise investment. Consulting with a financial advisor or insurance specialist can help you assess your specific needs.

Are there tax benefits associated with long-term care insurance?

+Yes, long-term care insurance premiums may be tax-deductible under certain circumstances. The IRS allows individuals to deduct qualified long-term care insurance premiums as a medical expense, subject to specific limits and conditions. It’s advisable to consult with a tax professional to understand the potential tax benefits applicable to your situation.