Auto Insurance Farm Bureau

In the realm of auto insurance, Farm Bureau has carved a significant niche, offering comprehensive coverage options tailored to the needs of policyholders. This article delves into the intricacies of Farm Bureau auto insurance, providing an in-depth analysis of its offerings, performance, and relevance in the competitive insurance market.

Understanding Farm Bureau Auto Insurance

Farm Bureau Auto Insurance is an integral part of the Farm Bureau Financial Services portfolio, which encompasses a range of insurance and financial products. With a focus on providing insurance coverage to rural communities, Farm Bureau has expanded its reach to cater to a broader spectrum of policyholders, offering a comprehensive suite of auto insurance plans.

The company's auto insurance policies are designed to offer protection against a range of risks, including accidents, theft, and natural disasters. Farm Bureau's approach is rooted in a deep understanding of the unique challenges faced by rural communities, and its insurance offerings reflect this insight.

Coverage Options

Farm Bureau’s auto insurance coverage options are diverse and flexible, allowing policyholders to tailor their plans to their specific needs. The key coverage options include:

- Liability Coverage: This provides protection against claims arising from bodily injury or property damage caused by the policyholder.

- Collision Coverage: Covers damages to the insured vehicle resulting from collisions, regardless of fault.

- Comprehensive Coverage: Protects against non-collision incidents such as theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides coverage for policyholders involved in accidents with drivers who lack sufficient insurance.

- Medical Payments Coverage: Covers medical expenses for the policyholder and passengers in the event of an accident.

Farm Bureau also offers additional endorsements and riders, allowing policyholders to further customize their coverage to suit their unique circumstances. These endorsements can include coverage for custom parts and equipment, rental car reimbursement, and roadside assistance.

Discounts and Savings

Farm Bureau understands the importance of cost-effectiveness in auto insurance, and thus offers a range of discounts and savings opportunities to policyholders. These include:

- Multi-Policy Discount: Policyholders who bundle their auto insurance with other Farm Bureau insurance products, such as home or life insurance, can avail of significant discounts.

- Safe Driver Discount : Drivers with a clean record and no at-fault accidents or traffic violations may qualify for this discount.

- Vehicle Safety Discount: Vehicles equipped with certain safety features, such as air bags or anti-lock brakes, may be eligible for this discount.

- Good Student Discount: Students who maintain a certain grade point average may be eligible for this discount, recognizing the correlation between academic achievement and responsible driving.

- Pay-in-Full Discount: Policyholders who pay their premiums in full at the inception of the policy may receive a discount.

Farm Bureau also offers discounts for senior citizens and for policyholders who complete approved defensive driving courses. These incentives aim to reward safe driving behaviors and encourage policyholders to take proactive steps to reduce their risk profile.

Performance and Claims Handling

Farm Bureau’s performance in the auto insurance market is underpinned by its commitment to prompt and efficient claims handling. The company’s claims process is designed to be straightforward and transparent, ensuring that policyholders receive the coverage they need in a timely manner.

Farm Bureau employs a team of experienced claims adjusters who are dedicated to investigating and resolving claims efficiently. The company's claims process involves the following steps:

- Reporting the Claim: Policyholders can report claims 24/7 through the Farm Bureau website, mobile app, or by phone. Farm Bureau encourages policyholders to report claims as soon as possible to facilitate a swift resolution.

- Claims Assessment: Once a claim is reported, a dedicated claims adjuster is assigned to the case. The adjuster works with the policyholder to understand the circumstances of the incident and assess the extent of the damage.

- Estimating and Repair: Based on the adjuster's assessment, Farm Bureau provides an estimate for the repairs. Policyholders can choose their preferred repair shop, and Farm Bureau works directly with the shop to ensure a smooth repair process.

- Payment and Resolution: Once the repairs are complete, Farm Bureau processes the payment directly to the repair shop. In cases where a rental car is required, Farm Bureau also handles the rental car reimbursement process.

Farm Bureau's claims process is designed to be as seamless as possible, minimizing the stress and inconvenience often associated with insurance claims. The company's focus on prompt resolution reflects its commitment to customer satisfaction and its understanding of the importance of reliable auto insurance coverage.

Technology and Digital Innovations

Farm Bureau has embraced digital innovations to enhance its auto insurance offerings and improve the overall customer experience. The company’s digital initiatives are aimed at streamlining processes, improving accessibility, and providing policyholders with greater control over their insurance journey.

Online and Mobile Services

Farm Bureau’s online and mobile platforms offer a range of services that empower policyholders. These include:

- Policy Management: Policyholders can access their policy details, make payments, and update their coverage options online or through the mobile app.

- Claims Reporting: As mentioned earlier, policyholders can report claims 24/7 through the online platform or mobile app, ensuring immediate attention to their needs.

- Document Upload: Policyholders can upload relevant documents, such as accident reports or repair estimates, directly to their online account, simplifying the claims process.

- Policy Comparison: Farm Bureau's online tools allow policyholders to compare their current coverage with alternative options, ensuring they have the most suitable plan for their needs.

Telematics and Usage-Based Insurance

Farm Bureau has also ventured into telematics and usage-based insurance, leveraging technology to offer more precise and personalized insurance rates. Telematics devices installed in vehicles can provide real-time data on driving behavior, such as acceleration, braking, and mileage. This data is used to calculate more accurate insurance premiums, rewarding safe driving habits.

Usage-based insurance programs, such as Farm Bureau's DrivePlan, offer policyholders the opportunity to lower their premiums by demonstrating safe driving habits. These programs use telematics devices to track driving behavior, and policyholders can receive discounts based on their performance.

Community Engagement and Customer Satisfaction

Farm Bureau’s commitment to its policyholders extends beyond providing insurance coverage. The company is actively engaged in community initiatives and programs aimed at promoting safe driving and overall well-being.

Community Initiatives

Farm Bureau supports various community initiatives, including:

- Safe Driving Campaigns: Farm Bureau partners with local organizations and schools to promote safe driving practices among young drivers. These campaigns often include educational workshops, driving simulations, and awareness campaigns.

- Community Safety Programs: The company supports initiatives aimed at improving road safety, such as installing traffic calming measures or enhancing pedestrian crossings.

- Financial Literacy Programs: Farm Bureau offers educational programs to help policyholders understand their insurance policies and make informed decisions about their coverage.

Customer Satisfaction and Reviews

Farm Bureau’s focus on customer satisfaction is reflected in its consistently high ratings and positive reviews. Policyholders often cite the company’s personalized approach, efficient claims handling, and competitive rates as key strengths. Farm Bureau’s commitment to understanding the unique needs of its policyholders and adapting its offerings accordingly is a significant factor in its success.

In an increasingly competitive insurance market, Farm Bureau's emphasis on community engagement, digital innovation, and customer satisfaction sets it apart. The company's approach to auto insurance is not merely transactional but is rooted in a deep understanding of its policyholders' needs and circumstances.

Future Outlook and Industry Implications

The auto insurance market is undergoing significant transformations, driven by technological advancements and changing consumer expectations. Farm Bureau’s forward-thinking approach positions it well to navigate these changes and continue to thrive.

Industry Trends and Innovations

Key industry trends and innovations that will shape the future of auto insurance include:

- Autonomous Vehicles: The rise of autonomous vehicles will bring about significant changes in the auto insurance landscape. Farm Bureau is well-positioned to adapt to these changes, having already demonstrated its ability to innovate and respond to technological advancements.

- Telematics and Data Analytics: The continued development and adoption of telematics and data analytics will allow for more precise insurance pricing and personalized coverage options. Farm Bureau's usage-based insurance programs already leverage these technologies, and the company is likely to further enhance its offerings in this area.

- Digital Transformation: The shift towards digital platforms and services is set to continue, with more insurers embracing online and mobile solutions. Farm Bureau's digital initiatives have already established a strong foundation, and the company is likely to build upon this to enhance its online presence and customer experience.

Conclusion

Farm Bureau Auto Insurance has established itself as a reliable and innovative provider, offering comprehensive coverage and a customer-centric approach. The company’s understanding of its policyholders’ needs, coupled with its commitment to community engagement and digital innovation, positions it well for continued success in the evolving auto insurance market.

As the industry continues to evolve, Farm Bureau is poised to adapt and thrive, ensuring its policyholders have access to the coverage and support they need. The company's focus on providing value, both in terms of coverage and customer experience, is a testament to its commitment to serving its policyholders and communities.

How does Farm Bureau determine auto insurance premiums?

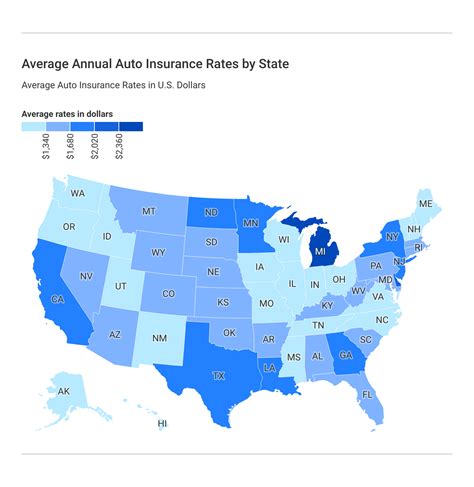

+Farm Bureau calculates premiums based on a variety of factors, including the policyholder’s driving record, the type of vehicle insured, the level of coverage selected, and the policyholder’s location. The company also offers discounts for safe driving behaviors and multi-policy bundles.

What are the benefits of Farm Bureau’s usage-based insurance programs?

+Usage-based insurance programs, like Farm Bureau’s DrivePlan, offer policyholders the opportunity to lower their premiums by demonstrating safe driving habits. These programs use telematics devices to track driving behavior, and policyholders can receive discounts based on their performance. This approach rewards safe driving and provides a more personalized insurance experience.

How does Farm Bureau support its policyholders in the event of a claim?

+Farm Bureau has a dedicated team of claims adjusters who work closely with policyholders to ensure a smooth and efficient claims process. Policyholders can report claims 24⁄7, and the company provides a range of online and mobile services to simplify the process. Farm Bureau also offers direct payment to repair shops and rental car reimbursement, further streamlining the claims experience.