Renters Insurance Agent

Understanding the Role of a Renters Insurance Agent: Navigating the Complexities of Coverage

In the world of insurance, the role of a renters insurance agent is often overlooked, yet it plays a crucial part in safeguarding the assets and peace of mind of countless individuals. As a renters insurance agent, my primary objective is to guide renters through the intricate process of securing appropriate insurance coverage for their unique circumstances. This article aims to delve into the multifaceted responsibilities and expertise required to excel in this field, offering an insightful perspective on the profession.

The Foundation: Education and Professional Development

Becoming a renters insurance agent necessitates a solid educational foundation. Many agents hold bachelor's degrees in fields such as insurance, risk management, or business administration, providing a comprehensive understanding of the industry's intricacies. Additionally, ongoing professional development is imperative to stay abreast of the ever-evolving insurance landscape.

My own journey began with a degree in Risk Management and Insurance Studies, offering a deep dive into the principles of insurance, risk assessment, and financial planning. This academic foundation was complemented by extensive industry certifications, such as the Certified Insurance Counselor (CIC) designation, which bolstered my expertise in risk management and insurance practices.

Continuous learning is integral to my role. I actively engage with industry associations, attend conferences, and participate in workshops to stay informed about the latest trends, regulations, and products in the insurance market. This commitment to professional development ensures that I can provide my clients with the most up-to-date and relevant advice, tailored to their specific needs.

Assessing Client Needs: A Comprehensive Approach

One of the most critical aspects of being a renters insurance agent is the ability to conduct thorough assessments of client needs. This process involves more than simply reviewing a rental property; it requires a holistic understanding of the client's lifestyle, assets, and potential risks.

When meeting with clients, I employ a meticulous approach, gathering detailed information about their possessions, liability concerns, and personal circumstances. This may include discussing their rental agreement, understanding the specific terms and conditions, and identifying any unique aspects of their rental property that could impact insurance coverage.

For instance, a client residing in a high-risk flood zone would require a different insurance strategy compared to someone in a low-risk area. By identifying such nuances, I can tailor insurance policies to provide the most comprehensive protection. This level of personalization is a cornerstone of my practice, ensuring that each client receives coverage that aligns perfectly with their individual needs.

Policy Selection and Customization: Tailoring Coverage

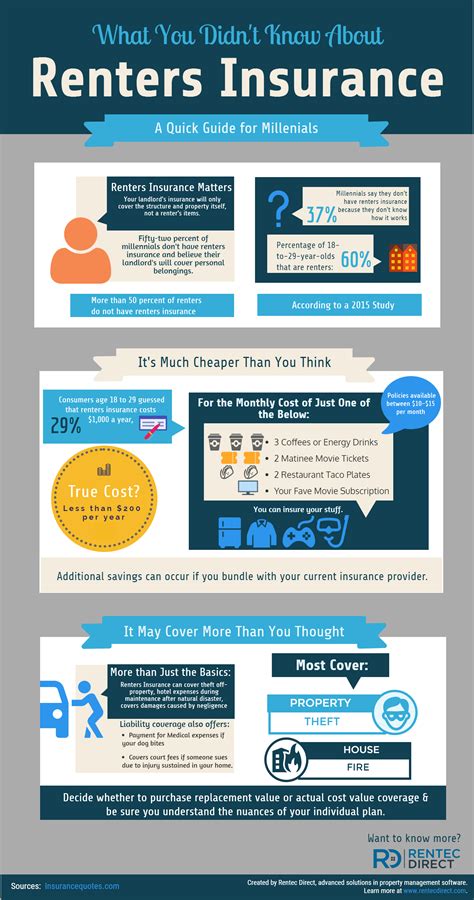

The renters insurance market offers a diverse range of policies, each designed to cater to specific needs. As an agent, my expertise lies in navigating this landscape to select the most suitable policy for my clients.

I work closely with clients to understand their priorities and budget constraints, offering guidance on the most appropriate coverage limits and deductibles. This may involve explaining the differences between actual cash value and replacement cost coverage, or discussing the benefits of additional endorsements for valuable items like jewelry or electronics.

| Policy Type | Coverage Highlights |

|---|---|

| Standard Renters Insurance | Covers personal belongings, liability, and additional living expenses. |

| Enhanced Renters Insurance | Offers higher coverage limits and additional perks like identity theft protection. |

| Valuable Items Endorsements | Provides extended coverage for high-value items like fine art or collectibles. |

Policy customization is a key strength of my practice. By offering a range of options and add-ons, I ensure that clients can select a policy that not only meets their basic needs but also provides peace of mind in the face of unforeseen circumstances.

The Claims Process: Navigating Complexities

One of the most challenging yet crucial aspects of my role is guiding clients through the claims process. When a renter experiences a loss, my expertise becomes invaluable in navigating the complexities of insurance claims.

I work diligently to assist clients in documenting their losses accurately and efficiently. This involves providing guidance on the necessary steps, from taking detailed inventories of damaged or stolen items to understanding the documentation required by insurance companies.

My experience in handling a wide range of claims situations allows me to offer tailored advice. Whether it's a natural disaster, theft, or a liability claim, I can provide insights into the typical claims process and potential pitfalls, ensuring that my clients receive the full benefits they are entitled to.

Moreover, I maintain close communication with insurance providers throughout the claims process, advocating for my clients to ensure fair and prompt settlements. This level of advocacy is a cornerstone of my practice, demonstrating my commitment to client satisfaction and peace of mind.

Building Trust and Relationships: A Client-Centric Approach

At the heart of my practice is a client-centric philosophy, focused on building long-term relationships based on trust and personalized service. I believe that renters insurance is not just a product, but a crucial aspect of financial security and peace of mind.

By offering a comprehensive suite of services, from initial consultations to ongoing support, I aim to become a trusted advisor for my clients. This may involve providing regular policy reviews to ensure coverage remains aligned with changing circumstances, or offering proactive advice on risk mitigation strategies to prevent potential losses.

I also recognize the importance of community involvement in building trust. Participating in local events, offering educational workshops, and providing resources to renters in my community are integral parts of my practice. By engaging with the community, I can better understand the unique challenges and needs of renters, allowing me to provide more tailored and effective insurance solutions.

Conclusion: A Commitment to Excellence

As a renters insurance agent, my dedication lies in delivering exceptional service and personalized solutions to my clients. Through a combination of academic rigor, professional development, and a deep understanding of the insurance landscape, I strive to provide the highest level of protection and peace of mind.

By continually refining my skills and staying abreast of industry trends, I am committed to ensuring that my clients have the coverage they need, when they need it. Whether it's navigating the complexities of policy selection, advocating for fair claims settlements, or providing proactive risk management advice, I am dedicated to the success and well-being of every client I serve.

What are the benefits of working with a renters insurance agent?

+Renters insurance agents offer personalized guidance, helping you navigate complex policies and ensuring you have adequate coverage. They provide ongoing support and can assist with the claims process, making the entire insurance journey smoother and more tailored to your needs.

How do renters insurance agents assess my specific needs?

+Agents conduct thorough assessments by discussing your rental agreement, understanding your possessions and liabilities, and identifying any unique risks associated with your rental property. This ensures a customized insurance plan tailored to your circumstances.

Can a renters insurance agent help with policy customization?

+Absolutely! Agents are experts in policy customization, offering a range of options and add-ons to ensure your coverage aligns with your priorities and budget. They can guide you through the process, explaining different coverage types and their benefits.