How Do I Get Cheap Health Insurance

Navigating Affordable Health Insurance: A Comprehensive Guide

Finding affordable health insurance is a top priority for many individuals and families, especially in today's economic climate. With the right approach and knowledge, it is possible to secure quality coverage at a reasonable cost. This comprehensive guide will walk you through the steps to identify and obtain cheap health insurance, providing you with the tools to make informed decisions and potentially save money on your healthcare expenses.

In today's dynamic healthcare landscape, understanding the intricacies of health insurance is crucial. Whether you're a young adult just entering the workforce, a parent seeking coverage for your family, or a retiree navigating Medicare options, the path to affordable health insurance can be complex. However, with the right strategies and resources, you can unlock access to comprehensive healthcare at a price that fits your budget.

Understanding Your Health Insurance Options

The first step in securing cheap health insurance is to familiarize yourself with the various options available in your region. Health insurance plans come in many forms, each with its own set of features and costs. By exploring these options, you can identify the plans that best align with your healthcare needs and financial capabilities.

Private Health Insurance Plans

Private health insurance plans are typically offered by commercial insurance companies. These plans can be purchased directly from the insurer or through a licensed insurance agent or broker. Private plans offer a wide range of coverage options, from basic catastrophic plans to comprehensive health maintenance organization (HMO) or preferred provider organization (PPO) plans.

When considering private plans, it's important to understand the different types of coverage they offer. HMO plans typically provide comprehensive coverage but require you to choose a primary care physician and obtain referrals for specialist care. PPO plans offer more flexibility in choosing healthcare providers but may come with higher out-of-pocket costs.

Government-Sponsored Health Insurance Programs

In addition to private plans, there are government-sponsored health insurance programs available to certain groups of people. These programs are often more affordable and can provide comprehensive coverage to those who qualify.

For example, Medicare is a federal program that provides health insurance for individuals aged 65 and older, as well as for younger people with certain disabilities or end-stage renal disease. Medicaid, another federal and state-run program, provides health coverage for low-income individuals and families. Both Medicare and Medicaid can be valuable resources for those who meet the eligibility criteria.

Furthermore, the Children's Health Insurance Program (CHIP) offers low-cost health coverage for children in families who earn too much to qualify for Medicaid but cannot afford private health insurance. CHIP is an excellent option for parents seeking affordable healthcare for their children.

Employer-Sponsored Health Insurance

If you are employed, your employer may offer health insurance as part of your benefits package. Employer-sponsored health insurance plans are often more affordable than individual plans, as the employer typically contributes a portion of the premium. These plans can be a great way to access comprehensive coverage at a reduced cost.

When evaluating employer-sponsored plans, it's important to consider the coverage options, out-of-pocket costs, and any potential limitations. Some employers may offer multiple plan options, allowing you to choose the one that best suits your needs and budget.

Comparing Health Insurance Plans

Once you have identified the types of health insurance plans available to you, the next step is to compare these plans to find the most affordable option that meets your healthcare needs. Comparison shopping is crucial to ensuring you get the best value for your money.

Key factors to consider when comparing health insurance plans include:

- Premiums: The amount you pay monthly for your health insurance coverage.

- Deductibles: The amount you must pay out of pocket before your insurance coverage begins.

- Copayments: The fixed amount you pay for covered medical services, such as doctor visits or prescriptions.

- Coinsurance: The percentage of covered medical expenses you pay after meeting your deductible.

- Out-of-Pocket Maximum: The maximum amount you will pay out of pocket for covered services in a year.

- Network of Providers: The list of healthcare providers and facilities that are in-network with your insurance plan.

- Covered Services: The types of medical services and treatments covered by the plan.

By carefully evaluating these factors, you can identify the health insurance plan that offers the best balance of affordability and comprehensive coverage.

Tips for Obtaining Cheap Health Insurance

Now that you have a solid understanding of your health insurance options, let’s explore some practical tips to help you obtain cheap health insurance that meets your needs:

Shop Around and Compare Prices

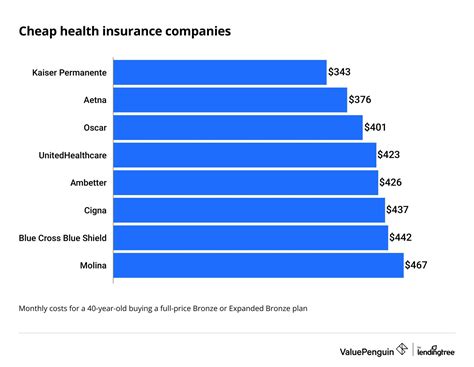

Don’t settle for the first health insurance plan you come across. Take the time to shop around and compare prices and coverage options from different insurers. Online comparison tools and insurance marketplaces can be valuable resources for this purpose.

When comparing plans, pay attention to the total cost of the plan, including premiums, deductibles, and out-of-pocket expenses. Look for plans that offer a good balance between affordability and the coverage you require.

Consider High-Deductible Health Plans (HDHPs)

High-deductible health plans (HDHPs) typically have lower monthly premiums compared to traditional health insurance plans. While these plans may require you to pay more out of pocket for medical services, they can be a cost-effective option if you are generally healthy and don’t anticipate frequent medical expenses.

HDHPs are often paired with health savings accounts (HSAs), which allow you to save money tax-free for future medical expenses. This can be a smart way to manage your healthcare costs and potentially save money over time.

Evaluate Your Healthcare Needs

Before selecting a health insurance plan, take the time to evaluate your current and potential future healthcare needs. Consider factors such as your age, pre-existing conditions, prescription medication requirements, and any specialized medical services you may need.

For example, if you have a chronic condition that requires regular medical attention, you may benefit from a plan with lower out-of-pocket costs and more comprehensive coverage. On the other hand, if you are generally healthy and only anticipate occasional medical visits, a plan with higher deductibles and lower premiums may be a better fit.

Take Advantage of Government Programs

If you qualify for government-sponsored health insurance programs like Medicare, Medicaid, or CHIP, be sure to explore these options. These programs often provide affordable coverage tailored to specific groups of people, making them an excellent choice for those who meet the eligibility criteria.

For instance, Medicare offers various parts, including Medicare Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage). Understanding the different parts of Medicare and how they work together can help you make informed decisions about your coverage.

Utilize Employer-Sponsored Plans

If you are employed, consider the health insurance plans offered by your employer. These plans are often more affordable than individual plans and may provide comprehensive coverage at a reduced cost. Employer-sponsored plans can be a great way to access quality healthcare without breaking the bank.

When evaluating employer-sponsored plans, be sure to understand the coverage options, any limitations, and the cost-sharing arrangements. Some employers may offer a choice of plans, allowing you to select the one that best suits your needs and budget.

Enroll During Open Enrollment Periods

Health insurance plans often have specific enrollment periods, known as open enrollment periods. These are the times when you can enroll in a new plan or make changes to your existing coverage. It’s crucial to be aware of these periods to ensure you don’t miss out on the opportunity to secure affordable health insurance.

If you miss the open enrollment period, you may need to wait until the next one or qualify for a special enrollment period due to a qualifying life event, such as marriage, divorce, or the birth of a child.

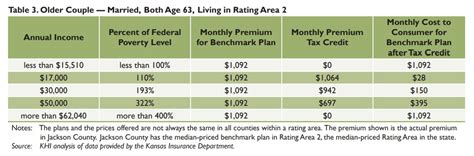

Use Health Insurance Tax Credits and Subsidies

In some cases, you may be eligible for health insurance tax credits or subsidies to help offset the cost of your insurance premiums. These credits and subsidies are designed to make health insurance more affordable for individuals and families with low to moderate incomes.

To determine if you qualify for these benefits, you can use online tools or consult with a tax professional. By understanding your eligibility and taking advantage of these credits and subsidies, you can significantly reduce the cost of your health insurance.

Practice Preventive Care

One of the most effective ways to save money on health insurance is to practice preventive care. By staying on top of your health and catching potential issues early, you can avoid more costly medical treatments down the line.

Regular check-ups, vaccinations, and screenings are essential components of preventive care. Many health insurance plans cover these services at little to no cost to you, so be sure to take advantage of these benefits to maintain your health and potentially reduce your long-term healthcare costs.

The Impact of Affordable Health Insurance

Securing affordable health insurance has far-reaching implications for individuals, families, and communities. It empowers people to take control of their healthcare and make informed decisions about their well-being. With affordable coverage, individuals can access the medical care they need without facing financial hardship.

Affordable health insurance also promotes preventive care, which can lead to better health outcomes and reduced healthcare costs over time. By catching potential health issues early and receiving timely treatment, individuals can avoid more serious and costly medical conditions. This not only benefits the individual but also contributes to a healthier and more productive society.

Furthermore, affordable health insurance can provide peace of mind and reduce financial stress. Knowing that you have access to quality healthcare without incurring exorbitant costs can alleviate anxiety and improve overall well-being. This is especially true for individuals and families who may have previously gone without insurance due to financial constraints.

Conclusion

In conclusion, finding cheap health insurance is a critical aspect of managing your healthcare expenses and maintaining your overall well-being. By understanding your options, comparing plans, and implementing the tips outlined in this guide, you can secure affordable health insurance that meets your needs and fits your budget.

Remember, health insurance is a crucial investment in your health and financial security. Take the time to research, compare, and make informed decisions to ensure you have the coverage you need at a price you can afford. With the right approach, you can navigate the complexities of health insurance and unlock access to quality healthcare.

Can I switch health insurance plans outside of the open enrollment period?

+Yes, in certain circumstances. If you experience a qualifying life event, such as marriage, divorce, birth of a child, or loss of other health coverage, you may be eligible for a special enrollment period. During this period, you can switch health insurance plans outside of the regular open enrollment period.

What is a health savings account (HSA)?

+A health savings account (HSA) is a tax-advantaged savings account that is designed to be used in conjunction with a high-deductible health plan (HDHP). HSAs allow you to save money tax-free for future medical expenses. Funds in an HSA can be used to pay for qualified medical expenses, and the account can be carried over year to year.

Are there any downsides to choosing a high-deductible health plan (HDHP)?

+While HDHPs can be cost-effective for healthy individuals, they may not be the best option for those who anticipate frequent medical expenses. HDHPs typically require you to pay more out of pocket before your insurance coverage kicks in. If you have a chronic condition or require regular medical care, a plan with lower deductibles and out-of-pocket costs may be more suitable.