How Much Does Auto Insurance Cost

Auto insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind to drivers. The cost of auto insurance is a topic that often sparks curiosity and concern among vehicle owners. While the specific price of insurance can vary greatly, there are several factors that influence the overall cost, making it an essential consideration for anyone seeking to understand their insurance options.

Factors Influencing Auto Insurance Costs

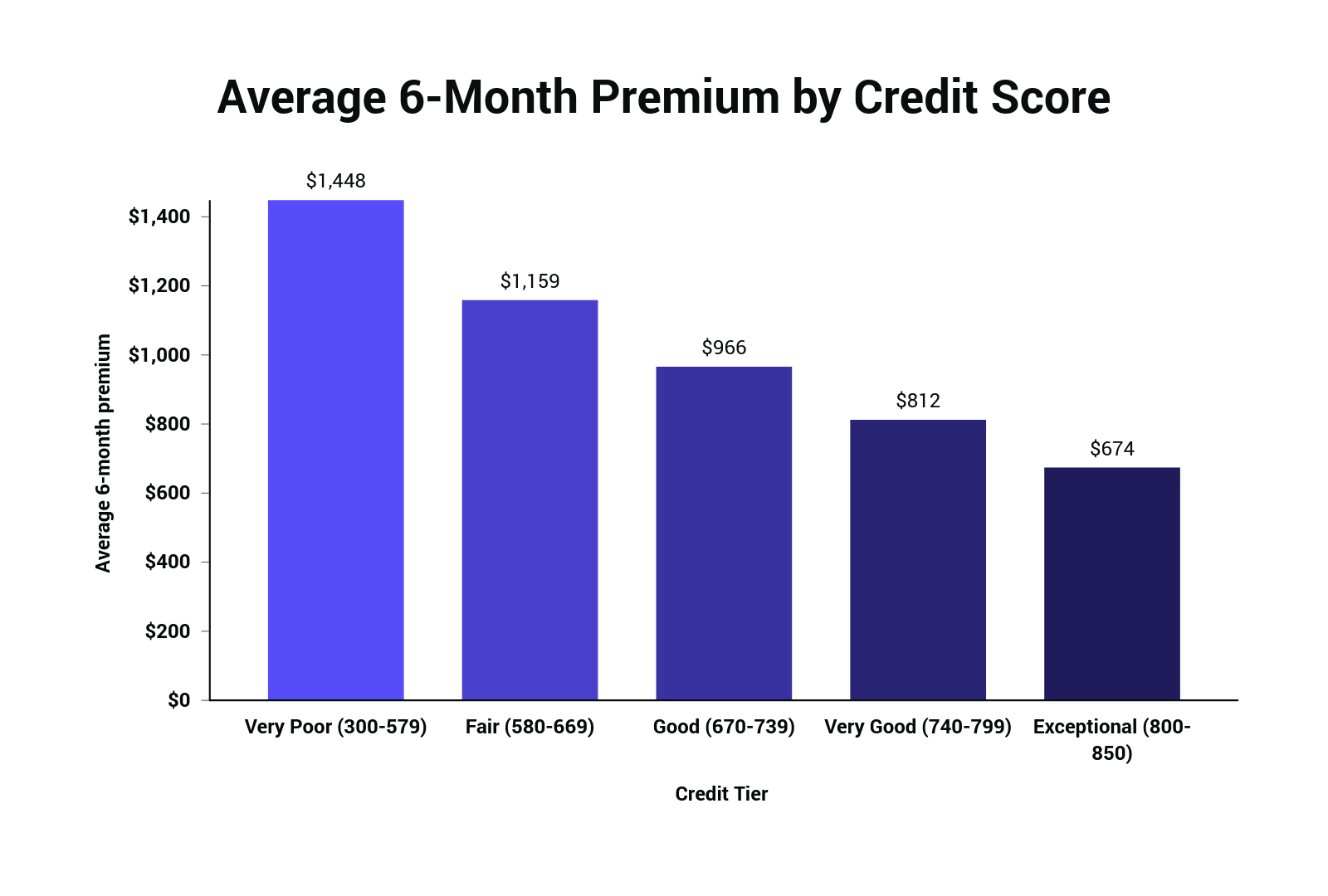

The cost of auto insurance is determined by a multitude of factors, each playing a unique role in the final premium calculation. These factors can be broadly categorized into three main groups: driver-related factors, vehicle-related factors, and external factors. Understanding how these elements interplay is crucial for predicting and managing insurance costs.

Driver-Related Factors

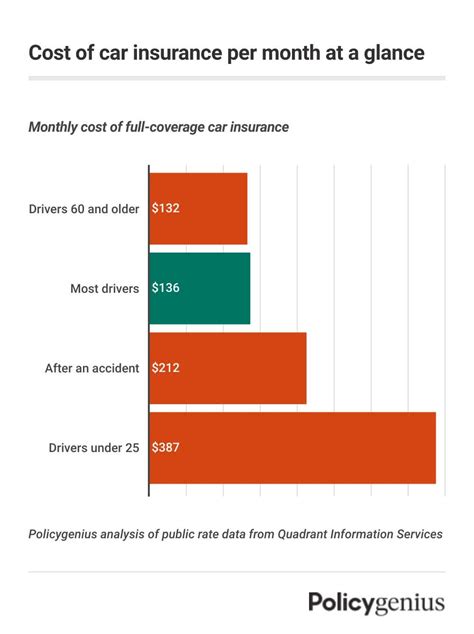

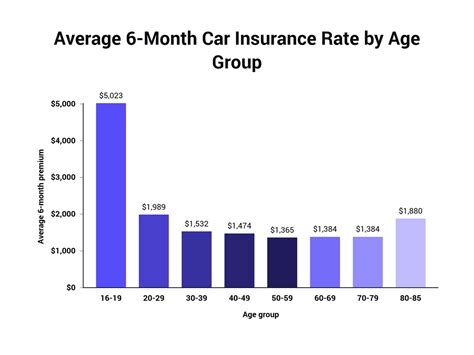

The characteristics and behavior of the driver are significant determinants of insurance costs. Age is a critical factor; younger drivers, particularly those under 25, often face higher premiums due to their perceived risk level. Gender can also play a role, with some insurance providers offering slightly different rates based on statistical trends.

Driving history is another critical aspect. A clean record with no accidents or traffic violations can lead to more favorable insurance rates. Conversely, a history of accidents or moving violations may result in higher premiums. The length of time a driver has been licensed can also impact rates, with more experienced drivers generally enjoying lower costs.

| Driver Factor | Impact on Insurance Cost |

|---|---|

| Age | Younger drivers pay more |

| Gender | Varies by provider |

| Driving History | Clean record = lower rates |

| Licensing Duration | More experience = lower cost |

Vehicle-Related Factors

The type of vehicle being insured can significantly impact insurance costs. Certain makes and models are statistically more likely to be involved in accidents or theft, leading to higher premiums. The age and value of the vehicle are also considered, as older vehicles may have lower replacement costs and therefore lower insurance rates.

The vehicle's primary use can influence rates. Personal use vehicles typically have lower premiums compared to commercial vehicles. The number of miles driven annually is another consideration; high-mileage vehicles may be at a higher risk of accidents or breakdowns, impacting insurance costs.

External Factors

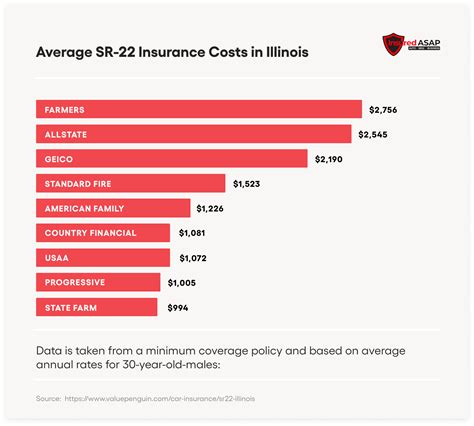

Several external factors beyond the control of the driver or the vehicle can influence insurance costs. The location where the vehicle is primarily garaged is a significant determinant. Urban areas often have higher insurance rates due to increased traffic and the potential for accidents and theft.

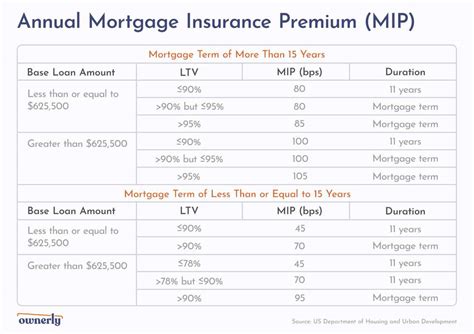

The level of insurance coverage chosen also affects the overall cost. Comprehensive and collision coverage, while providing more protection, can increase premiums. Conversely, choosing higher deductibles can reduce the premium but may result in higher out-of-pocket expenses if a claim is made.

Average Auto Insurance Costs

The average cost of auto insurance in the United States varies significantly based on these factors. According to recent data, the national average for auto insurance premiums is approximately 1,674 per year</strong> or <strong>139.50 per month. However, this average can vary widely depending on the state and specific circumstances.

For instance, in states like Maine and North Carolina, the average annual premium is around $1,000, while in Michigan and California, it can exceed $2,000. These differences highlight the impact of regional factors on insurance costs.

Regional Variations in Auto Insurance Costs

Regional variations in auto insurance costs are largely influenced by the prevalence of accidents, theft, and claims in a given area. States with higher rates of these incidents typically have higher average insurance premiums.

| State | Average Annual Premium |

|---|---|

| Maine | $1,000 |

| North Carolina | $1,000 |

| Michigan | $2,500 |

| California | $2,200 |

Additionally, the availability and cost of repairs, as well as the average cost of labor and parts, can influence insurance rates in a region. Areas with higher living costs may also see higher insurance premiums to reflect the potential for more expensive claims.

Strategies to Reduce Auto Insurance Costs

While auto insurance costs are influenced by a multitude of factors, there are strategies that drivers can employ to potentially reduce their insurance premiums.

Safe Driving Practices

Maintaining a clean driving record is a fundamental way to reduce insurance costs. Avoiding accidents and traffic violations can lead to more favorable insurance rates over time. Additionally, completing a defensive driving course or a safe driving program can often result in insurance discounts.

Bundling Insurance Policies

Bundling multiple insurance policies, such as auto and home insurance, with the same provider can often lead to significant savings. Insurance companies often offer discounts for customers who choose to bundle their policies, as it provides the company with additional business and reduces their administrative costs.

Choosing Higher Deductibles

Opting for a higher deductible can result in lower insurance premiums. While this strategy may require more out-of-pocket expenses if a claim is made, it can be a cost-effective approach for those who are confident in their ability to manage minor incidents without making an insurance claim.

Understanding Comprehensive Coverage

Comprehensive coverage is an optional component of auto insurance policies that provides protection against damage caused by incidents other than collisions. This includes damage from natural disasters, theft, vandalism, and other non-collision-related events.

While comprehensive coverage can increase insurance premiums, it offers valuable protection against a wide range of potential risks. For drivers who live in areas prone to natural disasters or who park their vehicles in high-risk areas, comprehensive coverage can provide essential financial protection.

The Impact of Claims on Insurance Costs

Making an insurance claim can have a direct impact on future insurance costs. When a claim is made, the insurance company may increase the premium to compensate for the potential of future claims. This is particularly true for at-fault accidents or for claims made under comprehensive or collision coverage.

However, not all claims result in an increase in insurance costs. No-fault accidents, where the driver is not held responsible, may not impact insurance rates. Additionally, the size of the claim can also play a role; smaller claims may have less impact on future premiums compared to larger, more expensive claims.

Future Trends in Auto Insurance Costs

The auto insurance industry is evolving, and several trends are likely to impact insurance costs in the future. The increasing adoption of autonomous vehicle technology is expected to lead to a reduction in accidents, potentially resulting in lower insurance premiums over time.

Additionally, the use of telematics and usage-based insurance policies is becoming more common. These policies use real-time data from a vehicle's onboard sensors to monitor driving behavior and offer discounts to drivers who exhibit safe driving practices. This technology has the potential to revolutionize the insurance industry, offering more personalized and affordable insurance options.

Conclusion

Understanding the factors that influence auto insurance costs is crucial for vehicle owners seeking to manage their insurance expenses effectively. By being aware of these factors and implementing strategies to reduce premiums, drivers can ensure they are getting the best value for their insurance dollar. As the auto insurance industry continues to evolve, staying informed about emerging trends and technologies will be essential for making informed insurance decisions.

How often should I review my auto insurance policy?

+It is generally recommended to review your auto insurance policy annually or whenever you experience significant life changes, such as getting married, purchasing a new vehicle, or moving to a new location. Regular reviews can help ensure you are adequately covered and taking advantage of any applicable discounts.

Can I negotiate my auto insurance rates?

+While auto insurance rates are primarily determined by statistical data and regulatory requirements, there may be room for negotiation with certain providers. Contacting your insurance company to discuss your circumstances and any available discounts can sometimes result in a lower premium.

What are some common discounts available for auto insurance?

+Common auto insurance discounts include safe driver discounts, multi-policy discounts (for bundling multiple policies with the same provider), loyalty discounts, and good student discounts. Additionally, some providers offer discounts for certain professions or membership organizations.