Cal Fair Insurance

Cal Fair Insurance is a leading provider of comprehensive insurance solutions, catering to the diverse needs of individuals and businesses across California. With a rich history spanning over 30 years, Cal Fair has established itself as a trusted partner, offering tailored coverage and exceptional customer service. In this in-depth exploration, we delve into the world of Cal Fair Insurance, uncovering its unique offerings, expert insights, and the impact it has had on the insurance landscape.

A Legacy of Excellence: Cal Fair Insurance’s Journey

Founded in 1992 by a group of visionary entrepreneurs, Cal Fair Insurance set out with a clear mission: to revolutionize the insurance industry by offering personalized, affordable, and accessible coverage to all Californians. Over the decades, the company has grown exponentially, expanding its reach and expertise to become a prominent player in the highly competitive insurance market.

One of the key strengths of Cal Fair Insurance lies in its ability to adapt to the ever-changing insurance landscape. As technology advanced and customer preferences evolved, Cal Fair embraced innovation, integrating digital solutions into its operations. This forward-thinking approach has not only enhanced efficiency but also improved the overall customer experience, making insurance more accessible and convenient.

Comprehensive Coverage: Tailored Solutions for Every Need

Cal Fair Insurance understands that no two individuals or businesses have identical insurance requirements. Therefore, the company offers a vast array of coverage options, ensuring that every client receives a personalized plan tailored to their specific needs. From auto and home insurance to business and specialty coverage, Cal Fair provides comprehensive protection for every aspect of life and work.

Auto Insurance: Safeguarding Your Wheels

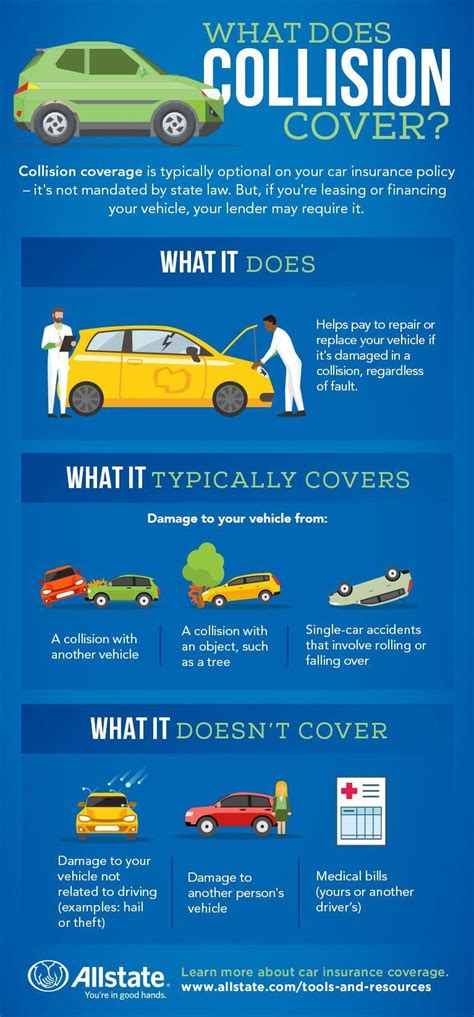

For vehicle owners in California, Cal Fair Insurance offers a wide range of auto insurance policies. These policies provide protection against various risks, including accidents, theft, and natural disasters. With competitive rates and flexible payment options, Cal Fair ensures that drivers can obtain the coverage they need without breaking the bank.

Additionally, Cal Fair's auto insurance plans offer a host of benefits, such as rental car coverage, roadside assistance, and gap insurance. The company's commitment to customer satisfaction is evident in its dedication to providing comprehensive and affordable solutions for all drivers.

| Coverage Type | Benefits |

|---|---|

| Liability Coverage | Protects against bodily injury and property damage claims |

| Collision Coverage | Covers repair or replacement costs after an accident |

| Comprehensive Coverage | Provides protection against theft, vandalism, and natural disasters |

| Uninsured/Underinsured Motorist Coverage | Offers financial protection in case of an accident with an uninsured or underinsured driver |

Home Insurance: Peace of Mind for Your Haven

Cal Fair Insurance recognizes the importance of safeguarding one’s home, which is why it offers a comprehensive range of home insurance policies. These policies are designed to protect homeowners and renters from various risks, including fire, theft, and liability claims. With customizable coverage options, homeowners can rest assured that their most valuable asset is adequately protected.

Cal Fair's home insurance plans also include additional benefits, such as coverage for personal belongings, temporary living expenses, and liability protection for guests. The company's expert agents work closely with clients to ensure that their specific needs are met, providing peace of mind and financial security.

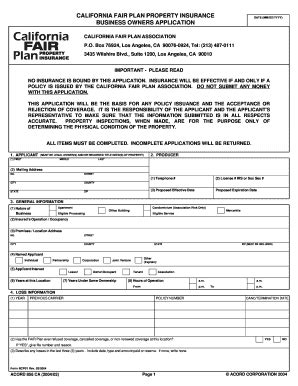

Business Insurance: Supporting California’s Enterprises

Cal Fair Insurance understands the unique challenges faced by businesses in California. To address these challenges, the company offers a comprehensive suite of business insurance solutions. From general liability and commercial property insurance to professional liability and workers’ compensation, Cal Fair provides the necessary coverage to protect businesses of all sizes and industries.

By offering flexible and customizable plans, Cal Fair ensures that businesses can obtain the coverage they need at competitive rates. The company's expert team works closely with business owners to assess their specific risks and tailor insurance plans accordingly, ensuring the long-term success and stability of California's thriving business community.

The Cal Fair Difference: Exceptional Customer Service

What truly sets Cal Fair Insurance apart is its unwavering commitment to exceptional customer service. The company’s dedicated team of experts is passionate about providing personalized attention and support to every client. Whether it’s answering queries, assisting with claims, or offering expert advice, Cal Fair’s customer service representatives go above and beyond to ensure client satisfaction.

Cal Fair Insurance understands that insurance can be complex and confusing. That's why the company takes the time to educate its clients, providing clear and concise explanations of coverage options and policy terms. This proactive approach ensures that clients fully understand their insurance plans, empowering them to make informed decisions about their financial protection.

A Technological Edge: Empowering Clients

In today’s digital age, Cal Fair Insurance recognizes the importance of leveraging technology to enhance the customer experience. The company has invested significantly in developing user-friendly online platforms and mobile apps, enabling clients to manage their insurance policies conveniently and efficiently.

Through these digital channels, clients can easily access their policy information, make payments, and file claims. Cal Fair's online portals also provide a wealth of resources, including educational materials, claim tracking tools, and personalized recommendations. This empowers clients to take control of their insurance journey, making it more accessible and transparent.

Digital Innovation: A Competitive Advantage

Cal Fair Insurance’s embrace of digital innovation has not only improved customer service but has also given the company a competitive edge. By leveraging technology, the company has been able to streamline its operations, reduce costs, and offer more competitive rates to its clients. This commitment to technological advancement positions Cal Fair as a forward-thinking insurance provider, attracting a new generation of tech-savvy consumers.

Community Engagement: Giving Back to California

Cal Fair Insurance believes in giving back to the communities it serves. The company actively engages in various philanthropic initiatives, supporting causes that align with its values and the needs of Californians. From sponsoring local events and charities to participating in volunteer programs, Cal Fair demonstrates its commitment to making a positive impact beyond its core business.

One of Cal Fair's key initiatives is its annual scholarship program, which provides financial assistance to deserving students pursuing higher education. By investing in the future of California's youth, Cal Fair not only supports individual growth but also contributes to the overall development of the state's talented workforce.

Sustainable Practices: A Commitment to the Environment

In addition to its community engagement efforts, Cal Fair Insurance is dedicated to promoting sustainable practices. The company recognizes the importance of environmental stewardship and has implemented various initiatives to minimize its ecological footprint. From adopting paperless processes to investing in renewable energy sources, Cal Fair strives to be a responsible corporate citizen.

The Future of Insurance: Cal Fair’s Vision

As the insurance industry continues to evolve, Cal Fair Insurance remains at the forefront, embracing change and innovation. The company’s forward-thinking approach and commitment to excellence position it for continued success in the years to come. With a focus on personalized coverage, exceptional customer service, and technological advancement, Cal Fair is well-equipped to meet the evolving needs of its clients.

As Cal Fair Insurance celebrates its 30th anniversary, it looks ahead with optimism and determination. The company's dedication to providing comprehensive, affordable, and accessible insurance solutions remains unwavering. With a talented team of experts and a customer-centric approach, Cal Fair is poised to continue its legacy of excellence, serving the insurance needs of Californians for generations to come.

How can I get a quote for Cal Fair Insurance’s services?

+Obtaining a quote from Cal Fair Insurance is simple and convenient. You can request a quote directly through their website by filling out a brief online form. Alternatively, you can contact their customer service team via phone or email, and a dedicated agent will assist you in providing a personalized quote based on your specific needs.

What sets Cal Fair Insurance apart from other insurance providers?

+Cal Fair Insurance stands out for its commitment to personalized service and tailored coverage. Unlike many insurance providers that offer one-size-fits-all policies, Cal Fair takes the time to understand each client’s unique needs and provides customized solutions. Additionally, their focus on customer education and technological innovation sets them apart, ensuring a seamless and empowering insurance experience.

Does Cal Fair Insurance offer discounts or special programs for certain groups or professions?

+Yes, Cal Fair Insurance understands the diverse needs of its clients and offers a range of discounts and special programs. These include discounts for safe driving records, multi-policy bundles, and loyalty rewards. Additionally, Cal Fair may offer specialized programs for specific professions or community groups, so it’s worth checking with their customer service team to explore potential savings.