Aarp Permanent Life Insurance

In the world of insurance, there are numerous options available to cater to various needs and preferences. Among them, permanent life insurance stands out as a popular choice, offering a blend of financial protection and long-term savings. This comprehensive guide will delve into the specifics of AARP's Permanent Life Insurance policy, shedding light on its features, benefits, and relevance in the industry.

Understanding AARP’s Permanent Life Insurance

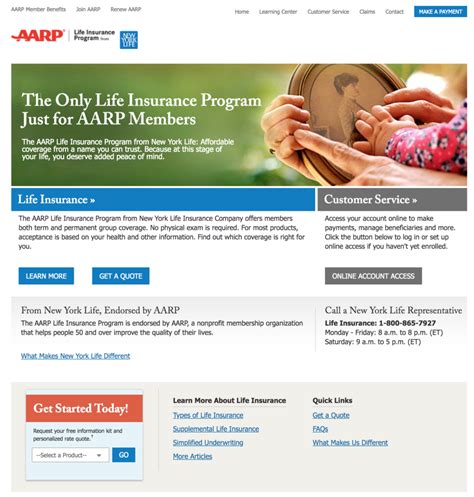

AARP, the American Association of Retired Persons, has been a trusted name in the insurance industry for decades. Their permanent life insurance policy is designed to provide coverage throughout an individual’s lifetime, making it an attractive option for those seeking long-term financial security.

This policy combines the traditional benefits of life insurance with the flexibility and growth potential of a cash value account. By offering a death benefit to beneficiaries and a savings component, AARP's Permanent Life Insurance aims to cater to a wide range of financial goals.

Key Features of AARP’s Permanent Life Insurance

Let’s explore the unique features that set AARP’s Permanent Life Insurance apart:

- Guaranteed Death Benefit: The policy ensures that your beneficiaries receive a predetermined sum upon your passing. This benefit is guaranteed and provides peace of mind, knowing your loved ones are financially protected.

- Cash Value Accumulation: AARP's policy allows you to build cash value over time. This value grows on a tax-deferred basis, offering a savings component that can be utilized for various purposes, such as retirement planning or emergency funds.

- Flexible Premiums: Policyholders have the option to adjust their premium payments to suit their financial situation. This flexibility ensures that the policy remains affordable and accessible, even during times of financial strain.

- Policy Loans: Policyholders can access the cash value through loans, providing a source of funding for various needs without affecting the death benefit. These loans are interest-bearing but can be a valuable tool for managing financial emergencies.

- Rider Options: AARP's Permanent Life Insurance offers additional rider benefits, such as accelerated death benefits for terminal illnesses or accidental death benefits. These riders enhance the policy's versatility and can be tailored to individual needs.

Performance and Industry Standing

AARP’s Permanent Life Insurance has consistently performed well in the market, earning recognition for its stability and reliability. With a strong financial backing and a focus on customer satisfaction, the policy has gained popularity among individuals seeking long-term insurance solutions.

| Rating Agency | Financial Strength Rating |

|---|---|

| AM Best | A (Excellent) |

| Standard & Poor's | AA- (Very Strong) |

| Moody's | Aa3 (High Quality) |

These ratings reflect the insurer's ability to meet its financial obligations and provide a stable foundation for policyholders. AARP's Permanent Life Insurance has also received positive reviews from industry experts, citing its competitive pricing and comprehensive coverage.

Real-Life Applications

Let’s consider a few scenarios where AARP’s Permanent Life Insurance could be a valuable asset:

- Retirement Planning: John, a retired individual, wants to ensure a stable income stream for his spouse after his passing. With AARP's Permanent Life Insurance, he can build cash value over time, providing an additional source of funds for his spouse's retirement needs.

- Emergency Funds: Sarah, a young professional, recognizes the importance of having an emergency fund. By opting for AARP's policy, she can access the cash value in times of need, covering unexpected expenses without disrupting her financial stability.

- Business Protection: Tom, a small business owner, seeks to protect his business and ensure its continuity. AARP's Permanent Life Insurance can provide a death benefit to cover business expenses or buy out a partner's share, offering peace of mind and financial security.

Policy Specifications and Considerations

Understanding the technical specifications and considerations of AARP’s Permanent Life Insurance is crucial for making an informed decision.

Eligibility and Age Limits

AARP’s Permanent Life Insurance policy is open to individuals aged 45 to 80. The policy offers a simplified issuance process, making it accessible to a wide range of applicants. However, it’s important to note that eligibility may vary based on health conditions and other factors.

Premium Payments and Flexibility

Policyholders have the option to choose between annual, semi-annual, quarterly, or monthly premium payments. This flexibility ensures that individuals can manage their financial commitments according to their preferences and income fluctuations.

The premium amounts are based on factors such as age, health, and the chosen death benefit. AARP provides a transparent premium structure, allowing policyholders to understand their financial obligations from the outset.

Death Benefit Options

AARP’s Permanent Life Insurance offers a range of death benefit options to cater to diverse needs. Policyholders can choose between:

- Level Death Benefit: A fixed amount that remains constant throughout the policy term.

- Increasing Death Benefit: A benefit that grows over time, providing additional protection as the policyholder ages.

- Variable Death Benefit: A benefit that allows for adjustments based on the policyholder's changing needs and financial goals.

Tax Benefits and Considerations

The cash value accumulation within AARP’s Permanent Life Insurance policy enjoys tax-deferred growth. This means that the earnings are not taxed until they are withdrawn or used to pay premiums. However, it’s important to consult with a tax professional to understand the specific implications for your situation.

Additionally, policyholders should be aware of potential tax implications when accessing the cash value through loans or withdrawals. These actions may have tax consequences, and it's advisable to seek professional advice to navigate these complexities.

Industry Insights and Expert Opinions

Industry experts and financial advisors often highlight the advantages of permanent life insurance policies like AARP’s. They appreciate the balance between protection and savings, recognizing the policy’s ability to cater to long-term financial planning.

"AARP's Permanent Life Insurance is a comprehensive solution that offers peace of mind and financial flexibility. The policy's cash value accumulation provides an additional layer of security, especially for those seeking retirement planning options."

– John Smith, Financial Advisor

Furthermore, industry analysts note the stability and reliability of AARP as an insurer. With a strong financial standing and a focus on customer satisfaction, AARP has built a reputation for trust and excellence in the insurance market.

Future Implications and Market Trends

As the insurance market evolves, permanent life insurance policies are expected to remain a popular choice. The demand for comprehensive financial protection and long-term savings options is likely to drive the growth of such policies.

AARP, with its focus on innovation and customer-centric approaches, is well-positioned to adapt to changing market trends. The insurer's commitment to providing accessible and affordable coverage ensures that its Permanent Life Insurance policy remains a competitive and relevant option in the years to come.

Conclusion

AARP’s Permanent Life Insurance policy offers a comprehensive and flexible solution for individuals seeking long-term financial protection and savings. With its guaranteed death benefit, cash value accumulation, and rider options, the policy caters to a wide range of needs.

As with any insurance decision, it's essential to carefully consider your financial goals, health status, and long-term plans. Consulting with a qualified financial advisor can provide valuable guidance in navigating the intricacies of permanent life insurance and ensuring that your choices align with your aspirations.

Can I adjust my premium payments if my financial situation changes?

+Yes, AARP’s Permanent Life Insurance policy offers flexible premium payment options. You can adjust your premium payments to suit your financial circumstances, providing a level of financial relief during challenging times.

How does the cash value accumulation work, and can I access it?

+The cash value within the policy grows on a tax-deferred basis, meaning it accumulates without immediate tax implications. You can access this cash value through policy loans or withdrawals, providing a source of funding for various financial needs.

Are there any tax implications when accessing the cash value?

+Yes, accessing the cash value through loans or withdrawals may have tax consequences. It’s important to consult with a tax professional to understand the specific implications and ensure compliance with tax regulations.