What Is Cgl Insurance

CGL, an acronym for Commercial General Liability, is a fundamental insurance coverage that safeguards businesses against a range of liability risks. It is a comprehensive policy designed to protect companies from financial losses arising from property damage, bodily injury, and personal and advertising injury claims. With the increasing complexity of the business landscape, CGL insurance has become an indispensable tool for mitigating potential risks and ensuring the long-term viability of enterprises.

The Essential Coverage for Businesses

CGL insurance serves as a critical safety net for businesses, providing protection in a variety of situations. It covers damages that a business may be legally liable for, including injuries to customers or visitors on business premises, property damage caused by business operations, and advertising-related injuries such as copyright infringement or libel.

The scope of CGL insurance is broad, encompassing a range of common business risks. It covers bodily injury, including medical expenses and lost wages, as well as property damage, which can include the cost of repairs or replacement. Personal and advertising injury coverage protects against non-physical injuries, such as defamation, false arrest, or invasion of privacy. CGL policies also often include coverage for legal defense costs, even if the business is not ultimately found liable.

Bodily Injury and Property Damage

Bodily injury and property damage are two key areas of coverage under CGL insurance. In the event of an accident on business premises, CGL insurance steps in to cover the costs associated with the injury. This includes medical expenses, rehabilitation costs, and even compensation for lost income. Property damage coverage, on the other hand, protects businesses from claims arising from damage to physical property, such as buildings, equipment, or inventory.

| Coverage Area | Examples of Claims |

|---|---|

| Bodily Injury | A customer slips and falls on a wet floor, injuring their back; an employee is injured while operating heavy machinery. |

| Property Damage | A fire caused by faulty electrical wiring damages neighboring businesses; a product defect leads to property damage for a customer. |

Personal and Advertising Injury

Personal and advertising injury coverage is a unique aspect of CGL insurance, protecting businesses from non-physical harm. This coverage applies to a range of situations, including copyright infringement, libel, slander, invasion of privacy, and more. For instance, if a business uses copyrighted material in an advertisement without permission, the copyright owner could file a lawsuit. CGL insurance would step in to defend the business and, if necessary, pay for any damages awarded.

Customizable Protection for Diverse Businesses

One of the strengths of CGL insurance is its adaptability to different industries and business needs. While the core coverage remains consistent, businesses can tailor their policies to fit their specific operations and risks. This flexibility allows for a more precise and effective risk management strategy.

For example, a construction company may require additional coverage for contractural liability, ensuring protection for work performed under contract. A retail business, on the other hand, might prioritize coverage for product liability, safeguarding against claims arising from defective products.

Industry-Specific Considerations

The diverse nature of businesses means that CGL insurance must be adaptable to a wide range of scenarios. For instance, a restaurant owner might need to consider coverage for food poisoning incidents, while a technology startup might be more concerned about intellectual property infringement claims. Each business, regardless of size or industry, has unique risks that CGL insurance can address.

| Industry | Specific Risks |

|---|---|

| Construction | Contractual liability, worker injuries, property damage |

| Healthcare | Medical malpractice, patient injury, privacy breaches |

| Retail | Slip and fall accidents, product liability, theft |

The Role of CGL Insurance in Risk Management

CGL insurance is a vital component of a comprehensive risk management strategy. It provides a financial safety net, ensuring that businesses can continue operations even in the face of significant liability claims. By transferring the risk of loss to an insurance company, businesses can focus on their core operations with peace of mind.

In addition to financial protection, CGL insurance can also provide valuable risk management insights. Insurance companies often have extensive resources and expertise in identifying and mitigating risks. They can offer guidance on risk prevention and management strategies, helping businesses to avoid potential liabilities in the first place.

Benefits of a Strong Risk Management Strategy

A robust risk management strategy, supported by CGL insurance, offers several key benefits to businesses. Firstly, it can help to reduce the frequency and severity of claims, leading to lower insurance premiums over time. Secondly, it provides a competitive advantage by demonstrating to customers, partners, and investors that the business is well-managed and prepared for potential risks.

Lastly, a strong risk management strategy can enhance a business's reputation. By showing a commitment to safety and responsibility, businesses can build trust with stakeholders and maintain a positive public image. This can be particularly important in industries where reputation is a key differentiator.

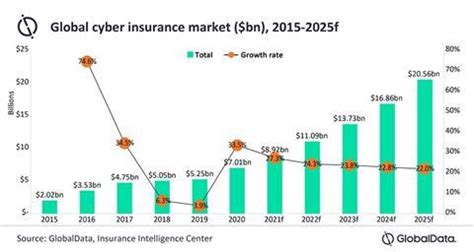

The Future of CGL Insurance

As the business landscape continues to evolve, so too will the role of CGL insurance. Emerging risks, such as those associated with cybersecurity and environmental issues, are likely to become more prominent in the coming years. Insurance companies will need to adapt their policies and offerings to address these new challenges.

Additionally, the increasing use of technology and data in business operations will likely lead to a greater focus on cyber liability coverage. With more businesses relying on digital platforms and data-driven strategies, the risks of cyber attacks and data breaches will only grow. CGL insurance will need to evolve to keep pace with these digital risks.

Staying Ahead of Emerging Risks

To stay ahead of emerging risks, businesses will need to work closely with insurance professionals to stay informed about changing coverage needs. Regular policy reviews and updates will be essential to ensure that coverage remains comprehensive and up-to-date. This proactive approach to risk management will be crucial in maintaining the viability and success of businesses in an ever-changing environment.

What is the difference between CGL insurance and other liability insurance policies?

+CGL insurance is a broad form of liability coverage, offering protection for a wide range of business activities. Other liability insurance policies, such as professional liability insurance or product liability insurance, are more specialized and focus on specific types of risks. For instance, professional liability insurance (also known as errors and omissions insurance) covers legal liability arising from the performance of professional services, while product liability insurance protects against claims related to defective products.

How can businesses choose the right CGL insurance coverage for their needs?

+Choosing the right CGL insurance coverage involves a thorough assessment of a business’s unique risks and operations. It’s crucial to work with an insurance professional who can guide you through the process. They will consider factors such as the industry you operate in, the size and nature of your business, and any specific risks or liabilities you face. By understanding these factors, they can help you tailor your CGL insurance to provide the most comprehensive and cost-effective coverage.

What should businesses do if they have a claim under their CGL insurance policy?

+If a business has a claim under their CGL insurance policy, it’s important to act promptly. The first step is to notify your insurance company as soon as possible, providing them with all relevant details and documentation. It’s also crucial to take steps to mitigate any further damage or loss. The insurance company will guide you through the claims process, which may involve further documentation, investigations, and potentially legal action.