Health Insurance Marketplace Ohio

The Health Insurance Marketplace, often referred to as the Health Insurance Exchange, is a vital platform that allows individuals and small businesses to compare and purchase health insurance plans. Ohio, with its diverse population and unique healthcare landscape, offers a range of options for residents seeking affordable and comprehensive coverage. In this article, we delve into the specifics of the Health Insurance Marketplace in Ohio, exploring the plans, providers, and key considerations for those navigating this essential aspect of personal finance and well-being.

Understanding the Health Insurance Marketplace in Ohio

The Health Insurance Marketplace in Ohio is an online platform that simplifies the process of finding and enrolling in health insurance plans. It is a user-friendly interface that brings together various insurance providers, offering a wide array of options tailored to the needs of Ohioans. This marketplace, established as a result of the Affordable Care Act (ACA), has revolutionized the way individuals and families access healthcare coverage, ensuring a more transparent and competitive market.

Key Features of the Ohio Health Insurance Marketplace

The Ohio Health Insurance Marketplace boasts several notable features that make it an attractive option for residents seeking healthcare coverage. Firstly, it provides a centralized platform where users can compare plans from multiple insurers, making it easier to find the right fit for their specific needs. Secondly, the marketplace offers financial assistance in the form of premium tax credits and cost-sharing reductions, making quality healthcare more affordable for low- and middle-income households.

Additionally, the Ohio Health Insurance Marketplace prioritizes consumer protection. It ensures that all plans offered meet certain standards for essential health benefits, network adequacy, and provider qualifications. This safeguards consumers from inadequate coverage and provides a level of assurance regarding the quality of care they can expect.

Plans and Providers on the Ohio Marketplace

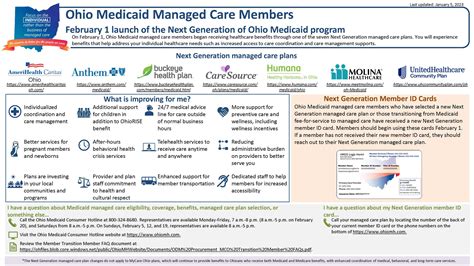

Ohio’s Health Insurance Marketplace features a diverse range of plans and providers, catering to various demographics and healthcare needs. Major insurance carriers in the state, such as Anthem Blue Cross Blue Shield, Medical Mutual of Ohio, and CareSource, actively participate in the marketplace, offering a variety of plan types including HMOs, PPOs, and POS plans.

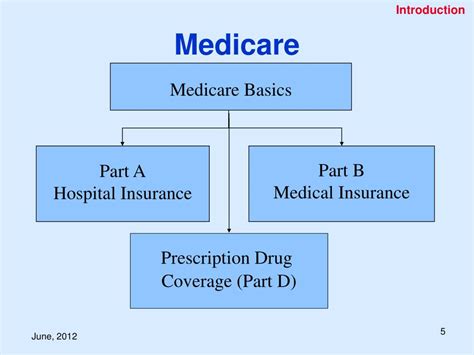

These plans vary in terms of premium costs, deductibles, copays, and covered services. For instance, some plans may offer lower premiums but higher out-of-pocket costs, while others may provide more comprehensive coverage with higher premiums. The marketplace also includes dental and vision plans, as well as standalone prescription drug coverage options.

| Insurance Carrier | Plan Types |

|---|---|

| Anthem Blue Cross Blue Shield | HMO, PPO, POS |

| Medical Mutual of Ohio | HMO, PPO |

| CareSource | HMO |

Eligibility and Enrollment

Eligibility for the Health Insurance Marketplace in Ohio is based on various factors, including income, household size, and citizenship status. Generally, individuals and families with incomes up to 400% of the Federal Poverty Level (FPL) are eligible for financial assistance to help cover the cost of premiums. This assistance is provided in the form of premium tax credits, reducing the monthly cost of coverage.

Enrollment periods for the Ohio Health Insurance Marketplace are typically divided into two categories: the Open Enrollment Period and Special Enrollment Periods. The Open Enrollment Period, which usually occurs from November to December each year, is a set timeframe during which anyone can enroll in a health insurance plan through the marketplace. Outside of this period, individuals can only enroll if they qualify for a Special Enrollment Period, triggered by specific life events such as losing other health coverage, moving, getting married, or having a baby.

Financial Assistance and Tax Credits

One of the significant advantages of the Health Insurance Marketplace is the availability of financial assistance and tax credits. Premium tax credits are designed to make health insurance more affordable for individuals and families with limited incomes. These credits are based on the estimated annual income and can be used to lower the monthly premium costs.

The amount of the premium tax credit is determined by the difference between the premium for a benchmark plan in the individual's area and a percentage of their household income. For example, if the benchmark plan premium is $500 per month and the individual's household income is 200% of the FPL, they may be eligible for a tax credit to cover a certain percentage of the premium, making their monthly payment significantly lower.

Consumer Protections and Quality Assurance

The Ohio Health Insurance Marketplace takes consumer protection seriously, implementing several measures to ensure the quality and integrity of the plans offered. All plans must meet the essential health benefits requirement, which includes coverage for a range of services such as ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, and chronic disease management.

Additionally, the marketplace conducts regular reviews of insurer networks to ensure they meet the standards for network adequacy. This means that insurers must have a sufficient number of healthcare providers and facilities in their network to serve the needs of their members. By maintaining these standards, the marketplace strives to provide Ohioans with access to a robust healthcare system.

Navigating the Ohio Health Insurance Marketplace

Navigating the Ohio Health Insurance Marketplace can be a straightforward process with the right guidance and resources. The marketplace website provides a wealth of information, including plan comparisons, eligibility criteria, and step-by-step guides for enrollment. Users can create an account, input their personal details, and receive personalized plan recommendations based on their needs and budget.

During the enrollment process, individuals will be asked to provide information about their household size, income, and any existing health conditions. This data is used to determine eligibility for financial assistance and to recommend plans that best suit their circumstances. The marketplace also offers tools to estimate out-of-pocket costs, helping users make informed decisions about their healthcare coverage.

The Future of Healthcare Coverage in Ohio

As the healthcare landscape continues to evolve, the Health Insurance Marketplace in Ohio remains a dynamic platform, adapting to meet the changing needs of its residents. Ongoing efforts to improve accessibility, enhance consumer education, and streamline the enrollment process are at the forefront of the marketplace’s mission.

Looking ahead, the marketplace is expected to expand its outreach initiatives, particularly in underserved communities, to ensure that all Ohioans have equal access to quality healthcare coverage. This includes partnerships with community organizations, educational campaigns, and digital initiatives to reach a wider audience.

Furthermore, the marketplace is committed to staying abreast of advancements in healthcare technology and policy. By integrating innovative solutions and keeping abreast of industry trends, Ohio's Health Insurance Marketplace aims to provide a seamless and user-friendly experience for its residents, making healthcare coverage more accessible and affordable.

Conclusion

The Health Insurance Marketplace in Ohio serves as a vital gateway for residents to access affordable and comprehensive healthcare coverage. With a diverse range of plans and providers, financial assistance for those who need it, and robust consumer protections, the marketplace empowers Ohioans to make informed decisions about their health and well-being. As the healthcare industry continues to evolve, the Ohio Health Insurance Marketplace stands ready to adapt and innovate, ensuring that the state’s residents have the tools they need to lead healthy lives.

What is the Open Enrollment Period for the Ohio Health Insurance Marketplace?

+

The Open Enrollment Period for the Ohio Health Insurance Marketplace typically occurs from November to December each year. This is a designated timeframe during which anyone can enroll in a health insurance plan through the marketplace, regardless of their eligibility for financial assistance.

How can I determine my eligibility for financial assistance on the Ohio Marketplace?

+

Eligibility for financial assistance on the Ohio Health Insurance Marketplace is primarily based on your household income. Generally, individuals and families with incomes up to 400% of the Federal Poverty Level (FPL) are eligible for premium tax credits to help cover the cost of premiums. You can use the marketplace’s online tools or consult with a marketplace navigator to determine your specific eligibility.

What happens if I miss the Open Enrollment Period?

+

If you miss the Open Enrollment Period, you may still be able to enroll in a health insurance plan through the Ohio Health Insurance Marketplace if you qualify for a Special Enrollment Period. Special Enrollment Periods are triggered by specific life events, such as losing other health coverage, moving, getting married, or having a baby. These events allow you to enroll outside of the regular Open Enrollment Period.