What Does Long Term Insurance Cover

Long-term insurance is a crucial financial tool that provides individuals and businesses with a safety net against potential long-term risks and unforeseen circumstances. This type of insurance offers comprehensive coverage for an extended period, typically spanning multiple years or even a lifetime. In this article, we will delve into the world of long-term insurance, exploring its various aspects, benefits, and the critical role it plays in safeguarding individuals and their assets.

Understanding Long-Term Insurance

Long-term insurance is a broad term encompassing various insurance policies designed to provide coverage over an extended duration. Unlike short-term insurance, which focuses on immediate risks, long-term insurance offers protection against events that may unfold over months or years. It serves as a financial buffer, ensuring individuals and businesses can navigate unforeseen challenges with financial stability and peace of mind.

Key Features of Long-Term Insurance

Long-term insurance policies are characterized by their longevity and the breadth of coverage they offer. Here are some key features that distinguish these policies:

- Extended Coverage Periods: Long-term insurance policies are designed to cover individuals or assets for an extended duration, often ranging from several years to a lifetime. This provides a sense of security and stability, knowing that protection is in place for the long haul.

- Comprehensive Benefits: These policies offer a wide range of benefits tailored to the specific needs of the insured. From health-related coverage to asset protection and income replacement, long-term insurance aims to address a variety of potential risks.

- Flexibility and Customization: Insurers provide flexibility in crafting long-term insurance policies to meet the unique needs of individuals and businesses. Policyholders can choose coverage limits, add optional riders, and customize the policy to align with their specific requirements.

- Inflation Protection: Many long-term insurance policies include inflation protection, ensuring that the coverage amount keeps pace with rising costs over time. This feature is particularly beneficial for policies covering assets or providing income replacement.

- Renewability: Most long-term insurance policies are renewable, allowing policyholders to extend their coverage beyond the initial term. This renewability ensures continuous protection, even as circumstances and needs evolve over time.

Types of Long-Term Insurance

Long-term insurance encompasses a diverse range of policies, each tailored to address specific risks and needs. Here are some common types of long-term insurance:

| Type of Insurance | Description |

|---|---|

| Long-Term Care Insurance | Provides coverage for extended care needs, including assistance with daily activities and medical expenses. It helps individuals maintain their independence and receive quality care without depleting their assets. |

| Life Insurance | Offers financial protection to beneficiaries in the event of the insured’s death. Life insurance policies come in various forms, including term life, whole life, and universal life, catering to different needs and financial goals. |

| Disability Insurance | Provides income replacement if the insured becomes disabled and unable to work. This type of insurance ensures financial stability during a time when earning capacity may be compromised. |

| Critical Illness Insurance | Provides a lump-sum payment upon the diagnosis of a specified critical illness, such as cancer, heart attack, or stroke. This payment can be used to cover medical expenses, debt repayment, or lifestyle adjustments. |

| Long-Term Business Insurance | Protects businesses against long-term risks, such as business interruption, property damage, or liability claims. It ensures that businesses can continue operating and recover from unforeseen events without significant financial strain. |

Benefits of Long-Term Insurance

Long-term insurance offers a multitude of benefits that extend beyond the basic coverage it provides. Here are some key advantages of investing in long-term insurance policies:

- Financial Security: Perhaps the most significant benefit is the financial security it provides. Long-term insurance policies offer a safety net, ensuring that individuals and businesses can weather unforeseen events without devastating financial consequences.

- Peace of Mind: Knowing that you have comprehensive coverage in place for an extended period can bring immense peace of mind. It allows individuals to focus on their daily lives and businesses to concentrate on growth and innovation without constant worry about potential risks.

- Asset Protection: Long-term insurance policies often include asset protection, safeguarding individuals’ hard-earned assets and investments. This is particularly crucial for high-net-worth individuals and businesses with significant assets to protect.

- Income Replacement: Certain long-term insurance policies, such as disability insurance, provide income replacement in the event of an injury or illness that renders the insured unable to work. This ensures financial stability and prevents individuals from falling into debt during challenging times.

- Tax Benefits: Depending on the type of long-term insurance policy, tax benefits may be available. For instance, life insurance policies often offer tax-free death benefits, and certain contributions to long-term care insurance plans may be tax-deductible.

- Customizable Coverage: The flexibility of long-term insurance policies allows individuals and businesses to tailor their coverage to their unique needs. This customization ensures that the policy aligns perfectly with their specific circumstances and financial goals.

- Inflation Protection: Inflation protection is a valuable feature of many long-term insurance policies. By adjusting coverage amounts to account for rising costs, these policies ensure that the insured’s protection remains adequate over time.

Choosing the Right Long-Term Insurance Policy

Selecting the appropriate long-term insurance policy is a critical decision that requires careful consideration. Here are some key factors to keep in mind when choosing a policy:

- Identify Your Needs: Begin by assessing your specific needs and risks. Consider your financial situation, family circumstances, and any unique risks associated with your profession or lifestyle. Understanding your needs will help you choose a policy that provides the right coverage.

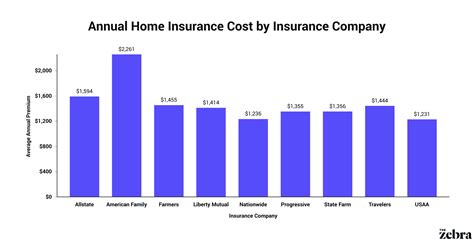

- Research and Compare Policies: Research different types of long-term insurance policies and compare their features, benefits, and costs. Look for policies that align with your identified needs and offer comprehensive coverage. Don’t hesitate to seek advice from insurance professionals or financial advisors.

- Consider Customization Options: Look for policies that offer customization options. This allows you to tailor the coverage to your specific requirements, ensuring you aren’t paying for unnecessary features while still maintaining adequate protection.

- Review Policy Terms and Conditions: Carefully read and understand the terms and conditions of the policy. Pay attention to exclusions, waiting periods, and any limitations or restrictions. Ensure that you are comfortable with the policy’s fine print before making a commitment.

- Evaluate the Insurer’s Reputation: Choose an insurer with a solid reputation and a track record of reliable claims handling. Check customer reviews and ratings to ensure that the insurer is trustworthy and likely to provide prompt and fair compensation in the event of a claim.

- Consider Premium Payment Options: Long-term insurance policies often offer various premium payment options, such as annual, semi-annual, or monthly payments. Choose an option that aligns with your financial situation and preferences.

- Seek Professional Advice: If you’re unsure about which policy to choose or have complex financial needs, consider consulting a financial advisor or insurance broker. These professionals can provide expert guidance and help you make an informed decision.

Real-World Applications and Success Stories

Long-term insurance has proven its worth time and again by providing financial stability and peace of mind to individuals and businesses facing various challenges. Here are a few real-world examples of how long-term insurance has made a difference:

- Medical Expenses Covered: A family with long-term care insurance found themselves facing the challenges of caring for an aging parent with severe dementia. The insurance policy provided the necessary funds to cover the costs of assisted living and specialized medical care, ensuring the parent received quality care without financial strain on the family.

- Business Continuity: A small business owner invested in long-term business insurance, including property and liability coverage. When a fire damaged their premises, the insurance policy covered the cost of repairs, allowing the business to continue operating and recover quickly.

- Income Protection: A young professional with disability insurance suffered a severe injury that left them unable to work. The insurance policy provided a monthly income replacement, ensuring they could maintain their standard of living and cover essential expenses during their recovery.

- Critical Illness Support: A couple with critical illness insurance received a devastating diagnosis of cancer. The insurance policy provided a substantial lump-sum payment, allowing them to focus on treatment and recovery without the added stress of financial worries.

- Legacy Protection: A high-net-worth individual with life insurance passed away unexpectedly. The insurance policy provided significant financial support to their family, ensuring their loved ones’ financial stability and the preservation of their legacy.

Future Implications and Trends

As the world continues to evolve, so do the risks and challenges individuals and businesses face. Long-term insurance must adapt to meet these changing needs. Here are some future implications and trends to consider:

- Emerging Risks: The insurance industry must stay ahead of emerging risks, such as cyber threats, climate change-related disasters, and new medical conditions. Insurers will need to develop innovative policies to address these evolving risks effectively.

- Technology Integration: The integration of technology into insurance processes, such as digital claims management and risk assessment, will continue to improve efficiency and customer experience. Insurers will leverage technology to offer more personalized and streamlined services.

- Wellness and Prevention: There is a growing focus on wellness and prevention in the insurance industry. Insurers may offer incentives and discounts to policyholders who maintain healthy lifestyles or participate in preventive measures, encouraging a proactive approach to health and well-being.

- Personalized Coverage: The future of long-term insurance may involve even more personalized coverage options. Insurers may utilize advanced analytics and data-driven insights to tailor policies to individual needs, providing highly customized protection.

- Global Reach: As the world becomes more interconnected, the demand for international long-term insurance coverage is likely to increase. Insurers will need to adapt their policies to cater to individuals and businesses operating globally, offering comprehensive protection across borders.

Frequently Asked Questions

How does long-term insurance differ from short-term insurance?

+

Long-term insurance provides coverage for an extended period, typically multiple years or a lifetime, offering comprehensive protection against long-term risks. In contrast, short-term insurance focuses on immediate risks and provides coverage for a shorter duration, such as a few months or a year.

What are the main types of long-term insurance policies available?

+

Common types include long-term care insurance, life insurance, disability insurance, critical illness insurance, and long-term business insurance. Each policy type is designed to address specific risks and provide tailored coverage.

Can I customize my long-term insurance policy to meet my specific needs?

+

Yes, many long-term insurance policies offer customization options. You can choose coverage limits, add optional riders, and tailor the policy to align with your unique circumstances and financial goals.

What are the benefits of investing in long-term insurance?

+

Long-term insurance offers financial security, peace of mind, asset protection, income replacement, tax benefits, and customizable coverage. It provides a safety net to navigate unforeseen challenges and ensures stability for individuals and businesses.

How do I choose the right long-term insurance policy for my needs?

+

Identify your specific needs, research and compare policies, consider customization options, review policy terms and conditions, evaluate the insurer’s reputation, and seek professional advice. Take the time to understand your options and choose a policy that aligns with your goals.