Dept Of Insurance Ga

Welcome to an in-depth exploration of the Georgia Department of Insurance, a critical agency dedicated to safeguarding consumers and fostering a robust insurance market within the state of Georgia. This article will delve into the diverse responsibilities, initiatives, and impact of this department, offering a comprehensive understanding of its role in the insurance landscape.

The Georgia Department of Insurance: An Overview

The Georgia Department of Insurance, under the leadership of Commissioner John F. King, serves as a cornerstone of the state’s regulatory framework. Established with the primary objective of protecting policyholders and ensuring a stable insurance marketplace, the department’s influence extends across a wide range of insurance sectors.

Key Responsibilities and Functions

At its core, the department undertakes the following critical tasks:

- Consumer Protection: A primary mandate involves safeguarding consumers from fraudulent or unethical insurance practices. This includes educating policyholders on their rights and responsibilities, investigating complaints, and ensuring fair and transparent business practices.

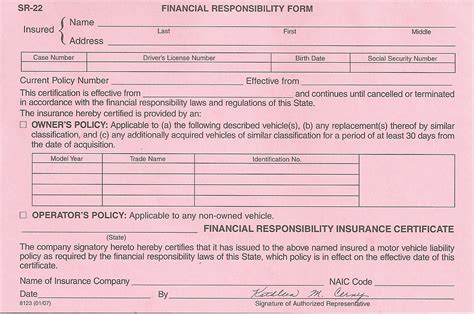

- Market Regulation: The department actively monitors and regulates the insurance market, ensuring compliance with state laws and maintaining a competitive environment. This involves licensing and overseeing insurance companies, agents, and brokers.

- Solvency Oversight: By conducting regular financial examinations, the department ensures that insurance companies operating within Georgia maintain adequate financial stability and solvency.

- Public Education: Through various initiatives and resources, the department empowers consumers to make informed insurance decisions. This includes providing guidance on policy selection, understanding coverage, and navigating the claims process.

- Industry Collaboration: Collaborating closely with insurance industry stakeholders, the department fosters an environment of innovation and growth while upholding consumer protection standards.

Recent Initiatives and Achievements

In recent years, the Georgia Department of Insurance has undertaken several notable initiatives to enhance its regulatory and consumer protection efforts. These include:

- Expanded Consumer Outreach: The department has strengthened its consumer education programs, offering a wealth of resources and tools to help Georgians navigate the complex world of insurance. This includes online guides, workshops, and community events.

- Enhanced Fraud Detection: Through advanced analytics and data-driven approaches, the department has improved its ability to identify and investigate insurance fraud, leading to increased prosecutions and protections for consumers.

- Insurance Innovation Support: Recognizing the importance of innovation in the insurance sector, the department has actively supported the development and adoption of new technologies and business models. This has included facilitating the integration of InsurTech solutions and promoting digital transformation.

- Regulatory Modernization: To keep pace with the evolving insurance landscape, the department has undertaken a series of regulatory reforms, streamlining processes and enhancing transparency. This has involved updating licensing procedures and adopting modern communication platforms to enhance consumer engagement.

A Closer Look at Key Departments

To effectively fulfill its diverse responsibilities, the Georgia Department of Insurance is organized into several specialized departments, each with its unique focus and expertise.

Consumer Services Division

The Consumer Services Division is the department’s primary interface with the public. This division:

- Receives and investigates consumer complaints, ensuring fair resolution.

- Provides guidance and resources to help consumers understand their insurance rights and responsibilities.

- Organizes community outreach events to raise awareness about insurance topics.

- Monitors and responds to emerging consumer trends and concerns in the insurance market.

Market Regulation Division

The Market Regulation Division is tasked with overseeing the insurance industry’s compliance with state laws and regulations. Key responsibilities include:

- Licensing and regulating insurance companies, agents, and brokers.

- Conducting financial examinations to ensure insurance companies’ solvency and financial stability.

- Reviewing and approving insurance policy forms to ensure compliance with state standards.

- Enforcing market conduct regulations to protect consumers from unfair or deceptive practices.

Fraud Investigation Division

The Fraud Investigation Division plays a crucial role in maintaining the integrity of the insurance market. This division:

- Investigates and prosecutes insurance fraud, working closely with law enforcement agencies.

- Utilizes advanced data analytics to identify potential fraud patterns and schemes.

- Collaborates with industry stakeholders to share intelligence and best practices in fraud detection.

- Provides educational resources to help consumers and industry professionals recognize and report fraud.

Legal and Policy Division

The Legal and Policy Division provides the department with critical legal and policy expertise. Key functions include:

- Drafting and interpreting insurance-related legislation and regulations.

- Representing the department in legal proceedings and administrative hearings.

- Providing legal guidance to other department divisions and industry stakeholders.

- Conducting policy research and analysis to inform the department’s strategic direction.

Impact and Future Outlook

The Georgia Department of Insurance has had a significant impact on the state’s insurance market and consumers. Through its regulatory and consumer protection efforts, the department has fostered a stable and competitive insurance environment, benefiting both policyholders and industry stakeholders.

Looking ahead, the department is poised to address emerging challenges and opportunities. This includes adapting to technological advancements, such as the growing influence of InsurTech, and navigating the complex landscape of cyber risks and data privacy. Additionally, the department will continue to prioritize consumer education and protection, ensuring that Georgians have the resources and support they need to make informed insurance decisions.

| Department | Key Focus |

|---|---|

| Consumer Services Division | Assisting and educating consumers, ensuring fair practices |

| Market Regulation Division | Overseeing industry compliance, ensuring market stability |

| Fraud Investigation Division | Combating insurance fraud, protecting market integrity |

| Legal and Policy Division | Providing legal and policy expertise, shaping regulatory framework |

What is the role of the Georgia Department of Insurance in consumer protection?

+The department safeguards consumers by investigating complaints, educating policyholders, and ensuring fair business practices. This includes providing resources and guidance to help consumers understand their rights and navigate the insurance landscape.

How does the department regulate the insurance market?

+The department licenses and oversees insurance companies, agents, and brokers. It conducts financial examinations to ensure solvency and reviews insurance policy forms for compliance with state standards.

What initiatives has the department undertaken to combat insurance fraud?

+The department has enhanced its fraud detection capabilities through advanced analytics. It collaborates with law enforcement and industry stakeholders to investigate and prosecute fraud, and provides educational resources to consumers and professionals.

How does the department support innovation in the insurance sector?

+The department actively promotes and facilitates the adoption of new technologies and business models in the insurance industry. This includes supporting InsurTech solutions and digital transformation efforts.