Compare Insurance Quotes For Car

Comparing insurance quotes for your car is a crucial step in finding the best coverage at the most competitive price. With numerous insurance providers offering a wide range of policies, it can be a daunting task to navigate through the options and make an informed decision. This comprehensive guide will delve into the process of comparing insurance quotes, providing you with the knowledge and tools to secure the ideal car insurance coverage tailored to your specific needs.

Understanding Your Insurance Needs

Before you begin comparing quotes, it’s essential to understand your insurance requirements. Consider the following factors:

- Vehicle Type and Usage: Different vehicles and their intended usage can impact insurance rates. For instance, sports cars often have higher premiums due to their performance capabilities and potential for accidents. Determine how you primarily use your vehicle (commuting, leisure, business) as this can influence the coverage you require.

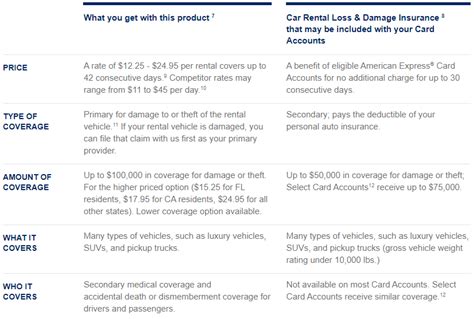

- Coverage Options: Familiarize yourself with the various types of coverage available, such as liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Each offers distinct benefits and protections, so understanding your needs is crucial for an accurate quote comparison.

- Deductibles and Limits: Deductibles represent the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles can result in lower premiums, so consider your financial situation and risk tolerance when selecting deductibles. Additionally, review the policy limits, ensuring they align with your desired level of coverage.

Researching Insurance Providers

The insurance market is vast, with numerous providers offering a myriad of policies. Researching these providers is an integral part of the quote comparison process:

- Reputation and Financial Stability: Opt for reputable insurance companies with a strong financial standing. Check industry ratings and reviews to ensure the provider has a good track record of claims handling and customer satisfaction. A financially stable insurer is more likely to honor your policy commitments.

- Policy Features and Benefits: Different providers offer unique policy features and benefits. Some may provide accident forgiveness, roadside assistance, or rental car coverage as standard inclusions. Others might offer discounts for specific occupations or memberships. Assess these additional perks to determine their value to you.

- Customer Service and Claims Process: The efficiency and responsiveness of an insurer’s customer service and claims handling processes can significantly impact your experience. Read reviews and seek recommendations to gauge the provider’s reputation in these areas. A seamless claims process can make a world of difference in times of need.

Obtaining and Comparing Quotes

Once you’ve understood your insurance needs and researched potential providers, it’s time to obtain and compare quotes:

- Online Quote Tools: Many insurance providers offer online quote tools, allowing you to input your vehicle and personal details to receive an instant quote. These tools provide a quick and convenient way to compare premiums and coverage options across different providers.

- Agent-Assisted Quotes: Working with an insurance agent can offer personalized guidance and support. Agents can help you tailor your policy to your specific needs and provide expert advice on coverage options. While this process might take longer, it ensures a comprehensive understanding of your policy.

- Comparison Websites: Comparison websites aggregate quotes from multiple insurance providers, providing a one-stop shop for quote comparisons. These platforms can be especially useful for quickly assessing a wide range of options, but remember to double-check the accuracy of the information provided.

Factors Influencing Quotes

Insurance quotes are influenced by a variety of factors. Understanding these factors can help you make more informed decisions:

| Factor | Description |

|---|---|

| Age and Driving Experience | Younger drivers often pay higher premiums due to their perceived higher risk. However, as you gain more driving experience, your premiums may decrease. |

| Driving Record | A clean driving record with no accidents or violations can lead to lower premiums. Conversely, a history of accidents or traffic violations may result in higher rates. |

| Credit Score | In many states, insurers use credit-based insurance scores to assess risk. A higher credit score may result in lower premiums, as it is seen as an indicator of financial responsibility. |

| Location | Insurance rates can vary significantly based on your geographic location. Factors like traffic density, crime rates, and weather conditions can impact premiums. |

| Vehicle Make and Model | Certain vehicle makes and models are more expensive to insure due to factors like repair costs, theft rates, and safety features. |

Negotiating and Finalizing Your Policy

After comparing quotes and selecting a provider, it’s time to negotiate and finalize your policy. Here’s how to ensure you get the best deal:

- Discounts: Inquire about available discounts. Many providers offer discounts for good driving records, multiple policies, safety features, and membership in certain organizations. Applying these discounts can significantly reduce your premiums.

- Bundle Policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance. Bundling often results in substantial savings and simplifies your insurance management.

- Policy Review: Regularly review your policy to ensure it aligns with your changing needs and circumstances. As your life circumstances evolve, so too might your insurance requirements. Stay informed and make necessary adjustments to maintain optimal coverage.

Common Pitfalls to Avoid

When comparing insurance quotes, it’s important to be aware of potential pitfalls that could lead to costly mistakes:

- Inadequate Coverage: Opting for the cheapest quote without considering the coverage it provides can leave you underinsured. Ensure the policy meets your specific needs and provides adequate protection in the event of an accident or other unforeseen circumstances.

- Lack of Transparency: Some providers may not disclose all the terms and conditions of their policies upfront. Be cautious of hidden fees, exclusions, or limitations that could impact your coverage. Read the fine print and ask questions to ensure you understand the full scope of the policy.

- Impulse Decisions: Resist the urge to make impulsive decisions based solely on the cheapest quote. Take the time to thoroughly research and compare providers, considering their reputation, financial stability, and customer service record. A well-informed decision is crucial for long-term satisfaction.

Conclusion

Comparing insurance quotes for your car is a critical step in ensuring you obtain the best coverage at a competitive price. By understanding your insurance needs, researching providers, and thoroughly comparing quotes, you can make an informed decision that aligns with your specific requirements. Remember, the process of selecting car insurance is ongoing, and regular policy reviews are essential to maintain optimal coverage as your needs evolve.

What is the average cost of car insurance in the United States?

+

The average cost of car insurance in the US varies widely depending on factors such as location, driving record, and the make and model of the vehicle. As of [current year], the national average cost of car insurance is approximately 1,674 per year, or 139 per month. However, it’s important to note that rates can vary significantly from state to state and even within different regions of the same state.

How can I get cheaper car insurance quotes?

+

To obtain cheaper car insurance quotes, consider the following strategies: Improve your driving record by avoiding accidents and traffic violations, as insurers reward safe drivers with lower premiums. Increase your deductible, as a higher deductible can result in reduced premiums. Shop around and compare quotes from multiple insurers to find the best rates. Take advantage of discounts offered by insurers for factors like good grades, safe driving programs, or bundling multiple policies.

What factors influence car insurance quotes?

+

Car insurance quotes are influenced by a variety of factors, including your age, gender, driving record, credit score, and the make and model of your vehicle. Additionally, your location, the purpose of your vehicle usage (e.g., personal, business, or pleasure), and the level of coverage you choose (e.g., liability-only vs. comprehensive) can impact your insurance rates.