Cheap And Affordable Health Insurance

In today's world, accessing quality healthcare is a fundamental need, yet the cost of medical services and insurance can be a significant barrier for many individuals and families. The search for cheap and affordable health insurance has become a priority for those aiming to safeguard their well-being without breaking the bank. This article delves into the strategies and options available to secure affordable health coverage, offering a comprehensive guide to navigate the complex world of healthcare insurance.

Understanding Affordable Health Insurance

Affordable health insurance refers to coverage options that offer an adequate level of healthcare benefits at a cost that is manageable for the average individual or family. It is designed to provide financial protection against the high costs of medical care, ensuring access to necessary services without imposing excessive financial burdens.

The concept of affordable health insurance is particularly relevant in countries where healthcare is not entirely covered by the government. In such systems, individuals must balance the need for comprehensive healthcare coverage with their financial capabilities. This delicate balance has driven the development of various insurance plans, each with unique features and pricing structures.

Factors Influencing Health Insurance Costs

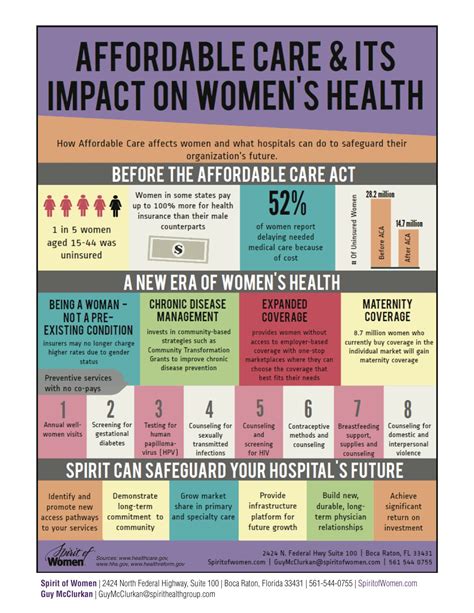

The cost of health insurance is influenced by a multitude of factors, including age, gender, geographical location, and the specific benefits included in the plan. Insurance companies assess these factors to determine the level of risk associated with each individual or family, which directly impacts the premium rates.

Age and Gender Considerations

Age and gender are two key factors in determining health insurance premiums. Generally, younger individuals tend to have lower premiums as they are perceived to be at a lower risk of developing serious health conditions. On the other hand, older individuals, especially those above 60, may face higher premiums due to the increased likelihood of requiring medical care.

Gender can also play a role, with some insurance providers charging different rates for men and women based on statistical differences in healthcare utilization. However, this practice is becoming less common due to legal restrictions and societal changes.

Location and Benefits

The geographical location of the insured individual can significantly impact insurance costs. Urban areas, for instance, often have higher premiums due to the increased cost of living and the availability of specialized medical services. In contrast, rural areas may offer more affordable options, although the range of available healthcare services might be more limited.

The benefits included in a health insurance plan are another critical factor. Plans with extensive coverage, including a wide range of services and minimal out-of-pocket expenses, will typically be more expensive than those with more basic coverage and higher deductibles.

Strategies for Finding Affordable Health Insurance

Despite the complex nature of health insurance, there are several strategies individuals can employ to secure affordable coverage. These strategies involve a combination of research, understanding personal healthcare needs, and leveraging available resources.

Research and Comparison

The first step in finding affordable health insurance is to conduct thorough research. This involves understanding the different types of insurance plans available, their coverage limits, and the associated costs. Online platforms and government resources often provide comparative information, making it easier to identify plans that align with individual needs and budgets.

Comparing insurance quotes from multiple providers is crucial. While one provider may offer a lower premium, another might provide better coverage for specific healthcare needs. By shopping around and comparing plans, individuals can identify the most cost-effective option that meets their requirements.

Understanding Personal Healthcare Needs

Identifying personal healthcare needs is essential in selecting the right health insurance plan. This involves considering factors such as the frequency of doctor visits, the need for specialized treatments or medications, and potential future healthcare requirements. By understanding these needs, individuals can choose plans that provide adequate coverage without unnecessary extras, thereby keeping costs down.

Utilizing Government Programs and Subsidies

In many countries, government programs and subsidies are available to make health insurance more affordable, especially for low-income individuals and families. These programs often provide financial assistance to reduce the cost of premiums or cover a portion of out-of-pocket expenses. Researching and understanding eligibility criteria for such programs can be a critical step in accessing affordable healthcare.

Employer-Sponsored Plans

For those who are employed, exploring employer-sponsored health insurance plans can be a cost-effective option. Many employers offer group insurance plans, which often provide better rates due to the large pool of insured individuals. These plans may also include additional benefits, such as dental or vision coverage, making them an attractive option for comprehensive healthcare coverage.

Comparing Insurance Providers and Plans

When comparing insurance providers and plans, it's essential to look beyond just the premium costs. While price is a significant factor, other aspects, such as the reputation of the provider, the quality of customer service, and the ease of claim processes, can significantly impact the overall experience and value of the insurance plan.

Reputation and Customer Service

The reputation of an insurance provider is a critical consideration. A reputable provider is more likely to have a reliable claims process, responsive customer service, and a track record of treating customers fairly. Reviews and ratings from other customers can provide valuable insights into the overall experience of dealing with a particular insurance company.

Claim Processes and Customer Satisfaction

Understanding the claim processes of different insurance providers can help individuals anticipate potential challenges. Some providers may have more straightforward and efficient claim processes, while others may be known for delays or complex procedures. Customer satisfaction ratings and feedback can provide valuable insights into the ease and reliability of these processes.

Coverage and Benefits

The coverage and benefits offered by different insurance plans can vary significantly. While some plans may focus on providing extensive coverage for a wide range of healthcare services, others may prioritize specific areas such as prescription drug coverage or mental health services. Understanding the specific benefits included in each plan is crucial to ensuring that personal healthcare needs are adequately met.

Navigating the Enrollment Process

Once an individual has identified the right health insurance plan, the next step is to navigate the enrollment process. This process can vary depending on the provider and the type of plan, but generally involves filling out an application, providing personal and medical information, and selecting the desired coverage level and benefits.

Application and Documentation

The application process typically requires individuals to provide personal details, such as name, date of birth, and contact information, as well as medical information, including any pre-existing conditions. It's essential to provide accurate and complete information to ensure that the insurance plan meets the individual's needs and to avoid potential issues with coverage down the line.

Coverage Selection and Premiums

During the enrollment process, individuals will need to select the level of coverage they desire, which can impact the monthly premium. Higher coverage levels usually result in higher premiums, but they also provide more comprehensive benefits. It's important to strike a balance between the desired level of coverage and the affordability of the premium.

Understanding Exclusions and Limitations

Health insurance plans often have exclusions and limitations, which are specific services or treatments that are not covered by the plan. These can include certain medical procedures, prescription drugs, or even entire specialties of medicine. Understanding these exclusions is crucial to managing expectations and ensuring that the chosen plan aligns with personal healthcare needs.

Maximizing the Value of Health Insurance

Once enrolled in a health insurance plan, there are several strategies individuals can employ to maximize the value of their coverage and minimize out-of-pocket expenses.

Utilizing Preventive Care Services

Many health insurance plans offer preventive care services, such as annual check-ups, vaccinations, and screenings, at little to no cost. Taking advantage of these services can help identify potential health issues early on, allowing for more effective treatment and potentially reducing future healthcare costs.

Understanding Cost-Sharing Arrangements

Health insurance plans often involve cost-sharing arrangements, such as deductibles, copayments, and coinsurance. Understanding how these work can help individuals manage their healthcare expenses effectively. For instance, choosing a plan with a higher deductible may result in lower premiums, but it means that the insured individual will have to pay more out-of-pocket before the insurance coverage kicks in.

Choosing In-Network Providers

Insurance plans typically have a network of healthcare providers, including doctors, hospitals, and pharmacies, with whom they have negotiated discounted rates. Choosing in-network providers can result in lower out-of-pocket costs, as these providers have agreed to accept the insurance company's payment rates. Using out-of-network providers may result in higher expenses, as the insurance company may pay less toward these services.

The Future of Affordable Health Insurance

The landscape of affordable health insurance is constantly evolving, influenced by changes in healthcare policies, technological advancements, and shifts in societal needs. As we move forward, several trends and developments are shaping the future of affordable healthcare coverage.

Telehealth and Digital Health Solutions

The rise of telehealth and digital health solutions has the potential to revolutionize affordable healthcare. These technologies allow for remote consultations, monitoring, and treatment, reducing the need for in-person visits and potentially lowering healthcare costs. As these solutions become more integrated into the healthcare system, they could make accessing healthcare more convenient and affordable for many individuals.

Value-Based Care Models

Value-based care models are gaining traction as a way to improve healthcare outcomes while controlling costs. These models focus on providing high-quality care that is also cost-effective, often by incentivizing healthcare providers to deliver efficient, evidence-based treatments. As these models become more widespread, they could lead to more affordable and accessible healthcare options.

Consumer-Directed Health Plans

Consumer-directed health plans, such as Health Savings Accounts (HSAs) and High Deductible Health Plans (HDHPs), are becoming increasingly popular. These plans give individuals more control over their healthcare decisions and costs, often by offering lower premiums and allowing individuals to save money tax-free for future medical expenses. While these plans may not be suitable for everyone, they offer a unique approach to managing healthcare costs.

Frequently Asked Questions

What is the average cost of health insurance per month?

+The average monthly cost of health insurance can vary significantly based on several factors, including age, location, and the level of coverage desired. According to recent data, the national average for individual health insurance premiums in the United States is around $450 per month, while family plans can cost upwards of $1,500 per month. However, these averages can vary widely depending on the specific circumstances.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any government programs that offer free or low-cost health insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, several government programs are designed to provide free or low-cost health insurance to eligible individuals. In the United States, for instance, programs like Medicaid and the Children's Health Insurance Program (CHIP) offer free or low-cost healthcare coverage to qualifying low-income families and individuals. Additionally, the Affordable Care Act (ACA) provides subsidies to reduce the cost of health insurance premiums for those who meet certain income requirements.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I get health insurance if I have a pre-existing condition?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely. In many countries, including the United States, insurance providers are prohibited from discriminating against individuals with pre-existing conditions. The Affordable Care Act (ACA) ensures that insurance companies must provide coverage regardless of pre-existing health issues. However, it's important to carefully review insurance plans to understand how they handle pre-existing conditions, as some may have waiting periods or other limitations.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are some ways to reduce the cost of health insurance premiums?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>There are several strategies to reduce health insurance premiums. These include shopping around and comparing quotes from different insurance providers, utilizing government subsidies or tax credits if eligible, choosing higher deductible plans (which typically have lower premiums), and considering employer-sponsored group plans, which often offer more competitive rates. Additionally, maintaining a healthy lifestyle and utilizing preventive care services can help reduce the risk of developing costly health conditions.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I choose the right health insurance plan for my needs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Choosing the right health insurance plan involves carefully considering your personal healthcare needs and financial situation. Evaluate the coverage offered by different plans, including the types of services covered, the network of healthcare providers, and the cost-sharing arrangements (deductibles, copayments, etc.). It's also important to understand any exclusions or limitations in the plan. Finally, consider the reputation and customer service of the insurance provider. Taking all these factors into account will help you make an informed decision.</p>

</div>

</div>

</div>