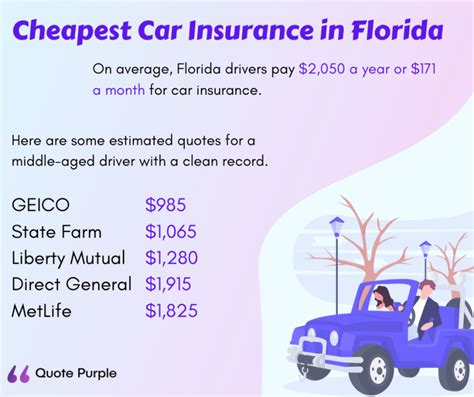

Cheapest Fl Auto Insurance

When it comes to finding the cheapest auto insurance in Florida, there are several factors to consider. The cost of car insurance can vary significantly depending on individual circumstances and the specific coverage needed. However, with some research and by understanding the factors that influence insurance rates, you can secure the most affordable coverage for your vehicle.

Understanding Florida’s Auto Insurance Market

Florida is known for its competitive insurance market, offering a wide range of options for drivers. The state’s unique no-fault insurance system, known as Personal Injury Protection (PIP), adds a layer of complexity to insurance policies. Additionally, factors such as traffic density, weather conditions, and the state’s high tourist population can impact insurance rates.

Despite these influences, there are strategies to find the cheapest auto insurance in Florida. By exploring various providers, understanding coverage options, and utilizing online tools, you can identify the most cost-effective policies for your needs.

Factors Influencing Auto Insurance Rates in Florida

Several key factors determine the cost of auto insurance in Florida. Understanding these elements can help you tailor your insurance search and potentially reduce your premiums.

Driver Profile and History

Your driving record and personal details significantly impact your insurance rates. Factors such as age, gender, marital status, and credit score can influence the price of your policy. Additionally, your driving history, including accidents, violations, and claims, plays a crucial role in determining your insurance costs.

For example, younger drivers, especially males under 25, often face higher premiums due to their perceived higher risk on the road. Similarly, a history of accidents or traffic violations can result in increased insurance rates. On the other hand, maintaining a clean driving record and taking defensive driving courses can help lower your insurance costs over time.

Vehicle Type and Usage

The type of vehicle you drive and how you use it also affect your insurance rates. Generally, newer, more expensive cars, sports cars, and luxury vehicles tend to have higher insurance costs due to their repair and replacement expenses. Additionally, the purpose for which you use your vehicle, such as personal use, business, or pleasure, can influence your insurance premiums.

For instance, if you primarily use your car for business purposes, your insurance rates may be higher due to the increased risk associated with business-related driving. On the other hand, if you have an older, less valuable vehicle and primarily use it for personal travel, your insurance costs may be more affordable.

Coverage and Deductibles

The level of coverage you choose and your deductible amount significantly impact your insurance premiums. Florida’s no-fault insurance system requires all drivers to carry Personal Injury Protection (PIP) coverage, which provides medical benefits for injuries sustained in an accident. However, beyond the mandatory PIP coverage, you can customize your policy to fit your needs and budget.

By selecting higher deductibles, you can often reduce your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. For example, if you choose a $1,000 deductible, you'll pay the first $1,000 of any claim, with your insurance covering the remaining expenses. While this may result in higher upfront costs in the event of an accident, it can lead to significant savings on your insurance premiums.

Location and Usage Patterns

Where you live and how you use your vehicle can also affect your insurance rates. Urban areas with higher traffic density and crime rates often result in increased insurance costs. Additionally, the frequency and distance of your travels can influence your insurance premiums. Insurance companies may offer discounts for low-mileage drivers or those who primarily use their vehicles for short, local trips.

Tips for Finding the Cheapest Auto Insurance in Florida

Now that we’ve explored the factors influencing auto insurance rates, here are some practical tips to help you find the cheapest insurance in Florida.

Shop Around and Compare Quotes

One of the most effective ways to find affordable auto insurance is to compare quotes from multiple providers. Insurance companies offer a wide range of rates, so shopping around can help you identify the best deal for your specific circumstances. Online comparison tools and insurance brokers can streamline this process, allowing you to quickly assess multiple quotes and choose the most cost-effective option.

Understand Your Coverage Needs

Before requesting quotes, it’s essential to understand your coverage needs. Consider the minimum coverage required by Florida law, as well as any additional coverage you may require based on your personal circumstances. By clearly defining your coverage needs, you can ensure you’re not paying for unnecessary coverage while still maintaining adequate protection.

Explore Discounts and Special Programs

Insurance companies often offer various discounts and special programs to attract customers and reduce their risk. Some common discounts include multi-policy discounts (for bundling your auto insurance with other policies like homeowners or renters insurance), safe driver discounts, good student discounts, and loyalty discounts for long-term customers. Additionally, some providers offer discounts for vehicle safety features, low mileage, or participation in usage-based insurance programs.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that allows insurance companies to track your driving behavior and offer customized premiums. By installing a small device in your vehicle or using a smartphone app, insurance providers can monitor your driving habits, such as mileage, speed, and braking patterns. This data is then used to calculate your insurance rates, often resulting in significant savings for safe drivers.

Maintain a Clean Driving Record

As mentioned earlier, your driving record plays a crucial role in determining your insurance rates. By maintaining a clean driving record, you can often qualify for lower premiums. Avoid traffic violations, practice defensive driving, and consider taking additional driving courses to enhance your skills and demonstrate your commitment to safe driving.

Consider Increasing Your Deductible

As discussed, increasing your deductible can lead to lower insurance premiums. While this approach may not be suitable for everyone, especially those with limited financial resources, it can be an effective strategy for reducing your insurance costs. By choosing a higher deductible, you’ll pay more out of pocket in the event of a claim, but you’ll benefit from lower monthly premiums.

Conclusion: Tailoring Your Insurance Strategy

Finding the cheapest auto insurance in Florida requires a combination of research, understanding of your needs, and strategic decision-making. By considering your driving profile, vehicle type, coverage requirements, and available discounts, you can tailor your insurance strategy to secure the most affordable coverage.

Remember, while cost is an essential factor, it's crucial to strike a balance between affordability and adequate protection. Take the time to explore your options, compare quotes, and seek expert advice to ensure you're making informed decisions about your auto insurance.

How do I know if I’m getting a good deal on auto insurance in Florida?

+To ensure you’re getting a good deal on auto insurance, compare quotes from multiple providers, understand your coverage needs, and explore available discounts. Additionally, consider usage-based insurance programs, which can offer significant savings for safe drivers.

What is the minimum auto insurance coverage required in Florida?

+Florida requires all drivers to carry Personal Injury Protection (PIP) coverage with a minimum of 10,000 in medical benefits. Additionally, property damage liability coverage with a minimum of 10,000 is also mandatory.

Can I get auto insurance without a license in Florida?

+While having a valid driver’s license is generally required to obtain auto insurance, some providers may offer coverage for vehicles without a designated driver. However, this is typically a temporary solution, and it’s advisable to obtain a license and insurance coverage as soon as possible.

How can I lower my auto insurance premiums if I have a poor driving record?

+If you have a poor driving record, you can still take steps to lower your insurance premiums. Consider increasing your deductible, exploring usage-based insurance programs, and taking additional driving courses to improve your driving skills and demonstrate your commitment to safety. Additionally, maintaining a clean driving record going forward will help reduce your insurance costs over time.