Cheap Insurance For A Car

Securing affordable car insurance is a top priority for many vehicle owners, as it provides the necessary coverage to protect against financial losses and unforeseen incidents on the road. With a wide range of insurance providers and policies available, finding the cheapest option that suits your specific needs can be a challenging task. This comprehensive guide will delve into the factors that influence insurance costs, explore strategies to reduce premiums, and highlight the best practices for obtaining the most cost-effective car insurance coverage.

Understanding the Factors that Impact Car Insurance Costs

The cost of car insurance is influenced by a multitude of factors, each playing a significant role in determining the premium you pay. These factors include the type of vehicle you own, your age and driving experience, the location where the vehicle is primarily driven, and your personal driving record. Additionally, insurance providers consider the coverage limits you choose, any discounts you may qualify for, and the deductible amount you select.

Vehicle-Related Factors

The make, model, and year of your vehicle are key considerations for insurance providers. Generally, newer and more expensive vehicles tend to have higher insurance costs due to their higher replacement and repair expenses. Furthermore, vehicles with advanced safety features or those less prone to theft may be eligible for insurance discounts.

| Vehicle Type | Insurance Cost |

|---|---|

| Sedans | $1,200 - $1,500 annually |

| SUVs | $1,500 - $2,000 annually |

| Sports Cars | $2,500 - $3,000 annually |

Driver-Related Factors

Your age, gender, and driving experience are crucial determinants of insurance costs. Younger drivers, particularly those under 25, often face higher premiums due to their perceived higher risk on the road. Similarly, drivers with a history of traffic violations or accidents may see increased insurance rates.

| Driver Age | Average Insurance Premium |

|---|---|

| 18-24 years | $2,500 - $3,000 annually |

| 25-34 years | $1,800 - $2,200 annually |

| 35-54 years | $1,500 - $1,800 annually |

| 55+ years | $1,200 - $1,500 annually |

Location and Usage

The area where you reside and the primary use of your vehicle can significantly impact insurance costs. Urban areas with higher population density and traffic congestion often result in increased insurance premiums. Similarly, if you primarily use your vehicle for business purposes or long-distance travel, your insurance rates may be higher.

Strategies to Reduce Car Insurance Costs

While various factors influence insurance costs, there are several strategies you can employ to reduce your premiums and secure more affordable coverage.

Shop Around and Compare Quotes

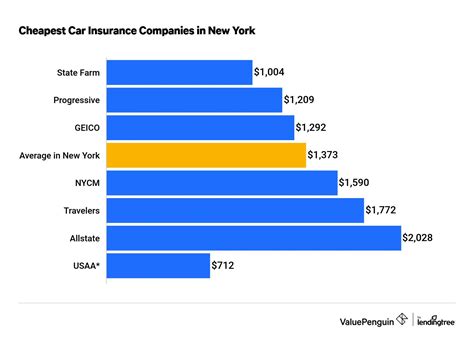

One of the most effective ways to find cheap car insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, so obtaining quotes from at least three different insurers is advisable. Online comparison tools and insurance brokerages can simplify this process, allowing you to quickly assess the market and identify the most competitive rates.

Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies with them. For instance, if you have home insurance and car insurance, consider consolidating them with the same provider to potentially save on both policies. This strategy is particularly beneficial for individuals with multiple vehicles or other insurance needs.

Increase Your Deductible

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can significantly reduce your insurance premiums. However, it’s essential to ensure that you can afford the higher deductible in the event of an accident or claim.

Explore Discounts

Insurance providers offer a variety of discounts to attract and retain customers. Common discounts include those for safe driving records, good student grades, low-mileage usage, and vehicle safety features. Additionally, some insurers provide loyalty discounts for long-term customers. Researching and understanding the discounts available can help you identify opportunities to reduce your insurance costs.

Maintain a Clean Driving Record

Your driving record is a critical factor in determining your insurance premiums. A clean driving record, free from accidents and traffic violations, can lead to lower insurance rates. Conversely, a history of accidents or violations can significantly increase your insurance costs. By practicing safe driving habits and adhering to traffic laws, you can maintain a positive driving record and potentially qualify for insurance discounts.

Best Practices for Cheap Car Insurance

To secure the most affordable car insurance coverage, it’s essential to follow some best practices. These practices ensure you’re not only getting a good deal but also adequate protection for your vehicle and financial well-being.

Understand Your Coverage Needs

Before shopping for car insurance, it’s crucial to understand your specific coverage needs. Consider the value of your vehicle, your financial situation, and any state-mandated insurance requirements. This knowledge will help you choose the appropriate coverage limits and deductibles to ensure you’re not overpaying for coverage you don’t need.

Choose the Right Coverage

Car insurance policies typically offer a range of coverage options, including liability, collision, comprehensive, and additional coverage endorsements. It’s important to select the coverage that aligns with your needs and provides adequate protection. For instance, if you own an older vehicle with low resale value, you may not require comprehensive or collision coverage.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that allows insurers to tailor premiums based on your actual driving behavior. This type of insurance uses telematics devices or smartphone apps to track your driving habits, such as mileage, braking, and acceleration. By demonstrating safe and cautious driving, you may be eligible for reduced premiums.

Maintain a Good Credit Score

Your credit score is often a determining factor in your insurance premiums. Insurance providers view individuals with higher credit scores as less risky, which can lead to lower insurance rates. Therefore, maintaining a good credit score is not only beneficial for financial health but also for securing affordable car insurance.

Review and Update Your Policy Regularly

Insurance needs can change over time, so it’s important to regularly review and update your car insurance policy. Factors such as changes in your vehicle, driving habits, or personal circumstances may impact your insurance requirements. By staying proactive and keeping your policy up-to-date, you can ensure you’re always getting the best value for your insurance coverage.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies based on several factors, including the state you reside in and your personal circumstances. However, the national average for car insurance premiums is approximately $1,500 per year.

How can I save money on car insurance as a young driver?

+Young drivers often face higher insurance premiums due to their perceived higher risk on the road. To save money, consider getting quotes from multiple insurers, maintaining a clean driving record, and exploring discounts for good students or safe driving programs.

What are some common discounts available for car insurance?

+Common discounts for car insurance include safe driver discounts, good student discounts, loyalty discounts, vehicle safety discounts, and low-mileage usage discounts. Additionally, some insurers offer discounts for bundling multiple policies or for belonging to certain professional organizations.