Private Mortgage Insurance Rates

Private Mortgage Insurance (PMI) is a common requirement for homebuyers who are unable to make a down payment of 20% or more on their home purchase. It protects the lender in case the borrower defaults on the loan, and it can significantly impact a homeowner's monthly payments and overall financial planning. Understanding PMI rates is crucial for anyone considering buying a home or refinancing their existing mortgage.

Understanding Private Mortgage Insurance

Private Mortgage Insurance is an insurance policy that the borrower pays for, but it benefits the lender. The primary purpose of PMI is to safeguard the lender’s interest in the property by reducing their financial risk. This insurance is typically required for conventional loans when the borrower’s down payment is less than 20% of the home’s purchase price. PMI is not to be confused with mortgage life insurance, which covers the outstanding mortgage balance in the event of the borrower’s death.

The cost of PMI is usually added to the borrower's monthly mortgage payment, although there are alternative payment structures available. The specific rate for PMI depends on several factors, including the borrower's credit score, the loan-to-value ratio (LTV), and the type of loan.

Factors Influencing PMI Rates

Credit Score

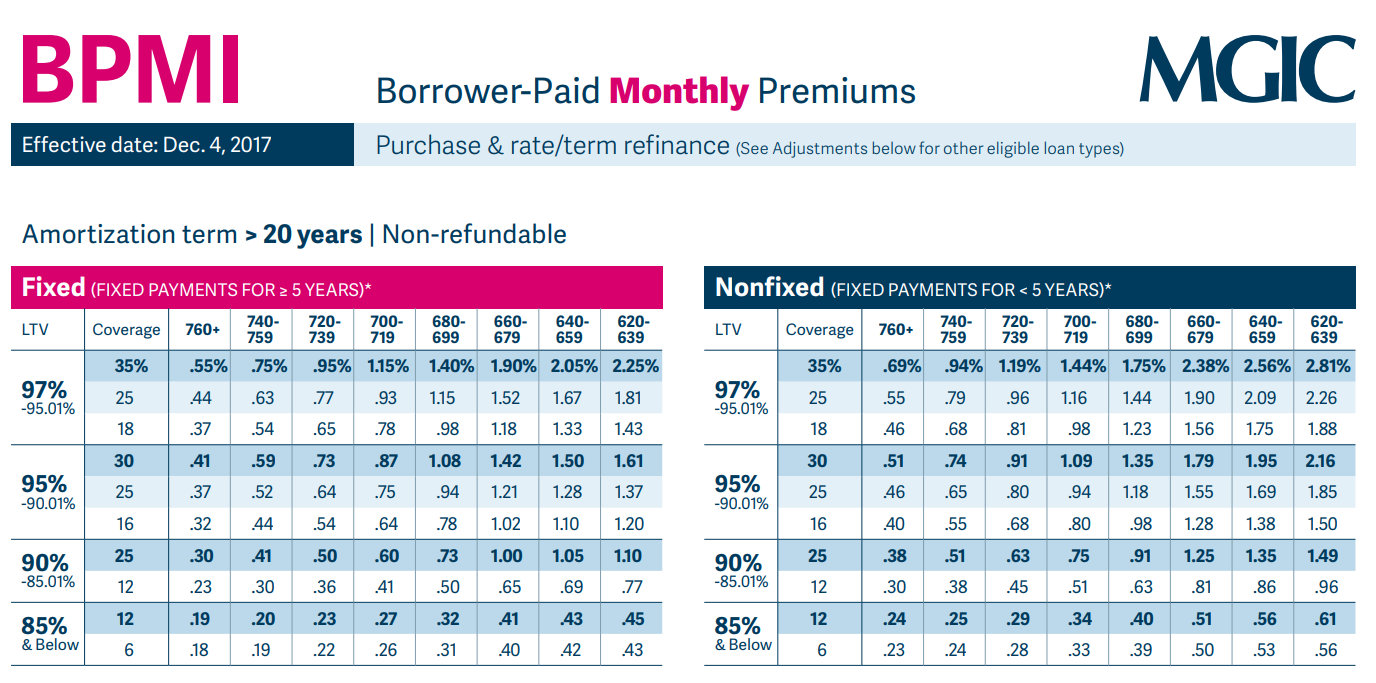

The borrower’s credit score is a significant factor in determining PMI rates. Lenders consider credit scores as an indicator of the borrower’s financial responsibility and their likelihood of making timely payments. Generally, borrowers with higher credit scores are seen as less risky and may qualify for lower PMI rates. Conversely, those with lower credit scores may face higher PMI costs.

| Credit Score Range | PMI Rate |

|---|---|

| 760 and above | 0.35% to 0.45% of the loan amount annually |

| 720 to 759 | 0.50% to 0.75% of the loan amount annually |

| 680 to 719 | 0.75% to 1.00% of the loan amount annually |

| 640 to 679 | 1.00% to 1.25% of the loan amount annually |

| Below 640 | 1.25% to 1.50% of the loan amount annually |

These rates are estimates and can vary based on the lender and the specific loan program. Additionally, some lenders may offer incentives or discounts for borrowers with exceptionally high credit scores.

Loan-to-Value Ratio

The loan-to-value ratio is the amount of the loan compared to the value of the property. It is another crucial factor in determining PMI rates. A lower LTV is generally seen as less risky, and therefore, borrowers with a lower LTV may qualify for lower PMI rates. As the LTV increases, so does the perceived risk, leading to higher PMI costs.

For example, a borrower with a 90% LTV (10% down payment) will typically pay more for PMI than a borrower with an 80% LTV (20% down payment). The exact rates will depend on the lender and other factors, but as a general rule, a higher LTV will result in a higher PMI cost.

Type of Loan

The type of loan also plays a role in determining PMI rates. Conventional loans are the most common type of loan that requires PMI. The specific terms and rates for PMI on conventional loans can vary widely between lenders, so it’s essential to shop around and compare offers.

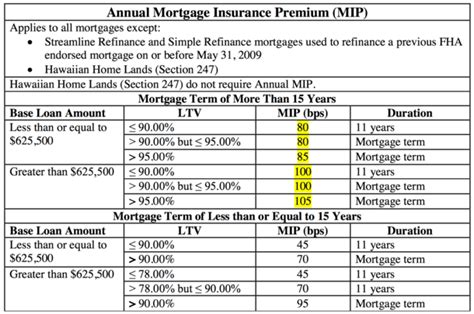

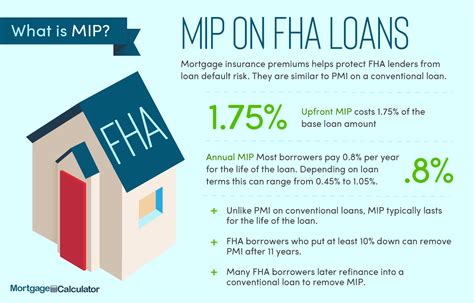

Other loan types, such as FHA loans, have their own mortgage insurance requirements, which are not technically considered PMI but serve a similar purpose. These loans often have different criteria and rates for mortgage insurance, which can be advantageous or disadvantageous depending on the borrower's circumstances.

Strategies to Reduce PMI Costs

Improving Credit Score

One of the most effective ways to reduce PMI costs is by improving your credit score. Lenders view borrowers with higher credit scores as less risky, which can lead to lower PMI rates. Strategies to improve your credit score include paying bills on time, reducing credit card balances, and maintaining a low credit utilization ratio.

If you're considering a home purchase and know your credit score needs improvement, it's best to focus on enhancing your credit before applying for a mortgage. This can save you significant money in the long run by reducing your PMI costs.

Increasing Down Payment

Another strategy to reduce PMI costs is by increasing your down payment. By making a larger down payment, you can lower your loan-to-value ratio, which often results in a lower PMI rate or even the elimination of PMI altogether. For example, if you can increase your down payment to 20%, you may no longer need PMI, saving you money over the life of your loan.

However, it's important to note that a larger down payment can be a significant financial commitment. It's crucial to carefully consider your financial situation and determine the right balance between a larger down payment and keeping some savings for emergencies and other financial goals.

Refinancing

If you already have a mortgage with PMI, you may be able to reduce your PMI costs by refinancing your loan. Refinancing can lower your interest rate, which may result in a reduced PMI cost. Additionally, if your home’s value has increased since you purchased it, refinancing can lower your LTV, which may also lead to a decrease in PMI costs.

However, refinancing is not always the best option. It can come with closing costs and other fees, so it's essential to carefully evaluate whether the savings from reduced PMI will offset these costs.

When PMI is No Longer Required

In most cases, borrowers are no longer required to pay PMI once their loan-to-value ratio reaches 78%. At this point, the lender considers the loan to have enough equity in the property, reducing the risk, and PMI is typically removed. However, this process is not automatic, and borrowers should take action to ensure the PMI is canceled.

To have PMI removed, borrowers should contact their lender and request a cancellation of PMI. The lender will typically require an updated appraisal to verify the current LTV. If the appraisal confirms that the LTV is at or below 78%, the lender should cancel the PMI. It's important to note that some lenders may have different requirements or thresholds for PMI cancellation, so it's crucial to understand your lender's specific policies.

The Impact of PMI on Homeownership

PMI can significantly impact a homeowner’s financial planning and overall homeownership experience. While it is an additional cost, it can provide access to homeownership for those who may not have the means to make a large down payment.

For example, let's consider a borrower who purchases a $300,000 home with a 5% down payment ($15,000). With a credit score of 740, their estimated PMI rate would be around 0.65% of the loan amount annually. This would add approximately $1,650 to their annual mortgage costs, or about $137.50 per month. Over the life of a 30-year mortgage, this could add up to over $49,500 in PMI costs.

However, it's important to note that PMI is not permanent. As we discussed earlier, PMI can be canceled once the LTV reaches a certain threshold. Additionally, borrowers can often request to have their PMI canceled earlier if they can provide evidence of increased home value or additional payments towards the principal.

The Future of PMI

The landscape of PMI is constantly evolving, and there are several trends and potential developments to consider.

Digitalization and Automation

The mortgage industry is increasingly embracing digitalization and automation. This trend is expected to continue, and it may lead to more efficient and streamlined PMI processes. Lenders may utilize advanced analytics and data-driven decision-making to offer more accurate and competitive PMI rates.

Alternative Mortgage Insurance

There are alternative mortgage insurance options available, such as lender-paid mortgage insurance (LPMI) and single-premium mortgage insurance (SPMI). LPMI involves the lender paying the PMI upfront, which is then built into the interest rate. SPMI is a one-time premium paid at closing, and it eliminates the need for monthly PMI payments. These alternatives can be beneficial for some borrowers, but they may not be suitable for all situations.

Changing Lender Policies

Lender policies regarding PMI can vary, and they may change over time. Some lenders may offer more flexible PMI cancellation policies or provide incentives for borrowers with higher credit scores. It’s crucial to stay informed about lender policies and shop around to find the best terms for your specific situation.

Economic Factors

Economic conditions can significantly impact PMI rates. During periods of economic uncertainty or recession, lenders may tighten their lending criteria and increase PMI rates to mitigate risk. On the other hand, a strong economy may lead to more competitive PMI rates as lenders compete for business.

Can I get a conventional loan without PMI?

+Yes, it is possible to obtain a conventional loan without PMI. One way to do this is by making a down payment of at least 20%, which eliminates the need for PMI. Additionally, some lenders offer programs that allow borrowers to avoid PMI even with a lower down payment. These programs often have specific criteria, such as higher credit scores or other financial requirements.

How long do I have to pay PMI on my mortgage?

+The duration of PMI payments can vary depending on several factors. In most cases, borrowers will need to pay PMI until their loan-to-value ratio reaches 78%. At this point, the lender will typically cancel the PMI. However, some lenders may have different requirements or allow borrowers to request an early cancellation if certain conditions are met.

Can I get a refund on my PMI if I pay off my mortgage early?

+It depends on the specific terms of your PMI policy. Some PMI policies may offer a refund if the mortgage is paid off early, while others may not. It's important to review your PMI agreement or consult with your lender to understand your specific refund eligibility.

Are there any government programs that can help me avoid PMI?

+Yes, there are government-backed loan programs, such as FHA loans, that have their own mortgage insurance requirements. These programs often have lower down payment requirements compared to conventional loans, which can help borrowers avoid PMI. However, it's important to note that FHA loans have their own insurance premiums, which are not technically PMI but serve a similar purpose.

What is the difference between PMI and mortgage life insurance?

+PMI and mortgage life insurance are two different types of insurance. PMI protects the lender in case the borrower defaults on the loan, while mortgage life insurance covers the outstanding mortgage balance in the event of the borrower's death. PMI is typically required for conventional loans with a down payment of less than 20%, while mortgage life insurance is optional and designed to provide financial protection for the borrower's family.

Understanding Private Mortgage Insurance rates is crucial for anyone considering a home purchase or refinancing. By considering factors such as credit score, loan-to-value ratio, and loan type, borrowers can make informed decisions to minimize their PMI costs. Additionally, strategies like improving credit scores, increasing down payments, and refinancing can further reduce PMI expenses. Staying informed about lender policies and economic trends is also essential to navigate the ever-changing landscape of PMI.