How Much Is Car Insurance Full Coverage

Car insurance is an essential aspect of vehicle ownership, providing financial protection in case of accidents, theft, or other unforeseen events. The cost of car insurance, particularly for full coverage, can vary significantly based on numerous factors. Understanding these factors and how they influence insurance rates is crucial for anyone seeking to insure their vehicle adequately while keeping costs manageable.

The Complexities of Car Insurance Costs

Determining the exact cost of full coverage car insurance is not a straightforward task. It involves a meticulous analysis of various factors that insurance companies consider when calculating premiums. These factors can be broadly categorized into two main groups: those related to the vehicle and those linked to the policyholder.

Vehicle-Related Factors

The type of car you drive plays a significant role in determining your insurance premium. Insurance companies assess the make, model, and year of the vehicle, considering factors like its safety features, repair costs, and susceptibility to theft. For instance, sports cars and luxury vehicles generally attract higher insurance premiums due to their high repair costs and increased risk of theft.

Furthermore, the primary use of the vehicle is taken into account. If the car is used primarily for business purposes, such as delivering goods or transporting clients, the insurance premium will likely be higher. This is because business-related driving often entails more miles traveled and a higher potential for accidents or incidents.

The geographical location where the vehicle is primarily garaged also influences insurance rates. Areas with a higher incidence of accidents, theft, or natural disasters tend to have higher insurance premiums. For example, a vehicle garaged in a metropolitan area with a high crime rate will likely face higher insurance costs compared to one in a rural, low-crime area.

The insurance company will also assess the vehicle's safety features, as these can significantly reduce the risk of accidents and injuries. Features like anti-lock brakes, air bags, and collision avoidance systems can lead to lower insurance premiums, as they decrease the likelihood and severity of accidents.

| Vehicle Feature | Impact on Premium |

|---|---|

| Anti-lock Brakes | Reduced Premium |

| Air Bags | Lower Premium |

| Collision Avoidance Systems | Significantly Lower Premium |

Policyholder-Related Factors

The policyholder’s personal details and driving history are pivotal in determining insurance premiums. Insurance companies meticulously analyze an individual’s age, gender, marital status, and driving record to assess their risk profile.

For instance, young drivers, especially males under 25 years, are statistically more likely to be involved in accidents, resulting in higher insurance premiums. Conversely, mature drivers, typically over 55 years old, often benefit from lower premiums due to their reduced risk profile.

The policyholder's driving record is another critical factor. A clean driving record with no accidents or traffic violations can lead to significantly lower insurance premiums. Conversely, a history of accidents, particularly those where the driver was at fault, or traffic violations such as speeding or drunk driving, can dramatically increase insurance costs.

The policyholder's credit score also plays a role in insurance pricing. Individuals with higher credit scores are often viewed as more responsible and, consequently, may receive lower insurance premiums. Conversely, lower credit scores can lead to higher insurance costs.

Lastly, the policyholder's insurance history is considered. Those with a long-standing relationship with an insurance company, or those who have maintained continuous insurance coverage, may be rewarded with loyalty discounts or other incentives.

Average Costs and Factors Influencing Them

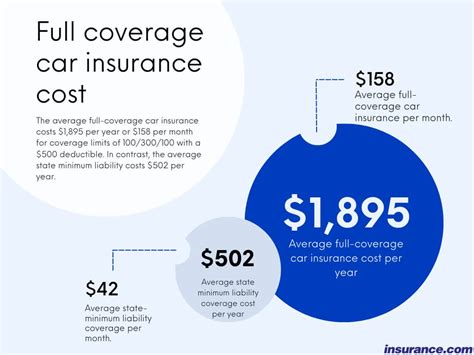

The average cost of full coverage car insurance in the United States is approximately $1,674 per year, according to a recent study by the Insurance Information Institute. However, it’s important to note that this figure is just an average and can vary significantly based on the factors discussed earlier.

For instance, a 30-year-old male with a clean driving record and a mid-range sedan may pay around $1,200 to $1,500 annually for full coverage insurance. On the other hand, a 22-year-old female with a sports car and a history of accidents might pay upwards of $3,000 per year for the same level of coverage.

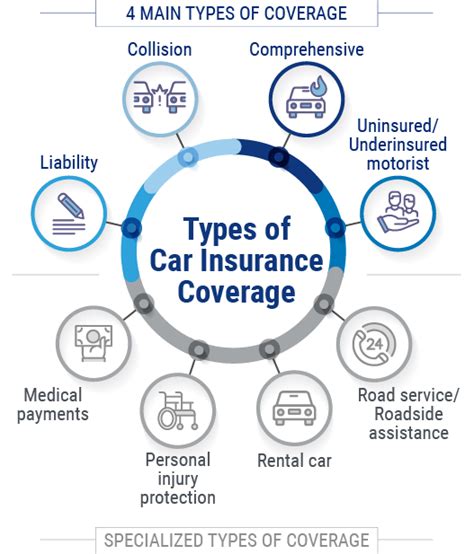

The type of coverage also influences the cost. Full coverage insurance, which includes liability, collision, and comprehensive coverage, will naturally be more expensive than basic liability-only insurance. However, the added protection and peace of mind that full coverage offers can be invaluable in the event of an accident or other unforeseen circumstance.

The Impact of Geographical Location

As mentioned earlier, the geographical location where the vehicle is garaged can significantly affect insurance premiums. States with higher populations and more traffic tend to have higher insurance rates due to the increased risk of accidents and traffic incidents.

For instance, New York and California, two of the most populous states, often have some of the highest average insurance rates in the country. In contrast, states like North Dakota and Maine, with lower populations and fewer traffic incidents, generally have lower average insurance costs.

| State | Average Annual Premium |

|---|---|

| New York | $2,197 |

| California | $2,031 |

| North Dakota | $786 |

| Maine | $831 |

Understanding Deductibles and Their Impact

When choosing full coverage car insurance, policyholders have the option to select their deductible, which is the amount they pay out of pocket before the insurance coverage kicks in. A higher deductible generally leads to a lower premium, while a lower deductible results in a higher premium.

For example, if a policyholder chooses a $1,000 deductible, they will pay less in monthly premiums but will have to pay $1,000 out of pocket in the event of a claim. On the other hand, a $500 deductible will result in higher monthly premiums, but the policyholder will pay less out of pocket in the event of a claim.

Strategies to Reduce Car Insurance Costs

While the cost of car insurance, particularly full coverage, can be significant, there are strategies policyholders can employ to reduce these costs without compromising on necessary coverage.

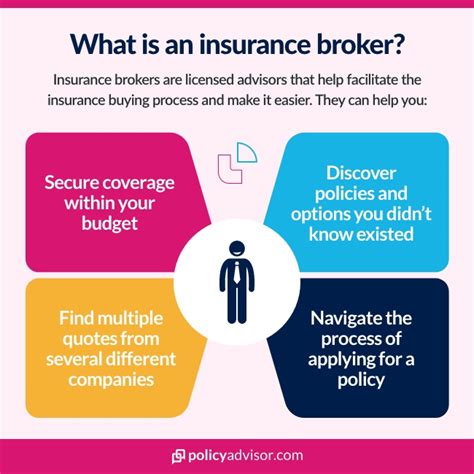

Shop Around and Compare Quotes

Insurance rates can vary significantly between different providers, so it’s important to shop around and compare quotes. Online comparison tools can be particularly useful for this, as they allow policyholders to quickly and easily view quotes from multiple providers.

For instance, a policyholder might find that Company A offers the best rate for their specific circumstances, while Company B might offer a more competitive rate for a different type of coverage. By comparing quotes, policyholders can ensure they're getting the best value for their insurance needs.

Utilize Discounts and Bundles

Insurance companies often offer a variety of discounts to policyholders. These can include discounts for safe driving records, multiple vehicles on one policy, bundling home and auto insurance, or even for certain professional affiliations or memberships.

For example, a policyholder who has been accident-free for the past 5 years might qualify for a safe driver discount, reducing their insurance premium. Or, a policyholder who bundles their home and auto insurance with the same provider might receive a multi-policy discount, saving them money on both policies.

Consider Higher Deductibles

As mentioned earlier, choosing a higher deductible can lead to lower insurance premiums. While this strategy requires the policyholder to pay more out of pocket in the event of a claim, it can significantly reduce monthly premiums.

For instance, a policyholder who opts for a $1,500 deductible might save several hundred dollars per year on their insurance premium compared to a policy with a $500 deductible. This strategy can be particularly beneficial for policyholders who are confident they won't need to make a claim or who have sufficient savings to cover a higher deductible in the event of an accident.

Maintain a Good Credit Score

As discussed earlier, a policyholder’s credit score can impact their insurance premium. A higher credit score generally indicates financial responsibility and can lead to lower insurance rates.

Therefore, maintaining a good credit score can be a strategy to reduce car insurance costs. This involves managing credit responsibly, paying bills on time, and keeping credit card balances low. While improving a credit score can take time and effort, the potential savings on insurance premiums can make it a worthwhile endeavor.

The Future of Car Insurance: Technological Advancements

The car insurance industry is evolving rapidly, with technological advancements playing a significant role in shaping its future. These advancements are not only transforming the way insurance is delivered but also influencing the cost and coverage options available to policyholders.

Telematics and Usage-Based Insurance

Telematics, the technology that allows the transmission of vehicle data in real-time, is increasingly being used by insurance companies to offer usage-based insurance policies. These policies, often referred to as “pay-as-you-drive” or “pay-how-you-drive,” use telematics to track a driver’s actual driving behavior and habits, such as mileage, speed, and time of day.

This data is then used to determine insurance premiums. Drivers who exhibit safe driving behaviors, such as driving fewer miles or avoiding high-risk driving times, can qualify for lower insurance rates. Conversely, drivers who engage in risky behaviors, such as frequent speeding or driving during high-risk hours, may face higher premiums.

For instance, a driver who primarily uses their car for short, local trips and rarely drives at night might qualify for a significant discount on their insurance premium under a usage-based insurance policy. This is because their driving behavior is considered lower risk compared to drivers who frequently drive long distances or during high-risk hours.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are also revolutionizing the car insurance industry. These technologies are being used to improve risk assessment, claims processing, and fraud detection.

For instance, AI algorithms can analyze vast amounts of data, including historical claims data, weather patterns, and traffic data, to more accurately predict the likelihood of accidents and assign appropriate insurance premiums. This can lead to more tailored insurance policies and potentially lower costs for policyholders.

Furthermore, AI and ML are being used to streamline the claims process. These technologies can quickly and accurately assess the extent of damage and the cost of repairs, leading to faster claim settlements. This not only benefits policyholders but also reduces the administrative burden on insurance companies, potentially leading to lower insurance costs.

Conclusion: A Complex Yet Crucial Aspect of Vehicle Ownership

Car insurance, particularly full coverage, is a complex yet crucial aspect of vehicle ownership. The cost of this insurance can vary significantly based on a multitude of factors, from the type of vehicle and its usage to the policyholder’s personal details and driving history.

While the average cost of full coverage car insurance in the United States is approximately $1,674 per year, this figure can be significantly higher or lower depending on individual circumstances. Strategies such as shopping around for quotes, utilizing discounts, choosing higher deductibles, and maintaining a good credit score can help reduce insurance costs without compromising necessary coverage.

Looking to the future, technological advancements like telematics and AI are set to play an increasingly significant role in the car insurance industry. These advancements have the potential to offer more tailored insurance policies, improve the efficiency of claims processing, and reduce insurance costs for policyholders.

In conclusion, understanding the factors that influence car insurance costs and staying informed about the latest advancements in the industry can empower vehicle owners to make informed decisions about their insurance coverage and costs.

How can I get the most accurate quote for my car insurance?

+To get the most accurate quote, provide detailed and accurate information about your vehicle, its usage, and your personal details. Be transparent about your driving history, including any accidents or traffic violations. Additionally, consider using online comparison tools that allow you to compare quotes from multiple providers.

What is the difference between liability-only insurance and full coverage insurance?

+Liability-only insurance provides coverage for damage or injury you cause to others in an accident. Full coverage insurance, on the other hand, includes liability coverage but also covers damage to your own vehicle, regardless of fault. It typically includes collision and comprehensive coverage, which can cover a wide range of incidents, from accidents to natural disasters.

Can I negotiate my car insurance premium?

+While car insurance premiums are typically set based on a variety of factors, you can sometimes negotiate with your insurance provider. This is especially true if you have a long-standing relationship with the company or if you’re bundling multiple policies. It’s always worth asking if there are any discounts or promotions you may qualify for.