Auto Insurance California Online

California is known for its diverse landscapes, vibrant cities, and, of course, its unique driving culture. With a vast network of highways, scenic roads, and bustling urban areas, the Golden State presents a range of driving experiences. As a result, auto insurance in California plays a crucial role in protecting drivers and their vehicles. Obtaining car insurance online has become increasingly popular due to its convenience and efficiency. This article delves into the world of auto insurance in California, exploring the key aspects, coverage options, and the benefits of securing your policy online.

Understanding Auto Insurance in California

Auto insurance is a legal requirement in California, and it serves as a financial safeguard for drivers and their vehicles. The state mandates that all registered vehicles carry a minimum level of liability insurance to protect against bodily injury and property damage claims. However, beyond the minimum requirements, California drivers have the flexibility to tailor their insurance policies to meet their specific needs and preferences.

Minimum Coverage Requirements

In California, the minimum liability insurance limits are as follows:

- Bodily Injury Liability: 15,000 per person / 30,000 per accident

- Property Damage Liability: $5,000 per accident

These limits are designed to provide basic protection in the event of an at-fault accident. However, many drivers opt for higher coverage limits to ensure they are adequately protected in the face of more severe accidents or lawsuits.

Comprehensive and Collision Coverage

Beyond the state-mandated liability insurance, California drivers can choose to add comprehensive and collision coverage to their policies. These coverages provide protection for the insured vehicle in various scenarios:

- Comprehensive Coverage: Covers damage to the vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or animal strikes.

- Collision Coverage: Covers damage to the insured vehicle in the event of a collision with another vehicle, object, or rollover.

While these coverages are optional, they offer valuable peace of mind for drivers who want to protect their vehicles from a wide range of potential risks.

Additional Coverages and Endorsements

California auto insurance policies can be further customized with additional coverages and endorsements. These optional add-ons can include:

- Uninsured/Underinsured Motorist Coverage: Provides protection if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have sufficient coverage.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of fault, following an accident.

- Rental Car Coverage: Provides reimbursement for rental car expenses if your vehicle is being repaired or is declared a total loss.

- Roadside Assistance: Offers emergency services such as towing, flat tire changes, or battery jumps.

The availability and pricing of these additional coverages may vary depending on the insurance provider and the driver's specific needs.

The Benefits of Online Auto Insurance

In recent years, obtaining auto insurance online has gained popularity due to its numerous advantages. Here’s a closer look at why California drivers are turning to online insurance platforms:

Convenience and Accessibility

Online auto insurance offers unparalleled convenience. With just a few clicks, drivers can compare multiple insurance providers, obtain quotes, and even purchase a policy from the comfort of their homes. This accessibility is especially beneficial for busy individuals who may not have the time to visit multiple insurance agencies or wait on hold over the phone.

Real-Time Comparisons

One of the most significant advantages of online auto insurance is the ability to compare multiple providers simultaneously. Online platforms aggregate insurance quotes from various companies, allowing drivers to quickly assess different coverage options, limits, and prices. This real-time comparison empowers drivers to make informed decisions and find the best policy that fits their budget and coverage needs.

Efficient Paperwork and Documentation

Online insurance platforms streamline the paperwork process. All necessary documents, including policy contracts, declarations pages, and ID cards, can be easily downloaded or accessed digitally. This eliminates the need for physical paperwork and reduces the risk of misplacing important documents.

Quick Claims Processing

In the event of an accident or vehicle damage, online insurance providers often offer streamlined claims processes. Policyholders can often file claims online, upload necessary documentation, and track the progress of their claims in real-time. This efficiency can significantly reduce the stress and inconvenience associated with filing and managing insurance claims.

Flexible Payment Options

Online auto insurance platforms typically offer a variety of payment options to suit different financial situations. Drivers can choose to pay their premiums annually, semi-annually, quarterly, or even monthly, depending on their preferences and budget. Some providers also offer discounts for paying in full or setting up automatic payments.

How to Choose the Right Online Auto Insurance Provider

With numerous online insurance providers available, selecting the right one can be a daunting task. Here are some key considerations to help you make an informed decision:

Reputation and Financial Stability

Start by researching the reputation and financial stability of the insurance provider. Look for companies with a solid track record, positive customer reviews, and a strong financial rating. This ensures that the provider is reliable and capable of honoring claims in the long term.

Coverage Options and Customization

Evaluate the range of coverage options and customization available. Different drivers have unique needs, so it’s essential to find a provider that offers a comprehensive suite of coverages and allows for flexible policy adjustments. Ensure that the provider offers the specific coverages you require, whether it’s comprehensive, collision, or specialized endorsements.

Pricing and Discounts

Compare prices and explore the discounts offered by different providers. While cost is an important factor, it’s crucial to balance affordability with adequate coverage. Many insurance companies offer discounts for various factors, such as safe driving records, loyalty, multi-policy bundles, or even vehicle safety features. Take advantage of these discounts to find the most cost-effective policy for your needs.

Customer Service and Claims Handling

Consider the provider’s customer service reputation and claims handling process. Look for companies with responsive customer support, either through online chat, email, or telephone. Additionally, assess the provider’s claims process, including the ease of filing claims, the speed of claim resolution, and the overall customer satisfaction with the claims experience.

Tips for Getting the Best Online Auto Insurance Rates

Securing the best auto insurance rates online involves more than just comparing prices. Here are some strategies to help you find the most affordable and comprehensive coverage:

Shop Around

Don’t settle for the first quote you receive. Take advantage of online comparison tools to explore multiple providers and quotes. Shopping around allows you to identify the best combination of coverage and price for your specific circumstances.

Consider Higher Deductibles

Increasing your deductible can lead to significant savings on your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you assume more financial responsibility in the event of a claim, which can result in lower premiums.

Bundle Policies

Many insurance providers offer discounts when you bundle multiple policies, such as auto and home insurance. By consolidating your insurance needs with a single provider, you can often save money and streamline your insurance management.

Maintain a Clean Driving Record

Insurance companies reward safe driving. Maintaining a clean driving record, free of accidents and violations, can lead to substantial discounts on your insurance premiums. Additionally, consider enrolling in defensive driving courses, which may further reduce your rates.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is a growing trend in the auto insurance industry. These policies use telematics devices or smartphone apps to track your driving behavior, such as mileage, driving speed, and braking habits. Insurers then use this data to offer personalized premiums based on your actual driving habits. For safe and cautious drivers, usage-based insurance can result in significant savings.

The Future of Auto Insurance in California

The auto insurance landscape in California is evolving, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of auto insurance in the Golden State:

Increased Automation and AI

Artificial intelligence (AI) and automation are expected to play a larger role in the insurance industry. From automated claims processing to AI-powered risk assessment, these technologies will streamline processes, improve accuracy, and enhance the overall customer experience.

Telematics and Usage-Based Insurance

Usage-based insurance is likely to become more prevalent, as it offers a more accurate assessment of individual driving risks. With the continued adoption of telematics and smartphone apps, insurers will have access to more precise data, allowing them to offer personalized premiums and incentivize safe driving behaviors.

Enhanced Data Analytics

Advanced data analytics will enable insurers to make more informed decisions and offer customized coverage options. By analyzing vast amounts of data, including driving patterns, weather conditions, and road infrastructure, insurers can better understand risks and develop innovative solutions to protect California drivers.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles will present new challenges and opportunities for the insurance industry. Insurers will need to adapt their policies and coverage options to accommodate these emerging technologies, ensuring that drivers of these vehicles have the appropriate protection.

Conclusion

Auto insurance in California is not just a legal requirement; it’s a crucial component of responsible driving and financial protection. By understanding the state’s minimum coverage requirements and exploring the various coverage options, drivers can tailor their policies to their specific needs. The convenience and efficiency of online auto insurance platforms have revolutionized the way Californians secure their insurance, offering real-time comparisons, streamlined paperwork, and flexible payment options.

As the future of auto insurance unfolds, California drivers can expect continued innovation and personalization. By staying proactive and informed, drivers can navigate the evolving insurance landscape with confidence, ensuring they have the right coverage to protect themselves, their vehicles, and their wallets.

How much does auto insurance cost in California?

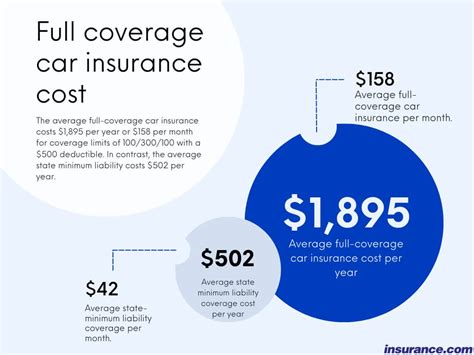

+The cost of auto insurance in California varies based on several factors, including the driver’s age, driving record, vehicle type, and coverage limits. On average, California drivers pay around 1,200 to 1,500 per year for minimum liability coverage. However, rates can range from as low as 500 to over 2,000, depending on individual circumstances. Shopping around and comparing quotes is crucial to finding the most affordable policy.

What are the penalties for driving without insurance in California?

+Driving without insurance in California is a serious offense. If caught, drivers can face penalties such as fines ranging from 100 to 2,000, license suspension, and even imprisonment for repeat offenders. Additionally, uninsured drivers may be required to file an SR-22 certificate, which provides proof of financial responsibility and typically results in higher insurance premiums.

Can I get a discount on my auto insurance in California if I have a good driving record?

+Yes, maintaining a clean driving record is one of the best ways to qualify for insurance discounts. Many insurance providers offer “good driver” or “safe driver” discounts to policyholders who have been accident-free and violation-free for a certain period. These discounts can significantly reduce your insurance premiums, so it’s essential to drive safely and responsibly.