What Do Insurance Brokers Do

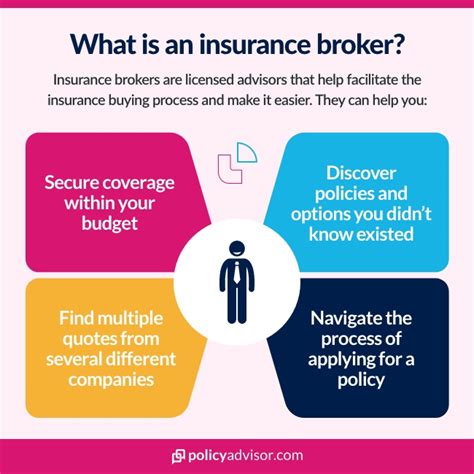

Insurance brokers play a vital role in the world of insurance, serving as intermediaries between insurance buyers and insurance companies. They provide an essential service by helping individuals, businesses, and organizations navigate the complex landscape of insurance coverage, offering expert guidance, and facilitating the process of obtaining suitable insurance policies.

The Role and Responsibilities of Insurance Brokers

Insurance brokers are licensed professionals who possess a deep understanding of various insurance products and the risks they cover. Their primary goal is to match their clients’ unique needs with the most appropriate insurance solutions. Here’s a closer look at their key responsibilities and the value they bring to the insurance industry.

Assessing Client Needs

One of the first steps in an insurance broker’s process is understanding the specific requirements and risks of their clients. This involves conducting thorough assessments to identify the types of insurance coverage needed, whether it’s for personal, commercial, or specialized purposes. By gathering detailed information, brokers can tailor their recommendations to fit each client’s circumstances precisely.

| Client Profile | Insurance Needs |

|---|---|

| Small Business Owner | Business Interruption, Product Liability, Cyber Security |

| Family Homeowner | Homeowner's Insurance, Auto Insurance, Life Insurance |

| Professional Services Firm | Professional Indemnity, Directors & Officers Liability |

Brokers often specialize in specific sectors, such as commercial insurance or personal lines, allowing them to develop expertise in the unique risks and coverage options within those areas. This specialization ensures that clients receive advice tailored to their industry or personal circumstances.

Market Analysis and Policy Selection

With a clear understanding of their clients’ needs, insurance brokers then conduct a comprehensive market analysis. They review policies offered by various insurance companies, comparing coverage, terms, and pricing. This process ensures that the selected policies provide the best possible protection at a competitive rate.

Brokers often have established relationships with multiple insurance carriers, giving them access to a wide range of policies. They can leverage these relationships to negotiate better terms and rates on behalf of their clients, often securing coverage that might not be available to individual buyers.

Policy Procurement and Management

Once the suitable policies are identified, insurance brokers facilitate the procurement process. They assist clients in completing application forms, ensuring all necessary information is provided accurately. Additionally, they manage the entire policy lifecycle, from inception to renewal, including any necessary amendments or adjustments along the way.

Brokers also provide invaluable support during claims processes. They guide their clients through the often complex and stressful process of filing and managing claims, advocating on their behalf to ensure fair and timely settlements. This service is particularly crucial when dealing with complex or disputed claims.

Risk Management and Advisory Services

Beyond policy procurement, insurance brokers offer a range of advisory services to help clients mitigate risks effectively. They provide guidance on risk assessment, loss prevention strategies, and risk management planning. By identifying potential risks and implementing preventive measures, brokers can help clients avoid costly incidents and minimize the need for insurance claims.

Continuous Support and Relationship Building

The relationship between an insurance broker and their client is often long-term. Brokers provide ongoing support and guidance, regularly reviewing policies to ensure they remain aligned with the client’s evolving needs. They also stay informed about changes in the insurance market, industry regulations, and emerging risks, allowing them to proactively advise their clients on any necessary adjustments.

The Benefits of Working with an Insurance Broker

Engaging the services of an insurance broker offers numerous advantages to both individuals and businesses. Here’s a closer look at some of the key benefits:

Expertise and Guidance

Insurance brokers bring a wealth of knowledge and experience to the table. They understand the intricacies of various insurance products, coverage options, and the unique risks faced by different industries. This expertise allows them to provide tailored advice and ensure that their clients’ insurance portfolios are comprehensive and cost-effective.

Access to a Wide Range of Options

By working with multiple insurance carriers, brokers can offer their clients a diverse range of policy options. This diversity ensures that clients can choose from a variety of coverage levels, deductibles, and additional endorsements to customize their policies to their specific needs. Brokers can also negotiate better terms and rates, often securing exclusive deals or discounts that individual buyers might not have access to.

Advocacy and Support During Claims

Insurance brokers act as advocates for their clients throughout the claims process. They assist with claim filings, ensuring all necessary documentation is provided and guiding clients through the often complex and stressful process. Brokers can also negotiate with insurance companies on behalf of their clients, ensuring fair and timely settlements. Their expertise in claim management can make a significant difference in the outcome of a claim.

Risk Management and Prevention

Brokers provide valuable risk management advice, helping clients identify and mitigate potential risks. By implementing effective loss prevention strategies, clients can reduce the likelihood of incidents and claims, thereby lowering their insurance costs and improving overall risk profiles. Brokers can also assist with risk transfer strategies, ensuring that the right balance of insurance coverage and self-insurance is maintained.

Time and Convenience

Engaging an insurance broker saves clients significant time and effort. Brokers handle the entire insurance procurement and management process, from policy selection to claims handling. This frees up valuable time for clients to focus on their core business or personal pursuits. Brokers also provide regular reviews and updates, ensuring clients’ insurance needs are always up-to-date and aligned with their changing circumstances.

Choosing the Right Insurance Broker

Selecting an insurance broker is a critical decision that can significantly impact the effectiveness of your insurance portfolio. Here are some key considerations to keep in mind when choosing a broker:

Experience and Expertise

Look for a broker with a proven track record and extensive experience in the insurance industry. They should have a deep understanding of the various insurance products and the ability to tailor recommendations to your specific needs. Inquire about their specialization and the industries or sectors they primarily serve.

Reputation and Referrals

Research the broker’s reputation in the market. Check online reviews and testimonials from their past clients. Ask for referrals from trusted sources, such as business associates or friends, who have had positive experiences with the broker. A strong reputation and positive feedback are good indicators of the broker’s reliability and service quality.

Licensing and Credentials

Ensure that the broker is licensed to operate in your jurisdiction and carries the necessary credentials. Check with your local insurance regulatory body to verify their licensing status. A reputable broker will be transparent about their qualifications and certifications.

Customized Solutions

When discussing your insurance needs with potential brokers, pay attention to their approach. A good broker should take the time to understand your unique circumstances and offer tailored solutions. They should provide clear explanations of the policies they recommend and be willing to answer any questions you may have. Avoid brokers who offer one-size-fits-all solutions without considering your specific requirements.

Service and Support

Consider the level of service and support the broker provides. Do they offer regular reviews and updates to ensure your insurance coverage remains up-to-date? Are they easily accessible and responsive to your inquiries and concerns? A broker who provides excellent service and support will be there for you throughout the entire insurance process, from policy procurement to claims management.

Cost and Value

While cost is an important factor, it should not be the sole determining factor when choosing a broker. A good broker will provide value beyond just the cost of their services. They should offer comprehensive solutions, negotiate better rates on your behalf, and provide ongoing support and guidance. Remember, the right insurance broker can save you money in the long run by ensuring you have the right coverage at the best possible price.

The Future of Insurance Brokering

The insurance broking industry is continuously evolving, driven by advancements in technology and changing client expectations. Here’s a glimpse into some of the trends and developments shaping the future of insurance broking.

Digital Transformation

The insurance industry is experiencing a digital revolution, and brokers are at the forefront of this transformation. Many brokers are embracing digital tools and platforms to enhance their services and improve efficiency. Online portals and mobile apps are being used to streamline the policy procurement process, provide real-time updates, and offer self-service options for clients. Digital transformation also allows brokers to access and analyze data more efficiently, enabling them to provide more personalized advice and solutions.

Data Analytics and AI

Advanced data analytics and artificial intelligence (AI) are revolutionizing the way brokers operate. These technologies enable brokers to analyze vast amounts of data, identify trends, and make more informed decisions. By leveraging AI-powered tools, brokers can provide more accurate risk assessments, predict potential claims, and offer more tailored insurance solutions. Data analytics also helps brokers identify areas where clients can improve their risk management practices, leading to better outcomes and reduced insurance costs.

Client Engagement and Experience

Insurance brokers are increasingly focusing on enhancing the client experience. This involves providing more personalized services, offering flexible payment options, and ensuring timely communication. Brokers are leveraging technology to create seamless digital experiences, making it easier for clients to access their insurance information and manage their policies. By prioritizing client engagement and satisfaction, brokers can build stronger relationships and retain clients for the long term.

Risk Management Innovation

Brokers are playing a pivotal role in driving innovation in risk management. They are collaborating with clients to develop new strategies and solutions to mitigate risks more effectively. This includes adopting emerging technologies such as the Internet of Things (IoT) and blockchain to enhance risk assessment and loss prevention. Brokers are also exploring alternative risk transfer mechanisms, such as parametric insurance and captive insurance, to provide more flexible and innovative coverage options.

Sustainability and Social Responsibility

The insurance industry, including brokers, is increasingly recognizing the importance of sustainability and social responsibility. Brokers are advocating for and implementing environmentally and socially conscious practices. This includes offering insurance solutions that support sustainable initiatives, such as renewable energy projects and climate resilience measures. Brokers are also educating their clients on the importance of sustainable practices and encouraging them to adopt more responsible business and personal behaviors.

Conclusion

Insurance brokers are invaluable partners in the complex world of insurance. They bring expertise, guidance, and support to individuals and businesses, helping them navigate the insurance landscape with confidence. As the insurance industry continues to evolve, brokers remain at the forefront, embracing new technologies and innovative practices to deliver the best possible outcomes for their clients. Whether it’s risk management, policy procurement, or claims support, insurance brokers are dedicated to ensuring their clients’ needs are met and their risks are mitigated effectively.

How do insurance brokers get paid?

+Insurance brokers typically earn commissions from insurance companies for the policies they sell. These commissions are built into the policy premiums and are a standard part of the insurance industry. Brokers may also offer additional services, such as risk management consulting, for which they may charge separate fees.

Can insurance brokers provide advice on multiple types of insurance?

+Yes, insurance brokers are often knowledgeable about various types of insurance, including personal, commercial, health, and specialty lines. They can assess their clients’ needs and recommend suitable policies across different insurance categories. However, some brokers may specialize in specific areas, such as commercial insurance or health insurance, offering more in-depth expertise in those sectors.

What happens if I have a dispute with my insurance company?

+In the event of a dispute with your insurance company, your insurance broker can act as an advocate on your behalf. They can help mediate the dispute, clarify policy terms, and ensure your rights as a policyholder are respected. Brokers often have established relationships with insurance carriers, which can be advantageous during the resolution process.

How often should I review my insurance policies with my broker?

+It’s recommended to review your insurance policies with your broker at least once a year, or whenever your circumstances change significantly. Life events such as marriage, the birth of a child, starting a business, or purchasing a new home can impact your insurance needs. Regular reviews ensure that your insurance coverage remains adequate and up-to-date.