Automobile Insurance California

Automobile insurance, often referred to as car insurance, is a vital aspect of vehicle ownership, ensuring financial protection for drivers and their vehicles. In the vast state of California, where the open road stretches across diverse landscapes, understanding the intricacies of auto insurance is essential. This comprehensive guide aims to navigate the complex world of automobile insurance in California, offering expert insights and practical information to help drivers make informed decisions.

The California Landscape of Auto Insurance

California’s unique geography and vibrant culture contribute to a dynamic auto insurance landscape. From the bustling streets of Los Angeles to the serene highways of Northern California, drivers encounter diverse road conditions and potential risks. Navigating this complex environment requires a thorough understanding of the state’s insurance requirements and the options available to protect oneself and their vehicles.

Understanding Minimum Coverage Requirements

In California, all drivers are legally required to carry a minimum level of auto insurance coverage. This is to ensure that, in the event of an accident, there is financial protection for all parties involved. The state’s minimum coverage requirements include:

- Liability Coverage: This covers the costs of injuries or damages caused to others in an accident where the insured driver is at fault. The minimum liability limits in California are 15,000 for bodily injury per person, 30,000 for bodily injury per accident, and $5,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the insured driver if they are involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability (per person) | $15,000 |

| Bodily Injury Liability (per accident) | $30,000 |

| Property Damage Liability | $5,000 |

| Uninsured/Underinsured Motorist Coverage | Equal to Bodily Injury Liability |

Note: While these are the state-mandated minimums, it is often advisable to carry higher limits to ensure adequate protection. Many insurance providers in California offer additional coverage options to cater to diverse driver needs.

Optional Coverage and Add-Ons

Beyond the minimum requirements, California drivers have a range of optional coverage and add-ons to consider. These can provide additional protection and peace of mind in various situations.

- Collision Coverage: This covers the cost of repairing or replacing the insured vehicle after an accident, regardless of fault.

- Comprehensive Coverage: This covers damages to the insured vehicle due to non-collision incidents, such as theft, vandalism, natural disasters, or collisions with animals.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this covers medical expenses for the insured driver and passengers, regardless of fault.

- Rental Car Reimbursement: This provides coverage for a rental car while the insured vehicle is being repaired after an accident.

- Roadside Assistance: Offers emergency services like towing, flat tire changes, and fuel delivery.

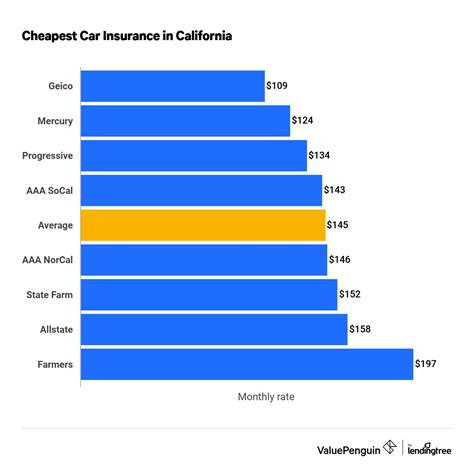

Factors Influencing Auto Insurance Rates in California

Auto insurance rates in California are influenced by a variety of factors, each playing a role in determining the cost of coverage. Understanding these factors can help drivers make informed decisions when selecting an insurance policy and managing their premiums.

Driver Profile and History

One of the primary factors that insurance companies consider when determining rates is the driver’s profile and history. This includes:

- Age: Younger drivers, particularly those under 25, often face higher premiums due to their relative lack of driving experience. Conversely, senior drivers may also see an increase in rates as they age.

- Gender: Historically, male drivers have been charged higher premiums, but this trend is changing as insurance companies move towards a more gender-neutral approach.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents or violations can significantly increase rates.

- Credit Score: In California, insurance companies are allowed to consider an individual’s credit score when determining rates. A higher credit score often correlates with lower insurance premiums.

Vehicle Details

The type of vehicle being insured can also impact insurance rates. Factors include:

- Vehicle Make and Model: Some vehicles, particularly high-performance or luxury cars, are more expensive to insure due to their cost of repairs and higher likelihood of theft.

- Vehicle Age: Older vehicles may have lower premiums as they generally have lower repair and replacement costs.

- Vehicle Usage: The primary purpose of the vehicle (commuting, business, pleasure) and the estimated annual mileage can influence rates. Higher mileage and commercial use may lead to increased premiums.

- Safety Features : Vehicles equipped with advanced safety features like lane departure warning, adaptive cruise control, and automatic emergency braking may qualify for discounts.

Location and Usage

The location where the vehicle is primarily driven and stored can significantly impact insurance rates. This is due to a variety of factors, including:

- Geographic Location: Urban areas, particularly those with high population density and traffic congestion, often have higher insurance rates due to increased risk of accidents and theft.

- Garaging Location: Whether the vehicle is stored in a garage, driveway, or on the street can impact rates. Garaged vehicles are generally considered less at risk of theft or vandalism.

- Commute Distance and Frequency: Longer commutes and frequent driving can increase insurance rates, as they expose the vehicle to more potential risks.

Choosing the Right Auto Insurance Provider in California

With a myriad of insurance providers operating in California, selecting the right one can be a daunting task. It’s essential to consider various factors and compare multiple options to find the best fit for your specific needs and budget.

Research and Compare

Start by researching and comparing multiple insurance providers. Consider factors such as:

- Coverage Options: Ensure the provider offers the specific coverage you require, including any optional add-ons that may be beneficial.

- Financial Stability: Look for providers with a strong financial rating, indicating their ability to pay out claims in the future.

- Customer Service: Assess the provider’s reputation for customer service, including response times, claim handling efficiency, and overall customer satisfaction.

- Digital Tools and Resources: In today’s digital age, many providers offer online and mobile tools for policy management, claims filing, and other services. These can enhance the overall customer experience.

Consider Discounts and Savings

Many insurance providers in California offer a range of discounts to help reduce premiums. Some common discounts include:

- Multi-Policy Discounts: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can lead to significant savings.

- Safe Driver Discounts: Maintaining a clean driving record for a certain period (often 3-5 years) can qualify you for a safe driver discount.

- Loyalty Discounts: Some providers offer discounts for long-term customers, rewarding loyalty with reduced rates.

- Student Discounts: Full-time students with a good academic record or those enrolled in a defensive driving course may be eligible for discounts.

- Safety Features Discounts: Vehicles equipped with advanced safety features may qualify for discounts, as these features can reduce the risk of accidents.

Review and Renew Regularly

Auto insurance needs and rates can change over time. It’s important to review your policy and shop around for better rates at least once a year, especially during major life changes such as moving, buying a new vehicle, or getting married.

Navigating the Claims Process in California

In the event of an accident or incident that results in a claim, understanding the claims process is crucial. This ensures a smoother and less stressful experience, helping you receive the compensation you’re entitled to.

Reporting an Incident

After an accident or incident, it’s important to take the following steps:

- Ensure the safety of yourself and others involved.

- Contact the police if necessary, particularly in cases of injury, significant property damage, or hit-and-run situations.

- Exchange contact and insurance information with other parties involved.

- Document the scene with photos and notes, including details of the accident and any damage to vehicles or property.

- Notify your insurance provider as soon as possible, providing them with all relevant details.

The Claims Process

Once you’ve reported the incident to your insurance provider, they will guide you through the claims process. This typically involves the following steps:

- Claims Assessment: The insurance company will evaluate the claim, including reviewing the police report (if applicable), photos, and other evidence.

- Determination of Fault: Based on the assessment, the insurance company will determine fault. If you are found at fault, your liability coverage will be used to cover the damages.

- Damage Estimation: The insurance company will assess the extent of the damage and estimate the cost of repairs or replacement.

- Claims Payment: Once the claim is approved, the insurance company will issue payment to the appropriate parties, including yourself, other drivers, or repair shops.

Understanding Your Deductible

When making a claim, it’s important to understand your deductible. This is the amount you pay out-of-pocket before your insurance coverage kicks in. For instance, if you have a 500 deductible and the estimated repairs for your vehicle are 3,000, you will pay the first 500, and your insurance will cover the remaining 2,500.

The Future of Auto Insurance in California

The auto insurance landscape in California is evolving, driven by technological advancements, changing consumer behaviors, and shifting regulatory environments. Here are some key trends and developments to watch for in the future:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is gaining traction in the insurance industry. This technology allows insurance companies to offer usage-based insurance policies, where premiums are determined based on actual driving habits and mileage. This can lead to more personalized and potentially more affordable insurance options for drivers.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles (AVs) presents both opportunities and challenges for the insurance industry. As AV technology advances and becomes more mainstream, insurance providers will need to adapt their policies to accommodate this new era of driving. This may involve developing new coverage options, liability models, and risk assessment methodologies.

Digital Transformation and Insurtech

The insurance industry is experiencing a digital transformation, with the rise of insurtech companies and innovative technologies. This includes the use of artificial intelligence, machine learning, and blockchain to enhance claims processing, risk assessment, and policy management. In California, this trend is expected to continue, leading to more efficient and customer-centric insurance services.

Regulatory Changes and Consumer Protection

California is known for its strong consumer protection regulations, and this trend is likely to continue in the auto insurance space. The state may introduce new regulations to address emerging issues, such as data privacy concerns related to telematics and the equitable treatment of drivers in the era of AVs. Keeping abreast of these regulatory changes will be crucial for both insurance providers and consumers.

FAQ

What are the penalties for driving without insurance in California?

+

Driving without insurance in California can result in a fine of up to $2,000, suspension of your driver’s license, and vehicle registration, as well as mandatory SR-22 insurance filing for three years. It’s crucial to maintain valid insurance coverage to avoid these penalties.

Can I choose my own repair shop after an accident?

+

Yes, you have the right to choose your preferred repair shop in California. However, some insurance companies may have preferred shops that they work with, which can sometimes offer faster and more efficient service. It’s important to discuss this with your insurance provider to understand your options.

How often should I review and update my auto insurance policy?

+

It’s recommended to review your auto insurance policy annually, or whenever there is a significant change in your life or circumstances. This could include buying a new vehicle, moving to a different location, getting married, or experiencing a change in your driving record. Regular reviews ensure that your coverage remains adequate and cost-effective.