Rent A Car Insurance

Renting a car is a convenient option for travelers and those in need of temporary transportation. However, the question of insurance coverage often arises, leaving many individuals uncertain about their protection during the rental period. This article aims to provide a comprehensive guide to Rent-A-Car Insurance, shedding light on the various aspects, benefits, and considerations to ensure a smooth and secure rental experience.

Understanding Rent-A-Car Insurance

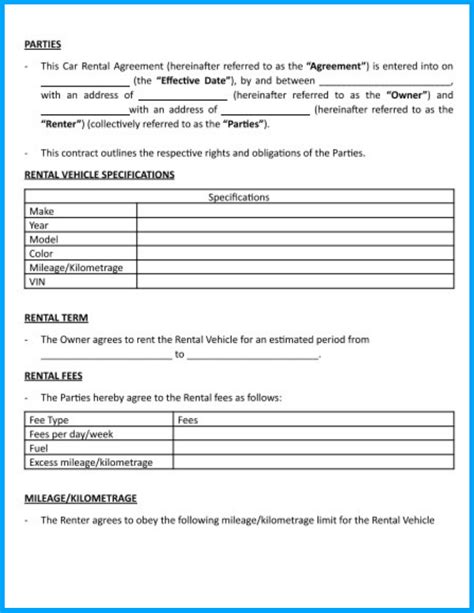

Rent-A-Car Insurance, or Car Rental Insurance, is a specialized type of coverage designed to protect individuals and their rental vehicles. It offers financial protection in the event of accidents, theft, or damage to the rented car. Understanding the nuances of this insurance is crucial to making informed decisions when renting a vehicle.

The Need for Rent-A-Car Insurance

When renting a car, the rental company typically provides some form of basic insurance coverage. However, this coverage often comes with limitations and exclusions, leaving renters vulnerable to unexpected costs. Rent-A-Car Insurance steps in to bridge these gaps, providing comprehensive protection tailored to the unique needs of rental situations.

Types of Coverage

Rent-A-Car Insurance encompasses several types of coverage, each addressing different potential risks:

- Collision Damage Waiver (CDW): CDW is the most common form of rental car insurance. It waives the renter’s responsibility for damage to the vehicle, providing coverage for accidents and collisions.

- Loss Damage Waiver (LDW): LDW is similar to CDW but extends coverage to include theft and vandalism. It provides protection against financial losses in the event the rental car is stolen or damaged by malicious acts.

- Liability Insurance: This coverage protects the renter against claims arising from bodily injury or property damage caused by an accident. It ensures that the renter’s personal assets are not at risk in the event of a lawsuit.

- Personal Accident Insurance (PAI): PAI provides coverage for the renter and any passengers in the event of an accident, offering medical and funeral expense reimbursement.

- Personal Effects Coverage (PEC): PEC covers personal belongings left in the rental car if they are stolen or damaged during the rental period.

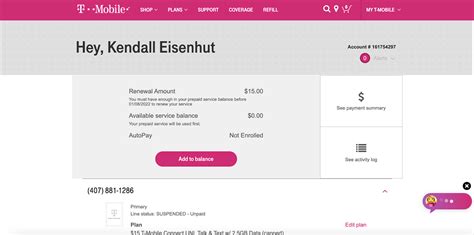

Insurance Providers and Options

Rent-A-Car Insurance can be obtained from various sources, including the rental car company itself, third-party insurance providers, and even through credit card companies. Each option offers different levels of coverage and pricing, so it’s essential to compare and choose the one that best suits your needs.

| Insurance Provider | Coverage Highlights |

|---|---|

| Rental Car Company | Convenient and often includes comprehensive coverage, but may be more expensive. |

| Third-Party Insurers | Offers a range of policies with customizable options, potentially providing better value. |

| Credit Card Companies | Some credit cards include rental car insurance as a benefit, but coverage may have limitations. |

The Benefits of Rent-A-Car Insurance

Rent-A-Car Insurance offers several advantages that contribute to a more stress-free rental experience:

Peace of Mind

Knowing that you have adequate insurance coverage provides peace of mind, allowing you to enjoy your journey without worrying about unforeseen circumstances. Rent-A-Car Insurance gives you the confidence to navigate unfamiliar roads and explore new destinations with a sense of security.

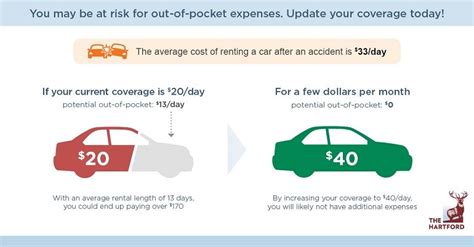

Financial Protection

Accidents and vehicle damage can result in costly repairs and liabilities. Rent-A-Car Insurance shields you from these financial burdens, ensuring that you’re not left with unexpected expenses. It provides a safety net, allowing you to focus on your travel plans rather than potential financial losses.

Flexibility and Convenience

Rent-A-Car Insurance offers flexibility in terms of coverage options and duration. You can choose the level of coverage that aligns with your specific needs, whether it’s for a short-term rental or an extended trip. Additionally, many insurance providers offer easy online booking and policy management, making the process convenient and efficient.

Enhanced Safety

Having comprehensive insurance coverage encourages safe driving practices. With the knowledge that you’re protected, you’re more likely to drive with caution, reducing the risk of accidents and ensuring a safer journey for yourself and others on the road.

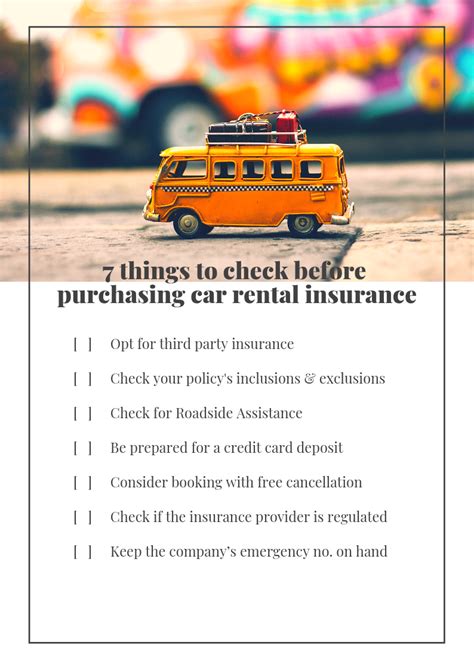

Considerations and Best Practices

To make the most of Rent-A-Car Insurance, it’s essential to consider certain factors and follow best practices:

Review Your Existing Insurance

Before purchasing Rent-A-Car Insurance, review your existing auto insurance policy and any other insurance coverages you may have. Some policies may already provide rental car coverage, either partially or fully, so it’s important to understand the extent of your existing protection.

Compare Coverage and Prices

Shop around and compare different insurance options. Consider the coverage limits, deductibles, and any additional benefits offered. Price should not be the sole deciding factor; ensure that the policy provides adequate protection for your specific needs.

Understand Exclusions and Limitations

Read the fine print and familiarize yourself with any exclusions or limitations in the insurance policy. Some policies may have restrictions on the type of rental vehicles covered, the geographic areas where coverage applies, or the duration of the rental period. Being aware of these limitations ensures you’re not caught off guard in the event of a claim.

Document and Report Accurate Information

In the event of an accident or incident, document all relevant details accurately. Take photos, gather witness statements, and report the incident promptly to the insurance provider. Providing accurate information helps expedite the claims process and ensures a fair resolution.

Future Implications and Trends

The landscape of Rent-A-Car Insurance is evolving, driven by technological advancements and changing consumer preferences. Here are some key trends and future implications:

Digitalization and Convenience

Insurance providers are increasingly embracing digital platforms, allowing renters to purchase and manage policies online. This shift towards digitalization enhances convenience and accessibility, enabling renters to compare and purchase insurance in real-time.

Personalized Coverage Options

With the availability of data analytics and personalized insurance solutions, renters can expect more tailored coverage options. Insurance providers can offer customized policies based on individual driving behaviors, destinations, and trip durations, ensuring a more precise and efficient insurance experience.

Integration with Rental Platforms

Rental car companies are integrating insurance offerings into their booking platforms, providing renters with a seamless and comprehensive rental experience. This integration simplifies the insurance selection process, making it more convenient for renters to choose the right coverage.

Focus on Sustainability and Eco-Friendly Vehicles

As sustainability gains prominence, Rent-A-Car Insurance is likely to adapt to cover eco-friendly vehicles and promote environmentally conscious choices. Insurance providers may offer incentives or specialized coverage for electric or hybrid rental cars, encouraging greener transportation options.

Conclusion

Rent-A-Car Insurance is an essential component of a well-planned rental experience. By understanding the different coverage options, weighing the benefits, and considering best practices, renters can make informed decisions to protect themselves and their rental vehicles. As the industry continues to evolve, Rent-A-Car Insurance will play a pivotal role in ensuring a safe, convenient, and enjoyable travel experience for all.

Can I rely solely on the insurance provided by the rental car company?

+While the rental car company’s insurance can provide a basic level of coverage, it often has limitations and exclusions. It’s recommended to review the terms carefully and consider supplementing with additional insurance to ensure comprehensive protection.

Are there any situations where Rent-A-Car Insurance is not necessary?

+If you already have adequate insurance coverage through your personal auto insurance or credit card benefits, you may not need additional Rent-A-Car Insurance. However, it’s crucial to review your existing policies to ensure they provide sufficient coverage for rental situations.

What happens if I decline the insurance offered by the rental car company?

+Declining the insurance offered by the rental car company means you’ll be responsible for any damages or liabilities incurred during the rental period. It’s essential to carefully consider your options and understand the potential risks before declining insurance coverage.