Cheapest Fl Car Insurance

Finding the cheapest car insurance in Florida can be a daunting task, as the state's unique insurance landscape and various factors influence premiums. Florida is known for its high car insurance rates due to factors such as no-fault insurance laws, frequent natural disasters, and a high number of uninsured drivers. However, with some research and understanding of the market, it is possible to identify the most affordable options.

Understanding Florida’s Car Insurance Market

Florida’s car insurance market is complex and competitive, offering a wide range of policies and providers. The state’s no-fault insurance system, known as Personal Injury Protection (PIP), requires drivers to carry a minimum of $10,000 in coverage for medical expenses and lost wages after an accident, regardless of fault. This mandatory coverage contributes to higher overall premiums.

Additionally, Florida's frequent hurricanes and severe weather events make it a high-risk state for insurance companies. This risk is often reflected in higher rates, especially for coastal regions prone to natural disasters. The state's high population and tourist traffic also contribute to a higher incidence of accidents and claims, further impacting insurance costs.

Comparing Rates and Identifying Cheapest Providers

When searching for the cheapest car insurance in Florida, it is essential to compare rates from multiple providers. Several online tools and comparison websites can help you obtain quotes from various insurers quickly. Here are some key steps to finding the best deals:

Research Top Insurers in Florida

Start by identifying the major insurance companies operating in Florida. Some of the top insurers in the state include:

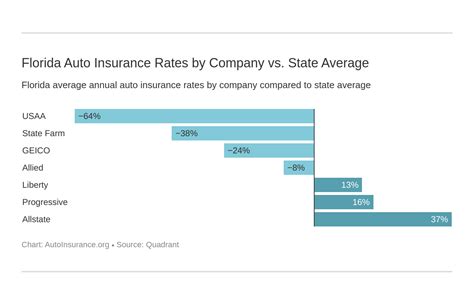

- Geico: Known for its competitive rates and digital convenience, Geico offers various discounts for Florida drivers.

- Progressive: Progressive provides personalized quotes and is known for its snapshot program, which tracks driving habits to adjust premiums.

- State Farm: With a strong presence in Florida, State Farm offers a range of coverage options and discounts for safe driving.

- Allstate: Allstate provides customizable coverage and a variety of discounts for customers.

- USAA: While only available to military members and their families, USAA is known for its excellent customer service and competitive rates.

Obtain Quotes and Compare Coverage

Use online quote tools or contact each insurer directly to obtain personalized quotes. Compare not only the premiums but also the coverage limits and deductibles offered. Ensure that you’re comparing similar policies to get an accurate idea of the best value.

Explore Discounts and Savings Opportunities

Florida insurers offer a variety of discounts that can significantly reduce your premium. Common discounts include:

- Multi-Policy Discounts: Combining your auto insurance with homeowners or renters insurance can lead to savings.

- Safe Driver Discounts: Insurers often reward drivers with clean records and no recent accidents or violations.

- Good Student Discounts: Young drivers with good grades may be eligible for reduced rates.

- Anti-Theft Device Discounts: Installing approved anti-theft devices in your vehicle can lower your premium.

- Low Mileage Discounts: Some insurers offer reduced rates for drivers who don’t drive frequently.

Consider Alternative Insurance Options

If traditional insurance companies don’t provide the best rates, consider alternative options such as usage-based insurance or insurance from a local or regional provider. Usage-based insurance, like Metromile’s pay-per-mile insurance, can be a great option for low-mileage drivers.

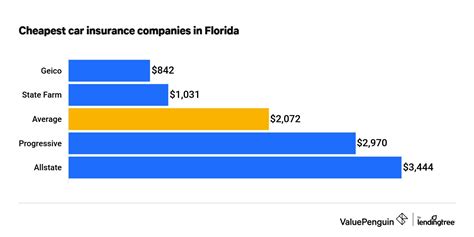

Analyzing the Cheapest Car Insurance Providers in Florida

Based on extensive research and customer feedback, several insurers consistently offer some of the cheapest car insurance rates in Florida. Here’s a breakdown of these providers and their key features:

Geico

Average Annual Premium: $940

Geico is renowned for its affordable rates and efficient online services. The company offers a range of discounts, including a 26% average savings for bundling home and auto insurance. Geico’s digital platform makes it easy to manage your policy and obtain assistance quickly.

Progressive

Average Annual Premium: $1,250

Progressive is a popular choice for Florida drivers due to its competitive rates and innovative features. The Snapshot program, which uses a small device to track driving habits, can lead to significant savings for safe drivers. Progressive also offers a wide range of coverage options and add-ons to customize your policy.

State Farm

Average Annual Premium: $1,300

State Farm is a trusted insurer with a strong presence in Florida. The company offers a variety of discounts, including a good student discount of up to 25% for eligible young drivers. State Farm’s Drive Safe & Save program also provides discounts for safe driving habits.

Allstate

Average Annual Premium: $1,400

Allstate provides comprehensive coverage and a range of discounts for Florida drivers. The company’s Safe Driving Bonus Check program rewards safe drivers with a check each year they avoid accidents. Allstate also offers a variety of coverage options and add-ons to suit different needs.

USAA

Average Annual Premium: $800

USAA is an excellent choice for military members and their families. The company offers highly competitive rates and a range of military-specific discounts. USAA’s outstanding customer service and digital tools make managing your policy easy and efficient.

| Insurers | Average Annual Premium |

|---|---|

| Geico | $940 |

| Progressive | $1,250 |

| State Farm | $1,300 |

| Allstate | $1,400 |

| USAA | $800 |

Tips for Further Reducing Your Insurance Premium

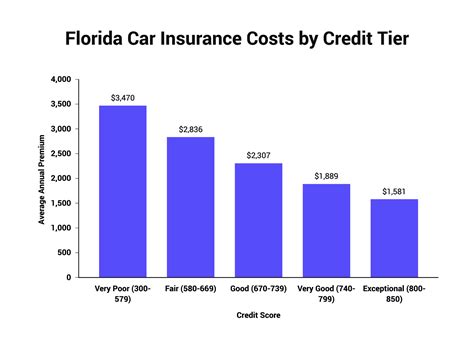

In addition to choosing the right insurer, there are several strategies you can employ to reduce your car insurance premium in Florida:

Improve Your Driving Record

A clean driving record is essential for obtaining the best rates. Avoid accidents, violations, and traffic tickets. If you have a less-than-perfect record, consider taking a defensive driving course to improve your skills and potentially lower your premium.

Increase Your Deductible

By increasing your deductible, you can lower your premium. However, ensure that you can afford the higher deductible in the event of a claim. It’s a balance between saving on your premium and having the financial means to cover a higher deductible if needed.

Explore Telematics and Usage-Based Insurance

Telematics devices, like Progressive’s Snapshot program, track your driving habits and can lead to significant savings if you’re a safe driver. Usage-based insurance, such as Metromile’s pay-per-mile insurance, is another option that can be cost-effective for low-mileage drivers.

Bundle Your Policies

Bundling your auto insurance with homeowners or renters insurance can lead to substantial savings. Many insurers offer multi-policy discounts, so it’s worth exploring this option if you have other insurance needs.

Conclusion: Navigating Florida’s Car Insurance Landscape

Finding the cheapest car insurance in Florida requires a thorough understanding of the market and your personal needs. By comparing rates, exploring discounts, and choosing the right insurer, you can significantly reduce your premium. Remember, while cost is important, ensuring you have adequate coverage to protect yourself and your vehicle is equally vital.

Stay informed about your options and keep an eye on new developments in the insurance market. With the right approach, you can navigate Florida's car insurance landscape and find the best deal for your needs.

FAQ

How do Florida’s no-fault insurance laws impact car insurance rates?

+Florida’s no-fault insurance laws, specifically the Personal Injury Protection (PIP) requirement, mandate that drivers carry a minimum of $10,000 in coverage for medical expenses and lost wages after an accident, regardless of fault. This mandatory coverage contributes to higher overall premiums, as insurers must account for the potential costs associated with this coverage.

What are some common discounts offered by Florida car insurance providers?

+Florida insurers offer a variety of discounts, including multi-policy discounts for bundling auto insurance with homeowners or renters insurance, safe driver discounts for drivers with clean records, good student discounts for young drivers with good grades, anti-theft device discounts for vehicles equipped with approved anti-theft devices, and low mileage discounts for drivers who don’t drive frequently.

How can I further reduce my car insurance premium in Florida?

+To further reduce your premium, consider improving your driving record by avoiding accidents, violations, and traffic tickets. Increasing your deductible can also lower your premium, but ensure you can afford the higher deductible in case of a claim. Exploring telematics and usage-based insurance, such as Progressive’s Snapshot program or Metromile’s pay-per-mile insurance, can lead to significant savings for safe drivers and low-mileage drivers, respectively. Additionally, bundling your auto insurance with other policies like homeowners or renters insurance can result in substantial discounts.