Pet Insurance Average Cost

Pet insurance has become an increasingly popular way for pet owners to manage the financial risks associated with veterinary care. With the rising costs of medical treatments and procedures, having insurance for your furry companions can provide peace of mind and ensure they receive the best possible care without breaking the bank. In this comprehensive guide, we will delve into the average costs of pet insurance, exploring the factors that influence these expenses and offering valuable insights to help you make informed decisions about protecting your pet's health.

Understanding the Average Cost of Pet Insurance

The average cost of pet insurance can vary significantly depending on several key factors. While it’s challenging to provide a precise average due to these variations, we can explore the range of expenses and the influences that shape them. Here’s an in-depth look at what contributes to the average cost of pet insurance.

Species and Breed Variations

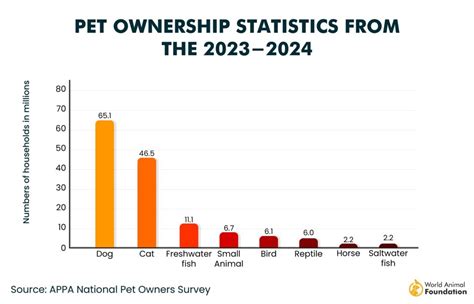

One of the primary factors affecting pet insurance costs is the species and breed of your pet. Different animals have unique health considerations and predispositions to certain conditions. For instance, larger dog breeds may face higher premiums due to their increased risk of joint issues and larger size requiring more extensive treatments. On the other hand, certain cat breeds might be more susceptible to specific genetic disorders, impacting the cost of their insurance.

| Pet Type | Average Annual Premium |

|---|---|

| Large Dogs (e.g., Labrador Retriever) | $600 - $1,200 |

| Small Dogs (e.g., Chihuahua) | $400 - $800 |

| Domestic Cats | $300 - $600 |

| Exotic Pets (e.g., Birds, Reptiles) | $200 - $500 |

Age and Health History

The age of your pet and its health history are crucial factors in determining insurance costs. Younger pets generally have lower premiums as they are less likely to develop serious health issues. As pets age, their insurance costs tend to rise, reflecting the increased likelihood of age-related ailments. Additionally, pre-existing conditions or a history of medical treatments can lead to higher premiums or even exclusion from certain insurance plans.

| Pet Age | Average Monthly Premium |

|---|---|

| Puppies/Kittens (0-1 year) | $25 - $50 |

| Young Adults (1-5 years) | $35 - $75 |

| Adults (6-10 years) | $50 - $100 |

| Seniors (11+ years) | $75 - $150 |

Level of Coverage and Deductibles

The level of coverage you choose for your pet’s insurance policy significantly impacts the average cost. Comprehensive plans that cover a wide range of treatments, including accidents, illnesses, and routine care, will typically have higher premiums. Conversely, basic plans that focus on essential coverage might be more affordable but may leave you with higher out-of-pocket expenses during unexpected veterinary visits.

Deductibles also play a role in the overall cost. A higher deductible means you pay more upfront before the insurance kicks in, but it can lower your monthly premiums. Conversely, a lower deductible provides more financial protection but may result in slightly higher monthly payments.

| Coverage Level | Average Monthly Premium |

|---|---|

| Basic Coverage (Accident-only) | $15 - $30 |

| Standard Coverage (Accident & Illness) | $30 - $60 |

| Comprehensive Coverage (Accident, Illness, & Routine Care) | $60 - $120 |

Geographical Location and Provider

The geographical location where you reside can influence the average cost of pet insurance. Veterinary care costs can vary significantly across different regions, and these variations are often reflected in insurance premiums. Additionally, the reputation and coverage options offered by different insurance providers can lead to pricing differences. It’s essential to compare multiple providers to find the best fit for your needs and budget.

Maximizing Value and Savings

While the average cost of pet insurance provides a baseline understanding, it’s crucial to consider ways to optimize your insurance plan and potentially reduce expenses. Here are some strategies to help you get the most value from your pet insurance while keeping costs manageable.

Comparing Plans and Providers

The pet insurance market is diverse, with numerous providers offering a range of plans. Take the time to compare different policies based on coverage, deductibles, and overall cost. Look for plans that align with your pet’s specific needs and budget. Consider factors like reimbursement rates, waiting periods, and the flexibility to customize your coverage.

Understanding Coverage Limits and Exclusions

Review the fine print of your chosen insurance plan to understand its coverage limits and exclusions. Some plans may have caps on annual or lifetime benefits, while others might exclude certain pre-existing conditions or treatments. Being aware of these limitations can help you make informed decisions about your pet’s healthcare and avoid unexpected out-of-pocket expenses.

Preventive Care and Discounts

Many pet insurance providers offer discounts for pets that receive regular preventive care, such as vaccinations, dental check-ups, and routine examinations. Maintaining a proactive approach to your pet’s health not only helps catch potential issues early but can also qualify you for discounts on your insurance premiums. Additionally, some providers offer multi-pet discounts if you insure multiple animals.

Tailoring Coverage to Your Pet’s Needs

Not all pets require the same level of insurance coverage. Consider your pet’s age, breed, and health history when choosing a plan. For younger, healthier pets, a basic accident-only plan might suffice, while older pets or those with specific health concerns may benefit from more comprehensive coverage. Tailoring your coverage ensures you’re not overpaying for unnecessary features.

Utilizing Wellness Plans and Additional Benefits

Some pet insurance providers offer wellness plans or additional benefits that can enhance your pet’s healthcare experience. These plans may cover routine procedures like vaccinations, spaying/neutering, or even alternative therapies like acupuncture. By taking advantage of these benefits, you can potentially reduce out-of-pocket costs for essential preventive care.

The Impact of Pet Insurance on Veterinary Care

Pet insurance not only provides financial protection for pet owners but also has a significant impact on the veterinary care industry. The availability of insurance options has led to increased accessibility and quality of care for pets. Here’s how pet insurance is shaping the veterinary landscape.

Expanding Access to Specialized Care

With pet insurance, pet owners have the means to access a wider range of veterinary services, including specialized care. This includes treatments for complex conditions, advanced diagnostic procedures, and even surgeries. Pet insurance helps bridge the gap between routine care and more specialized, costly treatments, ensuring that pets receive the best possible medical attention.

Encouraging Proactive Health Management

The presence of pet insurance encourages pet owners to be more proactive in their pets’ health management. Regular check-ups, vaccinations, and preventive measures become more accessible, leading to earlier detection of potential health issues. This proactive approach can prevent minor ailments from becoming major health problems, ultimately improving the overall well-being of pets.

Advancing Veterinary Medicine and Research

The funds generated from pet insurance premiums contribute to the advancement of veterinary medicine and research. Insurance providers often invest in research initiatives to improve treatment outcomes and develop innovative solutions for common pet health issues. This ongoing research benefits the entire veterinary community and leads to better healthcare options for pets.

Future Trends and Innovations in Pet Insurance

The pet insurance industry is evolving rapidly, driven by technological advancements and changing consumer expectations. As we look to the future, several trends and innovations are poised to shape the landscape of pet insurance, offering enhanced benefits and improved experiences for pet owners.

Digitalization and Telemedicine

The digital revolution is transforming the way pet insurance operates. Insurers are increasingly leveraging technology to streamline processes, from policy applications to claims submissions. Additionally, the rise of telemedicine services allows pet owners to consult with veterinary professionals remotely, providing convenient access to expert advice and potentially reducing the need for in-person visits for minor issues.

Personalized Coverage and Risk Assessment

Advanced data analytics and machine learning are enabling pet insurance providers to offer more personalized coverage options. By analyzing factors like breed, age, and lifestyle, insurers can tailor policies to the unique needs of each pet. This level of customization ensures that pets receive the right coverage at a fair price, reflecting their individual health risks.

Incentivizing Healthy Lifestyles

Pet insurance providers are recognizing the importance of preventive care and healthy lifestyles for pets. Some insurers are introducing wellness programs that reward pet owners for maintaining their pets’ health through regular exercise, proper nutrition, and routine check-ups. These incentives not only promote healthier pets but also help reduce the likelihood of costly health issues down the line.

Enhanced Coverage for Chronic Conditions

As veterinary medicine advances, the treatment of chronic conditions in pets is becoming more specialized and effective. Pet insurance providers are responding by offering enhanced coverage for these conditions, providing pet owners with greater peace of mind and financial support when managing long-term health issues for their furry companions.

Conclusion: Navigating the World of Pet Insurance

Pet insurance is a valuable tool for pet owners to ensure their beloved companions receive the care they need without incurring overwhelming financial burdens. While the average cost of pet insurance can vary, understanding the factors that influence these expenses empowers pet owners to make informed decisions. By comparing plans, tailoring coverage to individual needs, and staying proactive about preventive care, pet owners can maximize the benefits of insurance while keeping costs manageable.

As the pet insurance industry continues to evolve, embracing technological advancements and innovative coverage options, pet owners can look forward to even more accessible and comprehensive care for their furry family members. With the right insurance plan, pet owners can rest assured that their pets will receive the best possible treatment, fostering a lifetime of happiness and health.

How does the cost of pet insurance compare to other forms of insurance, like health insurance for humans?

+Pet insurance costs are generally more affordable compared to human health insurance. While human health insurance covers a broader range of services and has higher premiums, pet insurance focuses on veterinary care and can be tailored to specific needs. Pet insurance provides a cost-effective way to manage unexpected veterinary expenses.

Are there any tax benefits associated with pet insurance?

+Unfortunately, pet insurance premiums are not typically tax-deductible in most jurisdictions. However, the savings and financial protection provided by pet insurance can still make it a worthwhile investment for pet owners, especially when considering the potential costs of unexpected veterinary emergencies.

What are some common exclusions or limitations in pet insurance policies that pet owners should be aware of?

+Common exclusions in pet insurance policies include pre-existing conditions, elective procedures, and certain breed-specific disorders. Additionally, some policies may have limits on annual or lifetime benefits. It’s crucial to carefully review the fine print of your chosen policy to understand any exclusions or limitations and ensure it aligns with your pet’s needs.