Calif Insurance

Welcome to an in-depth exploration of the world of insurance in California, a state renowned for its diverse landscapes, thriving industries, and unique insurance landscape. With a population of nearly 40 million and a robust economy, California presents a complex and dynamic insurance environment. From the bustling cities of Los Angeles and San Francisco to the picturesque vineyards of Napa Valley, the insurance needs of Californians vary greatly, reflecting the state's diverse demographics and geographical features.

In this comprehensive guide, we will delve into the intricacies of Calif Insurance, shedding light on its unique characteristics, regulations, and best practices. Whether you're a resident seeking better coverage or an industry professional looking to expand your knowledge, this article aims to provide an expert-level understanding of insurance in the Golden State.

Understanding the Unique Insurance Landscape of California

California’s insurance market is influenced by a range of factors, including its diverse population, strict regulations, and natural disasters. The state’s unique challenges and opportunities make it a fascinating case study for insurance professionals and enthusiasts alike. Here, we’ll explore the key aspects that define Calif Insurance.

Diverse Population and Insurance Needs

California is a melting pot of cultures, with a population that spans various ages, ethnicities, and socio-economic backgrounds. This diversity translates to a wide array of insurance needs. For instance, the large population of young professionals in cities like San Francisco and San Diego often requires specialized coverage for their unique lifestyles and assets. On the other hand, the retirement communities in places like Palm Springs present a different set of insurance considerations, focusing more on health and long-term care.

The state's agricultural regions, such as the Central Valley, have their own specific insurance requirements, often related to crop insurance and farm liability. Additionally, the significant Hispanic population in California introduces unique cultural and linguistic considerations, necessitating insurance providers to offer services in multiple languages and tailor their policies to meet cultural expectations.

Stringent Regulatory Environment

California is known for its rigorous insurance regulations, designed to protect consumers and promote a fair market. The California Department of Insurance (CDI) oversees the insurance industry, enforcing laws that govern everything from policy terms to premium rates. This tight regulatory grip ensures that insurance providers operate ethically and in the best interest of policyholders.

One notable regulation is Proposition 103, passed in 1988, which mandates that insurance rates be approved by the CDI and cannot be excessively high or discriminatory. This proposition has significantly influenced the insurance landscape in California, promoting fair pricing and market competition.

Natural Disasters and Risk Management

California’s geographic location makes it susceptible to various natural disasters, including earthquakes, wildfires, and floods. These risks present unique challenges for both insurance providers and policyholders. The state has implemented specific measures to address these risks, such as the California Earthquake Authority (CEA), a publicly managed organization that provides residential earthquake insurance.

The CEA is a prime example of California's innovative approach to risk management. By offering earthquake insurance directly to homeowners, the CEA fills a gap in the private insurance market, providing an essential coverage option in a high-risk area. However, the complexity of insuring against earthquakes and the potential for catastrophic losses continue to shape the insurance landscape in California.

| Natural Disaster | Frequency | Impact on Insurance |

|---|---|---|

| Earthquakes | Moderate to High | Increased focus on earthquake coverage, development of innovative risk management strategies |

| Wildfires | High | Rising insurance costs, potential for non-renewals in high-risk areas |

| Floods | Moderate | Need for flood insurance, particularly in coastal and low-lying areas |

Key Insurance Products and Trends in California

The insurance market in California offers a wide range of products tailored to the diverse needs of its residents and businesses. Here, we’ll highlight some of the most prominent insurance types and explore emerging trends.

Homeowners Insurance

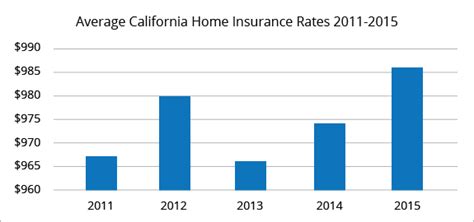

Homeowners insurance is a critical component of Calif Insurance, given the state’s diverse housing market and natural disaster risks. California’s homeowners insurance policies typically cover a range of perils, including fire, theft, and liability. However, due to the high risk of earthquakes, many policies exclude earthquake coverage, requiring homeowners to purchase separate policies or rely on state-sponsored programs like the CEA.

One emerging trend in homeowners insurance is the increasing focus on personalized coverage. Insurance providers are now offering more flexible policies that allow homeowners to customize their coverage based on their specific needs and assets. This shift towards personalized insurance is driven by the understanding that not all homeowners have the same risks or priorities.

Auto Insurance

Auto insurance is another essential aspect of Calif Insurance, with a large number of vehicles on the road and a high rate of accidents. California’s auto insurance policies must comply with the state’s minimum liability requirements, which are among the highest in the nation. This ensures that drivers have adequate coverage to protect others in the event of an accident.

An interesting trend in auto insurance is the growing popularity of usage-based insurance (UBI) programs. These programs use telematics devices to track driving behavior and offer discounts to safe drivers. UBI is particularly appealing to young drivers and those with a clean driving record, as it provides an opportunity to save on insurance costs.

Health Insurance

California has been at the forefront of health insurance reform, with the implementation of the Affordable Care Act (ACA) and its own state-based health insurance marketplace, Covered California. The state’s health insurance market is characterized by a strong emphasis on accessibility and affordability, with a range of plans designed to meet the needs of various income levels and demographics.

A notable trend in health insurance is the rise of value-based care models. These models, which focus on providing high-quality, cost-effective healthcare, are gaining traction in California. Insurance providers are partnering with healthcare organizations to implement these models, which aim to improve patient outcomes and reduce overall healthcare costs.

Life Insurance

Life insurance is an important component of financial planning for many Californians. The state’s life insurance market offers a variety of products, including term life, whole life, and universal life insurance. Term life insurance, which provides coverage for a specific period, is particularly popular due to its affordability and flexibility.

One emerging trend in life insurance is the integration of health and wellness programs. Some insurance providers are now offering discounted premiums or other incentives to policyholders who maintain healthy lifestyles. This trend aligns with the broader shift towards preventative healthcare and personal wellness.

Navigating the Calif Insurance Landscape: Tips for Consumers

For residents of California, understanding the insurance landscape is crucial to making informed decisions about coverage. Here are some expert tips to help navigate Calif Insurance effectively.

Shop Around and Compare Policies

The insurance market in California is highly competitive, with a range of providers offering different policies and pricing. It’s important to shop around and compare policies to find the best fit for your needs. Consider using online comparison tools or working with an independent insurance agent who can provide options from multiple carriers.

Understand Your Coverage Needs

California’s diverse landscape and unique risks mean that every resident’s insurance needs are different. Take the time to understand your specific risks and coverage requirements. For example, if you live in an area prone to wildfires, ensure your homeowners insurance policy includes coverage for this peril. If you have valuable assets, consider additional coverage through endorsements or separate policies.

Review Your Policies Regularly

Life and circumstances can change, which may impact your insurance needs. Regularly review your policies to ensure they still provide adequate coverage. This is particularly important if you’ve made significant life changes, such as getting married, having children, purchasing a new home, or starting a business. Keep in mind that your insurance needs may evolve over time, and your policies should reflect these changes.

Explore Discounts and Special Programs

Insurance providers in California often offer a range of discounts and special programs to attract and retain customers. These can include discounts for bundling multiple policies, safe driving or good student discounts, loyalty rewards, and more. Additionally, California residents may be eligible for state-sponsored programs like the California Low-Cost Auto Insurance Program, which offers reduced rates for qualified low-income drivers.

Utilize Technology and Online Resources

In today’s digital age, there are numerous online resources and tools available to help you navigate Calif Insurance. These include insurance comparison websites, mobile apps for policy management, and online portals for filing claims and accessing policy documents. Utilizing these resources can streamline the insurance process and make it more convenient and efficient.

The Future of Calif Insurance: Industry Insights and Predictions

As we look ahead, the insurance landscape in California is expected to continue evolving, driven by technological advancements, changing consumer expectations, and emerging risks. Here, we’ll explore some key trends and predictions for the future of Calif Insurance.

Increasing Role of Technology

Technology is set to play an even greater role in the insurance industry, particularly in California where there’s a strong tech presence. Insurtech, the fusion of insurance and technology, is expected to drive innovation and efficiency in the sector. This includes the use of artificial intelligence (AI) for automated underwriting and claims processing, as well as the development of new insurance products and services tailored to the digital age.

Additionally, the continued adoption of telematics and other data-driven technologies will likely shape the auto insurance market. These technologies can provide more accurate risk assessments and personalized coverage options, potentially leading to more affordable and customized insurance policies.

Focus on Customer Experience and Engagement

Insurance providers in California are expected to place a greater emphasis on delivering an exceptional customer experience. This includes providing easy-to-use digital platforms for policy management and claims filing, as well as offering personalized services and tailored insurance products. By focusing on customer engagement and satisfaction, insurance companies can build stronger relationships with their policyholders and improve retention rates.

Emerging Risks and New Insurance Products

California’s unique challenges, such as its susceptibility to natural disasters and the ongoing pandemic, will continue to shape the insurance landscape. Insurance providers will need to adapt and innovate to address these emerging risks. This may involve the development of new insurance products, such as pandemic-related coverage or innovative risk management solutions for natural disasters.

Additionally, the growing focus on sustainability and environmental concerns may lead to the emergence of new insurance products tailored to these issues. For example, insurance policies that cover damage caused by climate change-related events or encourage sustainable practices through incentives.

Regulatory Changes and Market Dynamics

The insurance market in California is heavily regulated, and any changes to these regulations can have significant impacts on the industry. As the state continues to evolve its insurance policies and laws, insurance providers will need to adapt to stay compliant. This may involve adjustments to pricing structures, coverage offerings, and sales strategies.

Furthermore, the competitive nature of the California insurance market is expected to persist, with a continued focus on affordability and accessibility. Insurance providers will need to find innovative ways to differentiate themselves and offer value to policyholders, whether through competitive pricing, unique coverage options, or superior customer service.

Conclusion

In conclusion, the insurance landscape in California is complex, dynamic, and unique. From its diverse population and stringent regulations to its natural disaster risks and innovative approaches to risk management, Calif Insurance presents a fascinating and challenging environment for both consumers and industry professionals.

As we've explored in this guide, understanding the key aspects of Calif Insurance is crucial for making informed decisions about coverage. Whether you're a resident seeking better protection or an industry professional looking to expand your expertise, a comprehensive understanding of this complex landscape is essential. By staying informed about the latest trends, regulations, and best practices, you can navigate the Calif Insurance landscape with confidence and ensure you're adequately protected.

What is the California Department of Insurance (CDI) and what does it do?

+The California Department of Insurance (CDI) is a state government agency that regulates the insurance industry in California. It enforces laws and regulations to protect consumers and ensure fair practices in the insurance market. CDI reviews insurance rates, investigates complaints, and oversees insurance companies to maintain a stable and competitive insurance environment in the state.

How does Proposition 103 impact insurance rates in California?

+Proposition 103, passed in 1988, mandates that insurance rates be approved by the CDI and cannot be excessively high or discriminatory. This proposition has led to more regulated and fair insurance rates in California, promoting market competition and protecting consumers from exorbitant premiums.

What is the California Earthquake Authority (CEA) and why is it important?

+The California Earthquake Authority (CEA) is a publicly managed organization that provides residential earthquake insurance. It’s important because California is prone to earthquakes, and traditional insurance companies often exclude earthquake coverage from their policies. The CEA fills this gap, offering essential coverage to homeowners in a high-risk area.