Medical Insurance Group

In the realm of healthcare, medical insurance plays a pivotal role in ensuring access to quality medical services and financial protection for individuals and families. This article explores the intricacies of the Medical Insurance Group, a leading provider in the healthcare industry, delving into its services, impact, and future prospects.

The Medical Insurance Group: A Comprehensive Overview

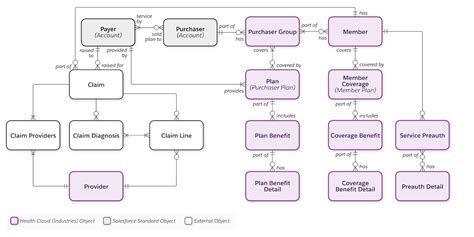

The Medical Insurance Group, a global leader in health insurance, has been at the forefront of innovative healthcare solutions for over three decades. With a diverse range of products and services, the group caters to a wide spectrum of individuals, families, and businesses, offering tailored insurance plans to meet specific healthcare needs.

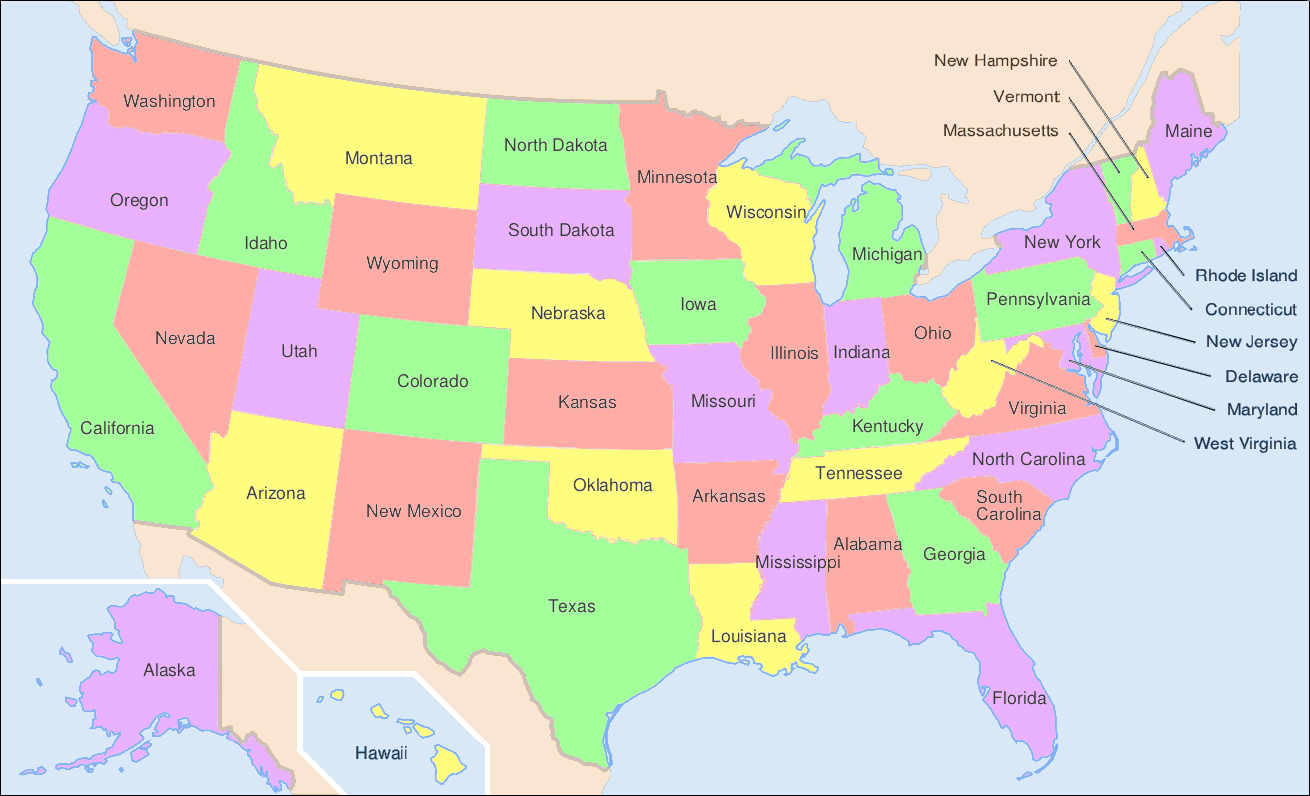

Headquartered in the heart of the financial district, the Medical Insurance Group boasts a global reach, with operations spanning across five continents. Its extensive network of healthcare providers, including hospitals, clinics, and specialized care centers, ensures that policyholders have access to a vast array of medical services, both locally and internationally.

One of the key strengths of the Medical Insurance Group lies in its ability to adapt to the dynamic nature of the healthcare industry. The group continuously invests in research and development, leveraging cutting-edge technologies to enhance its services and provide customers with the most advanced healthcare solutions available. From telemedicine initiatives to personalized health management programs, the group strives to revolutionize the way healthcare is delivered and experienced.

Services and Products

The Medical Insurance Group offers a comprehensive suite of insurance products, designed to cater to various demographics and healthcare requirements. These include:

- Individual Health Insurance Plans: Tailored plans for individuals, offering coverage for a range of medical expenses, including hospitalization, specialist consultations, and prescription medications. These plans are designed to provide financial security and peace of mind.

- Family Health Insurance: Comprehensive coverage for families, ensuring that all members have access to necessary medical care. Family plans often include additional benefits such as wellness programs and family-oriented health initiatives.

- Group Health Insurance: Customized plans for businesses and organizations, providing employees with comprehensive healthcare coverage. Group plans often offer competitive rates and additional benefits such as dental and vision care.

- Travel Health Insurance: Specialized plans for individuals and families traveling internationally, providing coverage for unexpected medical emergencies while abroad. These plans often include evacuation and repatriation services.

- Long-Term Care Insurance: Plans designed to cover the costs associated with long-term care, including assisted living, nursing home care, and home healthcare services. These policies provide financial support for individuals requiring extended care.

The Medical Insurance Group also offers a range of supplementary services, including health and wellness programs, disease management initiatives, and online health resources, to promote overall well-being and preventive care among its policyholders.

Impact and Success Stories

The impact of the Medical Insurance Group extends far beyond the provision of insurance services. The group has been instrumental in driving positive change within the healthcare industry, advocating for improved access to healthcare services and financial protection for all. Through its initiatives and partnerships, the group has:

- Contributed to the development of innovative healthcare solutions, such as telemedicine platforms, which have revolutionized access to medical care, particularly in remote and underserved areas.

- Partnered with leading healthcare providers to enhance the quality of care and improve patient outcomes, ensuring that policyholders receive the best possible medical attention.

- Implemented successful disease management programs, focusing on prevention and early intervention, which have resulted in significant cost savings and improved health outcomes for its policyholders.

- Launched educational campaigns and initiatives to raise awareness about the importance of preventive care and healthy lifestyles, empowering individuals to take charge of their health.

The success stories of the Medical Insurance Group are numerous and diverse. From individuals and families who have received life-saving medical treatment under the group's insurance plans, to businesses that have experienced significant cost savings through its group health insurance programs, the group's impact is felt across all sectors of society.

| Industry Sector | Impact and Benefits |

|---|---|

| Individuals and Families | Access to quality healthcare, financial protection, and peace of mind. |

| Businesses and Organizations | Competitive rates, comprehensive coverage, and improved employee well-being. |

| Healthcare Providers | Partnerships and collaborations to enhance quality of care and patient outcomes. |

| Community Initiatives | Support for healthcare infrastructure and access to care in underserved areas. |

Performance Analysis and Future Outlook

The Medical Insurance Group has consistently demonstrated strong financial performance, with steady growth and a solid track record of delivering value to its stakeholders. The group’s success can be attributed to its focus on innovation, customer-centric approach, and strategic partnerships.

In recent years, the group has expanded its global footprint, entering into new markets and strengthening its presence in existing ones. This strategic expansion has allowed the group to diversify its customer base and tap into new opportunities, solidifying its position as a leading health insurance provider.

Looking ahead, the Medical Insurance Group is well-positioned to navigate the evolving healthcare landscape. With a focus on digital transformation and technological advancements, the group is poised to leverage data analytics and artificial intelligence to enhance its services and improve customer experiences. Additionally, the group's commitment to sustainability and social impact initiatives ensures its long-term viability and relevance in a rapidly changing industry.

Key Performance Indicators

To assess the performance and growth of the Medical Insurance Group, several key performance indicators (KPIs) can be considered:

- Policyholder Growth: The group's ability to attract and retain policyholders is a critical indicator of its success. A steady growth rate in policyholders indicates a strong market position and customer satisfaction.

- Financial Stability: The group's financial health, as evidenced by its balance sheet and financial statements, is a key indicator of its stability and ability to weather economic fluctuations.

- Customer Satisfaction: Measuring customer satisfaction through surveys and feedback provides insights into the group's ability to meet customer needs and expectations.

- Healthcare Provider Network: The strength and diversity of the group's healthcare provider network are essential for ensuring access to quality medical services. A robust network indicates the group's ability to negotiate favorable terms and provide comprehensive coverage.

- Claims Management: Efficient and timely claims processing is crucial for maintaining customer trust and satisfaction. The group's claims management processes and turnaround times are key indicators of its operational efficiency.

By continuously monitoring and optimizing these KPIs, the Medical Insurance Group can ensure its long-term success and maintain its position as a leading health insurance provider.

Future Innovations and Opportunities

The Medical Insurance Group is poised to leverage several emerging trends and technologies to drive future growth and innovation. These include:

- Telemedicine and Digital Health: The group's investments in telemedicine platforms and digital health solutions have the potential to revolutionize healthcare delivery, particularly in the post-pandemic era. These technologies enable remote consultations, virtual care, and improved access to specialized medical services.

- Artificial Intelligence and Data Analytics: By leveraging AI and data analytics, the group can enhance its underwriting processes, personalize insurance plans, and improve risk assessment. These technologies also enable predictive analytics, allowing the group to anticipate and address healthcare needs proactively.

- Wellness and Preventive Care: With a focus on wellness and preventive care, the group can develop innovative programs and initiatives to promote healthy lifestyles and reduce the incidence of chronic diseases. This approach not only improves customer well-being but also reduces long-term healthcare costs.

- Sustainability and Social Impact: The group's commitment to sustainability and social impact initiatives can attract environmentally and socially conscious consumers. By integrating sustainable practices into its operations and supporting community initiatives, the group can enhance its brand reputation and attract a broader customer base.

By embracing these future opportunities and staying at the forefront of healthcare innovation, the Medical Insurance Group is well-equipped to meet the evolving needs of its customers and maintain its position as a global leader in health insurance.

How does the Medical Insurance Group ensure access to quality healthcare providers?

+The Medical Insurance Group maintains a comprehensive network of healthcare providers, including hospitals, clinics, and specialists. This network is carefully curated to ensure policyholders have access to high-quality medical care. The group regularly evaluates and selects providers based on their expertise, facilities, and patient satisfaction ratings.

What are the key benefits of the Medical Insurance Group’s travel health insurance plans?

+The group’s travel health insurance plans provide coverage for unexpected medical emergencies while traveling internationally. These plans offer benefits such as evacuation and repatriation services, ensuring policyholders receive timely and appropriate medical care, even when away from home.

How does the Medical Insurance Group support preventive care and wellness initiatives?

+The group places a strong emphasis on preventive care and wellness. It offers a range of supplementary services, including health and wellness programs, disease management initiatives, and online health resources. These initiatives aim to promote healthy lifestyles, encourage early detection, and empower individuals to take an active role in their health.