Medicare D Insurance Plans

Welcome to an in-depth exploration of Medicare Part D, a crucial component of the U.S. healthcare system. This article aims to demystify the complexities of Medicare Part D, shedding light on its intricacies and benefits. With an aging population and a healthcare landscape that continues to evolve, understanding Medicare Part D is essential for anyone seeking to navigate the healthcare system effectively.

Unraveling Medicare Part D: An Essential Guide

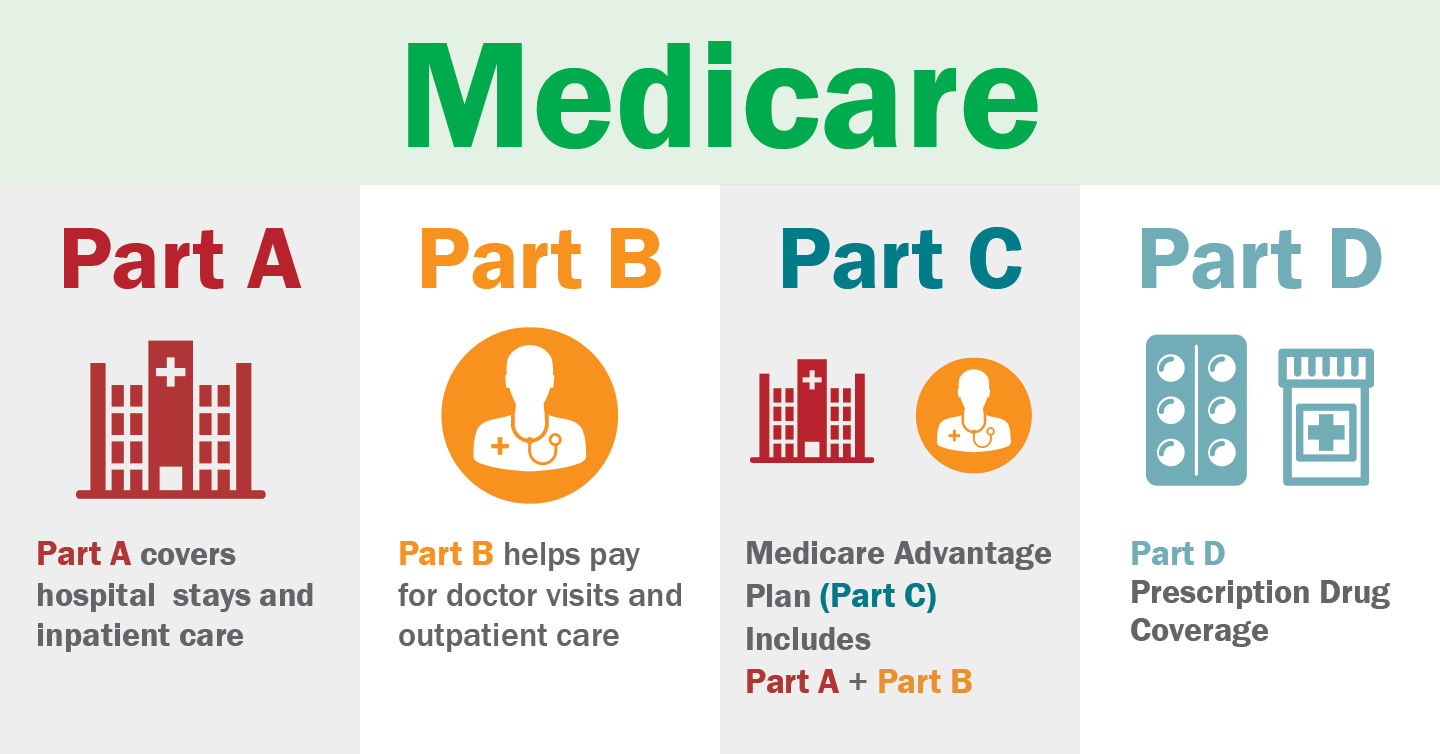

Medicare Part D, often referred to as the prescription drug coverage plan, plays a pivotal role in ensuring that beneficiaries have access to affordable and necessary medications. Introduced as part of the Medicare Prescription Drug, Improvement, and Modernization Act in 2003, it has since become an indispensable component of the Medicare program.

The premise of Medicare Part D is straightforward: it provides coverage for prescription medications, helping individuals manage the costs associated with their healthcare needs. However, the intricacies of this program are far from simple, with a myriad of plan options, coverage levels, and costs to navigate.

As of the latest available data, Medicare Part D has proven to be a vital safety net for millions of Americans. With a wide range of plans offered by both private insurance companies and Medicare-approved prescription drug plans (PDPs), beneficiaries have the flexibility to choose a plan that aligns with their unique healthcare requirements and budget.

The Fundamentals of Medicare Part D

Medicare Part D is designed to cover prescription drugs, offering a comprehensive solution for individuals who require ongoing medication. It operates as an optional benefit, allowing beneficiaries to enroll in a plan that suits their needs. While enrollment is not mandatory, it is highly recommended for individuals who rely on prescription medications to manage their health.

The coverage provided by Medicare Part D can vary significantly depending on the chosen plan. Plans typically cover a wide range of medications, including both brand-name and generic drugs. However, the specific drugs covered, the cost of premiums, deductibles, and copayments can differ from one plan to another. It is essential for beneficiaries to carefully review the details of each plan to ensure they select one that adequately covers their medication needs.

| Key Component | Description |

|---|---|

| Premiums | Monthly cost for Medicare Part D coverage, varying by plan. |

| Deductibles | The amount an individual must pay out-of-pocket before the plan begins to cover costs. |

| Copayments | A fixed amount an individual pays for a covered drug, determined by the plan's formulary. |

| Formulary | A list of drugs covered by the plan, which can vary by plan and may change annually. |

| Pharmacy Network | A network of pharmacies where individuals can obtain their medications with coverage. |

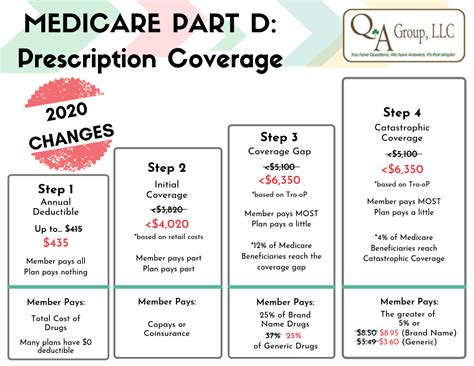

One unique aspect of Medicare Part D is the coverage gap, often referred to as the "donut hole." This coverage gap is a temporary limit on what the plan will cover for drugs during a calendar year. Once an individual reaches this limit, they may have to pay a larger percentage of their drug costs until they reach the catastrophic coverage level. However, the good news is that the Affordable Care Act has gradually closed this gap, offering significant savings for beneficiaries.

Enrolling in Medicare Part D: A Step-by-Step Guide

Enrolling in Medicare Part D is a straightforward process, but it requires careful consideration and attention to detail. Here’s a step-by-step guide to help you navigate the enrollment process:

-

Determine Eligibility: The first step is to ensure you are eligible for Medicare Part D. Generally, individuals who are enrolled in Medicare Part A and/or Part B are eligible for Part D. However, there may be specific eligibility criteria based on your circumstances, so it's essential to review your options thoroughly.

-

Research Plan Options: With a multitude of plans available, it's crucial to research and compare different options. Consider factors such as the drugs covered, the cost of premiums, deductibles, and copayments, as well as the plan's pharmacy network. Online tools and resources provided by Medicare can assist in this process.

-

Review Formularies: Each plan has its own formulary, which is a list of drugs covered by the plan. It's essential to review these formularies to ensure that your necessary medications are included. Some plans may have multiple tiers of coverage, with different cost-sharing requirements for each tier.

-

Consider Additional Coverage: If you have a Medicare Advantage Plan (Part C), you may already have prescription drug coverage included. In this case, it's essential to review the coverage provided by your Advantage Plan and determine if additional Part D coverage is necessary.

-

Choose a Plan: Once you've researched and compared your options, it's time to select a plan that best meets your needs. Consider your budget, the medications you require, and any additional benefits the plan may offer.

-

Enroll: Enrollment in Medicare Part D can be done online, by phone, or through the mail. The enrollment period typically occurs annually, but there may be special enrollment periods for individuals who qualify based on specific circumstances. Ensure you enroll during the appropriate period to avoid any delays in coverage.

💡 Pro Tip: If you are new to Medicare Part D, it's advisable to consult with a healthcare professional or a trusted advisor who can guide you through the process and help you choose a plan that aligns with your unique healthcare needs.

Maximizing Your Medicare Part D Benefits

Once enrolled in a Medicare Part D plan, it’s essential to understand how to maximize your benefits. Here are some key strategies to ensure you get the most out of your coverage:

-

Review Your Plan Annually: Medicare Part D plans can change from year to year, so it's crucial to review your plan annually to ensure it still meets your needs. Changes in your health status, medication requirements, or plan offerings may necessitate a switch to a different plan.

-

Utilize Mail-Order Pharmacies: Many Medicare Part D plans offer a reduced cost for a 90-day supply of medications when ordered through a mail-order pharmacy. This can be a cost-effective way to obtain your medications, especially if you require ongoing maintenance medications.

-

Explore Generic and Therapeutic Alternatives: Brand-name drugs often have generic equivalents that are just as effective but significantly cheaper. Additionally, your healthcare provider may be able to prescribe therapeutic alternatives that are covered by your plan at a lower cost.

-

Understand the Coverage Gap: While the coverage gap, or "donut hole," can be a challenge, it's essential to understand how it works and what resources are available to help. The Medicare.gov website provides tools and resources to help you navigate this period and maximize your savings.

-

Stay Informed About Your Medications: Keep a list of all your medications, including the dosage and frequency. This information is crucial when discussing your coverage with your healthcare provider or when comparing plans during the annual enrollment period.

-

Explore Financial Assistance Programs: If you have limited means, there may be financial assistance programs available to help cover the cost of your medications. Organizations like NeedyMeds and the Partnership for Prescription Assistance offer resources and guidance to help you access these programs.

The Future of Medicare Part D: Trends and Innovations

Medicare Part D continues to evolve, with ongoing efforts to improve access, affordability, and quality of care for beneficiaries. Here are some key trends and innovations shaping the future of Medicare Part D:

-

Value-Based Insurance Design (VBID): VBID is an innovative approach that tailors insurance benefits to the specific needs of individuals. It aims to reduce costs and improve outcomes by providing enhanced coverage for certain high-value services or medications. This approach has the potential to significantly impact the design and structure of Medicare Part D plans in the future.

-

Integration with Medicare Advantage Plans: Medicare Advantage Plans (Part C) are becoming increasingly popular, and many now include prescription drug coverage. As the integration between Part C and Part D continues to evolve, beneficiaries may find that a Medicare Advantage Plan offers a more comprehensive and cost-effective solution for their healthcare needs.

-

Enhanced Technology and Digital Tools: Technology is playing an increasingly important role in healthcare, and Medicare Part D is no exception. From online enrollment and plan comparison tools to digital prescription management and drug pricing apps, technology is making it easier for beneficiaries to navigate the complexities of Part D.

-

Focus on Chronic Disease Management: With an aging population and a rising prevalence of chronic diseases, there is a growing emphasis on managing these conditions effectively. Medicare Part D plans are increasingly incorporating strategies to improve medication adherence and chronic disease management, leading to better health outcomes and reduced costs.

-

Collaboration with Pharmaceutical Companies: To improve access to medications and reduce costs, Medicare Part D plans are collaborating with pharmaceutical companies to negotiate lower prices and develop innovative payment models. These partnerships have the potential to significantly impact the affordability and availability of medications for beneficiaries.

As the healthcare landscape continues to evolve, Medicare Part D remains a vital component of the U.S. healthcare system. By understanding the intricacies of this program, beneficiaries can make informed decisions about their healthcare and ensure they have access to the medications they need. With ongoing innovations and a focus on improving access and affordability, Medicare Part D is poised to play an even more significant role in the years to come.

What is the difference between Medicare Part D and a Medicare Advantage Plan (Part C) with prescription drug coverage?

+Medicare Part D is a standalone prescription drug coverage plan, while a Medicare Advantage Plan (Part C) is a bundled plan that includes Part A, Part B, and often Part D coverage. Part D plans are offered by private insurance companies, while Medicare Advantage Plans are offered by private companies approved by Medicare. The key difference is that Part D plans are separate add-ons to Original Medicare, while Medicare Advantage Plans are all-in-one alternatives to Original Medicare.

Can I change my Medicare Part D plan during the year?

+Generally, you can only change your Medicare Part D plan during the annual enrollment period, which typically runs from October 15 to December 7. However, there are special enrollment periods for certain circumstances, such as moving to a new plan service area or losing other drug coverage. It’s important to review the specific rules and guidelines for changing plans to ensure you meet the eligibility criteria.

What happens if I don’t enroll in Medicare Part D when I’m first eligible?

+If you don’t enroll in Medicare Part D when you’re first eligible, you may face a late enrollment penalty. This penalty is calculated as a percentage increase in your monthly premium, and it can be permanent. However, there are certain circumstances, such as having creditable prescription drug coverage from another source, that may exempt you from this penalty. It’s important to review your options carefully to avoid unnecessary penalties.