Affordable Pet Insurance For Dogs

Pet insurance is an essential aspect of responsible pet ownership, providing peace of mind and financial security for unexpected veterinary expenses. With the rising costs of medical care, it's crucial to find affordable coverage for your furry companions, especially for dog owners. In this comprehensive guide, we will explore the world of affordable pet insurance for dogs, delving into the various options, coverage details, and key considerations to help you make an informed decision.

Understanding the Basics of Pet Insurance for Dogs

Pet insurance, often referred to as veterinary insurance, is a type of health insurance designed specifically for pets. It operates similarly to human health insurance, offering coverage for various medical conditions and treatments. For dog owners, it can provide significant financial relief, ensuring that your beloved canine companion receives the necessary care without straining your wallet.

When it comes to pet insurance for dogs, there are two primary types: accident-only insurance and comprehensive coverage. Accident-only insurance, as the name suggests, covers injuries resulting from accidents, such as broken bones or lacerations. On the other hand, comprehensive coverage provides a wider range of benefits, including accidents, illnesses, and even routine care. It's essential to understand the differences between these options to choose the most suitable coverage for your dog's needs.

Key Benefits of Pet Insurance for Dogs

- Financial Protection: Pet insurance acts as a safety net, covering a portion of the veterinary bills, which can be particularly beneficial for unexpected emergencies or chronic conditions.

- Peace of Mind: Knowing that your dog’s health is financially protected allows you to focus on their well-being without worrying about the cost of treatment.

- Broad Coverage: Comprehensive plans often include coverage for a wide range of conditions, from common illnesses to specialized treatments, ensuring your dog receives the best care possible.

- Routine Care: Some plans cover routine procedures like vaccinations and annual check-ups, helping you stay on top of your dog’s preventive healthcare.

Exploring Affordable Pet Insurance Options

When it comes to finding affordable pet insurance for your dog, there are several key factors to consider. From comparing plans and providers to understanding the coverage limits and exclusions, this section will guide you through the process of selecting the most cost-effective option without compromising on essential benefits.

Comparing Pet Insurance Providers

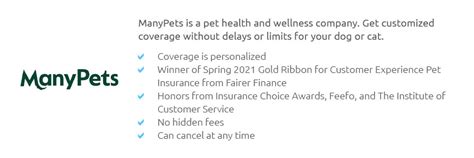

The pet insurance market is diverse, with numerous providers offering a range of plans and coverage options. To find the most affordable and suitable insurance for your dog, it’s crucial to compare different providers. Consider factors such as their reputation, customer reviews, and the breadth of their coverage. Some well-known pet insurance providers include:

- Embrace Pet Insurance: Known for their comprehensive coverage and innovative wellness plans, Embrace offers customizable policies with flexible deductibles and reimbursement options.

- Healthy Paws Pet Insurance: Renowned for their straightforward and comprehensive coverage, Healthy Paws provides unlimited payouts for life, ensuring your dog’s long-term health needs are met.

- Petplan: Petplan offers a wide range of customizable plans, allowing you to choose the level of coverage that suits your budget and your dog’s specific needs.

When comparing providers, pay attention to their claim processes, customer service reputation, and any additional perks they offer, such as discounts for multiple pets or loyalty programs.

Understanding Coverage Limits and Exclusions

To truly assess the affordability of a pet insurance plan, it’s essential to understand its coverage limits and exclusions. Here’s a breakdown of what you should consider:

- Annual Coverage Limits: Some plans have a maximum payout per year, which can impact the affordability of long-term treatments or chronic conditions. Opt for a plan with higher annual limits to ensure comprehensive coverage.

- Per-Incident Limits: These limits specify the maximum payout per incident. Higher limits are beneficial for unexpected emergencies or surgeries.

- Pre-Existing Condition Exclusions: Most insurance providers exclude coverage for pre-existing conditions. However, some offer waiting periods instead, allowing you to enroll your dog before any known issues arise.

- Routine Care Exclusions: While some plans cover routine procedures, others may exclude them. Consider whether these services are essential for your dog’s well-being and choose a plan accordingly.

Tailoring Coverage to Your Dog’s Needs

Every dog is unique, and their insurance needs may vary based on factors like breed, age, and lifestyle. This section will guide you through the process of selecting the right coverage level and understanding the impact of different plan features on affordability.

Selecting the Right Coverage Level

Determining the appropriate coverage level for your dog involves considering their age, breed, and potential health risks. Here’s a breakdown to help you make an informed decision:

- Puppies and Young Dogs: For puppies and young dogs, comprehensive coverage is often the best choice. This ensures they receive the necessary care as they grow and develop, covering any unexpected accidents or illnesses.

- Senior Dogs: As dogs age, they become more susceptible to certain health conditions. Opt for a plan with higher coverage limits and consider adding optional riders for specific conditions like joint issues or dental care.

- Breed-Specific Concerns: Certain dog breeds are prone to specific health issues. Research your breed’s common conditions and choose a plan that offers coverage for these potential concerns.

Understanding Plan Features and Their Impact

Pet insurance plans come with various features and options, and understanding these can help you tailor coverage to your budget and your dog’s needs. Here’s what to consider:

- Deductibles: Plans often offer different deductible options. Higher deductibles result in lower premiums, making insurance more affordable. However, be mindful of your financial capabilities and choose a deductible that aligns with your budget.

- Reimbursement Options: Some plans offer 100% reimbursement, while others provide a percentage of the veterinary bill. Understand the reimbursement process and calculate the potential out-of-pocket costs to ensure affordability.

- Optional Riders: Additional riders, such as coverage for specific conditions or routine care, can enhance your plan’s benefits. Evaluate your dog’s needs and decide whether these riders are necessary or a worthwhile investment.

Maximizing Affordability: Tips and Strategies

Finding affordable pet insurance for your dog involves more than just comparing plans. This section will provide practical tips and strategies to help you make the most of your insurance coverage, from enrolling at the right time to utilizing preventive care and understanding the benefits of wellness plans.

Enrolling at the Right Time

Timing is crucial when it comes to pet insurance. Enrolling your dog early, ideally as a puppy, can result in more affordable premiums. Younger dogs are less likely to have pre-existing conditions, and their insurance coverage can grow with them, providing long-term protection.

Additionally, consider enrolling your dog before any known health issues arise. Some providers offer a waiting period for pre-existing conditions, allowing you to secure coverage while managing existing health concerns.

Utilizing Preventive Care

Preventive care plays a significant role in maintaining your dog’s health and can also impact the affordability of insurance. Regular check-ups, vaccinations, and parasite control measures can help prevent serious health issues down the line. Look for pet insurance plans that cover a portion of these preventive services to encourage proactive healthcare.

The Benefits of Wellness Plans

Wellness plans, often offered as add-ons or separate policies, provide coverage for routine care and preventive services. These plans can include vaccinations, flea and tick prevention, spaying or neutering, and even routine dental care. By investing in a wellness plan, you can ensure your dog receives the necessary preventive care while also saving on out-of-pocket expenses.

Real-Life Case Studies: Affordable Pet Insurance in Action

To illustrate the impact of affordable pet insurance, let’s explore a few real-life case studies. These stories will showcase how pet insurance has provided financial relief and peace of mind to dog owners, covering a range of scenarios from emergency surgeries to chronic conditions.

Emergency Surgery: A Lifeline for a Beloved Companion

Meet Luna, a 3-year-old Labrador Retriever who suddenly developed a severe gastrointestinal issue. Her owners, John and Sarah, had enrolled Luna in a comprehensive pet insurance plan when she was a puppy. When Luna required emergency surgery, the insurance coverage came to the rescue.

The surgery and post-operative care cost John and Sarah 7,000. With their pet insurance plan, they received an 80% reimbursement, reducing their out-of-pocket expenses to 1,400. The insurance coverage not only provided financial relief but also ensured Luna received the best possible care without delay.

Chronic Condition Management: A Lifelong Journey

Max, a 7-year-old Golden Retriever, was diagnosed with hip dysplasia, a common condition in his breed. His owners, Emily and David, had enrolled Max in a pet insurance plan with high coverage limits and optional riders for joint issues.

Over the years, Max’s condition required ongoing treatment, including medications, physical therapy, and specialized surgeries. With their insurance coverage, Emily and David were able to focus on Max’s well-being without worrying about the financial burden. The plan covered a significant portion of the costs, ensuring Max received the necessary care throughout his journey with hip dysplasia.

Preventive Care Success: A Healthy and Happy Dog

Meet Bella, a 2-year-old mixed breed dog with a playful personality. Her owners, Mike and Rachel, enrolled Bella in a wellness plan alongside their comprehensive pet insurance policy. The wellness plan covered Bella’s annual check-ups, vaccinations, and parasite control measures.

Through regular preventive care, Bella remained healthy and active. The wellness plan not only saved Mike and Rachel money on these routine services but also ensured Bella’s overall well-being. By staying on top of her preventive care, Bella’s owners were able to catch potential issues early, preventing more serious health concerns down the line.

Future Implications and Industry Insights

The pet insurance industry is constantly evolving, and understanding its future trends and potential developments is essential for long-term planning. This section will explore the industry’s growth, technological advancements, and the impact of changing consumer preferences.

Industry Growth and Trends

The pet insurance market is experiencing significant growth, driven by increasing awareness among pet owners and the rising costs of veterinary care. As more people recognize the benefits of pet insurance, the industry is expanding, offering a wider range of coverage options and innovative features.

Key trends include the development of more specialized plans, catering to specific breed-related conditions, and the integration of technology for easier claim processes and policy management.

Technological Advancements in Pet Insurance

Technology is playing a pivotal role in shaping the future of pet insurance. Many providers are leveraging digital platforms and mobile apps to enhance the customer experience. From online claim submissions to real-time policy management, technology is streamlining the insurance process and making it more accessible.

Additionally, the use of wearable devices and health monitoring technologies is gaining traction. These devices can provide valuable health data for pets, helping insurers offer more personalized coverage and potentially reducing premiums for proactive pet owners.

Changing Consumer Preferences

As pet owners become more educated about their options, consumer preferences are evolving. There’s a growing demand for comprehensive coverage, including wellness plans and preventive care benefits. Pet owners are seeking insurance plans that align with their values, prioritizing both their pet’s well-being and financial security.

Furthermore, the rise of subscription-based models and customizable plans is catering to the diverse needs of pet owners. These innovative approaches allow consumers to tailor their insurance coverage to their budget and their pet's unique requirements.

| Provider | Coverage Highlights |

|---|---|

| Embrace Pet Insurance | Customizable plans, wellness coverage, flexible deductibles |

| Healthy Paws Pet Insurance | Unlimited lifetime payouts, comprehensive coverage |

| Petplan | Wide range of customizable plans, breed-specific options |

Can I enroll my dog in pet insurance if they already have a pre-existing condition?

+While most pet insurance providers exclude coverage for pre-existing conditions, some offer waiting periods or optional riders that can provide coverage for specific conditions. It’s essential to review the policy details and discuss your dog’s health history with the provider to understand the available options.

How much does pet insurance typically cost for a dog?

+The cost of pet insurance for dogs can vary widely based on factors such as the coverage level, deductibles, and the dog’s age and breed. On average, monthly premiums can range from 20 to 100 or more. However, the exact cost will depend on the specific plan and provider you choose.

What should I do if my dog requires emergency veterinary care but I haven’t yet enrolled in pet insurance?

+In an emergency, the priority is your dog’s health. Contact a nearby veterinary clinic and explain the situation. Many clinics offer payment plans or financing options to help cover the costs. Consider enrolling your dog in pet insurance as soon as possible to provide financial protection for future medical needs.