Liability Insurance For Professionals

In today's complex and ever-evolving professional landscape, the concept of liability and its management has become increasingly crucial. As professionals strive to navigate the intricate web of legal and ethical responsibilities, liability insurance emerges as a vital tool to mitigate risks and safeguard both their interests and those of their clients.

Understanding Liability Insurance for Professionals

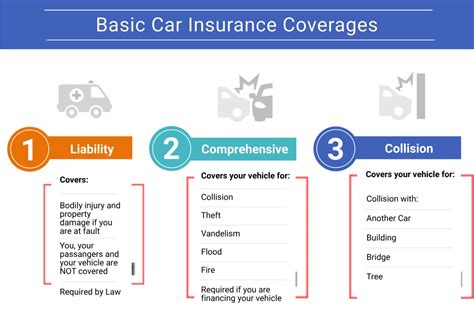

Liability insurance, a specialized form of coverage, is designed to protect professionals from financial losses arising from claims of negligence, errors, or omissions made against them in the course of their work. This insurance provides a crucial safety net, ensuring that professionals can continue to operate with confidence, knowing they have a robust defense mechanism in place should any unforeseen circumstances arise.

The scope of liability insurance for professionals is broad, covering a wide array of potential risks. From simple oversight to significant errors that could lead to substantial financial losses for clients, liability insurance offers a comprehensive solution. This type of insurance is particularly relevant for professionals in fields where the consequences of mistakes can be severe, such as healthcare, finance, law, and engineering.

In the healthcare industry, for instance, a single medical error can have devastating consequences for patients and significant financial implications for healthcare providers. Liability insurance ensures that medical professionals are protected from the potential financial ruin that could result from such incidents. Similarly, in the legal field, liability insurance safeguards attorneys from the high costs associated with malpractice suits, which could otherwise cripple their practices.

The Importance of Tailored Coverage

While the general concept of liability insurance is consistent across various professional fields, the specific coverage needs can vary significantly. Each profession has its unique set of risks and potential liabilities, which necessitates tailored insurance solutions.

Consider the example of a software development company. While software professionals may not face the same physical risks as, say, construction workers, they are exposed to a different set of liabilities. A simple bug in their software could lead to significant data loss or system failure for their clients, resulting in substantial financial damages. Liability insurance for software developers needs to account for these specific risks, offering coverage for the potential costs of such incidents.

In contrast, a construction company would require liability insurance that covers physical injuries and property damage, common risks in the construction industry. This highlights the need for customized insurance policies that address the unique challenges and potential liabilities specific to each profession.

Key Considerations for Professionals

When navigating the complex world of liability insurance, professionals must consider several critical factors to ensure they obtain the most suitable coverage.

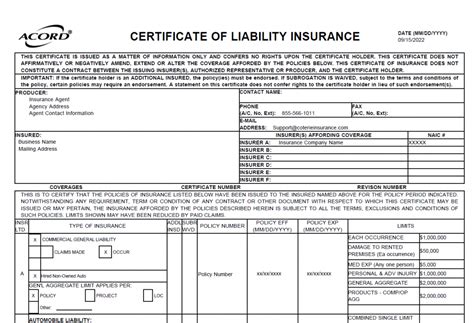

Understanding Policy Limits

Liability insurance policies come with defined limits, specifying the maximum amount the insurance company will pay for a covered claim. These limits can vary significantly depending on the profession and the specific risks involved. It is crucial for professionals to understand these limits and ensure they are adequate to cover potential losses.

| Professional Field | Average Policy Limit |

|---|---|

| Healthcare (Medical Practitioners) | $1,000,000 per incident |

| Legal Services | $500,000 per claim |

| Engineering Firms | $2,000,000 aggregate limit |

The table above provides a glimpse into the varying policy limits for different professional fields. These limits can significantly impact the financial protection offered by the insurance policy, making it vital for professionals to carefully review and understand their policy limits.

Exclusions and Deductibles

Like any insurance policy, liability insurance policies also come with certain exclusions, which are situations or claims that are not covered by the policy. Professionals need to thoroughly review these exclusions to ensure they are not leaving themselves vulnerable to significant risks. Additionally, liability insurance policies often include deductibles, which are the amounts that the insured must pay out of pocket before the insurance coverage kicks in. Understanding these deductibles is crucial to avoid any surprises in the event of a claim.

The Role of Professional Reputation

Beyond the financial protection it offers, liability insurance also plays a significant role in maintaining the professional reputation of individuals and businesses. In many industries, having adequate liability insurance is not just a recommendation but a requirement for maintaining professional licenses or certifications. It demonstrates a commitment to ethical practice and client protection, which can enhance the credibility and trustworthiness of the professional in the eyes of clients and peers.

Case Studies: Real-World Applications

To illustrate the practical implications of liability insurance, let’s explore two case studies that highlight its critical role in protecting professionals and their clients.

Case Study 1: Legal Malpractice

A prominent law firm, specializing in corporate law, faced a significant challenge when one of their associates made a critical error in drafting a merger agreement. This error led to a multimillion-dollar loss for their client, a large multinational corporation. The client sued the law firm for malpractice, seeking compensation for their financial losses.

In this scenario, the law firm's liability insurance policy played a crucial role. The policy covered the costs of defending the firm against the malpractice suit, including legal fees and potential settlement costs. The insurance provider also offered support and guidance throughout the legal process, ensuring the firm could focus on their core business while the insurance experts handled the complex legal proceedings.

Case Study 2: Medical Negligence

A respected medical clinic specializing in cosmetic surgery faced a patient lawsuit claiming negligence. The patient alleged that the clinic’s negligence during a routine procedure led to severe complications, requiring additional surgeries and extensive medical treatment. The patient sought significant compensation for their physical and emotional suffering, as well as the additional medical expenses.

In this case, the medical clinic's liability insurance policy provided the necessary financial support to cover the potential compensation costs. The policy also offered crisis management support, helping the clinic navigate the public relations challenges that often accompany such high-profile lawsuits. With the insurance provider's assistance, the clinic was able to manage the situation effectively, minimizing the impact on their reputation and financial stability.

Future Trends and Implications

As we look ahead, several emerging trends are shaping the landscape of liability insurance for professionals. One significant trend is the increasing focus on cyber liability insurance, given the rising prevalence of cyber threats and data breaches. With the rapid digital transformation across industries, professionals are increasingly exposed to cyber risks, making this type of insurance an essential addition to their liability coverage.

Another emerging trend is the shift towards more holistic insurance solutions. Instead of standalone liability policies, professionals are seeking comprehensive coverage that combines various types of insurance, such as liability, property, and business interruption insurance. This approach offers a more integrated and efficient risk management solution, ensuring professionals are adequately protected across a wide range of potential risks.

Furthermore, with the rise of remote work and the gig economy, there is a growing need for liability insurance that caters to the unique risks associated with these new work arrangements. This includes coverage for professionals working remotely, as well as insurance solutions for freelancers and independent contractors, who often face unique liability challenges.

In conclusion, liability insurance is an indispensable tool for professionals across a wide range of industries. It provides a vital safety net, offering financial protection and peace of mind, while also playing a critical role in maintaining professional reputation and credibility. As professionals navigate the complex and ever-changing landscape of liability risks, liability insurance remains a cornerstone of effective risk management.

What is the typical cost of liability insurance for professionals?

+The cost of liability insurance for professionals can vary widely depending on factors such as the type of profession, the level of risk involved, and the coverage limits. On average, professionals can expect to pay anywhere from a few hundred to several thousand dollars per year for liability insurance. It’s important to note that the cost of insurance can also be influenced by the insurer’s perception of the risk associated with the profession and the individual’s claim history.

How do I choose the right liability insurance policy for my profession?

+When selecting a liability insurance policy, it’s crucial to consider the specific risks and potential liabilities associated with your profession. Work with an insurance broker or agent who specializes in professional liability insurance to understand your options. Review the policy limits, exclusions, and deductibles carefully to ensure the policy aligns with your needs. Additionally, consider the insurer’s reputation, financial stability, and claims handling process to ensure you’re getting a reliable and responsive insurance partner.

Can I get liability insurance if I work in a high-risk profession?

+Yes, even professionals in high-risk professions can obtain liability insurance. However, it’s important to note that the cost and coverage limits for high-risk professions may be higher compared to lower-risk professions. Insurers may also have specific requirements or exclusions for high-risk professions. It’s advisable to work with an insurance broker who specializes in such professions to find the right coverage and ensure you’re adequately protected.