Recommended Auto Insurance Coverage

Choosing the right auto insurance coverage is crucial to ensure you have adequate protection on the road. The coverage options available to you can vary depending on your location and specific needs. This comprehensive guide will delve into the essential aspects of auto insurance, helping you make informed decisions to safeguard your vehicle and finances.

Understanding Auto Insurance Coverage

Auto insurance provides financial protection against potential risks associated with owning and operating a vehicle. It offers coverage for various situations, including accidents, theft, natural disasters, and other unforeseen events. Understanding the different types of coverage and their benefits is key to tailoring your insurance policy to your specific circumstances.

Liability Coverage

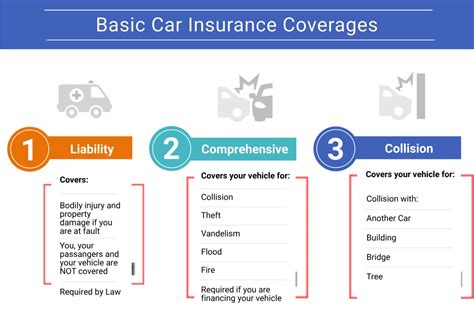

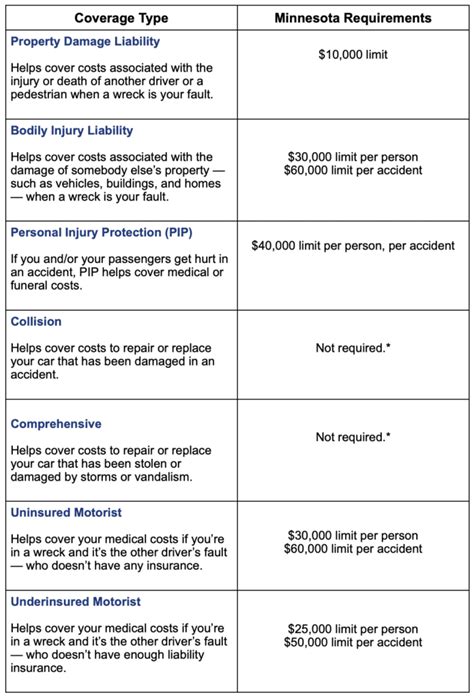

Liability coverage is a fundamental aspect of auto insurance. It protects you from financial responsibility if you cause an accident that results in injuries or property damage to others. This coverage typically includes:

- Bodily Injury Liability: Pays for medical expenses and lost wages of individuals injured in an accident you caused.

- Property Damage Liability: Covers the cost of repairing or replacing damaged property belonging to others, such as their vehicles or other assets.

Most states require drivers to carry a minimum amount of liability coverage to operate a vehicle legally. However, it’s often advisable to opt for higher limits to provide greater financial protection in case of severe accidents.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional but highly recommended. These coverages offer protection for your own vehicle in various situations:

- Collision Coverage: Pays for repairs or the replacement cost of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or hitting an animal.

While these coverages may come at an additional cost, they provide essential protection for your vehicle’s value and ensure you’re not left with unexpected expenses.

Medical Payments Coverage

Medical Payments Coverage, often referred to as MedPay, provides additional coverage for medical expenses incurred by you or your passengers in an accident, regardless of fault. It can cover a range of expenses, including:

- Doctor and hospital visits.

- Emergency medical services.

- Ambulance fees.

- Funeral costs.

MedPay can be a valuable addition to your policy, ensuring quick access to funds for medical care without waiting for liability claims to be resolved.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage (UM/UIM) is designed to protect you when involved in an accident with a driver who has little or no insurance. It covers your medical expenses, lost wages, and other damages when the at-fault driver’s insurance is insufficient to cover your losses.

UM/UIM coverage is particularly important as it ensures you’re not left financially burdened when dealing with an uninsured or underinsured driver. It provides a safety net to help cover your costs and can be a crucial aspect of your overall insurance protection.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a no-fault insurance coverage that provides benefits for policyholders and their passengers regardless of who caused an accident. It covers medical expenses, lost wages, and other related costs. PIP is mandatory in some states and offers comprehensive protection for personal injuries sustained in auto accidents.

Factors Affecting Auto Insurance Coverage

When determining your auto insurance coverage needs, several factors come into play. Understanding these factors can help you make informed choices and potentially save money on your premiums.

Vehicle Value and Usage

The value and usage of your vehicle are crucial considerations. If you own a newer, more expensive vehicle, you’ll want to ensure it’s adequately covered in case of accidents or theft. On the other hand, if you have an older vehicle with low market value, you may choose to opt for more basic coverage to keep costs down.

State Laws and Requirements

State laws dictate the minimum coverage requirements for auto insurance. It’s essential to be aware of these regulations to ensure you’re meeting the legal obligations in your state. However, it’s always advisable to consider going beyond the minimum requirements to provide better protection for yourself and your vehicle.

Your Personal Financial Situation

Your financial situation plays a significant role in determining your insurance coverage. Consider your ability to pay for repairs or replacement costs out of pocket. If you have substantial savings or emergency funds, you may be comfortable with higher deductibles or lower coverage limits to reduce your insurance premiums.

Risk Factors and Driving History

Insurance companies assess various risk factors when determining your premiums. These include your driving history, age, gender, and the location where you primarily drive. If you have a clean driving record and are considered a low-risk driver, you may qualify for lower premiums and have more flexibility in choosing your coverage levels.

Tailoring Your Auto Insurance Coverage

Now that we’ve covered the essential types of coverage and the factors influencing your choices, let’s explore how to tailor your auto insurance policy to your specific needs.

Assessing Your Risk Profile

Start by evaluating your risk profile. Consider your driving habits, the type of vehicle you own, and the areas you frequently drive in. Are you a cautious driver with a safe record, or do you frequently commute in high-risk areas? Assessing your risk profile can help you choose the right coverage levels and potential discounts.

Choosing the Right Deductibles

Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Choosing the right deductible can significantly impact your premium costs. Higher deductibles generally result in lower premiums, while lower deductibles provide more financial protection but come with higher premiums.

Consider your financial situation and comfort level with risk when selecting your deductible. If you can afford to pay a higher deductible in case of an accident, you can potentially save money on your insurance premiums.

Exploring Discounts and Savings

Insurance companies often offer a variety of discounts to help reduce your premiums. Some common discounts include:

- Safe Driver Discount: Rewards drivers with clean records and no recent accidents or violations.

- Multi-Policy Discount: Offers savings when you bundle your auto insurance with other policies, such as homeowners or renters insurance.

- Loyalty Discount: Recognizes long-term customers who have maintained their insurance coverage with the same provider.

- Good Student Discount: Provides savings for students with good academic standing, often applicable for young drivers.

Ask your insurance provider about available discounts and ensure you’re taking advantage of all applicable savings.

Reviewing Coverage Limits

Review the coverage limits on your policy regularly. Ensure they align with your current needs and circumstances. As your financial situation changes, you may want to increase or decrease certain coverage limits to maintain an optimal balance between protection and affordability.

The Importance of Regular Reviews

Auto insurance coverage is not a one-time decision. Regular reviews of your policy are essential to ensure it remains adequate and cost-effective. Life circumstances can change, and so can your insurance needs. Here’s why regular reviews are crucial:

Changing Circumstances

Life events such as marriage, buying a new home, or having children can impact your insurance needs. Review your policy whenever significant changes occur to ensure your coverage remains up-to-date and provides the protection you require.

Market Changes and New Offerings

The insurance market is dynamic, with providers regularly introducing new products and services. Regular reviews allow you to stay informed about potential cost savings and enhanced coverage options. You may discover new discounts or coverage features that better suit your needs.

Keeping Up with Legal Requirements

State laws and insurance regulations can change over time. Regular policy reviews ensure you’re aware of any updates and maintain compliance with legal requirements. Failing to keep up with these changes could result in fines or penalties.

Maximizing Savings and Benefits

Insurance providers often offer promotional rates or limited-time discounts. By regularly reviewing your policy, you can take advantage of these opportunities and potentially save money on your premiums. Additionally, reviewing your coverage allows you to assess whether you’re taking advantage of all applicable discounts and benefits.

Future Trends and Considerations

The auto insurance industry is constantly evolving, driven by technological advancements and changing consumer needs. Here are some future trends and considerations to keep in mind:

Telematics and Usage-Based Insurance

Telematics technology allows insurance providers to track driving behavior and offer policies based on actual usage. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive, uses telematics to monitor driving habits and adjust premiums accordingly. This trend provides an opportunity for safe drivers to potentially save on insurance costs.

Connected Car Technology

With the increasing integration of connected car technology, insurance providers are exploring new ways to offer personalized coverage. Connected cars can provide real-time data on vehicle performance, driving behavior, and even potential accidents. This data can be used to offer more accurate and tailored insurance policies.

Autonomous Vehicles and Liability

The rise of autonomous vehicles presents new challenges for the insurance industry. As self-driving cars become more prevalent, questions arise about liability in the event of an accident. Insurance providers are actively researching and developing coverage options to address these emerging risks.

Environmental Considerations

The push for more sustainable and environmentally friendly practices is impacting the insurance industry. Some providers are offering incentives for drivers who opt for electric or hybrid vehicles, recognizing the reduced environmental impact of these choices. Additionally, insurance policies may begin to factor in eco-friendly driving behaviors.

Conclusion

Choosing the right auto insurance coverage is a critical decision that impacts your financial well-being and peace of mind. By understanding the different types of coverage, assessing your specific needs, and regularly reviewing your policy, you can ensure you’re adequately protected on the road. Stay informed about industry trends and consider the future of auto insurance as you make decisions about your coverage.

What is the average cost of auto insurance in the United States?

+The average cost of auto insurance in the U.S. varies widely depending on factors such as location, age, and driving history. According to the Insurance Information Institute, the national average annual premium for auto insurance in 2021 was approximately $1,674. However, rates can range from a few hundred dollars to several thousand dollars per year.

How can I lower my auto insurance premiums?

+There are several strategies to reduce your auto insurance premiums. These include shopping around for quotes from different insurers, maintaining a clean driving record, increasing your deductible, taking advantage of discounts (such as safe driver or multi-policy discounts), and considering usage-based insurance if available.

What happens if I don’t have auto insurance and get into an accident?

+If you’re involved in an accident and don’t have auto insurance, you’ll be personally responsible for all costs associated with the accident, including repairs to your vehicle, medical expenses for yourself and others, and any property damage. In addition, you may face legal consequences, including fines and potential suspension of your driver’s license.