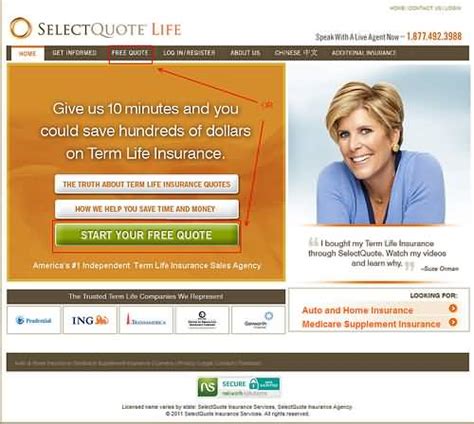

Life Insurance Select Quote

Welcome to a comprehensive guide on Life Insurance Select Quote, an innovative approach to protecting your future and ensuring financial security for your loved ones. In today's fast-paced world, it's crucial to have a reliable life insurance plan that suits your unique needs. This expert-led article will delve into the specifics of Select Quote, exploring its features, benefits, and how it can provide peace of mind for you and your family.

Understanding Life Insurance Select Quote

Select Quote is a revolutionary concept in the life insurance industry, offering a personalized and efficient way to secure coverage. Unlike traditional methods, Select Quote leverages technology to provide a seamless experience, connecting individuals with multiple top-rated insurance carriers. This approach ensures a competitive and tailored solution for your life insurance needs.

With Select Quote, the process begins with a simple online application. By providing essential details, you receive a personalized quote that considers your age, health status, and desired coverage amount. This transparent approach empowers you to make informed decisions, ensuring you get the best value for your money.

Key Features of Select Quote Life Insurance

- Customized Plans: Select Quote understands that every individual has unique circumstances. Their platform offers a wide range of customizable plans, including term life, whole life, and universal life insurance. This flexibility ensures you can choose a plan that aligns perfectly with your financial goals and family's needs.

- Competitive Rates: By partnering with multiple insurance providers, Select Quote can negotiate competitive rates on your behalf. Their extensive network allows for a thorough comparison of quotes, ensuring you receive the most cost-effective option available in the market.

- Streamlined Process: The traditional life insurance application process can be lengthy and cumbersome. Select Quote simplifies this by offering a digital application platform. You can complete the process online, saving you valuable time and effort. Additionally, their expert agents guide you through every step, ensuring a smooth and stress-free experience.

- Instant Quotes: One of the standout features of Select Quote is its ability to provide instant quotes. With just a few clicks, you can receive a personalized quote tailored to your requirements. This instant feedback helps you make quick decisions and take control of your financial planning.

- Expert Guidance: Behind the scenes, Select Quote employs a team of experienced insurance professionals. These experts are dedicated to helping you find the right coverage. They provide unbiased advice, ensuring you understand the nuances of different plans and make an informed choice.

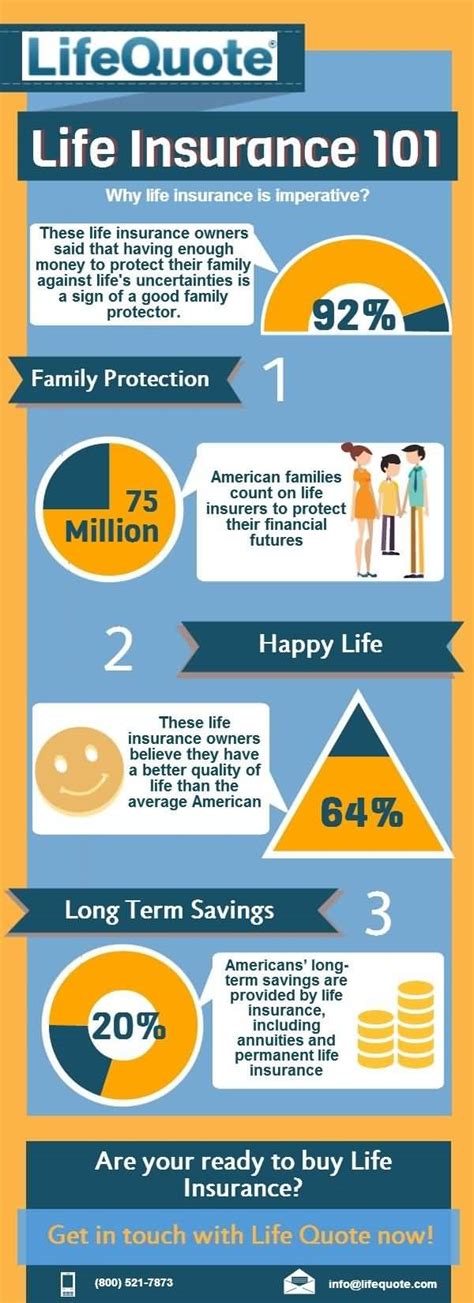

The Benefits of Choosing Select Quote

Opting for Life Insurance Select Quote offers a multitude of advantages, setting it apart from traditional insurance providers. Here's a deeper look at the benefits you can expect:

Convenience and Accessibility

In today's busy world, convenience is key. Select Quote understands this and has designed its platform to be easily accessible. Whether you're a busy professional or a stay-at-home parent, you can access their services from the comfort of your home or on the go. The digital application process eliminates the need for in-person meetings, saving you time and providing unparalleled convenience.

| Benefit | Description |

|---|---|

| Online Application | Complete your application anytime, anywhere, with no need for physical paperwork. |

| Digital Document Upload | Easily upload required documents, making the process paperless and efficient. |

| Real-time Updates | Receive instant notifications and updates on the status of your application. |

Personalized Coverage

Select Quote believes in a personalized approach to life insurance. By offering a wide range of plan options, they ensure that your coverage is tailored to your specific needs. Whether you're looking for short-term protection or a long-term investment, they have a plan to suit your goals. This flexibility is a significant advantage, as it allows you to adapt your coverage as your life circumstances change.

Competitive Pricing

One of the most attractive features of Select Quote is its ability to provide competitive pricing. By comparing quotes from multiple insurance carriers, they can negotiate the best rates on your behalf. This means you can secure high-quality coverage without breaking the bank. Their transparent pricing structure ensures you always know what you're paying for and why.

Expert Support

Behind the scenes, Select Quote has a dedicated team of insurance experts. These professionals are not only knowledgeable about the industry but also passionate about helping individuals like you. They provide personalized guidance, answering any questions you may have and ensuring you understand the fine print. With their support, you can make confident decisions about your life insurance coverage.

How Select Quote Works

The Select Quote process is designed to be straightforward and user-friendly. Here's a step-by-step breakdown of how it works:

Step 1: Application

The journey begins with a simple online application. You'll provide basic information about yourself, including your name, contact details, and desired coverage amount. This initial step is quick and easy, ensuring you can get started without any hassle.

Step 2: Quote Comparison

Once you've submitted your application, Select Quote's advanced system goes to work. It connects with multiple insurance carriers, gathering quotes based on your specified needs. This process is automated, ensuring accuracy and efficiency. Within minutes, you'll receive a personalized quote, giving you a clear understanding of your options.

Step 3: Expert Review

Select Quote's team of experts reviews your application and the quotes generated. They assess your unique circumstances and provide valuable insights. This review process ensures that the recommended plan aligns perfectly with your goals and budget. Their expertise adds an extra layer of confidence to your decision-making.

Step 4: Policy Selection

With a clear understanding of your options, it's time to select your life insurance policy. Select Quote's platform makes this step simple and transparent. You can review the details of each plan, compare prices, and make an informed choice. Their user-friendly interface ensures a seamless experience, allowing you to choose the policy that best fits your needs.

Step 5: Policy Issuance

Once you've selected your policy, the final step is to complete the issuance process. This involves providing additional details and finalizing your coverage. Select Quote's team guides you through this process, ensuring all necessary paperwork is completed accurately. With their support, you can rest assured that your policy is set up correctly and ready to provide the protection you need.

Select Quote's Commitment to Excellence

At Select Quote, excellence is not just a goal; it's a promise. They are committed to delivering exceptional service and ensuring your satisfaction at every step. Here's how they maintain their high standards:

Transparent Pricing

Select Quote believes in transparency. They provide clear and concise pricing information, ensuring you understand the cost of your coverage. There are no hidden fees or surprises. Their commitment to transparency builds trust and ensures you can make informed decisions about your life insurance.

Unbiased Advice

The Select Quote team is dedicated to providing unbiased advice. They work for you, not the insurance companies. Their experts offer impartial guidance, helping you navigate the complex world of life insurance. This ensures that the plan you choose is truly the best fit for your needs, not just the most profitable option for the provider.

Exceptional Customer Service

Select Quote prides itself on its exceptional customer service. Their team is readily available to answer your questions and address any concerns. Whether you need assistance with your application, have questions about your policy, or require support during a claim, they are there for you. Their responsive and friendly approach ensures a positive experience throughout your journey with Select Quote.

Frequently Asked Questions

What is the average cost of life insurance through Select Quote?

+The cost of life insurance through Select Quote varies depending on several factors, including your age, health status, and the coverage amount you choose. On average, a 30-year-old non-smoker can expect to pay around $20 to $30 per month for a $500,000 term life insurance policy. However, your individual quote may differ, and it's best to use Select Quote's online tools to get a personalized estimate.

Can I get life insurance if I have pre-existing health conditions?

+Yes, Select Quote works with a wide range of insurance carriers, many of whom offer coverage for individuals with pre-existing health conditions. While the cost and coverage options may vary, Select Quote's experts can help you find a plan that suits your needs and budget.

How long does it take to receive a quote from Select Quote?

+Select Quote's advanced system provides instant quotes upon completion of your online application. You can expect to receive a personalized quote within minutes, allowing you to make quick decisions about your life insurance coverage.

Can I customize my life insurance policy with Select Quote?

+Absolutely! Select Quote offers a wide range of customizable life insurance plans. Whether you're looking for term life, whole life, or universal life insurance, their platform allows you to tailor your coverage to your specific needs and financial goals.

What happens if I need to make a claim with Select Quote?

+In the event of a claim, Select Quote's dedicated team is there to guide you through the process. They provide step-by-step support, ensuring your claim is handled efficiently and with compassion. Their expertise ensures a smooth and timely resolution, providing the financial protection you need during difficult times.

Life Insurance Select Quote offers a modern and efficient approach to securing your future. With its personalized plans, competitive rates, and expert guidance, it’s a reliable choice for anyone seeking peace of mind. Remember, life insurance is an essential part of financial planning, and Select Quote is here to make that process as simple and stress-free as possible.