Car Insurance Firms List

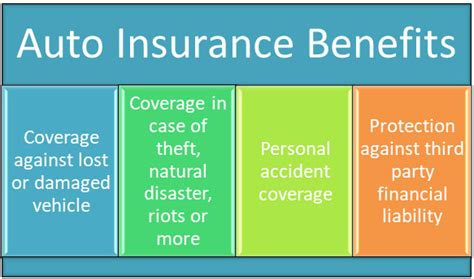

Welcome to this comprehensive guide on the world of car insurance. In this article, we will delve into the realm of automotive protection, exploring the top insurance firms that offer coverage tailored to your vehicle and driving needs. With the right insurance, you can navigate the roads with peace of mind, knowing you're protected against unforeseen circumstances. So, let's embark on this journey and discover the leading companies in the industry, their unique offerings, and how they can provide you with the security you deserve.

The Elite League of Car Insurance Providers

When it comes to safeguarding your vehicle, choosing the right insurance firm is crucial. These companies specialize in providing comprehensive coverage plans that cater to various driver profiles and vehicle types. From well-established industry giants to innovative startups, each firm brings its own unique set of advantages and features to the table. Let’s explore some of the top players in the car insurance market and understand what makes them stand out.

State Farm: A Trusted Companion for Your Journey

State Farm is a name synonymous with reliability and customer satisfaction in the insurance industry. With a rich history spanning over 90 years, they have built a reputation for being a trusted partner for millions of drivers across the United States. Their comprehensive car insurance policies offer a wide range of coverage options, including liability, collision, comprehensive, and personal injury protection.

One of the standout features of State Farm is their commitment to personalized service. Their agents take the time to understand your specific needs and tailor a policy that fits your budget and requirements. Whether you're a safe driver looking for discounts or a young driver seeking affordable coverage, State Farm has a plan for you. Additionally, they offer a user-friendly digital platform for easy policy management and claims processing, ensuring a seamless experience for their customers.

Geico: Innovation Meets Affordability

Geico, or Government Employees Insurance Company, has become a household name in the car insurance industry. Known for their catchy advertising campaigns and innovative approach, Geico has successfully combined affordability with comprehensive coverage. Their policies are designed to cater to a diverse range of drivers, making insurance accessible to all.

One of the key strengths of Geico is their focus on digital transformation. With a user-friendly website and mobile app, customers can easily manage their policies, file claims, and access various services with just a few clicks. Geico also offers a variety of discounts, including multi-policy, safe driver, and military discounts, making their policies even more attractive. Additionally, their 24/7 customer support ensures that you can always reach out for assistance, no matter the time or day.

Progressive: Empowering Drivers with Choices

Progressive Insurance has been a trailblazer in the industry, known for its customer-centric approach and innovative products. With a mission to empower drivers, Progressive offers a wide array of coverage options, allowing customers to customize their policies according to their preferences and needs.

Progressive's Name Your Price tool is a game-changer, enabling drivers to set their desired price range and receive customized policy options accordingly. This unique feature gives customers control over their insurance costs, ensuring they get the coverage they need without breaking the bank. Additionally, Progressive offers a variety of discounts, such as the Snapshot program, which rewards safe driving habits with potential premium discounts.

Allstate: The Good Hands People

Allstate Insurance is renowned for its commitment to customer service and comprehensive coverage. With a strong network of local agents, Allstate provides personalized guidance to help drivers choose the right insurance plan. Their policies offer a wide range of coverage options, including liability, collision, medical payments, and uninsured motorist protection.

Allstate's Drivewise program is a popular feature that encourages safe driving habits. By installing a small device in your vehicle, Allstate tracks your driving behavior and provides feedback on areas where you can improve. Based on your safe driving habits, you may be eligible for premium discounts, making insurance more affordable. Additionally, Allstate offers a variety of other discounts, including multi-policy, safe driver, and good student discounts.

USAA: Dedicated to Serving Military Families

USAA Insurance is a unique player in the market, catering specifically to military personnel, veterans, and their families. With a strong focus on serving those who serve our country, USAA has built a reputation for exceptional customer service and affordable insurance options.

USAA offers a range of car insurance policies tailored to the needs of military families. Their policies provide comprehensive coverage, including liability, collision, and comprehensive protection. Additionally, USAA understands the unique challenges faced by military personnel, such as frequent relocations and deployments. They offer flexible payment options and specialized coverage for military vehicles, ensuring that their members are always protected.

Performance Analysis and Key Features

Now that we’ve explored some of the top car insurance firms, let’s delve into a performance analysis and highlight the key features that set them apart. By understanding these aspects, you can make an informed decision when choosing an insurance provider.

| Insurance Firm | Coverage Options | Discounts | Digital Services | Customer Satisfaction |

|---|---|---|---|---|

| State Farm | Comprehensive, liability, collision, personal injury protection | Multi-policy, safe driver, good student | Online policy management, mobile app, 24/7 customer support | High customer satisfaction, known for personalized service |

| Geico | Affordable, comprehensive coverage | Multi-policy, safe driver, military | User-friendly website, mobile app, 24/7 customer support | Excellent customer service, known for digital innovation |

| Progressive | Customizable coverage, Name Your Price tool | Snapshot program, multi-policy, safe driver | Digital platform for policy management, claims processing | Strong focus on customer empowerment and choice |

| Allstate | Comprehensive, liability, collision, medical payments, uninsured motorist | Drivewise program, multi-policy, safe driver, good student | Online policy management, mobile app, 24/7 customer support | Renowned for personalized guidance and customer service |

| USAA | Tailored to military families, comprehensive coverage | Military-specific discounts, flexible payment options | Online and mobile services, specialized military coverage | Exceptional customer service, dedicated to military personnel |

Future Implications and Industry Trends

As the car insurance industry continues to evolve, several trends and advancements are shaping the future of automotive protection. Here are some key implications and insights to consider:

- Telematics and Usage-Based Insurance: The use of telematics devices and usage-based insurance programs is gaining popularity. These technologies track driving behavior and reward safe drivers with potential premium discounts, encouraging safer driving habits.

- Digital Transformation: Insurance firms are increasingly investing in digital platforms and mobile apps to enhance the customer experience. Easy policy management, seamless claims processing, and 24/7 customer support are becoming standard expectations.

- Personalized Coverage: The trend towards customized insurance plans is growing. Firms like Progressive are leading the way with tools like Name Your Price, allowing customers to tailor their policies to their specific needs and budgets.

- Emerging Technologies: The rise of autonomous vehicles and electric cars is expected to impact the insurance industry. Firms are exploring new coverage options and risk assessment methods to accommodate these emerging technologies.

- Data Analytics: Advanced data analytics and machine learning are being utilized to improve risk assessment and pricing accuracy. This allows insurance firms to offer more precise and tailored policies, benefiting both customers and the industry.

Frequently Asked Questions

How do I choose the right car insurance firm for me?

+

Choosing the right car insurance firm involves considering several factors. Evaluate your specific needs, such as coverage requirements, budget, and any discounts you may be eligible for. Research the reputation and customer satisfaction of different firms, and compare their coverage options, discounts, and digital services. It’s also beneficial to read reviews and seek recommendations from trusted sources.

What are some common discounts offered by car insurance firms?

+

Car insurance firms offer a variety of discounts to attract and reward customers. Common discounts include multi-policy discounts for bundling multiple insurance types, safe driver discounts for maintaining a clean driving record, and good student discounts for young drivers with good academic performance. Other discounts may include military service, loyalty, and vehicle safety features.

How can I save money on my car insurance policy?

+

To save money on your car insurance policy, consider shopping around and comparing quotes from different firms. Look for discounts that you may qualify for, such as safe driver or good student discounts. Additionally, maintain a good driving record and avoid accidents or violations, as this can impact your premium. Explore options like increasing your deductible or reducing certain coverage limits if you’re comfortable with a higher level of risk.

What factors impact car insurance rates?

+

Several factors influence car insurance rates, including your age, driving record, location, and the type of vehicle you drive. Insurance firms use these factors to assess risk and determine premiums. Other factors may include the level of coverage you choose, any additional drivers on your policy, and the specific discounts you qualify for.

How do I file a car insurance claim?

+

To file a car insurance claim, you’ll typically need to contact your insurance provider and provide details about the incident, such as the date, time, location, and any relevant information about the other party involved. Your insurance company will guide you through the claims process, which may involve submitting documentation, such as police reports or repair estimates. It’s important to cooperate with your insurer and provide accurate information to ensure a smooth claims process.