Motorcycle Insurers

The world of motorcycle insurance is a vital yet often overlooked aspect of motorcycling. It's a realm where enthusiasts and experts alike must navigate complex policies, intricate coverage options, and unique challenges to ensure they're adequately protected on the road. With the right insurance, motorcyclists can ride with peace of mind, knowing they're covered for a variety of situations. However, choosing the right insurance provider and policy can be a daunting task, which is why understanding the ins and outs of motorcycle insurance is crucial.

Understanding Motorcycle Insurance Policies

Motorcycle insurance policies are designed to provide financial protection to motorcycle owners and riders in the event of an accident, theft, or other unforeseen circumstances. These policies typically cover a range of scenarios, including liability, collision, comprehensive, and personal injury protection. Let’s delve deeper into each of these coverages to understand their importance and how they can benefit motorcyclists.

Liability Coverage

Liability coverage is a fundamental aspect of any insurance policy, and it’s no different for motorcycles. This type of coverage protects the insured rider from financial responsibility in the event they cause an accident that results in bodily injury or property damage to others. It’s a critical component, as it ensures the rider can fulfill their legal obligations and avoid personal financial ruin in the aftermath of an accident.

Liability coverage typically includes two main components: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and lost wages for injured parties, while property damage liability covers the cost of repairing or replacing damaged property, such as other vehicles, fences, or buildings. The limits for these coverages are typically expressed in three numbers, such as 100/300/100, which represent the maximum amount the insurer will pay per person, per accident, and per accident for property damage, respectively.

| Component | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injured parties. |

| Property Damage Liability | Covers the cost of repairing or replacing damaged property. |

Collision Coverage

Collision coverage is designed to protect the motorcycle itself. It covers the cost of repairing or replacing the insured motorcycle after an accident, regardless of who is at fault. This coverage is particularly beneficial for motorcyclists, as motorcycles can be more vulnerable to damage than cars due to their smaller size and unique design.

When selecting collision coverage, riders should consider the age and value of their motorcycle. For older motorcycles, it may not be cost-effective to pay for collision coverage, as the premiums could exceed the potential payout. However, for newer or more expensive bikes, collision coverage is often a wise investment to ensure the motorcycle is protected.

Comprehensive Coverage

Comprehensive coverage provides protection for situations other than collisions. This can include damage caused by fire, theft, vandalism, or natural disasters. It’s an important coverage to have, as it offers a broader level of protection beyond what collision coverage provides.

Like collision coverage, the cost of comprehensive coverage can vary based on the age and value of the motorcycle. Riders should carefully consider their individual circumstances and the potential risks they face to determine whether comprehensive coverage is a worthwhile investment.

Personal Injury Protection (PIP)

Personal Injury Protection, often referred to as PIP, is a crucial coverage for motorcyclists, given the increased risk of injury they face compared to car drivers. PIP provides coverage for medical expenses, lost wages, and other related costs resulting from an accident, regardless of who is at fault.

In some states, PIP is a mandatory coverage, while in others, it's optional. Regardless, it's a coverage that every motorcyclist should strongly consider, as it can provide significant financial protection in the event of an accident.

Choosing the Right Motorcycle Insurer

With a solid understanding of the different types of motorcycle insurance coverage, the next step is selecting the right insurer. This decision is critical, as it can impact the level of protection and the overall cost of insurance.

Factors to Consider

When choosing a motorcycle insurer, several factors should be taken into account. These include the insurer’s reputation, financial stability, the range of coverage options they offer, and their claims handling process.

Reputation and financial stability are key indicators of an insurer's reliability. A reputable insurer with a strong financial standing is more likely to be able to pay out claims promptly and fairly. Additionally, they are more likely to have a proven track record of customer satisfaction.

The range of coverage options an insurer offers is also important. Some insurers may specialize in certain types of motorcycles or offer unique coverage add-ons that cater to specific needs. For example, some insurers offer coverage for custom modifications or for racing motorcycles.

The claims handling process is another critical factor. A good insurer should have a straightforward, efficient claims process that ensures riders receive the compensation they're entitled to in a timely manner. Reviews and testimonials from existing or past customers can provide valuable insights into an insurer's claims handling process.

Comparing Quotes

Once you’ve identified a few potential insurers, the next step is to compare quotes. This involves obtaining quotes from each insurer for the same level of coverage to ensure an accurate comparison.

When comparing quotes, pay attention not just to the premium amount, but also to the specific coverages included and any exclusions or limitations. Some insurers may offer lower premiums but with more restrictive coverage, so it's important to carefully review the policy details.

Additionally, consider any discounts that may be available. Many insurers offer discounts for a variety of reasons, such as safe riding practices, multiple policy discounts (e.g., bundling motorcycle insurance with home or auto insurance), or even discounts for certain professions or affiliations.

Specialty Insurers vs. General Insurers

There are two main types of insurers: specialty insurers and general insurers. Specialty insurers focus specifically on motorcycle insurance, while general insurers offer a wide range of insurance products, including motorcycle insurance.

Specialty insurers often have a deeper understanding of the unique needs and risks associated with motorcycles. They may offer more tailored coverage options and be more flexible in accommodating the specific needs of motorcyclists. However, they may also have more limited resources or a smaller customer base, which could impact their financial stability or the range of coverage options they can offer.

General insurers, on the other hand, offer a broader range of insurance products, which can provide convenience for those who have multiple insurance needs. They may also have a larger customer base and more financial resources. However, they may not have the same level of specialization in motorcycle insurance as specialty insurers.

The Benefits of Comprehensive Motorcycle Insurance

Comprehensive motorcycle insurance offers a wide range of benefits that go beyond the basic liability coverage. It provides peace of mind and financial protection for a variety of situations, ensuring that motorcyclists are covered not just for accidents, but also for other unforeseen events.

Protection Against Theft and Vandalism

One of the key advantages of comprehensive insurance is the protection it offers against theft and vandalism. Motorcycles, especially high-end or customized models, can be attractive targets for thieves. Comprehensive insurance covers the cost of replacing the stolen motorcycle or repairing any damage caused by vandalism.

In addition, comprehensive coverage often includes provisions for personal belongings stored on the motorcycle, such as helmets, jackets, or other riding gear. This can provide added peace of mind, knowing that even personal items are protected.

Coverage for Natural Disasters and Other Incidents

Comprehensive insurance also covers damage caused by natural disasters, such as hurricanes, floods, or earthquakes. These events can cause significant damage to motorcycles, and without comprehensive coverage, riders may be left to bear the cost of repairs or replacements out of pocket.

Furthermore, comprehensive insurance often covers incidents such as fire, falling objects, or collisions with animals. These are events that may not be covered by standard collision insurance, highlighting the value of comprehensive coverage.

Roadside Assistance and Additional Benefits

Many comprehensive insurance policies include roadside assistance, which can be a lifesaver in emergency situations. This service provides assistance for a variety of issues, including flat tires, dead batteries, or even running out of fuel. It ensures that motorcyclists can get back on the road quickly and safely.

In addition, some comprehensive policies offer additional benefits such as rental car coverage, which can provide a temporary replacement vehicle while the insured motorcycle is being repaired. This can be particularly valuable for riders who rely on their motorcycles as their primary mode of transportation.

The Impact of Motorcycle Insurance on Riding Experience

Motorcycle insurance plays a crucial role in the overall riding experience. It provides a safety net that allows riders to enjoy the freedom of the open road without worrying about financial repercussions in the event of an accident or other unforeseen incidents. However, the impact of insurance goes beyond just providing financial protection.

Peace of Mind and Riding Confidence

Having adequate insurance coverage gives riders peace of mind, knowing they are protected in the event of an accident or other emergency. This peace of mind can enhance the riding experience, allowing riders to focus on the joy of riding rather than potential risks or financial concerns.

Additionally, comprehensive insurance can provide added confidence for riders. Knowing they are covered for a wide range of situations, from theft and vandalism to natural disasters and medical emergencies, can give riders the assurance they need to fully embrace the riding lifestyle.

Impact on Riding Behavior

Insurance can also have an impact on riding behavior. Riders with comprehensive insurance may feel more encouraged to take safety precautions, knowing they are protected in a variety of situations. This can lead to safer riding practices and potentially reduce the risk of accidents.

On the other hand, riders without insurance or with inadequate coverage may be more likely to engage in risky behavior, as they have less to lose financially in the event of an accident. This highlights the importance of having adequate insurance coverage, not just for personal protection, but also for promoting safer riding practices.

Future Trends in Motorcycle Insurance

The world of motorcycle insurance is continually evolving, with new technologies and changing consumer needs driving innovation in the industry. As we look to the future, several key trends are likely to shape the landscape of motorcycle insurance.

Technological Advancements

Advancements in technology are expected to play a significant role in the future of motorcycle insurance. For example, the increasing use of telematics devices in motorcycles could provide insurers with more accurate data on riding behavior, which could lead to more personalized and accurate insurance policies.

Additionally, the development of autonomous motorcycles and advanced safety features could potentially reduce the risk of accidents, leading to lower insurance premiums for riders. These technological advancements could also enable insurers to offer more innovative coverage options, such as usage-based insurance or coverage for specific riding conditions.

Changing Consumer Needs and Preferences

The changing preferences and needs of consumers are also likely to influence the future of motorcycle insurance. As more riders embrace the riding lifestyle, there may be a growing demand for coverage that caters to specific riding activities or interests. For example, insurers may start offering coverage for off-road riding, track days, or even motorcycle touring.

Furthermore, the increasing focus on sustainability and environmental consciousness may lead to a shift towards electric motorcycles. Insurers may need to adapt their policies to accommodate this shift, potentially offering incentives or discounts for riders who choose electric motorcycles.

Regulatory Changes and Industry Collaboration

Regulatory changes and industry collaboration are other factors that could shape the future of motorcycle insurance. As governments and regulatory bodies continue to review and update insurance regulations, insurers will need to adapt their policies and practices accordingly.

Additionally, collaboration between insurers, motorcycle manufacturers, and other industry stakeholders could lead to the development of innovative insurance products or services. For example, partnerships between insurers and motorcycle manufacturers could result in bundled insurance packages that offer discounts or other benefits to riders who purchase certain motorcycle models.

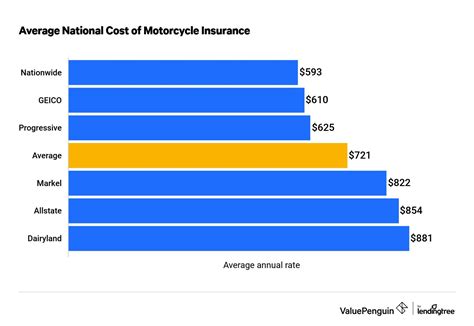

What is the average cost of motorcycle insurance?

+The average cost of motorcycle insurance can vary significantly depending on several factors, including the rider’s age, riding experience, the make and model of the motorcycle, and the level of coverage desired. On average, motorcycle insurance can range from 200 to 500 per year for basic liability coverage, but it can be much higher for more comprehensive coverage or for high-risk riders. It’s important to shop around and compare quotes from multiple insurers to find the best coverage at the most competitive price.

How does my riding experience impact my insurance rates?

+Your riding experience is a key factor in determining your insurance rates. Generally, the more experience you have as a rider, the lower your insurance rates are likely to be. Insurers view experienced riders as lower risk, as they have a better understanding of road conditions and are more likely to have developed safe riding habits. However, this does not mean that new riders are automatically considered high-risk. Many insurers offer discounts or special rates for new riders who complete approved safety courses or have a clean driving record.

What factors can lead to higher insurance premiums for motorcyclists?

+Several factors can lead to higher insurance premiums for motorcyclists. These include having a history of traffic violations or accidents, riding a high-performance or high-value motorcycle, living in an area with high crime rates or frequent natural disasters, and being a younger or less experienced rider. Additionally, certain modifications to your motorcycle, such as adding a racing kit or custom exhaust, can also increase your insurance premiums, as these modifications can affect the bike’s performance and safety.