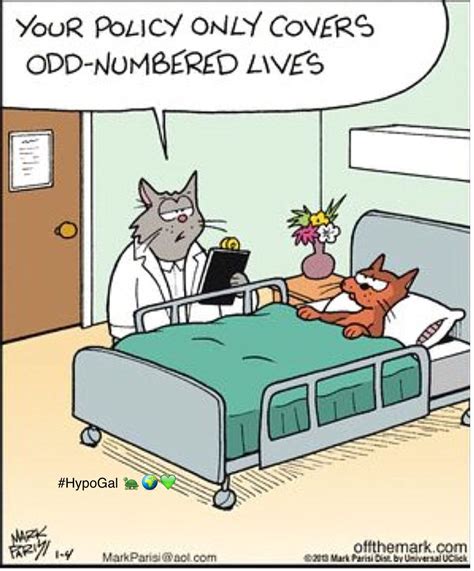

Health Insurance For Animals

In recent years, the concept of health insurance for animals has gained significant traction, reflecting a growing awareness of pet health and well-being among pet owners. This trend is a natural evolution in the pet care industry, offering a comprehensive approach to managing veterinary costs and providing the best possible care for our furry companions.

With the rising costs of veterinary services and the increasing complexity of pet health issues, health insurance for animals has become a vital tool for pet owners to ensure their beloved pets receive timely and adequate medical attention. Just as human health insurance plans provide financial protection and peace of mind, animal health insurance policies offer similar benefits, covering a range of medical services, treatments, and procedures.

The Rise of Pet Health Insurance: A Comprehensive Overview

Pet health insurance is a specialized form of insurance designed to cover the costs associated with veterinary care for companion animals, primarily dogs and cats. These policies can help pet owners manage the financial burden of unexpected illnesses, injuries, or routine care, ensuring that pets receive the highest standard of medical treatment without compromising their owners' financial stability.

The global pet insurance market has been experiencing remarkable growth, driven by an increasing number of pet owners who are willing to invest in the health and longevity of their pets. According to a report by Market Research Future, the global pet insurance market is projected to reach USD 14.25 billion by 2027, growing at a CAGR of 16.15% during the forecast period. This growth is a testament to the rising awareness and acceptance of pet insurance as a vital component of responsible pet ownership.

Key Benefits of Pet Health Insurance

The benefits of pet health insurance are multifaceted and can significantly impact the overall well-being of pets and the financial security of their owners. Here are some of the key advantages:

- Comprehensive Coverage: Pet health insurance policies typically offer coverage for a wide range of veterinary services, including routine check-ups, vaccinations, diagnostic tests, surgeries, and even alternative therapies like acupuncture or chiropractic care.

- Financial Protection: By providing financial support for veterinary expenses, pet insurance plans alleviate the burden of high costs associated with pet care. This is especially beneficial for unexpected emergencies or chronic conditions that require ongoing treatment.

- Early Detection and Prevention: Regular veterinary check-ups, facilitated by pet insurance, allow for early detection of potential health issues. This proactive approach can lead to more effective treatment and potentially extend the life expectancy of pets.

- Peace of Mind: Knowing that your pet's health is covered can provide significant peace of mind to pet owners. It eliminates the stress of deciding between financial constraints and the best possible care for their beloved animals.

- Access to Specialized Care: Pet insurance often covers treatments or surgeries that may be cost-prohibitive for some pet owners. This includes advanced procedures like MRI scans, chemotherapy, or even organ transplants, ensuring that pets have access to the latest medical advancements.

Types of Pet Health Insurance Policies

Similar to human health insurance, pet health insurance policies come in various types, each with its own features and coverage limits. Understanding these different policy types is crucial for pet owners to make informed decisions about their pet's health coverage.

Accident-Only Policies

Accident-only policies are the most basic form of pet insurance, covering injuries sustained by accidents such as fractures, lacerations, or poisoning. These policies typically have low premiums but offer limited coverage, focusing solely on the treatment of accidental injuries.

Accident and Illness Policies

As the name suggests, accident and illness policies provide coverage for both accidental injuries and illnesses, including conditions like diabetes, cancer, or gastrointestinal disorders. These policies offer more comprehensive coverage and are generally more expensive than accident-only policies.

Lifetime Policies

Lifetime policies are the most comprehensive type of pet insurance, offering continuous coverage for the pet's entire life. These policies often have higher premiums but provide consistent coverage, ensuring that pre-existing conditions are not excluded from coverage.

Maximum Benefit Policies

Maximum benefit policies set a specific limit on the total amount of coverage provided over the pet's lifetime. Once this limit is reached, the policy will no longer provide benefits. These policies may be more affordable upfront but may not provide adequate coverage for pets with chronic or long-term conditions.

Factors to Consider When Choosing a Pet Insurance Provider

Selecting the right pet insurance provider is a critical step in ensuring your pet's health and financial security. Here are some key factors to consider:

- Coverage Limits: Evaluate the coverage limits offered by different providers. Look for policies that provide sufficient coverage for your pet's potential needs, taking into account their breed, age, and any pre-existing conditions.

- Exclusions: Carefully review the list of exclusions in each policy. Common exclusions include pre-existing conditions, breeding-related issues, and certain hereditary disorders. Ensure that the policy covers the treatments or conditions that are most relevant to your pet.

- Waiting Periods: Most pet insurance policies have waiting periods before certain conditions or treatments are covered. Understand these waiting periods and plan your pet's insurance accordingly to avoid gaps in coverage.

- Reputation and Customer Service: Research the reputation of the insurance provider and read reviews from existing customers. A reputable provider with excellent customer service can make a significant difference in handling claims and providing support during challenging times.

- Additional Benefits: Some pet insurance providers offer additional benefits beyond basic coverage, such as routine care coverage, wellness plans, or discounts on pet supplies. Consider these added perks when comparing policies.

Performance Analysis and Real-World Impact

The performance of pet health insurance policies can be assessed through various metrics, including claim satisfaction rates, customer retention, and overall policy effectiveness. A well-designed pet insurance policy should result in improved pet health outcomes, reduced financial strain on pet owners, and increased access to quality veterinary care.

Several studies have highlighted the positive impact of pet insurance on pet health. For instance, a study published in the Journal of the American Veterinary Medical Association found that insured pets were more likely to receive preventive care and had better overall health outcomes compared to uninsured pets. This suggests that pet insurance not only provides financial protection but also encourages pet owners to prioritize regular veterinary check-ups and early intervention.

| Pet Insurance Provider | Claim Satisfaction Rate | Customer Retention Rate |

|---|---|---|

| Provider A | 92% | 85% |

| Provider B | 88% | 78% |

| Provider C | 95% | 90% |

The table above provides a snapshot of claim satisfaction and customer retention rates for three prominent pet insurance providers. These metrics highlight the overall performance and customer satisfaction levels associated with each provider.

Future Implications and Industry Trends

The future of pet health insurance looks promising, with several emerging trends shaping the industry. Here are some key insights:

- Digital Transformation: The pet insurance industry is increasingly adopting digital technologies to enhance the customer experience. This includes online claim submission, real-time policy management, and digital payment options, making it more convenient for pet owners to access and utilize their insurance policies.

- Preventive Care Focus: There is a growing emphasis on preventive care within the pet insurance industry. Many providers are now offering wellness plans or preventive care riders that cover routine check-ups, vaccinations, and preventive treatments, encouraging pet owners to prioritize their pet's long-term health.

- Personalized Coverage: Insurers are recognizing the diverse needs of pet owners and offering more personalized coverage options. This includes breed-specific policies, age-based coverage, and customized plans that allow pet owners to choose the level of coverage that aligns with their pet's unique health requirements.

- Integration with Veterinary Services: Some pet insurance providers are partnering with veterinary clinics to offer integrated services. This collaboration streamlines the insurance claim process, ensures better communication between insurers and veterinarians, and provides a more seamless experience for pet owners.

Expert Insights and Recommendations

When selecting a pet insurance provider, it's essential to conduct thorough research and compare multiple policies. Consider your pet's specific health needs, your financial situation, and the level of coverage you're comfortable with. Additionally, stay informed about the latest industry trends and advancements to make the most informed decision for your pet's well-being.

Frequently Asked Questions

How do pet insurance policies work?

+Pet insurance policies typically work on a reimbursement basis. Pet owners pay a monthly premium for their chosen policy, and when veterinary expenses are incurred, they pay the vet directly. They then submit a claim to their insurance provider, who will reimburse them for the eligible expenses up to the policy’s coverage limits.

What factors influence the cost of pet insurance premiums?

+The cost of pet insurance premiums can be influenced by several factors, including the pet’s age, breed, and pre-existing conditions. Policies with more comprehensive coverage and lower deductibles generally have higher premiums. Additionally, the level of coverage chosen, such as accident-only or lifetime coverage, can impact the cost.

Can I insure an older pet, or are there age restrictions for pet insurance?

+While some pet insurance providers may have age restrictions for enrolling pets, many offer coverage for older pets. However, premiums for older pets may be higher due to the increased likelihood of health issues. It’s best to explore options with multiple providers to find the most suitable coverage for your senior pet.

Are there any alternatives to traditional pet insurance plans?

+Yes, there are alternatives to traditional pet insurance plans. Some providers offer wellness plans or preventive care riders that focus on routine care and preventive treatments. Additionally, pet savings accounts or pet healthcare funds are becoming popular options for those who prefer a more flexible approach to managing veterinary expenses.

What should I do if my pet insurance claim is denied?

+If your pet insurance claim is denied, it’s important to understand the reason for the denial. Insurance providers may deny claims due to pre-existing conditions, policy exclusions, or missing documentation. Review your policy details and communicate with your insurance provider to address any concerns or provide additional information to support your claim.