Progressive Insurance Address

Welcome to our comprehensive guide on the Progressive Insurance Address! In today's fast-paced world, knowing where to reach out to a trusted insurance provider is crucial. Progressive Insurance, a leading name in the industry, offers a range of services to cater to its customers' needs. This article will delve into the various aspects of Progressive's address, its significance, and how it contributes to the company's success.

The Importance of Progressive Insurance’s Address

Progressive Insurance, with its innovative approach and customer-centric services, has established itself as a prominent player in the insurance market. The company’s address is not just a physical location; it represents a gateway to a vast network of services and support. Understanding the importance of this address is essential for anyone seeking reliable insurance solutions.

Headquarters and Regional Offices

Progressive Insurance operates on a national scale, with its headquarters strategically located in Mayfield Village, Ohio. This central location allows for efficient management and coordination of its operations across the United States. However, the company’s reach extends far beyond its headquarters, with regional offices spanning the country.

| Region | Address |

|---|---|

| Northeast | 5500 E Huntington Ave, Columbus, OH 43215 |

| Southeast | 12000 Fishhawk Blvd, Lithia, FL 33547 |

| Midwest | 6000 W Innovation Dr, Mason, OH 45040 |

| West | 14550 E Evans Ave, Aurora, CO 80014 |

Each regional office serves as a hub, catering to the specific needs of customers in its vicinity. This localized approach ensures that Progressive can offer personalized and timely assistance, making it a preferred choice for many.

Customer Service Excellence

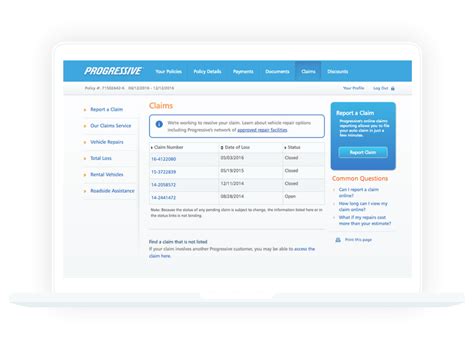

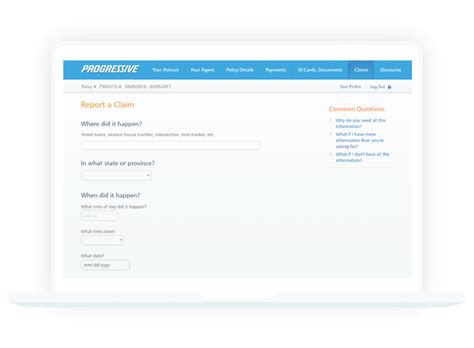

Progressive Insurance’s address is synonymous with customer service excellence. The company’s commitment to providing top-notch support is evident in its extensive network of contact centers and claims offices. These physical locations allow customers to interact with knowledgeable representatives, ensuring a seamless and efficient experience.

With a focus on convenience, Progressive has established multiple claims offices across the nation. These offices facilitate quick and efficient claim processing, minimizing the stress associated with unexpected events. Additionally, Progressive's contact centers are equipped to handle a wide range of inquiries, providing timely solutions and guidance to customers.

| Service Type | Address |

|---|---|

| Claims Office | 21212 W Florissant Ave, Phoenix, AZ 85027 |

| Contact Center | 11050 Michigan Ave, Detroit, MI 48210 |

| Claims Office | 12555 SW 112th St, Miami, FL 33186 |

| Contact Center | 2000 E Randolph St, Chicago, IL 60616 |

Progressive's customer-centric approach extends beyond its physical locations. The company leverages technology to offer 24/7 online and mobile services, ensuring that customers can access their accounts and receive assistance whenever needed. This combination of physical presence and digital innovation makes Progressive a leader in customer service.

Progressive’s Comprehensive Insurance Solutions

Beyond its physical addresses, Progressive Insurance is renowned for its comprehensive range of insurance products. The company offers auto, home, life, and business insurance, tailoring its services to meet the diverse needs of its customers.

Auto Insurance: A Tailored Approach

Progressive’s auto insurance is designed to provide customers with peace of mind. The company offers a wide range of coverage options, including liability, collision, comprehensive, and medical payments. With its Name Your Price® tool, customers can customize their policies to fit their budgets and preferences.

Furthermore, Progressive's Snapshot® program utilizes telematics technology to reward safe drivers with discounts. This innovative approach to insurance pricing has revolutionized the industry, making Progressive a trailblazer in personalized auto insurance.

Home and Life Insurance: Protection for What Matters

Progressive’s home insurance policies cover a wide range of perils, including fire, theft, and natural disasters. The company’s homeowners insurance provides comprehensive protection for dwellings, personal property, and liability. Additionally, Progressive offers renters insurance for those who lease their residences, ensuring their belongings are safeguarded.

In the realm of life insurance, Progressive provides term and whole life policies. These policies offer financial protection to individuals and their families, ensuring peace of mind during life's unforeseen events. Progressive's life insurance products are designed to be flexible and affordable, catering to a diverse range of needs.

Business Insurance: Supporting Entrepreneurs

Progressive understands the unique challenges faced by small business owners. Its business insurance solutions are tailored to provide comprehensive coverage for a variety of industries. From general liability to workers’ compensation, Progressive offers the protection entrepreneurs need to thrive.

Moreover, Progressive's commercial auto insurance covers a wide range of vehicles, including trucks, vans, and trailers. This ensures that business owners can operate their fleets with confidence, knowing they are protected.

The Impact of Progressive’s Address on its Success

Progressive Insurance’s success can be attributed, in part, to its well-established physical presence and digital innovation. The company’s strategic location and network of offices allow for efficient operations and exceptional customer service. By combining these physical assets with cutting-edge technology, Progressive has created a seamless experience for its customers.

Future Outlook and Expansion

As Progressive continues to grow, its address strategy is likely to evolve. The company may explore further expansion, opening new regional offices and contact centers to enhance its reach. Additionally, Progressive’s commitment to innovation suggests that its digital services will continue to improve, offering even more convenience to customers.

With its strong foundation and customer-centric approach, Progressive Insurance is well-positioned for continued success. The company's address remains a vital component of its operations, contributing to its reputation as a trusted and reliable insurance provider.

What are the benefits of Progressive’s Snapshot® program for auto insurance customers?

+

Progressive’s Snapshot® program offers an innovative way for drivers to save on their auto insurance premiums. By installing a small device in their vehicle or using a mobile app, drivers can provide data on their driving habits. Safe driving behaviors, such as avoiding harsh braking and maintaining a consistent speed, can lead to significant discounts on insurance policies. This program rewards responsible driving and encourages safer road practices, making it a win-win for both customers and Progressive.

How does Progressive’s Name Your Price® tool work, and what are its advantages for customers?

+

Progressive’s Name Your Price® tool is a unique feature that empowers customers to take control of their auto insurance costs. It allows individuals to input their desired monthly premium, and the tool then presents various coverage options that match their budget. This approach gives customers flexibility and control over their insurance choices. By prioritizing affordability without compromising on coverage, Progressive’s Name Your Price® tool has become a popular choice for budget-conscious drivers.

What sets Progressive’s business insurance solutions apart from its competitors, and how do they benefit small business owners?

+

Progressive’s business insurance offerings stand out due to their comprehensive nature and customization options. The company understands that every business is unique, and its insurance policies can be tailored to meet specific industry needs. From general liability coverage to specialized protections like cyber liability, Progressive ensures small businesses are adequately safeguarded. This personalized approach, combined with competitive pricing, makes Progressive a preferred choice for entrepreneurs seeking reliable business insurance.