What Is The Purpose Of Health Insurance

Health insurance is a vital component of healthcare systems worldwide, offering financial protection and access to essential medical services. It plays a crucial role in ensuring individuals can afford necessary healthcare and receive timely treatment without incurring excessive costs. Understanding the purpose of health insurance is essential for both individuals and policymakers, as it forms the foundation of a sustainable and equitable healthcare ecosystem.

Securing Financial Stability

The primary purpose of health insurance is to safeguard individuals from the potentially devastating financial burden of unexpected medical expenses. Healthcare costs can quickly escalate, especially with the advancements in medical technology and the increasing complexity of treatments. Health insurance acts as a financial safety net, covering a wide range of medical services, from routine check-ups and medications to more specialized procedures and emergency care.

By spreading the financial risk across a large pool of insured individuals, health insurance companies are able to offer coverage at more manageable rates. This ensures that even those with lower incomes or pre-existing health conditions can access quality healthcare without fear of financial ruin.

Example: Emergency Room Visits

Consider the scenario of an individual who suffers a severe injury requiring immediate medical attention. Without health insurance, the cost of emergency room treatment, diagnostic tests, and potential surgeries can easily run into thousands of dollars. However, with health insurance, a significant portion of these costs is covered, providing peace of mind during a stressful situation.

Promoting Preventive Care

Another key purpose of health insurance is to encourage individuals to prioritize preventive healthcare. By offering coverage for regular check-ups, screenings, and immunizations, health insurance providers aim to catch health issues early, when they are often more treatable and less costly to manage.

Preventive care not only benefits individuals by improving their overall health and well-being but also reduces the strain on healthcare systems. By addressing health concerns before they become severe, health insurance contributes to a more efficient and cost-effective healthcare system.

Real-World Impact: Immunization Campaigns

Health insurance plans often cover routine vaccinations, such as influenza shots or childhood immunizations. This coverage ensures that individuals can access these vital preventive measures without financial barriers. As a result, immunization rates increase, leading to reduced disease outbreaks and improved public health.

Ensuring Access to Specialized Care

Health insurance also plays a critical role in providing access to specialized medical services. Certain conditions may require highly specialized treatments or surgeries that are only available at certain healthcare facilities or from specific providers.

By including coverage for these specialized services, health insurance ensures that individuals with complex health needs can receive the appropriate care, regardless of their financial situation. This aspect of health insurance is particularly important for individuals with chronic illnesses or rare diseases.

| Specialized Treatment | Cost Range |

|---|---|

| Cancer Therapy | $50,000 - $200,000 per year |

| Organ Transplant | $250,000 - $1,000,000 |

| Advanced Neurosurgery | $50,000 - $250,000 |

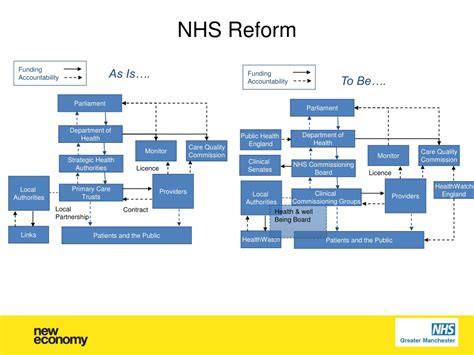

Supporting Healthcare Infrastructure

Beyond its direct benefits to individuals, health insurance also contributes to the overall sustainability of healthcare systems. By providing a stable revenue stream for healthcare providers, health insurance companies help maintain and improve the quality of healthcare infrastructure, including hospitals, clinics, and medical research facilities.

This support ensures that healthcare professionals have the resources they need to deliver high-quality care and that medical advancements can be quickly integrated into clinical practice.

Case Study: Rural Healthcare

In rural areas, where healthcare resources are often limited, health insurance plays a critical role in sustaining healthcare facilities. The steady income from insurance providers allows these facilities to maintain their operations, employ qualified staff, and provide essential services to remote communities.

Conclusion

The purpose of health insurance extends far beyond simply covering medical expenses. It serves as a cornerstone of modern healthcare systems, ensuring financial stability, promoting preventive care, and providing access to specialized treatment. By understanding and appreciating the multifaceted role of health insurance, individuals and policymakers can work together to create a more robust and equitable healthcare ecosystem.

How does health insurance impact the overall healthcare system?

+Health insurance plays a crucial role in stabilizing healthcare systems by providing a reliable funding source for medical services. It ensures that healthcare providers have the financial means to offer high-quality care, invest in medical infrastructure, and engage in ongoing research and development.

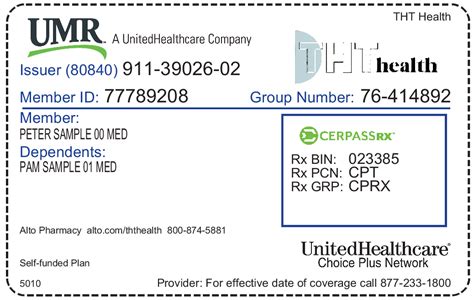

Are there different types of health insurance plans?

+Yes, there are various types of health insurance plans, including employer-sponsored plans, government-funded programs like Medicare and Medicaid, and private individual plans. Each type offers different levels of coverage, benefits, and cost structures to cater to diverse needs and budgets.

What happens if I don’t have health insurance?

+Without health insurance, individuals are at risk of facing significant financial burdens if they require medical treatment. They may be responsible for paying the full cost of medical services, which can lead to financial hardship or even bankruptcy. It’s important to explore available options to obtain coverage.