Car Insurance Review

Car insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind for drivers. With numerous insurance providers offering a wide range of policies, choosing the right coverage can be a daunting task. This comprehensive review aims to guide you through the world of car insurance, helping you make informed decisions and find the best policy for your needs. By examining key factors such as coverage options, pricing structures, customer satisfaction, and claims processes, we will delve into the intricacies of car insurance to ensure you receive the best value and protection.

Understanding the Basics: Coverage Options and Premiums

Car insurance policies offer a variety of coverage options to cater to different driving needs and preferences. The most common types of coverage include:

- Liability Coverage: This is the most basic form of insurance, protecting you against claims for bodily injury and property damage caused to others in an accident for which you are at fault. Liability coverage is mandatory in most states and is essential for protecting your assets.

- Collision Coverage: This coverage pays for the repair or replacement of your vehicle if it is damaged in a collision, regardless of fault. It provides financial protection for your car and is particularly beneficial for newer or more expensive vehicles.

- Comprehensive Coverage: This type of insurance covers damages to your vehicle that are not caused by a collision, such as theft, vandalism, natural disasters, or accidents involving animals. Comprehensive coverage is a wise choice for protecting your vehicle from unexpected events.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for the medical expenses of you and your passengers, regardless of fault, in the event of an accident. It provides crucial financial support during times of need.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has little or no insurance. It covers your medical expenses and property damage, ensuring you are not left financially burdened.

The cost of car insurance, known as the premium, varies significantly based on several factors, including your driving history, the make and model of your vehicle, your location, and the coverage options you choose. Understanding these variables is essential for obtaining the best value for your insurance needs.

Premium Factors and Savings

Insurance companies consider a multitude of factors when determining your premium. Some key factors include:

- Driving Record: A clean driving record with no accidents or violations can lead to lower premiums. Insurance companies view safe drivers as less risky, resulting in more affordable insurance.

- Vehicle Type: The make, model, and year of your vehicle play a significant role in determining your premium. Sports cars and luxury vehicles often have higher premiums due to their higher repair costs and potential for theft.

- Location: The area where you live and drive can impact your insurance rates. Urban areas with higher population densities and more traffic tend to have higher premiums due to increased accident risks.

- Usage: How you use your vehicle can affect your premium. Insurance companies often offer discounts for low-mileage drivers or those who primarily use their vehicles for pleasure rather than commuting.

- Discounts: Many insurance companies offer discounts to encourage safer driving and reduce risks. Common discounts include multi-policy discounts (bundling car insurance with other policies), safe driver discounts, good student discounts, and loyalty discounts.

By understanding these factors and shopping around for the best rates, you can find car insurance that suits your needs and budget. It’s important to compare quotes from multiple providers to ensure you’re getting the most competitive premiums.

The Insurance Shopping Process: A Step-by-Step Guide

Shopping for car insurance can be a complex process, but breaking it down into steps can make it more manageable. Here’s a comprehensive guide to help you through the insurance shopping journey:

- Assess Your Needs: Begin by evaluating your specific insurance needs. Consider factors such as the value of your vehicle, your driving habits, and any unique circumstances (e.g., teenage drivers, high-risk occupations) that may impact your insurance requirements.

- Research Insurance Companies: Research reputable insurance providers in your area. Look for companies with a solid financial rating and a good reputation for customer service and claims handling. Online reviews and industry rankings can provide valuable insights.

- Obtain Quotes: Contact multiple insurance companies or use online comparison tools to obtain quotes. Provide accurate and detailed information about your driving history, vehicle, and desired coverage options to ensure you receive accurate quotes.

- Compare Policies: Carefully compare the quotes you receive. Look beyond just the premium and consider factors such as coverage limits, deductibles, and any additional perks or discounts offered by the insurance companies. Ensure you understand the terms and conditions of each policy.

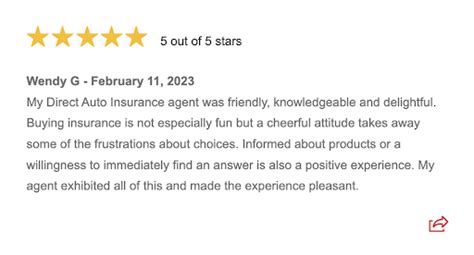

- Evaluate Customer Service and Claims Handling: Research the customer service reputation of the insurance companies you are considering. Look for companies with a history of prompt and efficient claims handling. Read online reviews and seek recommendations from friends and family to gauge customer satisfaction.

- Assess Additional Benefits and Perks: Some insurance companies offer additional benefits and perks that can enhance your coverage. These may include roadside assistance, rental car coverage, or accident forgiveness programs. Evaluate these extras to determine if they align with your needs and add value to your policy.

- Review Policy Terms and Conditions: Carefully read the policy documents provided by each insurance company. Pay attention to details such as coverage limits, exclusions, and any fine print that may impact your coverage. Ensure you understand the terms before committing to a policy.

- Choose the Right Policy: Based on your research and comparisons, select the insurance policy that best meets your needs and provides the best value for your money. Consider not only the premium but also the coverage, customer service, and overall reputation of the insurance company.

- Purchase Your Policy: Once you’ve made your decision, finalize the purchase of your chosen policy. Provide the necessary information and payment to activate your coverage. Remember to review and update your policy regularly to ensure it continues to meet your changing needs.

By following this step-by-step guide, you can navigate the car insurance shopping process with confidence and find a policy that offers the protection and value you deserve.

Claims Handling: A Critical Aspect of Car Insurance

When it comes to car insurance, the claims process is a critical aspect that can significantly impact your overall experience. How insurance companies handle claims can make a world of difference in your satisfaction and peace of mind during challenging times.

The Claims Process: A Step-by-Step Overview

The claims process typically involves the following steps:

- Report the Claim: As soon as an accident or incident occurs, it’s important to report the claim to your insurance company promptly. Most insurance providers offer multiple reporting methods, including online portals, phone calls, and mobile apps, to ensure convenience and ease of access.

- Initial Assessment: Once you’ve reported the claim, the insurance company will initiate an assessment process. This may involve gathering details about the accident, such as the date, time, location, and circumstances. They may also request photos or videos of the damage and any relevant documentation.

- Claims Adjustment: The insurance company will assign a claims adjuster to your case. The adjuster’s role is to evaluate the claim, assess the extent of the damage, and determine the appropriate coverage and compensation based on your policy terms.

- Claims Approval: After the adjuster completes their assessment, they will make a determination regarding the claim. If the claim is approved, they will authorize the necessary repairs or provide compensation based on the policy’s coverage limits.

- Repairs or Compensation: Depending on the nature of the claim, the insurance company may authorize repairs at a preferred repair shop or provide you with a rental car while your vehicle is being repaired. Alternatively, they may provide direct compensation for the value of the damage, allowing you to choose your own repair shop.

- Finalization: Once the repairs are completed or compensation is provided, the claims process is finalized. It’s important to ensure that all repairs meet your satisfaction and that any outstanding issues are addressed before closing the claim.

Key Factors in Claims Handling

When evaluating insurance companies, consider the following factors related to claims handling:

- Response Time: Look for insurance companies that prioritize prompt claim response times. Quick response can help alleviate stress and ensure timely repairs or compensation.

- Customer Service: Excellent customer service during the claims process is crucial. Seek insurance providers known for their friendly and helpful customer support teams.

- Claims Adjuster Expertise: The skills and knowledge of the claims adjuster assigned to your case can greatly impact the outcome. Look for insurance companies with experienced and fair adjusters.

- Repair Shop Options: Some insurance companies have preferred repair shops, while others allow you to choose your own. Consider your preference and evaluate the quality and reputation of the repair shops offered.

- Rental Car Coverage: If your vehicle requires repairs, having access to a rental car can be essential. Ensure your insurance policy includes rental car coverage or consider adding it as an optional coverage.

- Claims Resolution Time: Evaluate the average time it takes for insurance companies to resolve claims. Faster resolution times can minimize disruption to your daily life.

By considering these factors and researching insurance companies’ claims handling reputation, you can choose a provider that offers efficient, fair, and customer-centric claims processes.

The Future of Car Insurance: Emerging Trends and Technologies

The car insurance industry is continuously evolving, with new trends and technologies shaping the way insurance is offered and accessed. Staying abreast of these developments can help you make more informed choices and take advantage of innovative solutions.

Telematics and Usage-Based Insurance

Telematics is a technology that allows insurance companies to track and analyze driving behavior through devices installed in vehicles or smartphone apps. This data, which includes driving speed, braking habits, and mileage, is used to create personalized insurance policies known as Usage-Based Insurance (UBI) or Pay-as-You-Drive (PAYD) insurance.

UBI policies offer a more accurate assessment of risk based on individual driving habits, providing discounts to safe drivers and helping to identify high-risk behaviors. This technology encourages safer driving practices and can lead to significant savings for drivers with good habits.

Connected Car Technology

Connected car technology is revolutionizing the way vehicles interact with their surroundings and insurance providers. By integrating advanced sensors, cameras, and communication systems, connected cars can transmit real-time data about their location, speed, and driving conditions.

Insurance companies are leveraging this data to offer more precise and personalized insurance policies. For example, connected car technology can help identify and mitigate risks associated with harsh driving conditions, such as heavy rain or icy roads, leading to more accurate insurance pricing and better risk management.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the insurance industry by enabling more efficient and accurate risk assessment and claims handling processes. These technologies can analyze vast amounts of data, including driving behavior, weather conditions, and accident patterns, to identify trends and predict risks.

AI-powered systems can also automate various aspects of the insurance process, such as claim assessment and fraud detection, leading to faster and more accurate decision-making. Additionally, AI-driven chatbots and virtual assistants are enhancing customer service, providing instant support and personalized recommendations to policyholders.

Blockchain Technology

Blockchain technology, known for its secure and transparent nature, is being explored by the insurance industry to improve data sharing and reduce fraud. By creating a decentralized and tamper-proof record of insurance transactions, blockchain can enhance trust and efficiency in the insurance ecosystem.

For example, blockchain can be used to verify and store vehicle ownership records, insurance policies, and claim histories, making it easier for insurance companies to access accurate and up-to-date information. This technology can also streamline the claims process by providing a secure and transparent platform for sharing data between insurers, repair shops, and policyholders.

Digital Insurance Platforms

The rise of digital insurance platforms is transforming the way car insurance is purchased and managed. These platforms offer a convenient and user-friendly experience, allowing policyholders to purchase insurance, make changes to their policies, and file claims entirely online or through mobile apps.

Digital insurance platforms often provide real-time quotes, personalized policy recommendations, and instant policy updates, making the insurance process more efficient and accessible. Additionally, these platforms often integrate AI and machine learning technologies to enhance customer service and provide personalized insurance solutions.

FAQs

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the United States varies significantly based on factors such as location, driving record, and vehicle type. According to recent data, the average annual premium ranges from 500 to 1,500, with some states having much higher averages due to specific risk factors.

How can I lower my car insurance premiums?

+There are several strategies to reduce your car insurance premiums. These include maintaining a clean driving record, comparing quotes from multiple insurers, opting for higher deductibles, taking advantage of discounts (e.g., safe driver discounts, multi-policy discounts), and considering usage-based insurance programs that reward safe driving habits.

What factors impact my car insurance rates the most?

+The primary factors that influence car insurance rates include your driving history (accidents, violations), the make and model of your vehicle, your location (urban vs. rural, high-risk areas), and your age and gender. Insurance companies also consider your credit score and the coverage options you choose.

Is it possible to get car insurance without a driver’s license?

+Obtaining car insurance without a valid driver’s license can be challenging but not impossible. Some insurance companies may offer non-owner car insurance policies, which provide liability coverage for individuals who don’t own a vehicle but occasionally drive rented or borrowed cars. However, the availability and cost of such policies can vary significantly.

What should I do if I’m involved in a car accident?

+If you’re involved in a car accident, the first priority is ensuring the safety of all individuals involved. Call emergency services if necessary. Exchange information with the other driver(s), including names, contact details, and insurance information. Take photos of the accident scene and any damage to vehicles. Report the accident to your insurance company promptly and follow their guidance for filing a claim.