Insurance Quotes Vehicle

When it comes to insuring your vehicle, obtaining accurate and competitive insurance quotes is crucial. The process of comparing insurance quotes for your vehicle can be complex, but with the right knowledge and approach, you can secure the best coverage at an affordable price. This comprehensive guide will delve into the world of insurance quotes for vehicles, offering expert insights and practical tips to navigate this essential aspect of vehicle ownership.

Understanding Vehicle Insurance Quotes

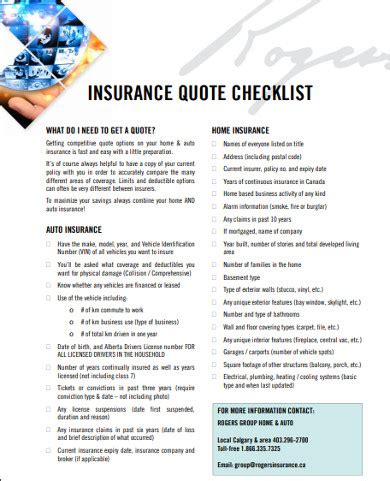

Vehicle insurance quotes are personalized assessments provided by insurance companies to determine the cost of covering your specific vehicle. These quotes are influenced by various factors, including the type of vehicle, its make and model, your driving history, and the coverage options you choose. Understanding the components that contribute to your insurance quote is key to making informed decisions.

Key Factors in Vehicle Insurance Quotes

Several critical factors play a role in determining your vehicle insurance quote. These include:

- Vehicle Type and Value: Different vehicles attract different insurance premiums. Luxury cars, sports cars, and high-performance vehicles often carry higher insurance costs due to their replacement value and potential for costly repairs.

- Make and Model: The make and model of your vehicle can impact your insurance quote. Certain makes and models may have a higher incidence of theft or be more prone to accidents, influencing the insurance rates.

- Driver’s Profile: Your driving history, age, and location significantly affect your insurance quote. Younger drivers, for instance, often pay higher premiums due to their lack of driving experience, while drivers with a clean record and mature age tend to receive more favorable rates.

- Coverage Options: The level of coverage you choose directly impacts your insurance quote. Comprehensive coverage, which includes collision and liability insurance, typically costs more than basic liability-only coverage.

- Discounts and Rewards: Many insurance companies offer discounts for various reasons, such as safe driving records, vehicle safety features, or loyalty. Understanding these discounts can help you lower your insurance costs.

The Impact of Deductibles

Deductibles are an essential aspect of vehicle insurance quotes. A deductible is the amount you agree to pay out-of-pocket in the event of a claim before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance premium, as you’re essentially agreeing to bear more of the financial risk. However, it’s crucial to select a deductible amount that you can afford in the event of an accident or claim.

| Deductible Level | Potential Premium Savings |

|---|---|

| $250 | Moderate savings |

| $500 | Significant savings |

| $1000 | Substantial savings |

Securing Competitive Insurance Quotes

Now that we’ve explored the fundamentals of vehicle insurance quotes, let’s delve into the strategies to secure the most competitive rates.

Comparing Quotes from Multiple Insurers

The key to obtaining the best insurance quote is comparison. Different insurance companies have varying pricing structures and policies, so it’s crucial to solicit quotes from multiple providers. This process allows you to identify the most favorable rates and coverage options for your specific needs.

Understanding Coverage Options

Vehicle insurance comes in various forms, each offering different levels of protection. Understanding the coverage options available is essential to tailoring your insurance policy to your needs. Here’s a breakdown of the primary coverage types:

- Liability Coverage: This is the most basic form of insurance, covering damages you cause to others’ property or injuries you inflict on others while driving. Liability coverage is mandatory in most states and is essential for protecting your assets.

- Collision Coverage: Collision coverage pays for repairs to your vehicle after an accident, regardless of who’s at fault. This coverage is particularly beneficial for newer or more valuable vehicles.

- Comprehensive Coverage: Comprehensive insurance provides protection against non-collision incidents, such as theft, vandalism, fire, or natural disasters. It’s an essential addition to your policy if you want protection beyond standard collision coverage.

- Personal Injury Protection (PIP): PIP coverage pays for medical expenses and lost wages for you and your passengers, regardless of who’s at fault in an accident. This coverage is mandatory in some states and highly recommended in others.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have sufficient insurance. It’s a vital addition to your policy to safeguard your financial well-being in such scenarios.

Utilizing Online Quote Comparison Tools

In today’s digital age, online quote comparison tools have made the process of securing insurance quotes more accessible and efficient. These tools allow you to input your vehicle and driver details and receive multiple quotes from various insurance providers. By leveraging these platforms, you can quickly identify the most competitive rates and coverage options.

Negotiating with Insurance Providers

While insurance quotes are typically based on standardized rates, there’s often room for negotiation. By discussing your specific needs and circumstances with insurance providers, you may be able to secure additional discounts or customized coverage options. Don’t be afraid to negotiate and advocate for your best interests.

Tailoring Your Insurance Coverage

The process of securing insurance quotes is just the beginning. Once you’ve obtained quotes and selected an insurer, it’s crucial to tailor your coverage to your specific needs and circumstances.

Assessing Your Risk Profile

Before finalizing your insurance coverage, take the time to assess your unique risk profile. Consider factors such as your driving history, the likelihood of accidents in your area, and the value of your vehicle. By understanding your risk profile, you can make informed decisions about the level of coverage you require.

Customizing Your Policy

Insurance policies are not one-size-fits-all. Depending on your needs and preferences, you can customize your policy to include specific endorsements or additional coverages. For instance, if you frequently drive in snowy conditions, you may want to add roadside assistance coverage. Customizing your policy ensures that you’re not paying for unnecessary coverage while still enjoying adequate protection.

Regularly Reviewing and Updating Your Policy

Your insurance needs may change over time, whether due to a new vehicle purchase, a move to a different location, or a change in your personal circumstances. It’s essential to regularly review your insurance policy and update it as necessary. This ensures that your coverage remains adequate and aligned with your current needs.

Common Pitfalls to Avoid

While securing insurance quotes and tailoring your coverage, it’s crucial to be aware of potential pitfalls that could lead to suboptimal insurance decisions.

Underestimating the Value of Comprehensive Coverage

Comprehensive coverage is often seen as an optional add-on, but it provides vital protection against a range of non-collision incidents. By skimping on comprehensive coverage, you may leave yourself vulnerable to financial losses in the event of theft, vandalism, or natural disasters. Consider the value of your vehicle and the potential risks it faces when deciding on the level of comprehensive coverage you need.

Neglecting to Shop Around

Failing to compare quotes from multiple insurers is a common mistake that can lead to overpaying for insurance. Each insurance company has its own pricing structure and policies, so it’s essential to shop around to find the best deal. By neglecting to compare quotes, you may miss out on significant savings and more favorable coverage options.

Overlooking Discounts and Rewards

Insurance companies offer a variety of discounts and rewards to attract and retain customers. These discounts can significantly reduce your insurance premium, so it’s important to be aware of them and ensure you’re taking advantage of all applicable discounts. Common discounts include safe driver discounts, loyalty rewards, and discounts for vehicle safety features.

The Future of Vehicle Insurance Quotes

The insurance industry is evolving rapidly, driven by advancements in technology and changing consumer expectations. Here’s a glimpse into the future of vehicle insurance quotes and what it could mean for policyholders.

The Rise of Telematics and Usage-Based Insurance

Telematics, the technology that allows insurance companies to monitor vehicle usage and driving behavior, is gaining traction in the insurance industry. Usage-based insurance, also known as pay-as-you-drive insurance, uses telematics to assess risk based on actual driving data rather than traditional risk factors. This shift towards usage-based insurance could lead to more personalized and potentially more affordable insurance rates for policyholders.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are increasingly being used by insurance companies to streamline processes and improve accuracy. These technologies can analyze vast amounts of data to identify patterns and predict risks, leading to more precise insurance quotes. As AI and ML continue to evolve, they’re likely to play an even bigger role in the insurance industry, potentially offering more tailored and efficient insurance solutions.

The Impact of Electric Vehicles

The rise of electric vehicles (EVs) is set to have a significant impact on the insurance industry. EVs present unique challenges and opportunities for insurers, from potential cost savings on repairs to new safety features that could reduce accident risks. As the EV market grows, insurance companies will need to adapt their policies and pricing structures to accommodate this new breed of vehicles.

Conclusion

Securing the best insurance quotes for your vehicle is a multifaceted process that requires knowledge, comparison, and customization. By understanding the factors that influence your insurance quote, leveraging online comparison tools, and tailoring your coverage to your needs, you can secure adequate protection at a competitive price. As the insurance industry continues to evolve, staying informed and proactive about your insurance decisions will be more important than ever.

How often should I review and update my insurance policy?

+It’s recommended to review your insurance policy annually or whenever there’s a significant change in your circumstances, such as a new vehicle purchase or a move to a different location. Regular reviews ensure your coverage remains adequate and aligned with your needs.

Can I negotiate my insurance rates?

+Yes, there’s often room for negotiation with insurance providers. By discussing your specific needs and circumstances, you may be able to secure additional discounts or customized coverage options. Don’t hesitate to advocate for your best interests.

What are some common discounts offered by insurance companies?

+Common discounts include safe driver discounts, loyalty rewards, and discounts for vehicle safety features such as anti-theft devices and advanced driver-assistance systems. Some insurers also offer discounts for bundling multiple policies or for certain professions.