Autocar Insurance

Autocar insurance is a specialized form of commercial auto insurance designed to cater to the unique needs of businesses operating multi-passenger vehicles, commonly known as autocars or passenger vans. These vehicles, typically with a capacity of 8 to 15 passengers, are used for a variety of purposes, including transportation services, tours, shuttles, and more. Understanding the specific requirements and challenges of insuring these vehicles is crucial for both business owners and insurance providers alike.

The Distinctive Nature of Autocar Insurance

Autocar insurance is not a one-size-fits-all proposition. Unlike personal auto insurance or standard commercial auto insurance, it requires a nuanced approach due to the specialized nature of these vehicles and their intended use. Some key considerations that set autocar insurance apart include:

- Passenger Capacity: Autocars are designed to accommodate a higher number of passengers compared to regular passenger vehicles. This increased capacity translates to a higher risk profile, as the potential for injury or harm to a larger group of people is greater.

- Commercial Use: These vehicles are primarily used for commercial purposes. This distinction is significant as it impacts the type of coverage needed, the potential risks involved, and the liability implications.

- Driver Training and Certification: Given the unique challenges of operating a vehicle with a high passenger capacity, drivers of autocars often require specialized training and certifications. Insurance policies may need to take into account the driver's qualifications and experience.

- Vehicle Maintenance and Safety: Regular maintenance and adherence to safety standards are critical for autocars. Insurance policies often have specific requirements related to vehicle upkeep and safety inspections.

- Coverage for Different Scenarios: Autocar insurance policies must account for a variety of potential scenarios, including passenger injuries, property damage, personal liability, and even specific risks like tour cancellations or delays.

Coverage Options and Considerations

When it comes to autocar insurance, businesses have a range of coverage options to choose from, each tailored to address specific risks and needs. Some of the key coverage types include:

Liability Coverage

Liability insurance is a cornerstone of any autocar insurance policy. It provides protection in the event that the autocar causes damage to other vehicles, property, or bodily injury to other people. This coverage is essential to safeguard the business against potentially catastrophic financial losses resulting from such incidents.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses, pain and suffering, and lost wages for individuals injured in an accident caused by the insured autocar. |

| Property Damage Liability | Pays for the repair or replacement of property damaged in an accident caused by the insured autocar. |

Comprehensive and Collision Coverage

These coverages protect the autocar itself from damage or loss. Comprehensive coverage provides protection against non-collision incidents such as theft, vandalism, fire, or natural disasters. Collision coverage, on the other hand, covers damages resulting from collisions with other vehicles or objects.

Uninsured/Underinsured Motorist Coverage

This coverage protects the insured business and passengers in the event of an accident with a driver who either lacks insurance or has insufficient coverage to pay for the damages caused.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, assists in covering the medical expenses of the autocar’s passengers, regardless of fault. This coverage is particularly valuable as it can help passengers receive prompt medical attention without having to wait for liability issues to be resolved.

Additional Coverage Options

Depending on the specific needs and risks of the business, additional coverage options may be beneficial. These could include coverage for specialized equipment, such as GPS systems or entertainment devices, or coverage for specific operational risks, like breakdown assistance or road hazard protection.

The Role of Risk Assessment in Autocar Insurance

Accurate risk assessment is paramount in autocar insurance. Insurance providers conduct thorough evaluations to understand the unique risks associated with each business and its autocar operations. This process often involves:

- Vehicle Inspection: A detailed inspection of the autocar to assess its condition, maintenance history, and safety features.

- Driver Evaluation: A review of the drivers' records, including their training, experience, and any past incidents or violations.

- Operational Analysis: An in-depth look at the business's operations, including the routes traveled, the nature of the trips, and the frequency of use.

- Risk Management Programs: Assessing the effectiveness of the business's risk management strategies and suggesting improvements where necessary.

Based on this comprehensive risk assessment, insurance providers can tailor coverage to meet the specific needs of the business while also setting appropriate premiums and deductibles.

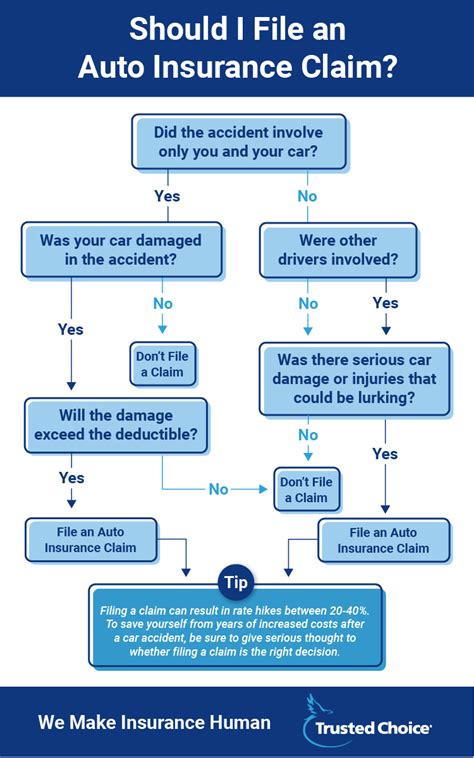

The Impact of Claims on Autocar Insurance

Claims play a significant role in autocar insurance, as they can impact future premiums and coverage availability. Businesses operating autocars should be aware of the potential consequences of filing claims and take steps to minimize the likelihood and severity of incidents that may lead to claims.

One of the primary ways claims can affect autocar insurance is through the application of surcharges. When a claim is filed, the insurance provider may apply a surcharge, which is an additional fee added to the premium. This surcharge is typically based on the severity and frequency of claims and can remain in effect for several years. Multiple claims or severe incidents can lead to substantial surcharges, significantly increasing the cost of insurance.

In addition to surcharges, claims can also lead to policy non-renewal. If an autocar business files multiple claims or is involved in severe incidents, the insurance provider may decide not to renew the policy at the end of its term. This can make it challenging for the business to secure new insurance coverage, especially if the incidents were considered preventable or resulted from negligent practices.

To mitigate the impact of claims, autocar businesses should focus on implementing robust risk management strategies. This includes regular driver training and education, strict adherence to safety protocols, and the use of technology to enhance safety measures. By minimizing the likelihood of incidents and claims, businesses can not only protect their passengers and assets but also maintain a positive insurance profile, which can lead to more favorable premium rates and coverage terms.

The Future of Autocar Insurance

The landscape of autocar insurance is evolving, driven by technological advancements and changing industry dynamics. As autonomous vehicles and electric powertrains become more prevalent, insurance providers will need to adapt their coverage offerings and risk assessment methodologies.

Autonomous vehicles, for instance, present a unique set of risks and challenges. While they have the potential to significantly reduce human error-related accidents, they also introduce new risks related to software malfunctions, cyber threats, and liability attribution. Insurance providers will need to develop coverage options that address these emerging risks while also considering the potential benefits of autonomous technology in enhancing safety.

Similarly, the shift towards electric powertrains in autocars will impact insurance considerations. Electric vehicles have different maintenance requirements and may be subject to unique risks, such as battery-related fires or the challenges of charging infrastructure. Insurance policies will need to adapt to cover these specific risks and provide adequate protection for businesses transitioning to electric fleets.

Furthermore, the rise of ride-sharing and transportation network companies has expanded the market for autocar services. This trend is expected to continue, creating a larger pool of potential insureds. Insurance providers will need to develop innovative coverage solutions that cater to the diverse needs of this expanding market, including options for part-time operators, shared vehicles, and dynamic pricing models that reflect usage patterns.

In conclusion, autocar insurance is a specialized field that requires a deep understanding of the unique risks and needs of businesses operating multi-passenger vehicles. By offering tailored coverage options, conducting thorough risk assessments, and adapting to emerging trends and technologies, insurance providers can ensure that autocar businesses have the protection they need to operate safely and successfully.

What are the key factors that insurance providers consider when assessing autocar insurance applications?

+Insurance providers assess a range of factors when evaluating autocar insurance applications. These include the business’s operational history, the driver’s records, the vehicle’s condition and maintenance history, and the nature of the business’s operations. Providers also consider the business’s risk management strategies and any past claims or incidents.

How can businesses operating autocars reduce their insurance costs?

+Businesses can take several steps to reduce their insurance costs. This includes implementing robust risk management strategies, maintaining a safe driving record, and ensuring regular vehicle maintenance and safety inspections. Additionally, shopping around for insurance and negotiating coverage terms can also lead to cost savings.

What are some common mistakes businesses make when it comes to autocar insurance?

+Some common mistakes include underestimating the importance of risk management, failing to adequately train and monitor drivers, and not keeping up with regular vehicle maintenance. Additionally, businesses may make the mistake of not fully understanding their insurance coverage and the implications of filing claims.