Lowest Vehicle Insurance

When it comes to finding the lowest vehicle insurance rates, there are numerous factors at play. From the type of vehicle you own to your personal circumstances, various elements influence the cost of your insurance policy. In this comprehensive guide, we will delve into the world of vehicle insurance, exploring the key considerations and strategies to help you secure the most affordable coverage while maintaining the necessary protection.

Understanding Vehicle Insurance Rates

Vehicle insurance rates are determined by a complex interplay of variables, each contributing to the overall cost of your policy. Let's break down some of the primary factors that insurance companies take into account when calculating premiums.

Vehicle Type and Age

The type and age of your vehicle play a significant role in determining insurance rates. Generally, newer and more expensive vehicles tend to have higher insurance costs due to their higher replacement and repair values. Additionally, certain vehicle models may be more prone to theft or accidents, leading to increased insurance premiums.

| Vehicle Type | Average Insurance Premium |

|---|---|

| Sports Cars | $1,800 - $2,500 annually |

| Luxury SUVs | $1,500 - $2,000 annually |

| Compact Cars | $1,000 - $1,500 annually |

| Electric Vehicles | $1,200 - $1,800 annually |

As you can see from the table above, the type of vehicle you own directly impacts your insurance premiums. Sports cars and luxury SUVs often command higher rates due to their performance capabilities and higher repair costs.

Driving Record and History

Your driving record is a crucial factor in insurance premium calculations. A clean driving record with no accidents or violations typically leads to lower insurance rates. On the other hand, a history of accidents, traffic violations, or even minor parking tickets can result in increased premiums.

Insurance companies use a point system to assess your driving record. Each violation or accident incurs a certain number of points, and these points can stay on your record for several years. The more points you accumulate, the higher your insurance premiums are likely to be.

Location and Usage

Where you live and how you use your vehicle also influence insurance rates. Insurance companies consider the geographic location of your residence and the corresponding risk factors associated with that area. For instance, regions with high crime rates or frequent natural disasters may have higher insurance premiums.

Additionally, the purpose for which you use your vehicle can impact your insurance rates. If you primarily use your vehicle for commuting to work or running errands, your insurance costs may be lower compared to someone who uses their vehicle for business purposes or long-distance travel.

Coverage and Deductibles

The level of coverage you choose for your vehicle insurance policy can significantly affect your premiums. Comprehensive coverage, which includes protection for a wide range of incidents such as theft, vandalism, and natural disasters, typically comes with higher premiums. On the other hand, opting for a basic liability-only policy may result in lower premiums but offer limited protection.

Another factor to consider is the deductible amount. A deductible is the portion of a claim that you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lead to lower insurance premiums, as you are assuming more financial responsibility in the event of a claim.

Strategies for Securing the Lowest Vehicle Insurance Rates

Now that we have a better understanding of the factors influencing vehicle insurance rates, let's explore some practical strategies to help you find the lowest insurance premiums.

Shop Around and Compare Quotes

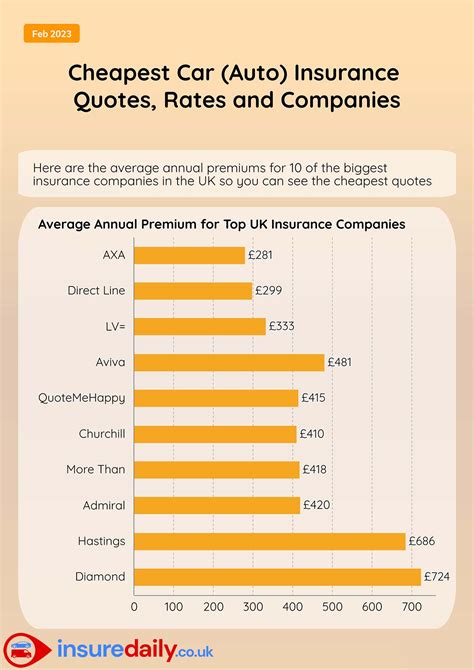

One of the most effective ways to find the lowest vehicle insurance rates is to shop around and compare quotes from multiple insurance providers. Insurance companies use different algorithms and criteria to calculate premiums, so it's essential to explore various options.

Utilize online insurance comparison tools or directly visit the websites of reputable insurance companies to obtain quotes based on your specific circumstances. Be sure to provide accurate and detailed information about your vehicle, driving history, and coverage needs to ensure you receive accurate quotes.

Bundling Policies for Discounts

Many insurance companies offer discounts when you bundle multiple policies together. Consider insuring your vehicle, home, or renters insurance with the same provider. By combining policies, you may be eligible for significant discounts, ultimately reducing your overall insurance costs.

Bundling policies not only saves you money but also simplifies your insurance management. You can streamline your billing and have a single point of contact for all your insurance needs.

Maintain a Good Credit Score

Your credit score is an important factor in determining your insurance premiums. Insurance companies often use credit-based insurance scores to assess the risk associated with insuring you. A higher credit score indicates a lower risk, which can lead to more favorable insurance rates.

Take steps to improve and maintain a good credit score. Pay your bills on time, reduce your credit card balances, and regularly monitor your credit report for any inaccuracies. A strong credit score can not only lower your insurance premiums but also open up more insurance options and better rates.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that allows insurance companies to monitor your driving behavior and adjust your premiums accordingly. This type of insurance uses telematics devices or smartphone apps to track your driving habits, such as mileage, acceleration, and braking patterns.

If you are a safe and cautious driver, usage-based insurance can potentially lower your insurance premiums. By demonstrating responsible driving behavior, you may be eligible for discounts or lower rates. However, it's important to note that usage-based insurance may not be suitable for everyone, and it's essential to carefully review the terms and conditions before enrolling.

Explore Group or Association Discounts

Certain groups or associations may offer exclusive insurance discounts to their members. These discounts can be significant and are often overlooked by many individuals. Check with your employer, professional organizations, alumni associations, or even social clubs to see if they have partnerships with insurance companies that offer discounted rates.

By leveraging these group or association discounts, you can access insurance coverage at a lower cost. It's always worth exploring these options and taking advantage of any available discounts to reduce your insurance expenses.

Frequently Asked Questions

How often should I review my vehicle insurance policy and shop for better rates?

+It's recommended to review your vehicle insurance policy and shop for better rates at least once a year. Insurance rates can change based on various factors, and you may find more competitive options by regularly comparing quotes. Additionally, your personal circumstances and vehicle usage may have changed, which could impact your insurance needs and potential savings.

<div class="faq-item">

<div class="faq-question">

<h3>Can I negotiate my vehicle insurance rates with insurance companies?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While insurance companies typically have set rates based on their algorithms and risk assessments, you can still negotiate your insurance rates. Contact your insurance provider and discuss your specific circumstances, such as a clean driving record, safe driving behavior, or any recent life changes that may impact your risk profile. Insurance companies may be willing to offer discounts or alternative coverage options to retain your business.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any disadvantages to usage-based insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Usage-based insurance has its advantages, such as the potential for lower rates for safe drivers. However, there are a few considerations to keep in mind. Some drivers may feel uncomfortable with the idea of their driving behavior being constantly monitored. Additionally, if you drive frequently or engage in risky driving habits, usage-based insurance may result in higher premiums. It's essential to carefully evaluate your driving habits and preferences before opting for this type of insurance.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are some common mistakes to avoid when shopping for vehicle insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>When shopping for vehicle insurance, avoid common mistakes such as rushing the process and not comparing enough quotes. Take your time to carefully review your options and consider factors like coverage limits, deductibles, and customer reviews. Additionally, avoid providing inaccurate information or omitting important details when obtaining quotes, as this can lead to incorrect premium calculations.</p>

</div>

</div>

</div>

Securing the lowest vehicle insurance rates requires a comprehensive understanding of the factors influencing premiums and a strategic approach to shopping for insurance. By considering your vehicle type and age, maintaining a clean driving record, exploring bundling options, and staying informed about available discounts, you can significantly reduce your insurance costs while ensuring adequate coverage. Remember to regularly review your insurance policy and stay proactive in managing your insurance needs.