Business And Liability Insurance

In the complex landscape of business ownership, safeguarding your enterprise against unforeseen risks is paramount. This comprehensive guide delves into the world of business and liability insurance, exploring its intricacies and emphasizing the critical role it plays in securing the future of your venture.

Business and liability insurance are often the unsung heroes in the narrative of entrepreneurial success. They provide a vital safety net, protecting businesses from financial pitfalls that could otherwise cripple their operations. This article aims to shed light on these essential forms of coverage, offering an in-depth analysis and practical insights to empower business owners in making informed decisions.

Understanding the Landscape of Business Insurance

The realm of business insurance is multifaceted, offering a range of policies tailored to address specific risks faced by different enterprises. At its core, business insurance serves as a protective shield, mitigating the financial impact of unforeseen events that could disrupt or derail operations.

For instance, consider a retail store that suffers extensive property damage due to a sudden storm. Without adequate property insurance, the financial burden of repairs and potential business interruption could be overwhelming. Similarly, a service-based business might face lawsuits stemming from client dissatisfaction or alleged negligence. Professional liability insurance steps in to provide crucial coverage in such scenarios, safeguarding the business's reputation and financial stability.

The scope of business insurance extends beyond tangible assets and professional responsibilities. It encompasses a myriad of potential risks, from cyberattacks that compromise sensitive data to product defects that lead to customer harm. Each of these scenarios presents unique challenges, underscoring the importance of tailored insurance solutions.

Tailoring Insurance to Your Business Needs

Every business is unique, and its insurance requirements reflect this individuality. A comprehensive insurance strategy involves assessing various factors, including the nature of the business, its size, the industry it operates in, and the specific risks it faces.

Take, for example, a small e-commerce startup dealing in electronic goods. While product liability insurance is crucial to protect against claims arising from defective products, this business might also benefit from cyber insurance to safeguard against online threats and data breaches. On the other hand, a large manufacturing firm might prioritize workers' compensation insurance to protect its employees and general liability insurance to cover a wide range of potential risks, from property damage to personal injury claims.

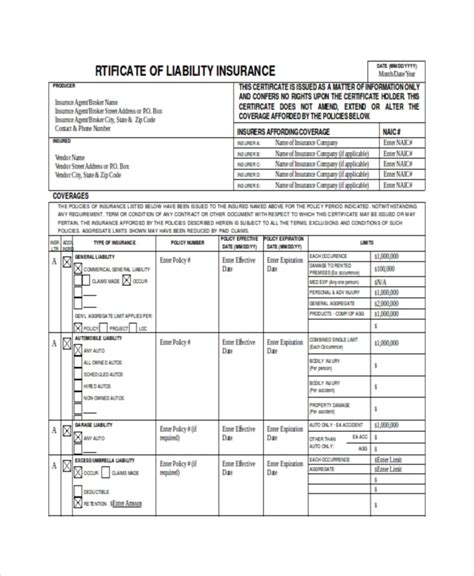

In the realm of liability insurance, the focus shifts to protecting businesses from legal claims and lawsuits. Liability coverage is particularly crucial for businesses that interact directly with the public or offer services that carry inherent risks.

| Insurance Type | Description |

|---|---|

| General Liability Insurance | Covers a broad range of common risks, including bodily injury, property damage, and advertising injuries. |

| Professional Liability Insurance | Provides protection for professionals against negligence claims arising from their services. |

| Product Liability Insurance | Safeguards businesses that produce or sell products from claims related to product defects. |

| Workers' Compensation Insurance | Mandated in most states, it covers medical expenses and lost wages for employees injured on the job. |

The Importance of Liability Insurance

Liability insurance is a cornerstone of business protection, especially for enterprises that face inherent risks in their day-to-day operations. It provides a critical safety net, ensuring that businesses can continue to operate smoothly even in the face of legal challenges.

Imagine a construction company that inadvertently causes damage to a neighboring property during a project. Without adequate general liability insurance, the financial implications could be catastrophic, potentially leading to bankruptcy. Similarly, a medical clinic might face lawsuits from patients alleging medical malpractice. Professional liability insurance, often referred to as malpractice insurance in this context, steps in to cover the costs associated with such claims, including legal fees and potential settlements.

Navigating the Complexities of Liability Coverage

Liability insurance is not a one-size-fits-all solution. The coverage required can vary significantly depending on the nature of the business and the specific risks it encounters.

For service-based businesses, such as consulting firms or accounting practices, professional liability insurance is a key component. It protects against claims of negligence, errors, or omissions in the services provided. In contrast, manufacturing or retail businesses might prioritize product liability insurance, which covers claims related to products that cause harm or property damage.

The scope of liability insurance can also extend to cyber risks. In today's digital age, businesses are increasingly vulnerable to cyberattacks and data breaches. Cyber liability insurance provides coverage for potential financial losses, legal fees, and the cost of repairing or restoring data and systems.

| Business Type | Key Liability Risks |

|---|---|

| Construction Companies | Property damage, bodily injury, worker injuries |

| Service Providers (e.g., Consultants) | Negligence claims, errors in services provided |

| Manufacturers and Retailers | Product defects, product recalls, bodily injury from products |

| Tech Companies | Cyberattacks, data breaches, privacy violations |

Evaluating and Choosing the Right Insurance Coverage

Selecting the appropriate insurance coverage is a critical decision for any business. It involves a meticulous evaluation of potential risks, a deep understanding of available policies, and a strategic approach to mitigate these risks effectively.

Risk Assessment: Identifying Potential Pitfalls

The first step in choosing the right insurance coverage is conducting a thorough risk assessment. This process involves identifying all potential hazards that could impact the business, from natural disasters and cyber threats to legal liabilities and employee injuries.

Consider a hospitality business, such as a hotel or resort. The risks it faces are diverse: from property damage due to natural disasters to guest injuries that could lead to liability claims. A comprehensive risk assessment would help identify these potential issues, guiding the business toward the appropriate insurance policies.

Policy Comparison: Navigating the Insurance Landscape

With a clear understanding of the risks, the next step is to delve into the insurance market. This involves researching and comparing various policies offered by different providers. It’s essential to understand the specific coverage, exclusions, and limits of each policy to ensure the best fit for the business’s needs.

For instance, when comparing general liability insurance policies, businesses should pay attention to the limits of coverage and the deductibles involved. Higher limits typically provide more comprehensive protection but also come with higher premiums. Similarly, the choice between a claims-made policy or an occurrence policy can significantly impact the coverage timeline.

Expert Advice: Consulting Insurance Professionals

Navigating the complex world of insurance can be daunting, and that’s where insurance professionals come into play. Insurance brokers and agents can provide valuable insights and guidance, helping businesses make informed decisions about their coverage.

These experts can offer personalized advice based on the business's unique circumstances. They can also negotiate with insurance providers to secure the best rates and terms, ensuring the business is adequately protected without overspending on premiums.

The Impact of Insurance on Business Resilience

Business and liability insurance are not just about complying with legal requirements; they are integral to building a resilient and sustainable business. Insurance provides a critical layer of protection, allowing businesses to weather unforeseen events and continue operations with minimal disruption.

Mitigating Financial Risk: The Core Function of Insurance

At its essence, insurance is a financial risk management tool. It helps businesses transfer the burden of potential losses to insurance providers, who spread this risk across a large pool of policyholders. This mechanism ensures that businesses can continue to operate even in the face of significant financial setbacks.

Consider a small business owner who experiences a major fire incident that destroys their premises and inventory. Without insurance, the financial impact could be devastating, potentially leading to business closure. However, with adequate property insurance in place, the business can rebuild and recover, thanks to the financial support provided by the insurer.

Building a Resilient Business: The Long-Term Benefits of Insurance

Insurance not only provides immediate protection but also contributes to the long-term resilience and sustainability of a business. By mitigating financial risks, insurance allows businesses to focus on their core operations and growth strategies without the constant worry of unforeseen events.

For instance, a tech startup might face the risk of cyberattacks that could cripple its operations and damage its reputation. With cyber liability insurance, the startup can have peace of mind, knowing that it has a robust defense mechanism in place to handle such incidents. This assurance allows the business to focus on innovation and growth, fostering a resilient culture.

The Future of Business and Liability Insurance

As the business landscape evolves, so too does the world of insurance. The future of business and liability insurance is marked by innovation and adaptation to emerging risks. This section explores some of the key trends and developments shaping the insurance industry.

Emerging Risks and the Need for Adaptive Insurance

The digital age has brought about a host of new risks, from cyber threats to data privacy concerns. Traditional insurance policies may not adequately address these emerging risks, highlighting the need for adaptive insurance solutions.

Insurance providers are increasingly focusing on specialized coverage to address these new challenges. For instance, cyber liability insurance has become a critical component for businesses operating in the digital sphere. This type of insurance provides coverage for a range of cyber-related incidents, including data breaches, network disruptions, and privacy violations.

Technology’s Role in Enhancing Insurance

Technology is revolutionizing the insurance industry, from the way policies are underwritten to how claims are processed. Insurtech, the marriage of insurance and technology, is driving innovation and efficiency in the sector.

One notable development is the use of telematics in insurance. Telematics devices, often used in vehicle insurance, can provide real-time data on driving behavior, allowing insurers to offer personalized premiums based on actual risk. This technology not only benefits insurers but also encourages safer driving practices, leading to fewer claims and lower premiums for responsible drivers.

The Rise of Parametric Insurance

Parametric insurance is an innovative approach that provides coverage based on predefined parameters rather than traditional claims processes. This type of insurance is particularly useful in industries where traditional insurance may not adequately address specific risks.

For example, in the agriculture sector, parametric insurance can provide coverage for crop failures due to extreme weather events. Instead of waiting for an assessment of actual crop damage, which can be time-consuming and subjective, parametric insurance pays out based on predefined triggers, such as the severity of a drought or the extent of a hurricane.

Conclusion: Navigating the Complex World of Business Insurance

In the dynamic and often unpredictable world of business, insurance serves as a critical tool for managing risk and ensuring long-term sustainability. From protecting against property damage and liability claims to mitigating emerging risks like cyber threats, insurance provides a vital safety net for businesses of all sizes and industries.

The key to effective insurance coverage lies in a comprehensive understanding of the business's unique risks and a strategic approach to risk management. By partnering with insurance professionals and staying abreast of emerging trends and innovations, businesses can ensure they have the right coverage in place to protect their operations, their assets, and their future.

How does business insurance differ from personal insurance?

+Business insurance is designed to protect commercial entities from risks associated with their operations, such as property damage, liability claims, and professional negligence. Personal insurance, on the other hand, is tailored to individuals and typically covers personal assets and liabilities, like home or auto insurance.

What are some common exclusions in business liability insurance policies?

+Common exclusions in business liability insurance policies may include intentional acts, contractual liabilities, pollution, and certain types of professional services. It’s important to carefully review the policy document to understand the specific exclusions that apply to your coverage.

How can businesses reduce their insurance costs without compromising coverage?

+Businesses can explore options such as increasing deductibles, bundling policies with the same insurer, maintaining a good safety record, and implementing risk management strategies to mitigate potential losses. Consulting with an insurance professional can also help identify cost-saving opportunities while maintaining adequate coverage.