Low Price Health Insurance

Access to affordable and comprehensive healthcare is a fundamental concern for individuals and families worldwide. In the quest for financial security and peace of mind, low-price health insurance emerges as a critical topic, offering protection against unexpected medical expenses. This comprehensive guide aims to delve into the intricacies of low-price health insurance, exploring its various facets, benefits, and considerations.

Understanding Low-Price Health Insurance

Low-price health insurance, often referred to as budget-friendly or economical health plans, is designed to provide essential healthcare coverage at a more affordable cost. These plans cater to individuals and families seeking basic medical protection without incurring high premiums. By understanding the nuances of low-price health insurance, one can make informed decisions to safeguard their health and finances.

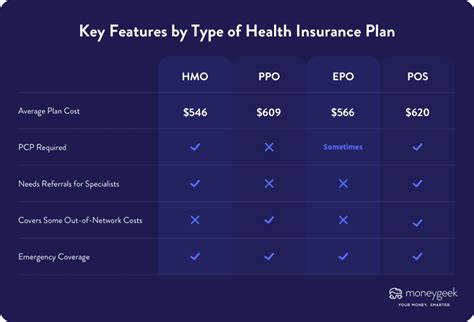

Key Features of Low-Price Health Insurance Plans

Low-price health insurance plans typically offer a more restricted network of healthcare providers, focusing on cost-effectiveness rather than extensive coverage. Here are some key features:

- Limited Provider Network: These plans often have a predefined list of doctors, hospitals, and specialists within their network, offering cost savings by negotiating lower rates with these providers.

- Lower Premium Costs: The primary attraction of low-price health insurance is the reduced monthly premiums, making healthcare more accessible for those on a tight budget.

- Basic Coverage: While offering essential coverage, these plans may have higher deductibles and out-of-pocket expenses, making them suitable for individuals with relatively low healthcare needs.

- Restricted Benefits: Low-price plans might have limitations on certain services or treatments, such as mental health coverage or prescription drug benefits.

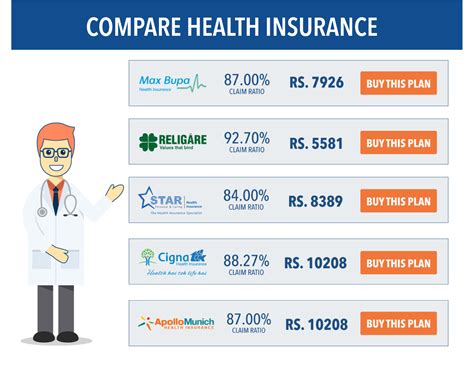

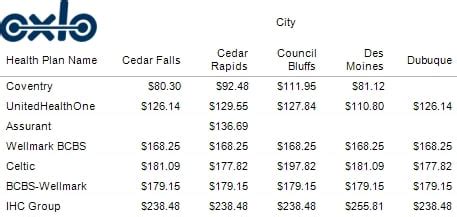

Real-World Examples

To illustrate, consider the Blue Cross Blue Shield’s Value Plan, which offers affordable coverage with a network of over 10,000 providers nationwide. This plan boasts a monthly premium of 150 for individuals, making it an attractive option for those seeking basic coverage. However, it comes with a 5,000 deductible and limited coverage for specialist visits.

Performance and Analysis

When evaluating the performance of low-price health insurance plans, several factors come into play:

Cost-Effectiveness

The primary appeal of these plans lies in their ability to offer substantial cost savings. By opting for a low-price plan, individuals can expect to pay lower monthly premiums, which can be a significant relief for those on fixed incomes or facing financial constraints.

Network Flexibility

Low-price health insurance plans often come with a trade-off: a restricted provider network. While this may limit one’s choices, it can also provide cost predictability. By staying within the network, individuals can avoid unexpected expenses associated with out-of-network care.

Coverage Considerations

It’s essential to thoroughly examine the coverage offered by low-price plans. Some plans may have limitations on specific treatments or conditions, which could become a concern if an individual’s healthcare needs are more complex or unpredictable. Understanding these restrictions is crucial before committing to a plan.

| Plan | Premium | Deductible | Out-of-Pocket Max |

|---|---|---|---|

| Low-Price Plan A | $120/month | $4,000 | $6,500 |

| Low-Price Plan B | $135/month | $3,000 | $7,000 |

| Low-Price Plan C | $110/month | $5,000 | $8,000 |

Future Implications

The landscape of low-price health insurance is continually evolving, driven by advancements in technology and changes in healthcare policies. As we look ahead, several trends and developments are shaping the future of these plans.

Digital Health Solutions

The integration of digital health solutions is transforming the way low-price health insurance plans operate. Telehealth services, for instance, are becoming increasingly popular, offering convenient and affordable access to medical consultations. By leveraging technology, these plans can provide remote monitoring and support, improving patient engagement and reducing costs.

Personalized Health Management

The future of low-price health insurance lies in personalized health management. With the advent of wearable devices and health tracking apps, plans can offer tailored recommendations and interventions based on an individual’s unique health data. This shift towards personalized care can lead to more efficient and cost-effective healthcare delivery.

Expanded Coverage Options

As the demand for low-price health insurance grows, insurers are exploring ways to expand coverage options while maintaining affordability. This could involve partnerships with healthcare providers to negotiate better rates or the introduction of innovative plan designs that cater to specific demographic needs.

In Conclusion

Low-price health insurance plans offer a crucial safety net for those seeking affordable healthcare coverage. While they may have certain limitations, their cost-effectiveness and accessibility make them an essential option for many individuals and families. As the healthcare industry evolves, these plans are likely to play an even more significant role in ensuring widespread access to essential medical services.

Frequently Asked Questions

How do I choose the right low-price health insurance plan for my needs?

+

Selecting the right low-price health insurance plan involves careful consideration of your healthcare needs and financial situation. Evaluate the plan’s coverage, including deductibles, out-of-pocket expenses, and network of providers. Assess your health requirements and choose a plan that aligns with your needs while offering cost-effectiveness. Don’t hesitate to seek guidance from insurance professionals or use online tools to compare plans.

Are there any disadvantages to low-price health insurance plans?

+

Low-price health insurance plans often come with trade-offs. These plans may have limited provider networks, higher deductibles, and restrictions on certain services. It’s essential to carefully review the plan’s benefits and understand the potential out-of-pocket costs. While they offer affordability, they might not be suitable for individuals with complex or frequent healthcare needs.

Can I customize my low-price health insurance plan to suit my specific needs?

+

Customization options for low-price health insurance plans can vary. Some insurers offer add-on coverage or rider options to enhance basic plans. These add-ons may include dental or vision coverage, prescription drug benefits, or specific treatments. It’s advisable to discuss customization possibilities with your insurance provider to ensure you get the coverage that aligns with your unique requirements.

What happens if I require medical treatment outside the plan’s network?

+

Receiving medical treatment outside the plan’s network can result in higher out-of-pocket costs. It’s crucial to understand your plan’s out-of-network coverage before seeking such care. Some plans may offer limited coverage for out-of-network services, but you might be responsible for a larger portion of the expenses. Consider contacting your insurance provider to discuss options and potential alternatives.

Are there any government programs or subsidies available to make low-price health insurance more affordable?

+

Government programs and subsidies can indeed make low-price health insurance more accessible. Depending on your income and family size, you may qualify for financial assistance through programs like Medicaid or the Health Insurance Marketplace. These programs offer reduced premiums, cost-sharing assistance, and tax credits to make healthcare coverage more affordable. It’s advisable to explore these options to determine your eligibility.