Best Deal Auto Insurance

In the vast landscape of auto insurance, finding the best deal is akin to navigating a complex maze. The quest for affordable coverage that meets your specific needs can be both daunting and time-consuming. This comprehensive guide aims to shed light on the intricacies of auto insurance, offering insights into securing the most advantageous policies tailored to your unique circumstances.

As we delve into the world of auto insurance, we will explore the key factors that influence rates, provide strategies for comparison shopping, and offer practical tips to ensure you receive the coverage you deserve at a price that aligns with your budget. By the end of this guide, you will be equipped with the knowledge and tools necessary to make informed decisions, ensuring you secure the best deal auto insurance has to offer.

Understanding Auto Insurance Rates: A Comprehensive Breakdown

The cost of auto insurance is influenced by a myriad of factors, each playing a crucial role in determining your premium. From your driving record and vehicle type to location and credit score, these variables collectively shape the landscape of your insurance rates. Understanding how these factors interplay is fundamental to securing the best possible deal.

The Impact of Your Driving Record

Your driving history is a primary determinant of your insurance rates. A clean driving record, free of accidents and violations, often translates to lower premiums. Conversely, a history marred by traffic infractions and accidents can significantly increase your insurance costs. Insurance providers meticulously analyze your driving record to assess your level of risk, with a focus on the past three to five years. Even a single infraction can impact your rates, so maintaining a safe and responsible driving behavior is crucial.

Vehicle Type and Usage: A Key Consideration

The type of vehicle you drive and how you use it are significant factors in determining your insurance rates. Generally, newer and more expensive vehicles tend to have higher insurance premiums due to the cost of repairs and replacement. Additionally, the purpose for which you use your vehicle matters. If you primarily use your car for personal transportation, your rates may be lower compared to those who use their vehicles for business or commercial purposes.

Location, Location, Location: Its Influence on Rates

Your geographic location plays a pivotal role in shaping your insurance rates. Insurance providers consider various location-specific factors, including crime rates, traffic congestion, and even weather conditions. Areas with higher instances of accidents, theft, or natural disasters often see increased insurance premiums. Similarly, densely populated urban areas typically have higher rates compared to rural regions.

Credit Score: An Often-Overlooked Factor

Your credit score can have a surprising impact on your insurance rates. Many insurance providers utilize credit-based insurance scores to assess your level of risk. While the exact methodology varies, a good credit score is generally associated with lower insurance premiums. This practice, known as credit-based insurance scoring, is used in most states, except California, Hawaii, and Massachusetts, where it is prohibited.

Comparing Auto Insurance: A Strategic Approach

Securing the best auto insurance deal requires a systematic approach to comparison shopping. By following these strategic steps, you can navigate the complex world of insurance policies with confidence, ensuring you find the coverage that best suits your needs at the most competitive price.

Define Your Coverage Needs

Before embarking on your search, it’s essential to define your specific coverage needs. Consider the level of protection you require for your vehicle and personal circumstances. Are you looking for comprehensive coverage that includes collision and liability insurance? Or do you primarily need liability coverage to meet state requirements? Understanding your unique needs will guide your search and help you avoid unnecessary expenses.

Research Insurance Providers

The market is abundant with insurance providers, each offering a unique set of policies and features. Researching these providers is a critical step in your journey. Explore their websites, read reviews, and seek recommendations from trusted sources. Look for providers that align with your coverage needs and offer competitive rates. Consider established insurers as well as smaller, niche providers that may offer specialized coverage options.

Obtain Multiple Quotes

Obtaining multiple quotes is a cornerstone of comparison shopping. Request quotes from at least three to five providers to get a comprehensive view of the market. Many insurance providers offer online quote tools, making the process quick and convenient. Ensure you provide accurate and consistent information across all quotes to ensure an apples-to-apples comparison.

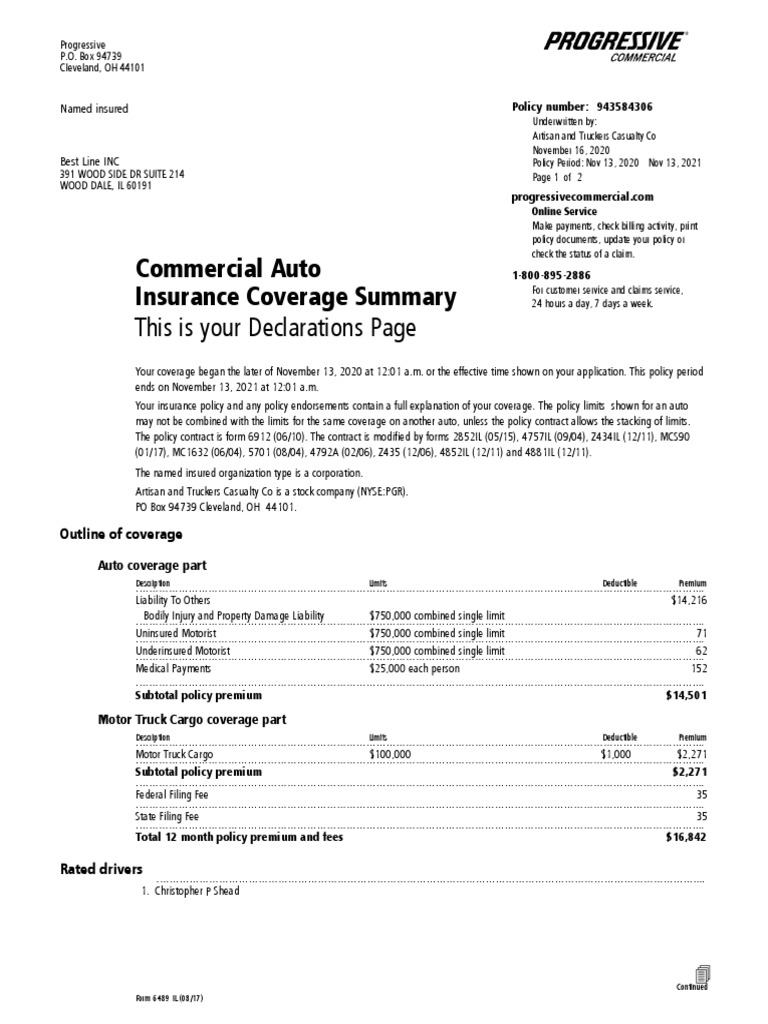

Evaluate Policy Details

Beyond the premium, it’s crucial to evaluate the policy details and coverage options offered by each provider. Compare the limits, deductibles, and additional coverages included in each policy. Look for policies that offer the right balance of coverage and affordability, ensuring you’re not sacrificing essential protections for a lower premium.

Consider Discounts and Bundling Options

Insurance providers often offer a range of discounts and bundling options to make their policies more attractive. Common discounts include those for safe driving, multi-policy bundles (combining auto and home insurance), and loyalty rewards. Additionally, some providers offer discounts for specific professions or affiliations. Explore these options to further reduce your insurance costs.

Read Customer Reviews

Customer reviews can provide invaluable insights into an insurance provider’s service quality and reliability. Read reviews on trusted platforms and forums to gauge customer satisfaction and potential issues. Look for patterns in the feedback to identify potential red flags or areas of concern. Positive reviews can also highlight a provider’s strengths and unique advantages.

Tips for Lowering Your Auto Insurance Costs

While securing the best deal on auto insurance involves a comprehensive approach, there are additional strategies you can employ to lower your insurance costs. By implementing these tips, you can further optimize your coverage and save money on your premiums.

Maintain a Clean Driving Record

As mentioned earlier, your driving record is a significant factor in determining your insurance rates. Maintaining a clean driving record by avoiding accidents and violations is crucial. Even a single infraction can lead to increased premiums, so practicing safe and responsible driving is essential. If you have a history of infractions, consider taking a defensive driving course to improve your record and potentially lower your rates.

Increase Your Deductible

Your deductible, the amount you pay out of pocket before your insurance coverage kicks in, is a key factor in determining your premium. Increasing your deductible can lead to significant savings on your insurance costs. However, it’s important to ensure that you choose a deductible amount that you can comfortably afford in the event of a claim. A higher deductible may reduce your monthly premiums, but it means you’ll pay more upfront in the event of an accident.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach to auto insurance that bases your premium on your actual driving behavior. By installing a tracking device in your vehicle or using an app to monitor your driving, insurance providers can assess your risk based on factors like mileage, time of day, and driving habits. If you’re a safe and cautious driver, you may qualify for significant discounts with this type of insurance.

Utilize Safety Features

Many vehicles are equipped with advanced safety features such as anti-lock brakes, air bags, and electronic stability control. These features not only enhance your safety on the road but can also lead to lower insurance premiums. Insurance providers often offer discounts for vehicles with these safety enhancements, recognizing the reduced risk they pose. When shopping for a new vehicle, consider models with advanced safety features to potentially save on insurance costs.

Bundle Your Policies

Bundling your insurance policies is a strategic way to save money. Many insurance providers offer discounts when you combine multiple policies, such as auto and home insurance, or auto and life insurance. By consolidating your insurance needs with a single provider, you can often secure a lower overall premium. Additionally, bundling your policies can simplify your insurance management, providing a more streamlined experience.

The Future of Auto Insurance: Trends and Implications

The auto insurance landscape is evolving rapidly, driven by technological advancements and changing consumer needs. Understanding these trends is essential to staying ahead of the curve and securing the best deals in the future. Here’s a glimpse into the future of auto insurance and its potential implications.

The Rise of Telematics and Usage-Based Insurance

Telematics and usage-based insurance are poised to play an increasingly prominent role in the auto insurance market. With the widespread adoption of connected cars and advanced telematics technologies, insurance providers will have access to more detailed and accurate data on driving behavior. This shift will enable more precise risk assessment, potentially leading to more tailored and affordable insurance policies for safe drivers.

Autonomous Vehicles and Insurance Implications

The advent of autonomous vehicles (AVs) is set to revolutionize the auto insurance industry. As AVs become more prevalent, the nature of accidents and liability will shift significantly. Insurance providers will need to adapt their policies to accommodate this new paradigm, potentially leading to changes in coverage options and pricing structures. The transition to AVs may also result in reduced insurance costs overall, as accidents become less frequent and less severe.

Personalized Insurance: Tailored to Your Needs

The future of auto insurance is moving towards personalized policies that are tailored to individual needs and circumstances. With the advancement of data analytics and machine learning, insurance providers will be able to offer more precise and customized coverage options. This shift will allow consumers to select the specific coverages they require, potentially leading to more affordable and efficient insurance plans.

Digital Transformation and Convenience

The digital transformation of the insurance industry is underway, with many providers investing in online platforms and mobile apps to enhance the customer experience. This shift towards digital convenience will make it easier for consumers to compare policies, obtain quotes, and manage their insurance needs. Additionally, the integration of digital technologies will enable more efficient claims processing, providing a faster and more seamless experience for policyholders.

Environmental Considerations in Insurance

As environmental sustainability gains prominence, the insurance industry is likely to incorporate eco-friendly practices and incentives. Insurance providers may offer discounts for eco-conscious consumers, such as those who drive electric or hybrid vehicles, or who take steps to reduce their carbon footprint. This shift towards environmental responsibility may also influence the development of new insurance products and services focused on sustainability.

| Factor | Impact on Rates |

|---|---|

| Driving Record | Clean record leads to lower rates; violations and accidents increase costs. |

| Vehicle Type and Usage | Newer, more expensive vehicles tend to have higher premiums; personal use often results in lower rates. |

| Location | Urban areas and regions with higher accident rates may have increased premiums. |

| Credit Score | Good credit score often correlates with lower insurance rates. |

What is the average cost of auto insurance in the US?

+

The average cost of auto insurance in the US varies significantly depending on factors such as location, age, vehicle type, and driving record. According to the Insurance Information Institute, the national average annual premium was $1,674 in 2022. However, this figure can range from as low as a few hundred dollars to several thousand dollars depending on individual circumstances.

How can I save money on my auto insurance premiums?

+

There are several strategies to reduce your auto insurance premiums. These include maintaining a clean driving record, increasing your deductible, exploring usage-based insurance, utilizing safety features in your vehicle, and bundling your insurance policies. Additionally, shopping around for quotes from multiple providers and negotiating discounts can lead to significant savings.

What factors influence my auto insurance rates the most?

+

The primary factors that influence auto insurance rates include your driving record, the type and value of your vehicle, your location, and your credit score. Other factors such as your age, gender, marital status, and the number of miles you drive annually can also play a role in determining your insurance premiums.

Are there any discounts available for auto insurance policies?

+

Yes, insurance providers offer a range of discounts to make their policies more attractive. Common discounts include those for safe driving, multi-policy bundles (combining auto and home insurance), loyalty rewards, and certain professions or affiliations. It’s worth inquiring about these discounts when obtaining quotes to ensure you’re taking advantage of all available savings.