Insurance Exchange Market

The insurance exchange market, often referred to as the "health insurance marketplace," is a critical component of the healthcare industry, especially in regions with regulated healthcare systems. This marketplace plays a pivotal role in connecting individuals and families with a range of insurance plans, offering a centralized platform for comparison and enrollment.

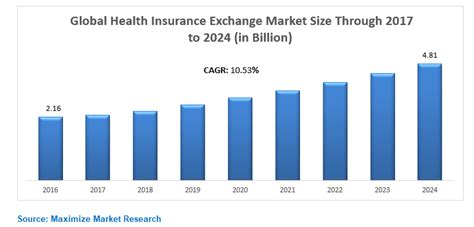

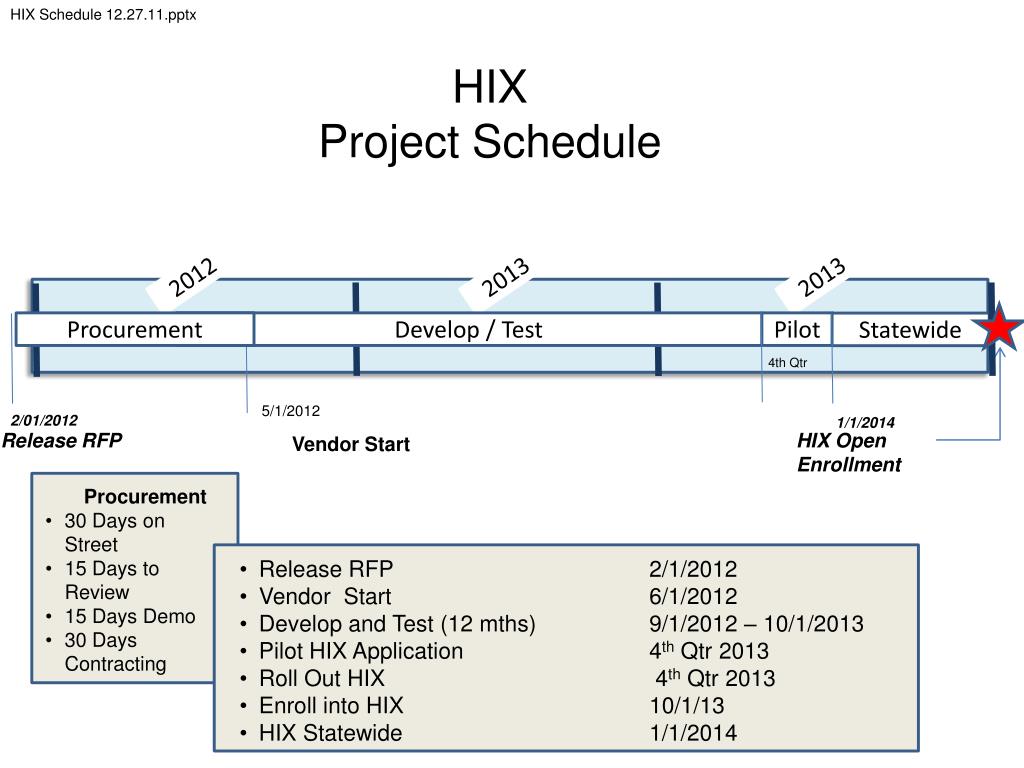

In recent years, the insurance exchange market has undergone significant transformations, largely driven by technological advancements and changing consumer preferences. These shifts have not only improved accessibility and transparency but have also presented unique challenges and opportunities for stakeholders across the healthcare spectrum.

Understanding the Insurance Exchange Market

At its core, the insurance exchange market is a digital ecosystem where consumers can browse, compare, and purchase health insurance plans. These exchanges, often government-regulated, provide a structured environment for insurers to offer their products and for consumers to make informed choices based on their specific healthcare needs and financial situations.

The introduction of these exchanges was a strategic move to enhance competition among insurance providers, thereby driving down costs and improving the overall quality of healthcare coverage. It aimed to empower consumers by giving them a broader range of options and the ability to tailor their insurance to their unique circumstances.

Key Features and Benefits

- Transparency and Choice: The insurance exchange market provides a transparent platform where consumers can easily compare plans based on coverage, cost, and benefits. This level of transparency helps individuals make more informed decisions about their healthcare.

- Subsidies and Tax Credits: Many exchanges offer financial assistance in the form of subsidies or tax credits to make insurance more affordable, especially for low- to middle-income households. This feature is a significant incentive for consumers to explore their insurance options.

- Easy Enrollment: The digital nature of these exchanges simplifies the enrollment process. Consumers can complete their applications online, often with guidance and support, making it a convenient and efficient process.

The Role of Technology

The insurance exchange market’s evolution is deeply intertwined with technological progress. Advanced algorithms and data analytics have revolutionized the way insurance is offered and consumed. These technologies enable insurers to personalize their offerings, provide more accurate quotes, and streamline the enrollment process.

For instance, insurers can now leverage data-driven insights to offer tailored plans that cater to specific demographic needs. This level of personalization not only improves customer satisfaction but also leads to more effective risk management for insurers.

Market Dynamics and Consumer Behavior

Understanding consumer behavior is crucial for insurers operating in the exchange market. Consumers’ choices are influenced by a multitude of factors, including the cost of premiums, deductibles, and copays, as well as the breadth of coverage and network of providers.

Recent studies indicate a growing trend towards more cost-conscious decisions among consumers. There is a noticeable shift towards high-deductible plans, especially among younger individuals, as they prioritize affordability over comprehensive coverage.

Challenges and Opportunities

While the insurance exchange market offers numerous benefits, it also presents challenges. One of the primary concerns is the complexity of the insurance landscape, which can be overwhelming for consumers, particularly those who are less digitally literate or less familiar with healthcare terminology.

Insurers and marketplace administrators are addressing this challenge by investing in educational resources and simplified language to ensure consumers understand their options. Additionally, the development of user-friendly platforms and mobile applications is making the insurance shopping experience more accessible and intuitive.

| Market Segment | Key Insights |

|---|---|

| Young Adults | This demographic often opts for high-deductible plans, favoring affordability over comprehensive coverage. |

| Middle-Aged Individuals | This group tends to prioritize coverage for specific health conditions or chronic illnesses, indicating a shift towards preventative care. |

| Senior Citizens | Older adults, especially those eligible for Medicare, often seek plans that complement their existing coverage, focusing on prescription drug benefits and specialized care. |

Industry Innovations and Future Trends

The insurance exchange market is witnessing several exciting innovations and trends that are shaping its future trajectory.

Telehealth and Virtual Care

The integration of telehealth services into insurance plans is a notable trend. Insurers are recognizing the value of virtual care, especially in the post-pandemic era, and are incorporating these services into their offerings to enhance accessibility and convenience for policyholders.

For instance, some insurers now offer unlimited virtual doctor visits as part of their standard plans, removing barriers to primary care and promoting early intervention for potential health issues.

Blockchain and Data Security

With the increasing importance of data in the insurance industry, blockchain technology is gaining traction. Blockchain offers a secure and transparent way to manage and share healthcare data, ensuring privacy and reducing the risk of fraud.

By leveraging blockchain, insurers can streamline processes like claim settlements, reduce administrative costs, and build trust with their policyholders through enhanced data security.

AI-Driven Personalization

Artificial Intelligence (AI) is revolutionizing the way insurers interact with their customers. AI-powered chatbots and virtual assistants are now being deployed to provide real-time support to consumers, offering personalized plan recommendations based on individual health histories and preferences.

Additionally, AI is being used to analyze large datasets, helping insurers identify trends and patterns to develop more targeted and effective insurance products.

Conclusion

The insurance exchange market is a dynamic and evolving landscape, offering both challenges and opportunities for insurers and consumers alike. As we move forward, the continued integration of technology and a focus on consumer education will be pivotal in shaping the future of this market.

By staying attuned to the evolving needs and preferences of consumers, insurers can develop innovative products and services that not only meet but exceed the expectations of their policyholders. This, in turn, will foster a more competitive and consumer-centric insurance market.

How do insurance exchanges work?

+Insurance exchanges are digital platforms that allow individuals and families to compare and purchase health insurance plans. These exchanges, often government-regulated, provide a structured environment for insurers to offer their products, and consumers can enroll in plans that meet their specific healthcare needs and financial situations.

What are the benefits of the insurance exchange market for consumers?

+The insurance exchange market offers consumers transparency and choice. They can easily compare plans based on coverage, cost, and benefits. Additionally, many exchanges provide financial assistance, such as subsidies or tax credits, making insurance more affordable. The digital enrollment process is also streamlined and convenient.

How is technology shaping the insurance exchange market?

+Technology, particularly advanced algorithms and data analytics, has revolutionized the insurance exchange market. Insurers can now personalize their offerings, provide accurate quotes, and streamline the enrollment process. This technology also enables better risk management and more effective decision-making for insurers.