Allstate Car Insurance Telephone Number

In today's fast-paced world, having reliable car insurance is essential for peace of mind and financial protection. Allstate, a well-known insurance provider, offers a range of coverage options to meet the diverse needs of drivers. With a commitment to customer service, Allstate ensures that its policyholders can easily reach out for assistance, including contacting them by phone. This article will delve into the importance of having a direct line of communication with your insurance provider and provide you with the essential details to connect with Allstate's car insurance team.

The Significance of Direct Communication with Your Insurance Provider

When it comes to car insurance, having a reliable and accessible insurance provider is crucial. Direct communication ensures that you can promptly address any concerns, make policy changes, or report claims efficiently. In the event of an accident or unexpected situation, being able to reach your insurance company quickly can make a significant difference in the resolution process.

Allstate understands the value of timely and effective communication. They prioritize providing multiple avenues for their customers to reach out, including phone calls, which are often the preferred method for many individuals seeking immediate assistance.

Contacting Allstate Car Insurance: The Telephone Number

To reach Allstate’s car insurance team, you can utilize the following telephone number: 1-800-ALLSTATE (1-800-255-7828). This dedicated line is available 24⁄7, ensuring that you can connect with a representative whenever the need arises.

When calling, you'll be greeted by a friendly and knowledgeable Allstate representative who will assist you with your inquiries or concerns. Whether you're looking to make a policy change, report an accident, or simply have questions about your coverage, they are ready to provide the support you need.

Allstate's commitment to customer service extends beyond the phone lines. They also offer online resources and tools to manage your policy, file claims, and stay informed about your coverage. However, for many situations, a direct phone call can provide the most efficient and personalized assistance.

Additional Contact Methods for Allstate Car Insurance

While the telephone number is a convenient and direct way to reach Allstate’s car insurance team, they also offer alternative contact methods to cater to different preferences and needs:

- Online Chat: Visit the Allstate website and navigate to the "Contact Us" section. You'll find an option to initiate a live chat with a representative. This method is ideal for quick questions or if you prefer typing your inquiries.

- Email: Allstate provides an email address for general inquiries. While email responses may take a bit longer than phone calls, it is a convenient way to communicate detailed information or attachments.

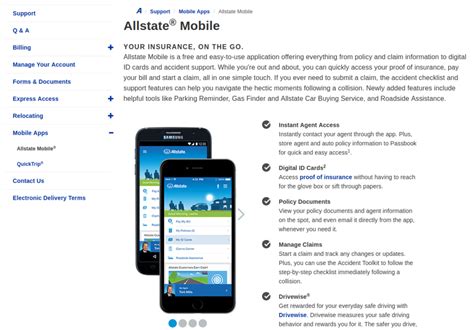

- Mobile App: Allstate's mobile app offers a user-friendly interface to manage your policy, view coverage details, and even file claims. It's a great option for on-the-go policy management.

- In-Person Visits: Allstate has a network of local agents who can provide personalized assistance. You can locate your nearest agent through their website and schedule an in-person meeting to discuss your insurance needs.

The Benefits of Having Allstate as Your Car Insurance Provider

Allstate is renowned for its comprehensive car insurance coverage options, competitive pricing, and dedication to customer satisfaction. Here are some key benefits of choosing Allstate for your car insurance needs:

Comprehensive Coverage Options

Allstate offers a wide range of coverage options to tailor your policy to your specific needs. These include liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), and more. Whether you’re looking for basic coverage or want to add additional protections, Allstate has you covered.

Competitive Pricing

Allstate understands that car insurance is a significant expense, and they work hard to provide competitive rates without compromising on coverage. They offer various discounts to help you save, including safe driver discounts, multi-policy discounts, and good student discounts. By choosing Allstate, you can find a policy that fits your budget without sacrificing quality.

Excellent Customer Service

Allstate prides itself on its commitment to customer service. From the moment you contact them, whether by phone, online, or in person, you’ll experience a high level of professionalism and expertise. Their representatives are trained to provide clear and concise information, ensuring that you understand your coverage and can make informed decisions.

Digital Tools and Resources

In addition to their dedicated phone lines, Allstate offers a suite of digital tools and resources to enhance your insurance experience. The Allstate mobile app, mentioned earlier, allows you to manage your policy, view coverage details, and even file claims from the convenience of your smartphone. They also provide online resources, such as educational articles and tools, to help you better understand your insurance options and make informed choices.

Conclusion: The Allstate Advantage

Choosing Allstate for your car insurance needs provides you with peace of mind, knowing that you have a reliable and responsive insurance provider by your side. With their commitment to customer service, comprehensive coverage options, competitive pricing, and digital tools, Allstate ensures that you receive the support and protection you deserve. Remember, in the event of any questions or concerns, you can always reach out to their car insurance team using the telephone number provided: 1-800-ALLSTATE (1-800-255-7828).

How do I know if Allstate offers the best car insurance rates for my specific needs?

+To determine if Allstate offers the best rates for your situation, it’s recommended to obtain quotes from multiple insurance providers. Compare the coverage options, discounts, and overall value to make an informed decision. Allstate provides competitive rates, but it’s essential to assess your specific needs and circumstances.

Can I purchase additional coverage options after my policy has been issued?

+Yes, you can make changes to your coverage options at any time. Contact Allstate’s car insurance team, either by phone or through their online platform, to discuss your needs and add or remove coverage as necessary. They will guide you through the process and ensure your policy is updated accordingly.

What should I do in the event of an accident while insured with Allstate?

+If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Then, promptly contact Allstate’s car insurance team using the dedicated phone number (1-800-ALLSTATE) to report the incident. They will guide you through the claims process and provide the necessary support to resolve the situation efficiently.