Aig Insurance Life

AIG, or American International Group, is a renowned global insurance corporation with a rich history spanning over a century. In this article, we delve into the world of AIG's life insurance offerings, exploring their products, services, and the impact they have on policyholders and the industry as a whole.

AIG Life Insurance: A Legacy of Trust and Innovation

With a presence in over 80 countries and territories, AIG has established itself as a leader in the insurance industry, particularly in the life insurance sector. Their commitment to innovation, customer-centric approaches, and financial stability has positioned them as a trusted partner for individuals and businesses seeking comprehensive life insurance solutions.

AIG's life insurance offerings are designed to meet a wide range of needs, providing financial protection and security to policyholders and their beneficiaries. Let's explore the key aspects of their life insurance products and the unique value they bring to the market.

A Comprehensive Range of Life Insurance Products

AIG’s life insurance portfolio is diverse, catering to various life stages and financial goals. Here’s an overview of their key product offerings:

- Term Life Insurance: Offering pure protection for a specified term, AIG's term life policies provide affordable coverage for a defined period, typically 10, 20, or 30 years. These policies are ideal for individuals seeking temporary coverage during critical life stages, such as starting a family or paying off a mortgage.

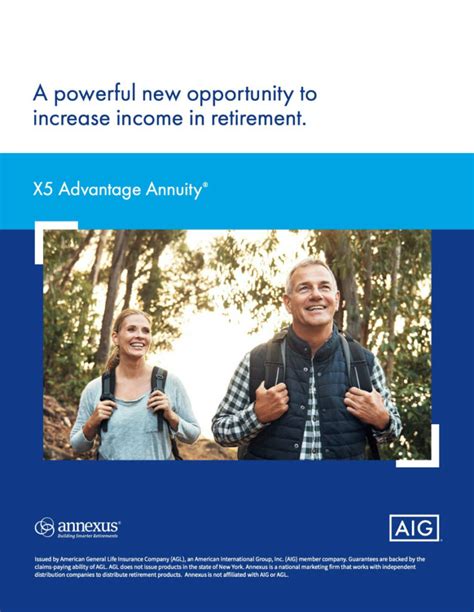

- Whole Life Insurance: As a permanent life insurance option, whole life policies from AIG offer lifelong coverage with a guaranteed death benefit. These policies also accumulate cash value over time, providing policyholders with a valuable financial asset.

- Universal Life Insurance: With flexible premium payments and coverage amounts, universal life insurance from AIG offers policyholders the ability to customize their coverage based on their changing needs. The cash value component allows for tax-deferred growth, providing additional financial flexibility.

- Variable Life Insurance: AIG's variable life insurance policies offer a unique blend of protection and investment opportunities. Policyholders can allocate their premiums to various investment options, allowing for potential higher returns while still maintaining a guaranteed death benefit.

- Group Life Insurance: AIG also specializes in providing group life insurance solutions for employers. These policies offer affordable coverage to employees, with the added benefit of potential tax advantages for both the employer and employees.

Each of these life insurance products is tailored to meet specific needs, whether it's providing financial protection during a certain life stage, building long-term savings, or offering comprehensive coverage for a family's future.

Industry-Leading Claims Processing and Customer Service

AIG prides itself on its commitment to prompt and efficient claims processing. Their dedicated claims teams work diligently to ensure that policyholders and their beneficiaries receive the benefits they are entitled to in a timely manner. This focus on efficient claims handling has earned AIG a reputation for reliability and trustworthiness.

Additionally, AIG places a strong emphasis on delivering exceptional customer service. Their knowledgeable and compassionate agents are readily available to assist policyholders with any inquiries or concerns they may have. Whether it's explaining policy details, providing guidance on coverage options, or assisting with claims, AIG's customer service teams are dedicated to ensuring a positive experience for all their clients.

Innovative Technology and Digital Solutions

In today’s digital age, AIG recognizes the importance of leveraging technology to enhance the customer experience. Their online and mobile platforms offer policyholders convenient access to their accounts, allowing them to manage their policies, view coverage details, and make payments with ease.

AIG's digital tools also extend to the claims process, providing a seamless and efficient experience for policyholders and beneficiaries. Online claims submission, real-time claim status updates, and digital documentation all contribute to a faster and more convenient claims journey.

| Product | Key Benefits |

|---|---|

| Term Life Insurance | Affordable, flexible coverage for a specified term |

| Whole Life Insurance | Lifetime coverage with cash value accumulation |

| Universal Life Insurance | Customizable coverage with tax-deferred cash value growth |

| Variable Life Insurance | Protection with investment opportunities for potential higher returns |

| Group Life Insurance | Affordable coverage for employees with potential tax advantages |

AIG’s Impact on the Insurance Industry

AIG’s influence extends beyond their own products and services. As a global leader in the insurance industry, their innovations and best practices have had a significant impact on the overall market.

Advancing Digital Transformation

AIG has been at the forefront of digital transformation in the insurance sector. Their investment in technology and digital solutions has not only enhanced their own operations but has also set a benchmark for other insurers to follow. By embracing digital tools and platforms, AIG has streamlined processes, improved customer engagement, and enhanced overall efficiency across the industry.

Promoting Financial Stability and Regulation

As a leading insurance provider, AIG plays a crucial role in promoting financial stability and adherence to regulatory standards. Their commitment to transparency, risk management, and compliance with international insurance regulations sets an example for the industry. AIG’s robust financial strength and risk management practices contribute to a stable insurance market, benefiting policyholders and the industry as a whole.

Leading the Way in Innovation and Product Development

AIG’s culture of innovation has led to the development of cutting-edge insurance products and services. Their focus on understanding customer needs and market trends has resulted in the creation of unique and tailored solutions. By continuously evolving their product offerings, AIG stays at the forefront of the industry, setting trends and raising the bar for other insurers.

Empowering Agents and Brokers

AIG recognizes the importance of their agent and broker network in delivering exceptional customer service. They provide comprehensive training and support to their sales force, ensuring that agents and brokers are equipped with the knowledge and tools to serve their clients effectively. By empowering their sales team, AIG ensures that policyholders receive personalized guidance and support throughout their insurance journey.

Conclusion: A Legacy of Trust and Financial Security

AIG’s life insurance offerings are built on a foundation of trust, innovation, and financial stability. With a comprehensive suite of products, a commitment to customer service, and a focus on digital transformation, AIG continues to be a leader in the insurance industry. Whether it’s protecting a family’s future, building long-term savings, or providing coverage for employees, AIG’s life insurance solutions offer peace of mind and financial security to policyholders around the world.

How does AIG’s life insurance compare to other providers in terms of premiums and coverage options?

+AIG’s life insurance premiums are competitive and often offer flexible payment options. Their coverage options are diverse, allowing policyholders to choose the type of life insurance that best suits their needs and budget. While premiums and coverage may vary based on individual circumstances, AIG’s commitment to innovation and customer service sets them apart in the market.

What are the key benefits of choosing AIG’s life insurance products over other providers?

+AIG’s life insurance products offer a range of benefits, including competitive premiums, a wide array of coverage options, efficient claims processing, and exceptional customer service. Their focus on innovation and digital transformation ensures a seamless and convenient experience for policyholders. Additionally, AIG’s financial stability and global presence provide added peace of mind.

Can AIG’s life insurance policies be customized to meet specific needs?

+Absolutely! AIG understands that every individual’s financial needs are unique. Their life insurance products, especially universal and variable life insurance, offer a high degree of customization. Policyholders can adjust coverage amounts, premium payments, and even allocate funds to different investment options, ensuring their policy aligns perfectly with their specific requirements.