Ambetter Insurance

In the ever-evolving landscape of healthcare coverage, Ambetter Insurance has emerged as a prominent player, offering accessible and comprehensive plans to a wide range of individuals and families. This article delves into the world of Ambetter, exploring its origins, the services it provides, and its impact on the healthcare industry.

The Rise of Ambetter Insurance

Ambetter Insurance, a subsidiary of Centene Corporation, made its debut in the health insurance market in 2014. With a mission to provide affordable and quality healthcare coverage, Ambetter quickly gained recognition for its innovative approach and commitment to serving underserved communities.

The company's entry into the market was timely, addressing the growing need for accessible healthcare options. Ambetter's plans were designed to cater to a diverse range of individuals, including those with low to moderate incomes, small businesses, and those who might otherwise face challenges in obtaining adequate healthcare coverage.

One of the key factors contributing to Ambetter's success is its partnership with local healthcare providers. By establishing strong relationships with hospitals, clinics, and physicians, Ambetter ensures that its policyholders have access to a robust network of medical professionals, making healthcare more convenient and efficient.

Ambetter’s Product Portfolio: A Comprehensive Overview

Ambetter offers a comprehensive suite of health insurance plans, tailored to meet the diverse needs of its customers. Here’s a closer look at the key products and services they provide:

Health Maintenance Organization (HMO) Plans

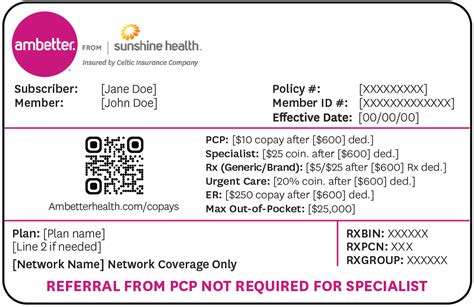

Ambetter’s HMO plans are designed to offer cost-effective coverage. Policyholders are required to select a primary care physician (PCP) from the Ambetter network, who coordinates their healthcare needs. This plan typically covers a wide range of services, including doctor visits, preventive care, and prescription medications.

One unique feature of Ambetter's HMO plans is the inclusion of wellness programs and health coaching. These programs aim to empower individuals to take control of their health, providing resources and support for managing chronic conditions or adopting healthier lifestyles.

Preferred Provider Organization (PPO) Plans

Ambetter’s PPO plans offer policyholders more flexibility in choosing healthcare providers. Unlike HMO plans, PPO plans do not require a designated PCP, allowing individuals to seek treatment from any in-network provider. This plan is ideal for those who value the freedom to choose their own doctors and specialists.

In addition to standard healthcare coverage, Ambetter's PPO plans also include dental and vision benefits. These add-ons ensure that policyholders can access a full spectrum of healthcare services without the need for separate insurance plans.

Short-Term Medical Plans

Recognizing the temporary nature of some individuals’ healthcare needs, Ambetter offers short-term medical plans. These plans provide coverage for a specified period, typically ranging from a few months to a year. They are ideal for individuals between jobs, recent graduates, or those awaiting long-term insurance coverage.

While short-term plans offer more limited coverage compared to long-term plans, they still provide essential benefits such as doctor visits, hospital stays, and emergency care. They serve as a cost-effective solution for those seeking temporary healthcare coverage.

Medicaid and Medicare Advantage Plans

Ambetter is also a trusted provider of Medicaid and Medicare Advantage plans. These plans are tailored to meet the specific needs of individuals eligible for government-assisted healthcare programs.

Ambetter's Medicaid plans provide comprehensive coverage, including doctor visits, hospital stays, prescription drugs, and specialized services. The company's commitment to serving underserved communities is evident in its Medicaid offerings, ensuring that those in need have access to quality healthcare.

Similarly, Ambetter's Medicare Advantage plans offer an alternative to traditional Medicare, providing additional benefits and services. These plans often include dental, vision, and hearing coverage, enhancing the overall healthcare experience for Medicare beneficiaries.

Ambetter’s Impact: Transforming Healthcare Access

Ambetter’s presence in the healthcare industry has had a significant impact, particularly in improving access to quality healthcare for underserved populations. By offering affordable and comprehensive plans, Ambetter has become a trusted partner for individuals and families seeking reliable healthcare coverage.

One of the key strengths of Ambetter is its focus on community engagement. The company actively works with local organizations and healthcare providers to identify and address the unique healthcare needs of different communities. This approach ensures that Ambetter's plans are tailored to the specific requirements of each region, making healthcare more accessible and relevant.

Furthermore, Ambetter's commitment to innovation has led to the development of digital health solutions. The company's mobile app and online platform provide policyholders with convenient access to their healthcare information, allowing them to manage their coverage, find in-network providers, and even schedule appointments.

Key Features and Benefits of Ambetter Plans

- Wide Network of Providers: Ambetter maintains an extensive network of healthcare providers, ensuring that policyholders have a variety of options when seeking medical care.

- Flexible Payment Options: The company offers various payment plans, including monthly, quarterly, or annual premiums, providing flexibility to its customers.

- 24⁄7 Customer Support: Ambetter provides round-the-clock customer service, ensuring that policyholders can receive assistance whenever they need it.

- Discounts and Rewards: Many Ambetter plans include incentives and discounts for healthy lifestyle choices, encouraging policyholders to take an active role in their well-being.

Real-World Success Stories

To illustrate the impact of Ambetter Insurance, let’s explore a few real-life success stories:

Sarah, a single mother, struggled to find affordable healthcare coverage for her family. With limited income, she faced the challenge of providing essential healthcare services for her children. Ambetter's HMO plan offered a cost-effective solution, allowing Sarah to access a network of providers and ensuring her children received the medical care they needed.

John, a small business owner, wanted to provide healthcare benefits to his employees but faced budgetary constraints. Ambetter's PPO plan provided an affordable option, offering comprehensive coverage without compromising on quality. John's employees now have access to a wide range of healthcare services, improving their overall well-being.

For seniors like Maria, navigating the complexities of Medicare can be daunting. Ambetter's Medicare Advantage plan simplified the process, providing her with additional benefits such as dental and vision coverage. Maria can now access the healthcare services she needs without the worry of high out-of-pocket expenses.

Ambetter’s Future Outlook: Expanding Horizons

As Ambetter continues to thrive in the healthcare industry, its future outlook is promising. The company’s commitment to innovation and community engagement positions it well for continued success.

Looking ahead, Ambetter aims to expand its reach, offering even more accessible and tailored healthcare solutions. The company is exploring partnerships with technology providers to enhance its digital health offerings, making healthcare more convenient and efficient for its policyholders.

Additionally, Ambetter is dedicated to advocating for healthcare reform and policy changes that benefit underserved communities. By actively engaging in policy discussions, the company aims to shape a healthcare landscape that is more equitable and accessible to all.

| Ambetter Plan Type | Key Benefits |

|---|---|

| HMO Plans | Cost-effective coverage, wellness programs, and health coaching |

| PPO Plans | Flexibility in provider choice, dental and vision benefits |

| Short-Term Plans | Temporary coverage for doctor visits, hospital stays, and emergency care |

| Medicaid Plans | Comprehensive coverage for low-income individuals, including specialized services |

| Medicare Advantage Plans | Additional benefits for Medicare beneficiaries, including dental and vision coverage |

Frequently Asked Questions

What makes Ambetter Insurance unique compared to other providers?

+Ambetter’s uniqueness lies in its focus on serving underserved communities and its commitment to providing affordable, comprehensive healthcare plans. The company’s partnership with local healthcare providers and its innovative digital health solutions set it apart from traditional insurance providers.

How can I find an Ambetter provider near me?

+Ambetter offers a convenient online provider search tool on its website. Simply enter your location, and you’ll be able to find a list of in-network providers in your area. You can also call Ambetter’s customer support for assistance in locating the right provider for your needs.

Are Ambetter plans suitable for families with children?

+Absolutely! Ambetter offers family plans that provide comprehensive coverage for children, including well-child visits, immunizations, and access to pediatric specialists. The company’s focus on wellness and health coaching ensures that families can take a proactive approach to their children’s healthcare.

What happens if I need to seek treatment outside of the Ambetter network?

+Ambetter’s plans typically cover out-of-network treatment at a reduced rate. However, it’s important to check your specific plan’s coverage details. Out-of-network care may result in higher out-of-pocket expenses, so it’s best to utilize in-network providers whenever possible.

Can I switch to an Ambetter plan during the year, or is it only available during open enrollment periods?

+Depending on your circumstances, you may be eligible for a Special Enrollment Period, allowing you to switch to an Ambetter plan outside of the regular open enrollment window. Qualifying life events, such as losing other health coverage or experiencing a change in income, can trigger a Special Enrollment Period. It’s best to consult with an Ambetter representative to determine your eligibility.