Buy Life Insurance Policy

Purchasing a life insurance policy is a significant financial decision that can provide peace of mind and security for both individuals and their loved ones. Life insurance offers a safety net, ensuring that your family's financial well-being is protected in the event of your untimely demise. In this comprehensive guide, we will delve into the intricacies of buying a life insurance policy, covering everything from understanding the different types of policies to making informed choices tailored to your unique needs.

Navigating the Landscape of Life Insurance Policies

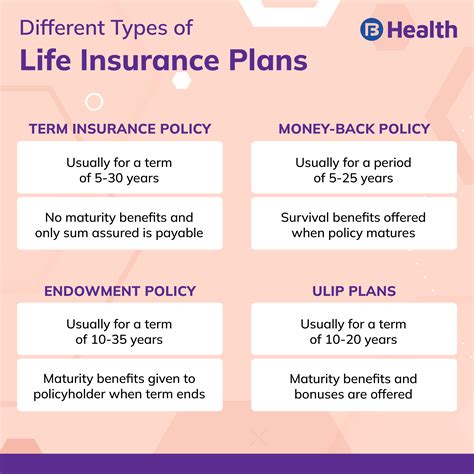

The world of life insurance is diverse, with various policy types catering to different life stages and financial goals. Let's explore some of the most common types of life insurance policies:

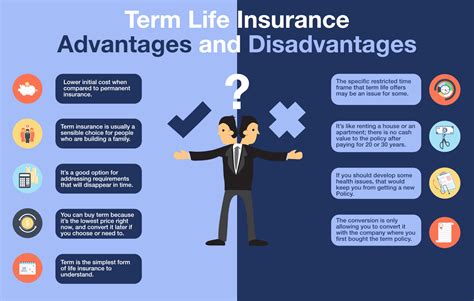

Term Life Insurance

Term life insurance is often the most straightforward and cost-effective option. It provides coverage for a specified period, typically ranging from 10 to 30 years. During this term, the policy pays out a lump sum to your beneficiaries if you pass away. Term life insurance is ideal for covering specific financial obligations, such as mortgages, education expenses, or supporting your family's income during your working years.

| Policy Type | Coverage Period | Premium Flexibility |

|---|---|---|

| Term Life | 10-30 years | Affordable, fixed premiums |

| Whole Life | Lifetime | Higher premiums, potential for cash value |

| Universal Life | Flexible | Adjustable premiums and coverage |

One of the key advantages of term life insurance is its affordability. The premiums are generally lower compared to other types of policies, making it accessible for individuals with limited budgets. However, it's important to note that the coverage is temporary, and you may need to consider other options if you require lifelong protection.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers coverage for your entire life. It provides a guaranteed death benefit, ensuring that your beneficiaries receive a payout regardless of when you pass away. Whole life policies also accumulate cash value over time, which can be borrowed against or used to pay premiums, providing a level of financial flexibility.

While whole life insurance offers long-term protection and the potential for cash value, it comes at a higher premium cost. The premiums are typically fixed, and the policy's cash value grows slowly but steadily. Whole life insurance is suitable for those seeking lifelong coverage and the ability to build a financial asset.

Universal Life Insurance

Universal life insurance is a flexible option that allows you to adjust your coverage and premiums over time. This type of policy provides a death benefit, similar to whole life insurance, but with the added benefit of adjustable premiums. You can increase or decrease your coverage and premiums based on your changing financial circumstances.

Universal life insurance is ideal for individuals who require flexibility in their life insurance coverage. Whether you experience financial ups and downs or have varying needs over time, this policy type can adapt to your situation. However, it's important to note that the cash value growth in universal life policies may be lower compared to whole life insurance.

Assessing Your Life Insurance Needs

Before purchasing a life insurance policy, it's crucial to assess your unique needs and financial goals. Here are some key considerations to guide your decision-making process:

Determining Coverage Amount

The first step in buying life insurance is determining the appropriate coverage amount. This amount should be sufficient to cover your financial obligations and provide a comfortable standard of living for your loved ones in your absence. Consider factors such as outstanding debts, mortgage payments, education expenses, and any other financial commitments you wish to ensure.

Evaluating Your Financial Situation

Assessing your current financial situation is vital when choosing a life insurance policy. Evaluate your income, assets, and liabilities to determine how much coverage you can afford. Term life insurance is often the most affordable option, making it suitable for individuals with limited budgets. However, if you have significant assets or complex financial needs, whole life or universal life insurance may be more appropriate.

Considering Your Family's Needs

Your family's financial well-being is a primary concern when purchasing life insurance. Consider their current and future needs, including education expenses, healthcare costs, and any specific goals or aspirations they may have. Ensure that the coverage amount you choose is sufficient to provide for their financial security and maintain their quality of life.

The Process of Buying Life Insurance

Now that you have a better understanding of the different types of life insurance policies and your unique needs, let's explore the step-by-step process of purchasing a policy:

Step 1: Research and Compare Policies

Start by researching and comparing various life insurance policies from different providers. Look for reputable insurance companies with a strong financial rating and a history of reliable claim settlements. Consider the coverage options, premium costs, and any additional benefits or riders offered by each policy.

Step 2: Obtain Quotes

Request quotes from multiple insurance providers to compare rates and coverage options. Online quote tools can provide a quick and convenient way to gather initial estimates. However, remember that these quotes are often based on standard assumptions and may not reflect your specific circumstances.

Step 3: Consult with an Insurance Agent

Consider consulting with an experienced insurance agent who can provide personalized guidance and advice. They can help you navigate the complex world of life insurance, assess your needs, and recommend suitable policies. An agent can also assist with the application process and ensure that you receive the coverage that best aligns with your goals.

Step 4: Complete the Application Process

Once you've selected a policy, you'll need to complete the application process. This typically involves providing personal and health information, as well as undergoing a medical exam. The insurance company will use this information to assess your risk profile and determine your eligibility for coverage.

Step 5: Review and Understand the Policy

Before finalizing your purchase, carefully review the policy documents provided by the insurance company. Ensure that you understand the terms and conditions, including the coverage amount, premium payments, and any exclusions or limitations. If you have any questions or concerns, don't hesitate to reach out to your insurance agent or the company's customer support.

Maximizing the Benefits of Your Life Insurance Policy

Purchasing a life insurance policy is just the beginning. To ensure you make the most of your investment, consider the following strategies to maximize the benefits:

Regularly Review and Update Your Policy

Life insurance policies should be reviewed periodically to ensure they remain aligned with your changing needs and circumstances. As your financial situation evolves, you may need to increase or decrease your coverage amount, adjust your beneficiaries, or consider switching to a different policy type. Regular reviews can help you stay proactive and ensure your life insurance continues to provide the protection you require.

Consider Adding Riders or Additional Benefits

Many life insurance policies offer optional riders or additional benefits that can enhance your coverage. These riders can provide extra protection for specific situations, such as critical illness, accidental death, or disability. By adding these riders, you can customize your policy to address your unique concerns and provide additional financial support in times of need.

Utilize the Cash Value (if applicable)

If you have a whole life or universal life insurance policy, the cash value accumulated over time can be a valuable asset. You can borrow against this cash value to cover expenses or use it to pay premiums during financial hardships. However, it's important to understand the potential impact on your policy and the implications of borrowing against the cash value.

Common Questions and Concerns About Life Insurance

How much life insurance do I need?

+The amount of life insurance you need depends on your individual circumstances and financial goals. Factors to consider include your income, debts, mortgage, and the financial needs of your loved ones. A common rule of thumb is to have coverage that is 10-15 times your annual income. However, it's best to consult with a financial advisor or insurance agent to determine the appropriate coverage amount for your specific situation.

Can I buy life insurance if I have health issues?

+Yes, individuals with health issues can still purchase life insurance. However, the availability and cost of coverage may vary depending on the severity of your health condition. Some insurance companies offer specialized policies for individuals with pre-existing conditions, while others may require a medical exam and may charge higher premiums. It's important to be transparent about your health status during the application process.

What happens if I miss a premium payment?

+Missing a premium payment can have different consequences depending on the type of policy you have. With term life insurance, missing a payment may result in the policy lapsing, and you may need to reapply for coverage. Whole life and universal life policies often have a grace period, allowing you to make the payment within a certain timeframe without losing coverage. It's crucial to stay up-to-date with your premium payments to maintain continuous coverage.

Purchasing a life insurance policy is a responsible decision that provides financial security and peace of mind for you and your loved ones. By understanding the different policy types, assessing your needs, and following a comprehensive buying process, you can make an informed choice that aligns with your unique circumstances. Remember to regularly review and update your policy, maximize its benefits, and seek professional advice when needed.