Insurance Of Florida

Florida, known for its sunny skies and vibrant lifestyle, presents a unique set of challenges when it comes to insurance. From hurricanes to unexpected storms, the state's climate can significantly impact insurance needs and policies. As a resident or business owner in Florida, understanding the intricacies of insurance coverage is crucial to protect yourself, your property, and your financial well-being.

The Importance of Insurance in Florida’s Climate

Florida's weather is a double-edged sword. While it attracts tourists and offers a pleasant year-round climate, it also poses risks that can lead to significant losses. Hurricanes, tropical storms, and heavy rainfall are common occurrences, often resulting in property damage, business interruptions, and potential injuries. Insurance becomes a vital tool to mitigate these risks and ensure financial stability during challenging times.

Moreover, Florida's unique environment can also lead to other insurance-related concerns. For instance, the state's diverse wildlife and ecological systems can sometimes result in unexpected claims, such as damage caused by wild animals or environmental factors. Understanding these potential risks and having the right insurance coverage is essential to navigate these challenges effectively.

Navigating Insurance Options for Homeowners

Homeowners in Florida face a unique set of insurance considerations. Here's a breakdown of the key aspects to keep in mind:

1. Comprehensive Coverage

It's crucial to opt for comprehensive insurance policies that cover a wide range of potential risks. Standard homeowner's insurance policies typically include coverage for:

- Structural damage to your home

- Personal belongings and valuables

- Liability protection for accidents on your property

- Additional living expenses if your home becomes uninhabitable

However, Florida's climate often requires additional coverage. For instance, windstorm coverage is essential to protect against hurricane-force winds, which can cause significant damage to roofs, windows, and structures.

2. Flood Insurance

Florida's susceptibility to flooding, whether from hurricanes, heavy rainfall, or storm surges, makes flood insurance a non-negotiable consideration. While standard homeowner's policies may cover certain types of water damage, they typically exclude flood-related claims. To protect your property and belongings from flood risks, it's crucial to have a separate flood insurance policy.

The National Flood Insurance Program (NFIP) offers flood insurance to homeowners, renters, and business owners. It's important to note that there is a 30-day waiting period for new flood insurance policies, so planning ahead is essential. Additionally, understanding the coverage limits and specific exclusions in your policy is crucial to ensure you have adequate protection.

3. Hurricane Deductibles

Florida insurance policies often include hurricane deductibles, which are separate from your standard deductible. These deductibles apply specifically to damage caused by hurricanes and named storms. The amount of the deductible can vary based on factors such as the location of your property and the level of hurricane coverage you choose.

It's essential to understand how hurricane deductibles work and to review your policy regularly to ensure you're prepared for the potential financial impact of a hurricane. Some policies may have a percentage-based deductible, where you pay a certain percentage of the insured value of your home, while others may have a fixed dollar amount deductible.

Business Insurance Considerations

For business owners in Florida, insurance becomes even more critical to protect your investments and ensure continuity in the face of unexpected events.

1. Commercial Property Insurance

Commercial property insurance is essential to safeguard your business premises and its contents. This coverage protects against damage to your building, inventory, equipment, and other assets. It's crucial to review your policy carefully to understand the specific perils covered, as well as any exclusions or limitations.

2. Business Interruption Insurance

Florida's unpredictable weather can lead to business interruptions, whether due to hurricanes, storms, or other unforeseen events. Business interruption insurance provides coverage for lost income and ongoing expenses during the period when your business is unable to operate normally. This type of insurance is especially crucial for businesses that rely on seasonal tourism or those that may face extended periods of closure due to weather-related incidents.

3. Workers’ Compensation and Liability Insurance

Protecting your employees and your business from liability claims is essential. Workers' compensation insurance covers medical expenses and lost wages for employees who are injured on the job. Additionally, general liability insurance protects your business from third-party claims, such as slip-and-fall accidents or product liability issues.

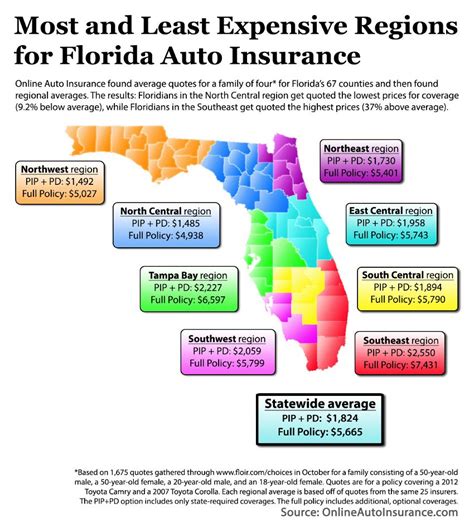

Auto Insurance Requirements and Considerations

Florida has specific requirements for auto insurance to ensure that drivers are financially responsible for accidents they cause. Understanding these requirements and choosing the right coverage is crucial for every driver in the state.

1. Minimum Liability Coverage

Florida law requires drivers to carry minimum liability coverage to protect other drivers in the event of an at-fault accident. The minimum liability limits are:

| Bodily Injury | Property Damage |

|---|---|

| $10,000 per person | $10,000 per incident |

While these are the legal minimums, it's often recommended to carry higher liability limits to provide adequate protection in the event of a serious accident.

2. Personal Injury Protection (PIP)

Florida is a no-fault state for auto insurance, which means that drivers must carry Personal Injury Protection (PIP) coverage. PIP covers medical expenses and a portion of lost wages for the policyholder and their passengers, regardless of who is at fault in an accident.

The minimum PIP coverage in Florida is $10,000, but drivers can choose higher limits to provide more comprehensive coverage.

3. Uninsured/Underinsured Motorist Coverage

Given the potential for uninsured or underinsured drivers on the roads, it's wise to consider adding uninsured/underinsured motorist coverage to your auto insurance policy. This coverage protects you and your passengers if you're involved in an accident with a driver who doesn't have enough insurance to cover the damages.

Health Insurance Options in Florida

Health insurance is a critical aspect of financial security, and Florida residents have various options to choose from.

1. Employer-Sponsored Plans

Many Floridians receive health insurance coverage through their employers. These plans often provide comprehensive benefits and may be more cost-effective due to the employer's contribution. It's important to review the details of your employer-sponsored plan, including covered services, deductibles, and out-of-pocket maximums, to ensure it meets your healthcare needs.

2. Individual and Family Plans

For those who don't have access to employer-sponsored plans, or for those who prefer more personalized coverage, individual and family health insurance plans are available. These plans can be purchased directly from insurance companies or through the Health Insurance Marketplace. Florida residents can shop for and enroll in plans during the annual Open Enrollment Period, which typically runs from November to January.

3. Medicare and Medicaid

Florida residents who are eligible for Medicare (usually those aged 65 and older or those with certain disabilities) have access to a range of Medicare plans, including Original Medicare (Parts A and B) and Medicare Advantage (Part C) plans. Medicare Part D prescription drug coverage is also available to help manage the cost of medications.

Additionally, Florida's Medicaid program provides healthcare coverage for low-income residents, including children, pregnant women, the elderly, and people with disabilities. Eligibility and benefits vary based on individual circumstances.

Life Insurance Considerations

Life insurance is an essential component of financial planning, providing financial protection for your loved ones in the event of your passing. Florida residents have various life insurance options to consider.

1. Term Life Insurance

Term life insurance offers coverage for a specific period, typically 10, 20, or 30 years. It's often the most affordable option, providing a large death benefit for a relatively low premium. Term life insurance is particularly suitable for those who have temporary financial needs, such as covering mortgage payments or supporting dependent children until they reach adulthood.

2. Permanent Life Insurance

Permanent life insurance, such as whole life or universal life insurance, provides coverage for your entire life, as long as premiums are paid. These policies also accumulate cash value over time, which can be borrowed against or withdrawn. Permanent life insurance is often more expensive than term life, but it offers lifelong coverage and the potential for cash value growth.

3. Rider Options

Both term and permanent life insurance policies often offer additional rider options, which are add-ons that provide extra coverage or benefits. Common rider options include:

- Waiver of Premium: Waives your premium payments if you become disabled and unable to work.

- Accidental Death Benefit: Provides an additional payout if your death is accidental.

- Long-Term Care Rider: Offers benefits to help cover the cost of long-term care expenses.

Final Thoughts and Next Steps

Navigating the world of insurance in Florida can be complex, but it's a crucial step to protect your assets, your business, and your loved ones. Whether you're a homeowner, business owner, driver, or healthcare consumer, understanding your insurance needs and options is essential.

Start by assessing your unique situation and risks. Evaluate your property's vulnerability to storms and floods, consider your business's specific insurance needs, and review your personal healthcare and financial planning requirements. Once you have a clear understanding of your needs, shop around for policies that offer comprehensive coverage at competitive rates.

Remember, insurance is an ongoing process. Regularly review and update your policies to ensure they continue to meet your changing needs. Stay informed about Florida's unique insurance considerations and don't hesitate to seek professional advice when making important insurance decisions.

FAQ

What is the average cost of homeowner’s insurance in Florida?

+The average cost of homeowner’s insurance in Florida can vary widely based on factors such as location, the value of the home, and the level of coverage. As of [current year], the average premium for a 250,000 home in Florida is approximately 3,500 per year. However, this can range significantly, with premiums as low as 2,000 or as high as 6,000 or more.

Are there any discounts available for homeowner’s insurance in Florida?

+Yes, there are several discounts available for homeowner’s insurance in Florida. These may include discounts for:

- Having a monitored security system

- Installing impact-resistant windows and doors

- Bundling multiple policies with the same insurer (e.g., auto and home insurance)

- Being claim-free for a certain number of years

- Being a loyal customer with a long-standing policy

It’s worth shopping around and comparing quotes to find the best rates and discounts available.

What should I do if I’m denied auto insurance in Florida?

+If you’re denied auto insurance in Florida, there are a few steps you can take. First, understand the reason for the denial. Common reasons include a poor driving record, a history of accidents or claims, or even your credit score. If you believe the denial was in error, you can request a review of your application.

If the denial is upheld, you may need to explore other options. Florida has a state-run insurance plan called the Florida Joint Underwriting Association (FJUA) that provides coverage to high-risk drivers who cannot obtain insurance through the voluntary market. You can also consider working with an insurance agent or broker who specializes in high-risk insurance to help you find coverage.